- Stock Picker's Corner

- Posts

- The Greater the "Tariff Tantrum," the Higher This Stock Will Soar

The Greater the "Tariff Tantrum," the Higher This Stock Will Soar

As traders "gamble" with stocks and options, this company will mint cash ..

You’ve heard me say it here — repeatedly.

A “DraftKings Gambling Mindset” has infected the financial markets …

Investing has given way to trading. Stocks have given way to options. And wins have given way to losses … strings of losses.

Retail investors are the latest victims and have been infected badly.

As the old aphorism tells us: “When it Comes to Gambling, the House Always Wins.”

But there is a cure …

First, Wealth Builders invest. Wealth Killers trade.

So … invest … don’t gamble.

Even better: Why not win, while everyone else loses?

If we know that, when it comes to gambling “The House” always wins …

Skip gambling … and own “The House.”

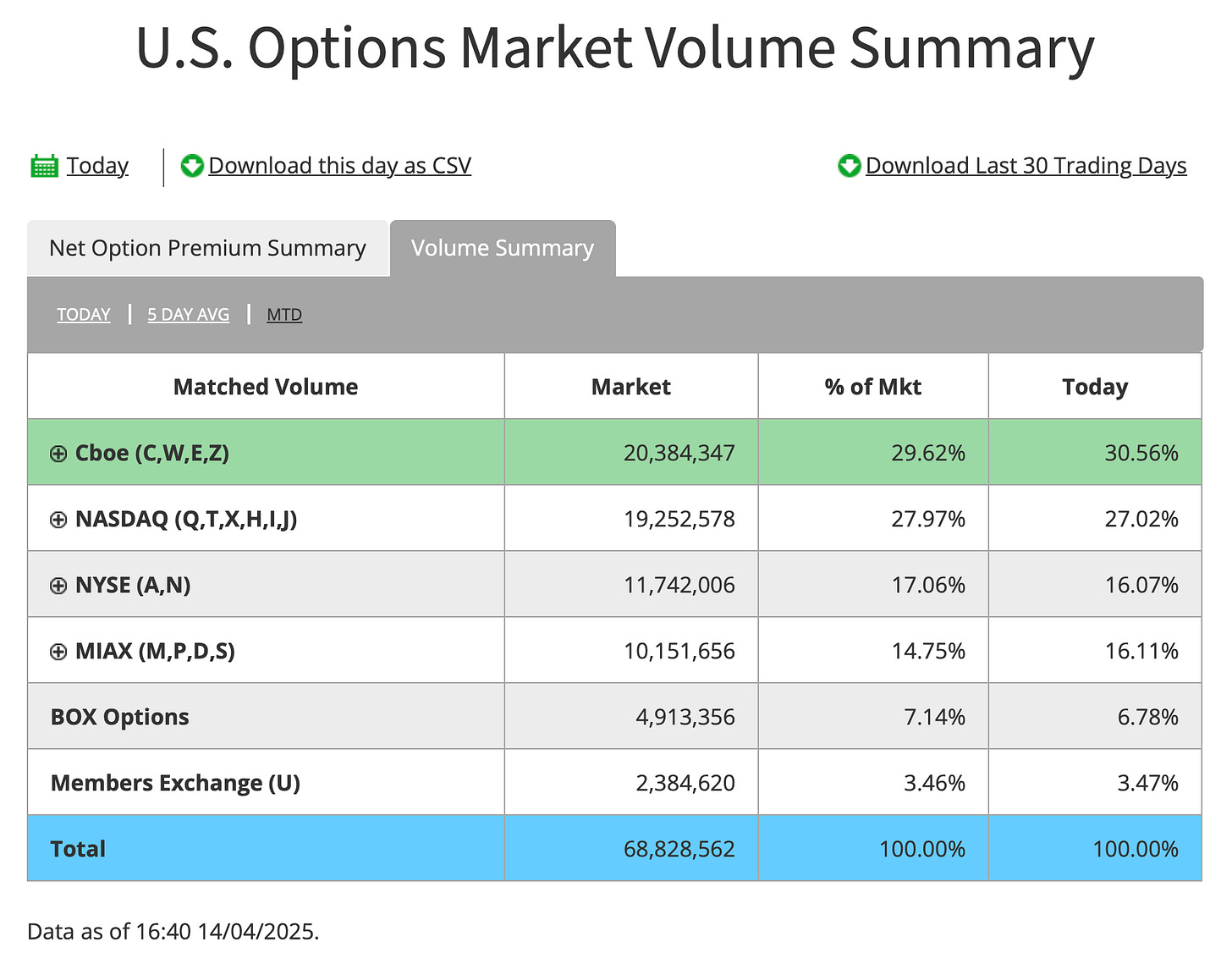

In the financial markets, CBOE Global Markets Inc $CBOE ( ▼ 0.93% ) is “The House.” It’s the market leader in transactions volume (see chart below).

Source: Utradealgos

And when markets get bad — as we’ve seen from the “Tariff Wipeout” of the last few weeks — trading volumes soar.

As Barron’s writer Andrew Bary recently said, that’s turned CBOE into “the most defensive stock in the S&P 500.”

And as I’ll show you here today, the changes we’re seeing are here to stay.

That’s turning CBOE into the “Ultimate All-Weather Stock.”

And a company you need to “Accumulate” for the long haul.

Trading Volumes Soar

Check out this headline about Goldman Sachs Group Inc. $GS ( ▲ 2.01% ) , a company I said would find a way to do well (one way or another) during this second Trump Administration.

Source: Bloomberg

Goldman on Monday said its stock-trading revenue zoomed 27% to a record $4.19 billion in the first quarter. That follows similar reports last week from Goldman peers JPMorgan Chase & Co. $JPM ( ▲ 1.99% ) and Morgan Stanley $MS ( ▲ 3.04% ), which saw trading revenue zoom 45% and 48%, respectively.

And it follows 2024, when Goldman said full-year stock-trading revenue zoomed a full 50%.

With trading like that, all roads to victory lead through exchanges — like CBOE.

Because it’s not just stocks … it’s also options … and all sorts of new financial “products.”

And some are both.

Just this week, CBOE said it “launched for trading” a so-called S&P 500 Equal Weight Index (EWI) options.

When Catherine Clay, head of CBOE’s global-derivatives business, talked about the launch, she hit all the “hot buttons” I mentioned to you.

“As investors turn to options at record levels to help manage U.S. equity market exposure and volatility, we are pleased to expand our S&P product suite with [this] launch,” Clay said Monday. "Investors are increasingly seeking to gain more balanced exposure across the market, and with the indexing expertise of S&P Dow Jones Indices and demand for the capitalization-weighted SPX options, the S&P 500 Equal Weight Index is ideally suited to underlie these new options."

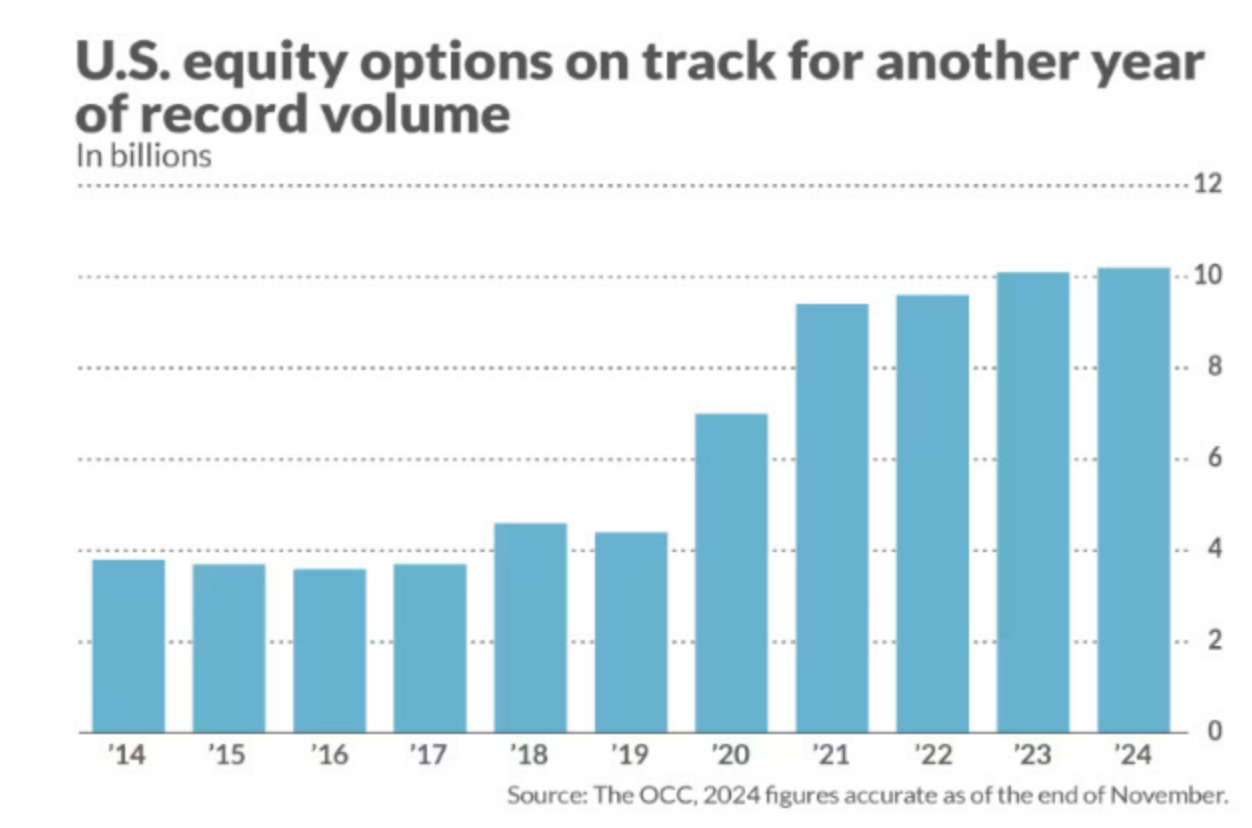

With that kind of “institutional tailwind” (direct-and-innovative pushes), it’s no surprise options trading has soared.

Last year, nearly 10.2 billion equity options contracts were traded on U.S. exchanges — setting a new record. And (as ill-advised as I believe it to be) lots of this growth is being driven by retail investors, who accounted for 29% of U.S. options activity as of September, the most-recent data available.

Take a look …

CBOE’s Stock Price Could Zoom

We’ve been telling Stock Picker’s Corner (SPC) subscribers about CBOE since we launched this investing newsletter early last year.

The stock is up more than 11.1% year to date — while the S&P 500 is down nearly 8.1%.

That’s an “outperformance” of nearly 20%.

Over time, that’s the kind of relative performance that separates Wealth Builders from Wealth Killers — and can make you rich.

But others are finally getting wise to this company.

Also on Monday, Zacks Investment Research said it recently upgraded CBOE to a “Buy” — giving the stock its No. 2 numerical ranking (with No. 1 being “Strong Buy” stocks).

CBOE “could be a solid addition to your portfolio given its recent upgrade [to a Zacks “Buy”],” the investment researcher wrote. “This upgrade primarily reflects an upward trend in earnings estimates, which is one of the most powerful forces impacting stock prices.”

We’ll get a look at CBOE’s first-quarter earnings on May 2.

And that brings us to a kind of basic “Wealth Builder 101” formula: Rising revenue (from rising trading) will lead to rising earnings … which leads to a rising stock price.

Bank of America Analyst Craig Siegenthaler just reiterated his own “Buy” rating on CBOE and boosted his target price from $251 to $260.

The increasingly uncertain macroeconomic and geopolitical backdrop produced “ideal conditions for trading across asset classes,” Siegenthaler wrote, explaining why he was boosting his earnings estimates for “market-structure” stocks.

Hitting that target would represent a 20% gain from its $217 share price.

And I see more from there in the years to come …

That makes CBOE an “Accumulate” stock – one you’ll want to own now, and add to on pullbacks.

To learn more, check out our full research report here.

See you next time;

P.S. Stop gambling and losing money — start investing to build wealth. Consider becoming a paid member today for only $10 a month or $100 a year to receive full access to our Model Portfolio, Special-Situation Portfolio, Dossiers, Premium Issues, Quarterly Roundtables, and more.