- Stock Picker's Corner

- Posts

- Forecast: The "Good, the Bad and the Ugly" of the Year's Second Half

Forecast: The "Good, the Bad and the Ugly" of the Year's Second Half

Five storylines — and five stocks — that will bolster your portfolio for years to come ...

My son Joey graduated from high school a few weeks back. And last Friday, Robin and I threw him a party to celebrate.

We rented out a historic old bank (it even still has its heavy-doored, walk-in vault, with the mammoth locking mechanism visible behind plexiglass window). We invited family members, friends and Joey’s classmates. We had balloon place settings, a balloon arch and custom M&Ms — all three in red and white, the colors of the Berklee School of Music in Boston, where Joey will start college in the fall.

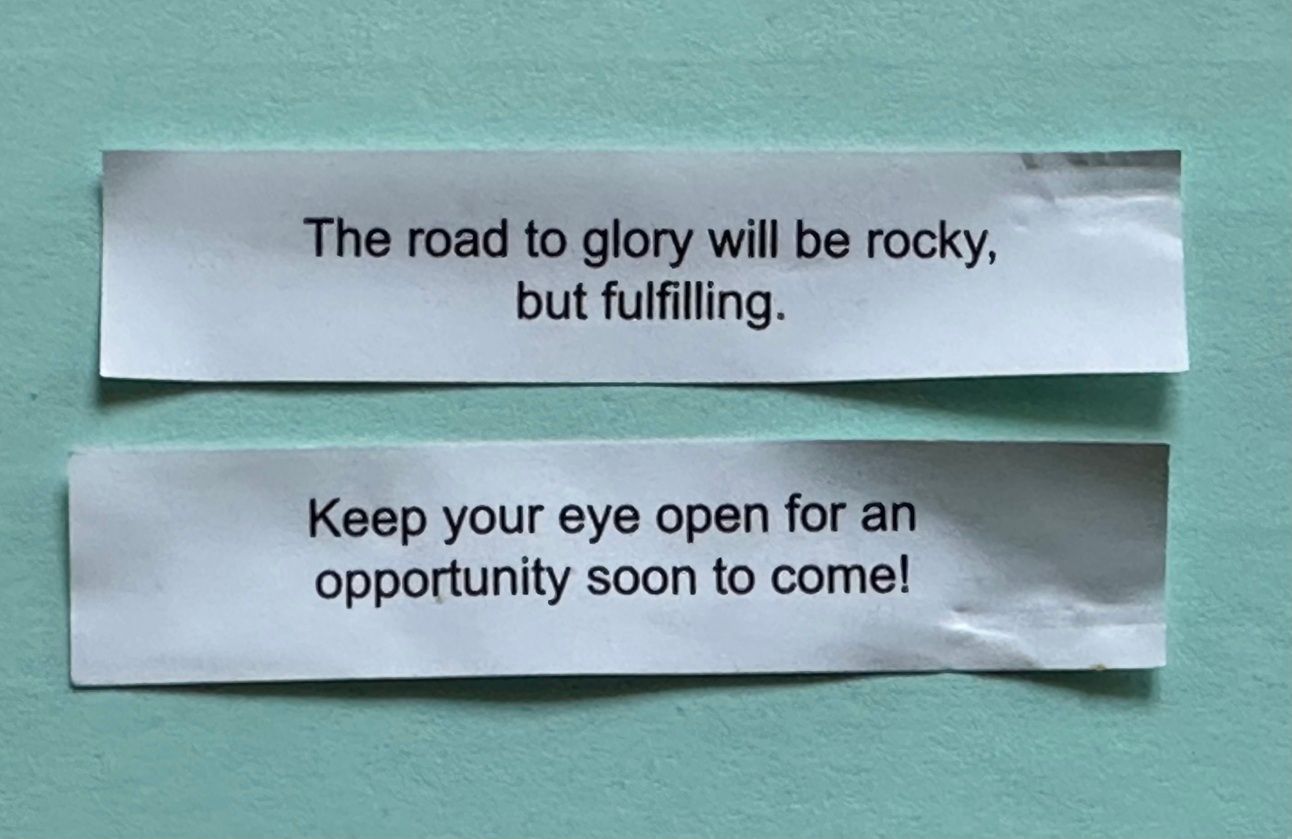

We also had a jar filled with fortune cookies — and gave them to folks to take as they left.

We had plenty left over.

This week, as I gathered up my research for the Stock Picker’s Corner (SPC) Mid-Year Forecast — but before I sat down to write this report — I grabbed a couple of those fortune cookies for myself … cracked them open … and extracted the “fortunes.”

I did it … just for fun.

As it turns out, two of them — the two I’ve shared in the image above — lined up 100% with the “Mid-Year Forecast” message I was already planning to deliver, for instance that:

The second half of year figures to be rocky — for stocks … for the economy … and in the headlines.

That rockiness will uncover opportunities.

You need to watch for them.

When they appear, you need to strike.

And if you strike … you will get paid.

That’s the Wealth Builder Way. We flip the script. We find the gold in the sludge of bad news. We see opportunity when most run scared.

Let me show you what we’re watching, how things could play out and some stocks to consider between now and New Year’s Eve.

Strengths, Worries and Risks

Let’s start with a crucial point: We “do forecasts” in a different way than everyone else.

Most investors use forecasts like this to guide their short-term investments.

We do the same work but to guide our long-term moves.

Remember, Wealth Builders invest.

Wealth Killers trade.

Wealth Builders play the “long game.” Wealth Killers obsess over what’s right in front of them.

With that bit of “scene-setting,” let’s talk about “what comes next.”

And let’s do it through a bit of analysis I will call “The Good, the Bad and the Ugly.”

✅ The Good

The U.S. economy remains strong. Consumer spending accounts for 70% of American gross domestic product (GDP), so jobs and wages are critical. The most recent reports show that companies are still hiring and wages are still growing — though at more moderate rates than before.

That means Americans still have money to spend; but the job-switching and big salary hikes that we saw right after the COVID-19 Pandemic have eased.

Innovation continues to create new wealth opportunities for companies, workers, entrepreneurs and investors.

President Donald Trump’s “Big Beautiful Bill” would deliver tax breaks to everyday folks and working families.

And the U.S. Federal Reserve could deliver one or two rate cuts by the end of the year, making it cheaper for companies to operate, for consumers to keep buying and for stocks to power their way higher.

The Takeaway: There’s still enough “oomph” to keep the economy growing, but not so much that it overheats, reigniting the inflation conflagration of 2022. And the central bank still has “dry powder,” should any “wildcards” emerge.

⚠️The Bad

When I look at the American economy right now, I see a “fragile equilibrium.”

Growth is slowing. And when it comes to the “Big Problem,” inflation has been replaced by affordability — especially in areas like energy, healthcare and housing. The housing shortage keeps worsening, home prices soared 60% from 2019 to last year (nearly triple the rate of inflation). A recent survey said only three of the Top 100 major metro areas have “affordable” housing — and U.S. home ownership declined last year for the first time since 2016.

Although debt on credit cards and auto loans have eased a bit, overall household debt here in America recently hit a record $18.2 trillion, as mortgage and student loan balances are at all-time highs.

And a recent survey found that 53% of U.S. adults believe they can’t make financial progress — with 48% saying they are “constantly treading water financially.” The loss of a job or some sort of emergency could push them over the edge.

The Takeaway: That close-to-the-edge descriptor holds for the economy in general; we’re at the point where a “black swan” event could tip the economy into recession. After all, GDP fell in the first quarter. It bears watching.

💀The Ugly

There are some big worries here.

America is currently carrying $36 trillion in debt. Analysts say the “Big Beautiful Bill” will add trillions to that debt load in the decades to come. And there has been no demonstrated political will to tackle America’s debt addiction.

Then there’s the Artificial Intelligence (AI) Era.

Anthropic CEO Dario Amodei warns that AI could eliminate up to half of entry-level white collar jobs here in America within five years — with tech and officer workers taking the biggest hits.

It’s already happening: The ability to automate tasks contributed to the estimated 3.7 million white-collar layoffs last year.

The Takeaway: In addition to the longer-term threats of debt and technology-driven job eliminations, a growing “gambling mindset” in the financial markets, economic deglobalization, New Cold War flare-ups, black-swan financial events and super-high asset valuations may well have that afore-mentioned “fragile equilibrium” teetering at an “at-risk” extreme. That means the year’s second half is likely to be a “stock picker’s market” — our speciality.

Here's where that leaves us …

A Volatile Run?

We’re in a momentum stock market. And there’s still “fuel” to power it higher.

But the list of risks keep growing. And the likelihood we’ll fly through a hailstorm of volatility before New Year’s Eve is pretty high. Probably very high.

So let’s go back to our bailiwick — using the best storylines to find the best stocks.

Here are five storylines — or sub-narratives — to watch, along with some strong beneficiaries. These are stocks you can look to buy now, research further or put on a “Watch List” to snag if volatility spikes and stocks pull back.

The “DraftKings Mindset:” Wealth Builders invest, Wealth Killers trade. And really smart Wealth Builders look to directly capitalize on Wealth Killer miscues. One of those miscues is the explosion in a gambling recklessness that’s infected the trading markets. I call it the “DraftKings Mindset,” and one long-term beneficiary will be CBOE Global Markets CBOE 0.00%↑, inventor of the “Fear Gauge,” more formally known as the VIX. Here's the “kicker:” If we get the big volatility spike I just talked about, it'll be a short-term beneficiary, too. Get the full lowdown in the report below.

The Long-Term Commodity Supply Shortfall: It’s a story we’ve been talking about since launching SPC in early 2024: Demand for “critical materials” like nickel, copper, silver and others keep zooming. But look out to the decade’s end — and beyond — and supplies fall way short of demand. Another one to consider: Titanium, which is crucial to defense, electric vehicles, medical devices and 3D printing. A stock to consider: IperionX LTD IPX 0.00%. The Charlotte-based Iperion owns the Titan Project, a Tennessee mine that produces titanium, zircon, high-grade silica and other critical materials. The company is developing low-carbon, fully recyclable titanium technologies. And its Titanium Production Facility (TPF) at the Virginia Titanium Manufacturing Campus will be key to this. The company’s 100% ownership of its reserves gives it control over supply.

Money-Doubler Stocks: The stock market has grown at an average annual rate of about 11% over the last five years — which would double your money in about 6.4 years. We want to find companies that can double your money even faster. One candidate: The Latin American retailer MercadoLibre Inc. MELI 0.00%. If you combined Amazon.com Inc. $AMZN ( ▼ 1.29% ) with Paypal Inc. $PYPL ( ▼ 3.78% ) and Meta Inc. $META ( ▲ 0.51% ) and Alphabet Inc. $GOOGL ( ▼ 1.76% ) — and you planted it in Latin America — you’d have MELI. This also follows our “Deglobalization” narrative. And as I told you folks before, MercadoLibre is reinvesting in growth — but is still growing earnings at an annual clip of 20% to 25%, a pace that will double its bottom line in 2.9 years to 3.6 years. And since stock prices tend to follow profits, you could be looking at a stock that could double in less than four. And some estimates have profits growing at paces as high as 35% — which could double your money in a bit more than two. This stock could be a candidate for our Model Portfolio, which is our collection of our highest-conviction stocks reserved for our SPC Premium members. Since May 9, 2024, our Model Portfolio is up 32.54% (excluding our income stocks), while the S&P 500 has returned 20.04% over the same time.

The New Cold War: The Trump Administration earlier this year proposed America’s first-ever $1 trillion defense budget. And global defense spending is on the march. I don’t expect it to change. New technologies and new battlefields – like cyberspace and outer space – will create big new opportunities. One big beneficiary: Rocket Lab Corp. $RKLB ( ▼ 8.16% ), a feisty startup that specializes in in hypersonic boosters and quick-launch technologies. Think of it like a “Junior SpaceX” (which you can’t invest in). We’ve talked about it a lot.

And “Real Income:” Most investors just don’t “get” income investments. They don’t account for inflation, taxes or prevailing market rates. They don’t think about how much money ends up in your pocket. As we say here, you need to think about investments in terms of “cash flow,” not income. So I’m sharing a new income investment here with all of our members: Healthcare Realty Trust HR 0.00%↑ — which, as its name implies, is a real estate investment trust (REIT) that invests in healthcare-related properties like medical office buildings and outpatient operations. I like the business model for a couple of reasons. Most of its properties are on (or near) the campuses of acute-care hospitals. And those office buildings house surgery centers, imaging operations, medical specialties and other outpatient services. The income streams from those properties tend to come from long-term leases, making them more recession-resistant than retail REITs. The yield is 7.8% — high enough to view it as “ real cash flow.” And our SPC Premium members have access to our Income Dossier, with two investments yielding 8.74% and 14.88%, respectively.

There you have it … my view of the year’s second half.

The economy and the stock market are still pretty healthy — though perhaps a bit long of tooth.

But that long run of relative health is also a weakness.

The list of “wild cards” continues to grow — as do the risks.

Volatility is likely to surge if any of this happens.

Pullbacks are likely … and a downturn is possible.

But if that happens, use your long-term view to flip the script and “accumulate” when most others panic.

You don't need a fortune teller, a fortune cookie or the Magic 8 Ball to guide you.

You just need a Wealth Builder mindset, which you get, with Stock Picker’s Corner in your corner.

See you next time;