- Stock Picker's Corner

- Posts

- Your Next Move After the Tariff Wipeout

Your Next Move After the Tariff Wipeout

Three moves to transform that "very bad day" into a very big fortune ...

Before we get into this issue, we have a quick message from today’s partner:

Your job called—it wants better business news

Welcome to Morning Brew—the world’s most engaging business newsletter. Seriously, we mean it.

Morning Brew’s daily email keeps professionals informed on the business news that matters, but with a twist—think jokes, pop culture, quick writeups, and anything that makes traditionally dull news actually enjoyable.

It’s 100% free—so why not give it a shot? And if you decide you’d rather stick with dry, long-winded business news, you can always unsubscribe.

Ugly … brutal … a meltdown … a stock-market wipeout.

In newsrooms around the world yesterday, financial editors had a field day finding words — and crafting headlines — that might adequately capture what happened to stocks yesterday after the Trump Administration’s new tariff plan ignited fears of a global trade war … a recession … or worse.

As a former national business reporter who spent 20 years in the newsrooms of America, I witnessed scores of similar days — so I understand that journalists live for big, news-driven moments like this.

But thanks to my decades as a “professional observer,” I also understand what a “bad day in the stock market” can do to regular folks — like family members and friends … your neighbors … your favorite coworkers … the parents of your kid’s Little League teammates … or that person you volunteer with.

Like you, I’ve seen how a stumble in the Nasdaq Composite, the Dow Jones Industrial Average or the S&P 500 can start smart people down an ill-advised money path.

It starts with tiny tendrils of doubt … which evolves into worry … which is turbocharged into fear.

Sell-offs like yesterday — the sharpest drop since 2020 — hasten that emotional tailspin. And they prompt additional moves — with “moves” being a synonym for “investing mistakes.”

In short, those are Wealth Killer miscues.

During sharp rallies, it’s a greed-based fear of getting left behind — a ruinous mindset known as “FOMO,” or “Fear Of Missing Out.” In the face of a sell-off like the one we saw yesterday, we see an equally damaging “Where Is The Exit?” response.

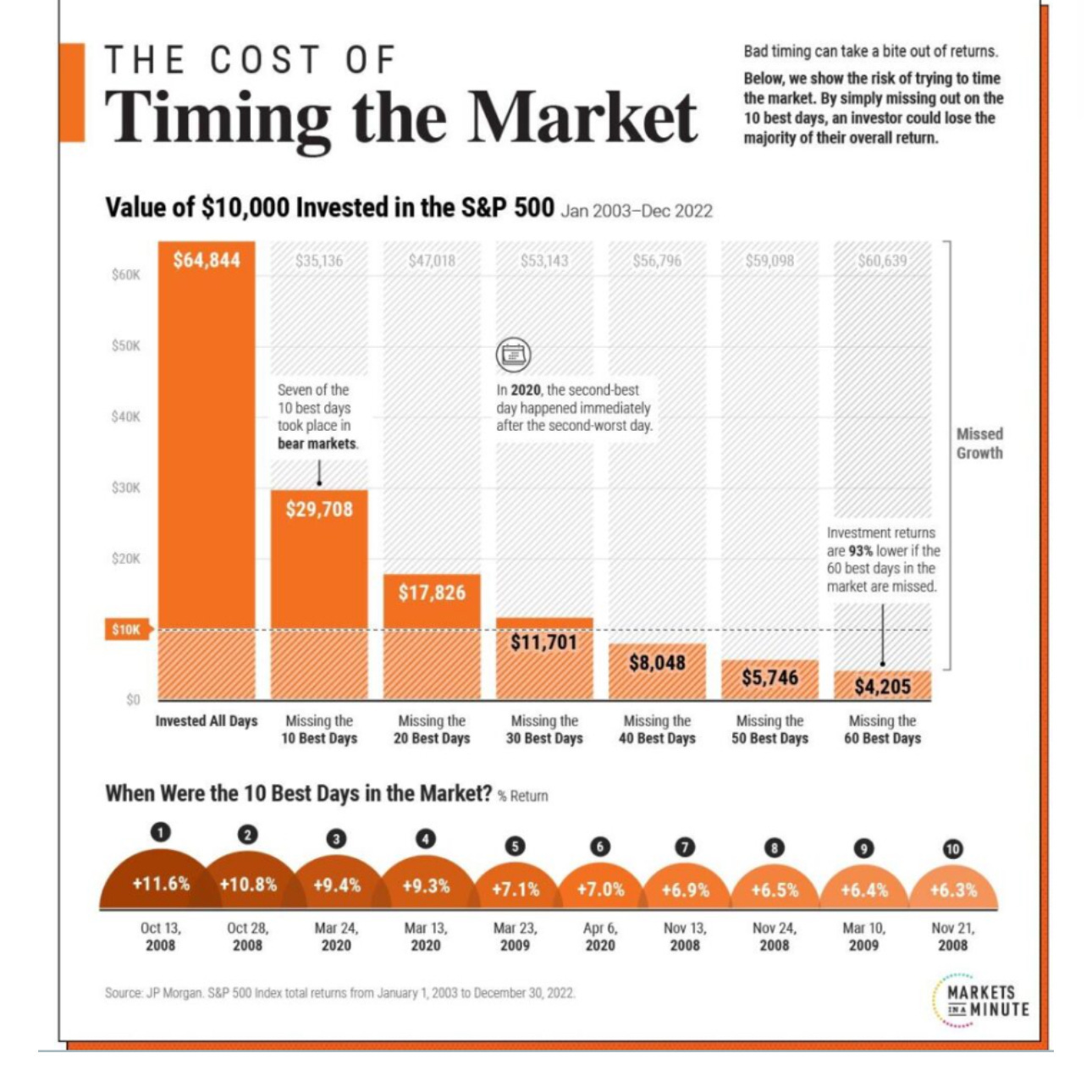

And it costs investors — dearly.

Source: The Visual Capitalist

Most investors are selling to escape that doubt/worry/fear cycle — without any real consideration of the long-term impact of that near-term, knee-jerk decision — because they don’t know what comes next.

“This is truly a fog-of-war moment,” says commodities expert Matt Warder, a friend and longtime industry colleague who runs The Coal Trader on Substack. “Are we talking a single quarter? Or are we talking two years? The duration of this consternation is really the critical issue. And it’s just not knowable right now.”

Fear Strikes Out

Matt’s right, of course.

When it comes to stock prices, it’s the “what comes next” that matters. In the jargon-laced parlance of investing, stocks are “discounting mechanisms.” Translated into plain English, that means a company’s share price reflects everything we expect about its earnings, its market, the surrounding economy and investor sentiment.

After months of talk about tariffs and trade wars, a trading day that wiped out $3.1 trillion in shareholder value — or almost a full year’s economic output from France — investors are already on the “Fear” block on the stock market’s Chutes and Ladders game board. Even wealthy folks got stung: The world’s 500 richest people lost $208 billion in combined wealth, the biggest one-day decline in the 13-year history of the Bloomberg Billionaire’s Index.

I read through reams of stories, reports, analyses and forecasts — on Substack, on Beehiiv, on mainstream news sites and from financial news feeds. Some of it was very good, much of it was thought-provoking and slices of it were alarmist and even predatory. The authors speculated about corrections and crashes, recessions and collapses, inflation and stagflation, trade wars and real wars — and more.

At the end of the day, we don’t know. And we can’t know. So, for regular investors, all that writing and speculation really isn’t helpful. It’s distracting. And diverting.

And we can’t control what we don’t understand.

But there’s one thing we can control: We can control ourselves. We can control our own emotions, our own expectations and our own actions.

We can be Wealth Builders.

To get you into that “correct” mindset, I’m giving you three “focal-point” thoughts to get you centered and to keep you centered.

Plus, I’ll throw in a few investments to consider as well.

Focal Point No. 1: Play the “Next Bull Market”

I tell folks that I’m a “Next Bull Market Investor.”

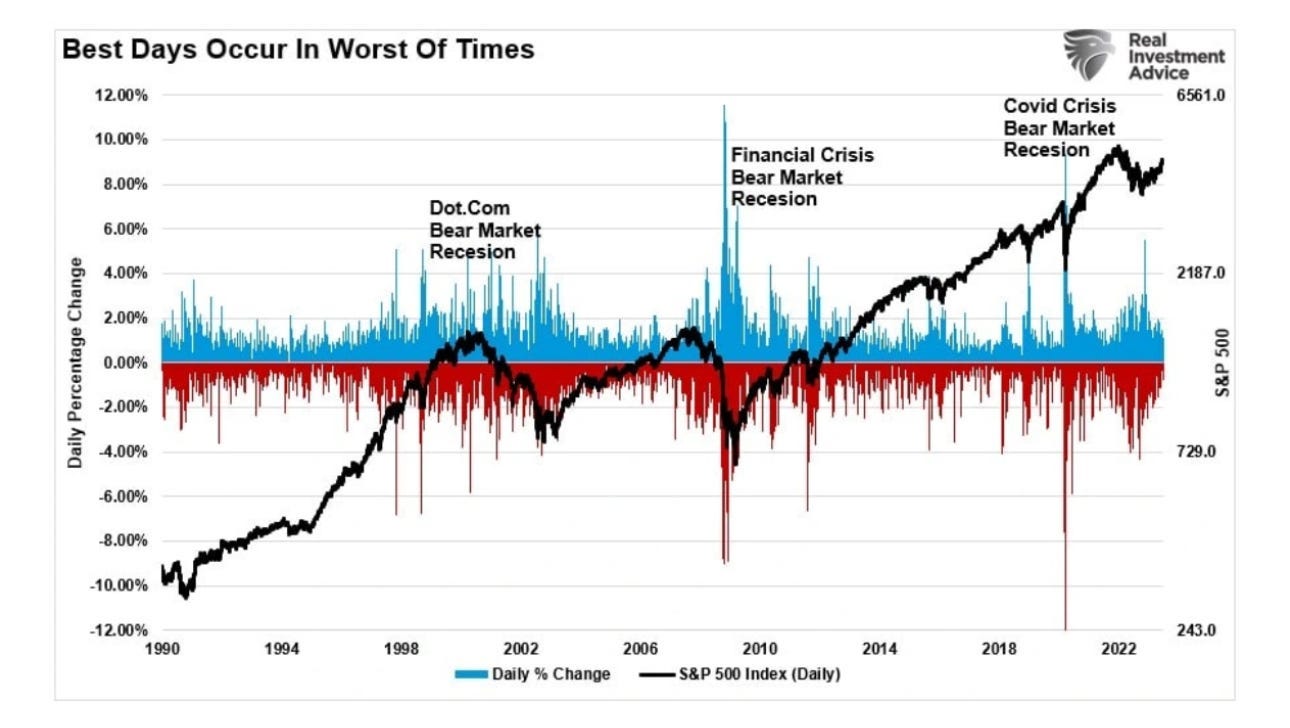

Indeed, there’s an old market maxim: “Bull Markets Make Money; Bear Markets Create Fortunes.”

That’s 100% correct. In other words, don’t obsess over the “bear market today.” Get ready for the “bull market tomorrow.”

And when you excise those knee-jerk, emotional mistakes, you can see that: Over the long-term, stocks go up.

Source: Real Investment Advice

Wealth Builders invest. They don’t trade. They play the “long game” — which can be three, five or seven years … or longer.

Morgan Housel, author of the best-selling Same As Ever, says that 10 years is an optimal holding period to build your game plan around.

Especially for retail investors, obsessing over the current action in the S&P 500 or Dow Jones Industrial Average is pointless. And it leads to self-inflicted wounds to your personal game plan. If you try to pick tops and bottoms, or rotate your way through markets or asset classes, you’ll almost always end up running behind.

Stocks to Consider

There are some great rebound plays to research. Salesforce Inc. $CRM ( ▲ 1.9% ) and Alphabet Inc. $GOOGL ( ▲ 0.43% ) are two companies I like — and the shares of both are at the low end of our trading range.

Focal Point No. 2: Find Those Great Storylines

When we tell folks to “find the best storylines, and you’ll find the best stocks,” we’re talking about narratives that will persist for years. And we’re not talking “buy and hold.” By playing the long game, you can use pullbacks like this one to “Accumulate” more shares — an approach that will magnify your upside when stock prices rebound.

To Accumulate, build a starting stake in the stocks you want to hold. Then plan out “buy points” — prices you’ll use as triggers for additional purchases. Or use dollar-cost-averaging strategies to build your stakes as you get more cash.

We’ll have more about these storylines in future issues, but they include:

Inflation and Income.

The “New Cold War.

The “Next Blockbuster Era” in biotech.

The AI Revolution and Quantum Computing.

The Private-Equity Tidal Wave.

The Commercial Space Race, and the Militarization of Space.

And Special-Situation Investing.

Stocks to Consider

Dutch Bros. Inc. $BROS ( ▼ 0.35% ) is a fascinating special-situation play — an intriguing company whose product and corporate growth plan we like a great deal. Its stock price was plastered by President Trump’s tariff plans — but that long-term growth plan (and the possibility of a takeover in the future) — makes it an interesting grab here. Utility-in-the-making Hallador Energy Inc. $HNRG ( ▼ 1.58% ) may actually benefit from the tariff forces. And “Pet Biotech” Zoetis Inc. $ZTS ( ▲ 2.84% ) is also down near the bottom of its 52-week range.

Focal Point No. 3: Focus on the “Money Doublers”

With a consistent-and-disciplined plan, Wealth-Builder math is powerful and simple.

Stocks have delivered an average return of 11% annually over the past 10 years, which means it would take 6.55 years for your nest egg to double.

And anything you can do to accelerate that a bit will help.

For instance:

At 12%, your money will double in six years.

At 15%, it’ll double in 4.8.

At 20%, it’ll double in 3.6.

Stocks to Consider

Two of the most-promising money-doubler candidates I see are companies operating outside the U.S. market. One is Latin American FinTech Nu Holdings Ltd. $NU ( ▲ 2.08% ). And the other is Latin America e-commerce leader MercadoLibre Inc. $MELI ( ▲ 1.7% ).

These are stocks that could double in about three years.

A Quick Review

Be a Wealth Builder. Not a Wealth Killer.

Embrace an approach that works for you — and that structures you for success.

A good starting point:

Identify good storylines.

Identify the biggest beneficiaries.

Establish foundational positions.

Accumulate as you go.

And play the long game.

See you next time;