- Stock Picker's Corner

- Posts

- The Top Stock of 2025 Mid-Year Review

The Top Stock of 2025 Mid-Year Review

Shares are up 83% this year ...

Last week, Chief Stock Picker Bill Patalon shared his outlook for the rest of 2025, which was a mix of what he called “The Good, the Bad and the Ugly.”

While innovation from artificial intelligence (AI), quantum computing, and new technological advances can be an on-ramp for economic growth, rising debt, affordability issues, and job disruption all signal a bumpy road ahead.

That’s not to discourage anyone, as we believe its a road that well reward sharp-eyed stock pickers even further …

Like it has with the company we’re sharing today: Palantir Technologies Inc. $PLTR ( ▲ 0.92% ).

It was our choice as the “Top Pick” for 2025” for the MoneyShow:

So we wanted to do a quick follow up today on some of the highlights for the company in the first half of the year.

In addition, we’ll share what we’re watching for the rest of the year.

Palantir Financial Results

One of the knocks on Palantir has been its perceived overreliance on government contracts, which can be a risky income source because of budget cuts, policy shifts, and less predictable renewal cycles.

But the first quarter showed its commercial revenue growth steadily climbing, jumping 71% from the previous year and 19% from the previous quarter.

Segment | Q1 2025 Revenue | Year-over-Year Growth | Quarter-over-Quarter Growth |

|---|---|---|---|

Total Revenue | $884 million | +39% | +7% |

U.S. Revenue | $628 million | +55% | +13% |

U.S. Commercial Revenue | $255 million | +71% | +19% |

U.S. Government Revenue | $373 million | +45% | +9% |

Those commercial clients include all kinds of well-known companies, from Lowe’s Companies Inc. $LOW ( ▲ 0.07% ) to Wendy’s Co. $WEN ( ▼ 1.03% ) to CVS Health Corp. $CVS ( ▲ 2.42% ).

Palantir’s second-quarter results are expected on Aug. 5. And we’ll be watching to see if that U.S. commercial revenue continues to climb both yearly and sequentially.

In the first quarter, Palantir also boosted its revenue guidance to between $3.89 billion and $3.9 billion, up from previous guidance of $3.75 billion. We’ll also want to see if that’s still on track and even if Palantir boosts those projections once again.

Palantir Stock Performance

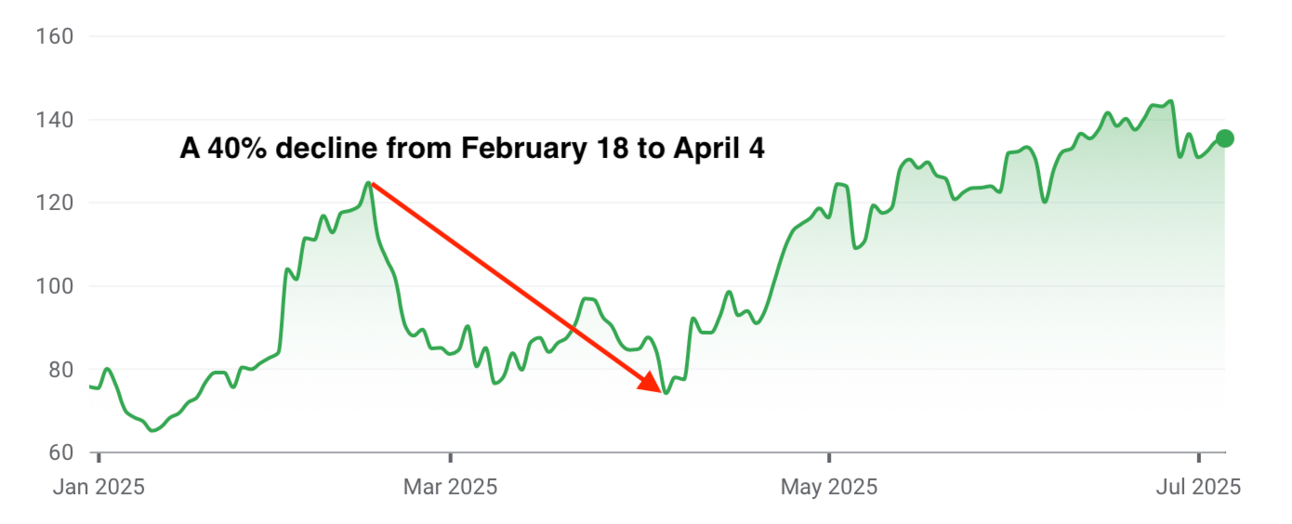

On Feb. 19, the U.S. Defense Department announced plans to cut its budget by $50 billion over the next five years, sending shares of Palantir into a freefall.

Then, tariff uncertainty in April once again kicked shares lower.

Palantir plunged 40% from Feb. 18 to April 4.

Source: Google Finance

But as we told our SPC Premium members back on Feb. 24, the budget cut worry was an overreaction, and we even labeled it the “Palantir Pullback Opportunity.

That’s because we said Palantir isn’t a “defense contractor” in the classic sense: Its business isn’t about building $100 million combat jets that will take years to deliver. Its speciality is AI that allows companies and government agencies to deploy super-fast data collection, analysis, and decision-making technology.

In the corporate world, that kind of technology can slash costs and make things run faster and smoother. Out on the battlefield, AI can provide the kind of true “competitive edge” that saves lives.

That’s why we saw Palantir as an actual benefactor of any budget cuts, as money would be funneled into more cost-efficient programs.

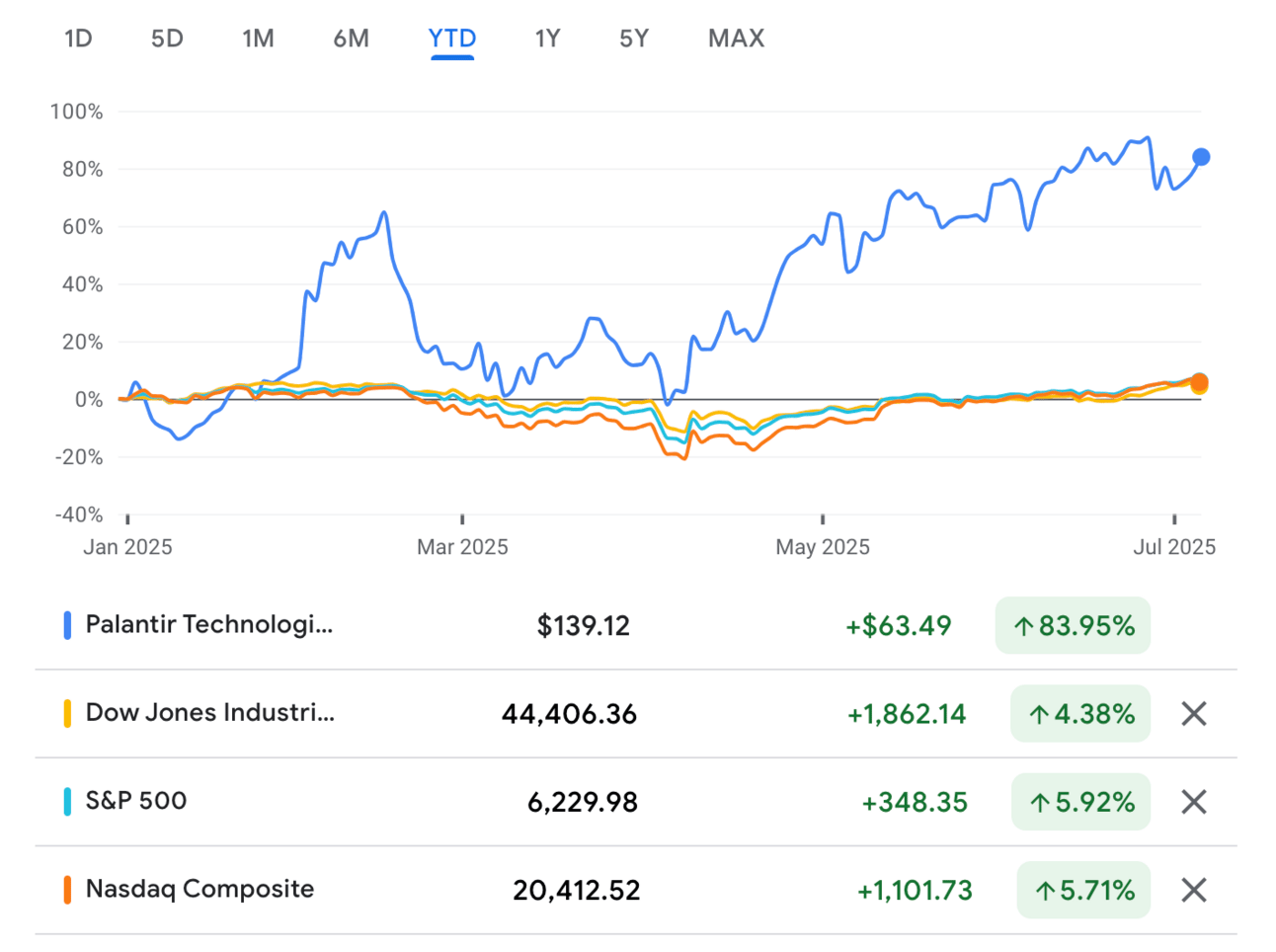

That view has paid off for any folks who bought shares during that pullback. And even if you didn’t and just sat on the shares you owned at the start of the year, PLTR has returned 83% …

Easily outperforming benchmarks like the S&P 500, Dow Jones Industrial Average and Nasdaq.

Source: Google Finance

Palantir Risks and Challenges

We still like the long-term prospects for Palantir, and Wedbush analyst Dan Ives believes it will be a $1 trillion company in the next two to three years.

At its current price of around $139, that would place the stock price at $421 — for a 203% increase.

So if you’re a Wealth Builder and believe in Palantir, your game plan is to keep buying shares on pullbacks.

But if we’re looking ahead for the rest of 2025, one of the biggest risks/challenges for Palantir shareholders is simply that it is a red-hot company. Over the past two years, the share price has climbed 1,300%, so it’s not a question of “If” we’ll see a significant pullback, it’s “When” and by “How Much.”

Connected to that, as investors continually hear Palantir is “overvalued,” they may shift money into advanced software companies like Snowflake Inc. $SNOW ( ▼ 2.69% ) and C3.ai Inc. $AI ( ▼ 5.36% ), which are both expanding into government work.

Snowflake received clearance from the Department of Defense in April to handle Controlled Unclassified Information (CUI), which will allow them to compete for more government contracts. And the U.S. Air Force Rapid Sustainment Office upped the ceiling value of a previous $100 million contract with C3.ai for predictive analytics and aircraft maintence to $450 million in May.

Final Thoughts on Palantir

Palantir has long faced critcism for its heavy reliance on government contracts, but its U.S. commercial revenue is witnessing a promising shift.

Plenty of risks remain for the rest of the year, as valuation concerns and rising competition can speed up an inevitable pullback.

But with Palantir as the leader for “AI use cases,” it’s well positioned with a long-term time horizon to make Wealth Builders even more money.

That’s it for today.

Take care,

📬 Missed a free issue? Catch up here and stay in the loop on every market-moving insight.

🚀 Want deeper dives, exclusive stock picks, and real-time alerts? Learn more about SPC Premium — where Wealth Builders get their edge.

Let us know your thoughts on Palantir below 👇

What do you think of Palantir? |