- Stock Picker's Corner

- Posts

- Surprised by the Iran Strike? The 20 Hot Spots That Could Boil Over Next

Surprised by the Iran Strike? The 20 Hot Spots That Could Boil Over Next

We bring you the "what-comes-next" warning signs, the igniting "triggers" and the fallout to expect ...

America’s surprise strike on three of Iran’s key nuclear sites Saturday has spooled up an already flinty Middle East, bringing with it the escalation potential that already played out yesterday — with Iran launching missile strikes against U.S. bases in Qatar and Iraq.

I warned of this possibility last week, in my report detailing the early lessons learned in the Israeli/Iran War.

“Operation Midnight Hammer” — where the U.S. military used misdirection, B-2 stealth bombers, bunker-buster bombs and sub-launched Tomahawk cruise missiles to blast Fordrow, Natanz and Isfahan — just boosted the stakes.

One thing I’ll say: In the four decades I’ve been covering the military and the defense industry, U.S. President Donald Trump’s post-strike address was one of the shortest — and feistiest — I can recall.

Part of that is just President Trump’s personality — and his affinity for bravado. But as I told several colleagues, there was more of an “I dare you" tenor than I’ve ever seen. My take at that time: The administration’s insular inner circle will have no reticence about launching new strikes — and hammering Iran — if Tehran were to fight back in a sustained manner.

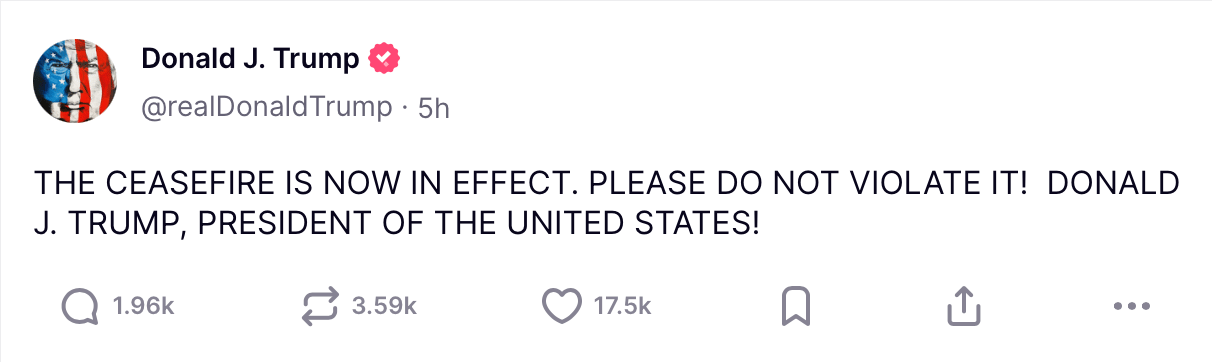

(And yesterday evening — before we “went to press” with this report to you folks — I saw discussion of a phased-in cease-fire, though nothing was official at that point.)

Source: Truth Social

I’ll be watching that storyline — indeed, all of the Iran-related developments — very closely.

In the meantime, the surprise nature of the U.S. strike is a reminder of a key lesson here in the New Cold War: Expect surprises — change (and especially unpleasant change) can come quickly.

With that in mind, and understanding it’s the “what comes next” that really matters in the financial markets, here are 20 major geopolitical “hot spots” that could escalate into full-blown crises.

With each one, I’ll give you their current status, triggers for escalation and fallout scenarios. And the order I present them in conveys no ranking of impact/fallout or probability of occurring.

1. Ukraine-Russia Conflict

Current Status: Ongoing war since 2022, with Russia controlling parts of eastern Ukraine.

Trigger: A major Russian offensive or outside intervention could escalate the conflict.

Fallout: Global energy crisis, further economic sanctions, potential direct NATO-Russia confrontation.

Probability: Highly likely – The war continues with no clear resolution.

Key Point to Watch: Western military aid—if it increases, Russia may escalate.

Winners: Defense contractors (Lockheed Martin Corp. $LMT ( ▼ 2.55% ) , RTX Corp. $RTX ( ▼ 1.25% )), energy exporters.

Losers: European economies, global food supply chains.

2. China-Taiwan-US (South China Sea)

Current Status: China continues military drills near Taiwan, increasing tensions.

Trigger: A Chinese blockade or invasion of Taiwan.

Fallout: U.S. military response, disruption of global semiconductor supply, economic downturn.

Probability: Probable – China’s military pressure is increasing.

Key Point to Watch: Taiwan’s 2025 elections—China may act if leadership shifts.

Winners: Semiconductor firms (Taiwan Semiconductor $TSM ( ▲ 0.51% ) , Intel Corp. $INTC ( ▲ 1.65% ) ), defense stocks.

Losers: Global trade, shipping, Asian markets.

3. North Korea-South Korea

Current Status: North Korea continues missile tests, while South Korea strengthens defenses.

Trigger: A North Korean nuclear test or border skirmish.

Fallout: U.S. and Japan intervention, refugee crisis, global instability.

Probability: Unlikely – North Korea prefers brinkmanship over full war.

Key Point to Watch: Missile tests—a nuclear test could change the equation.

Winners: Defense firms, cybersecurity companies.

Losers: South Korean economy, regional stability.

4. India-Pakistan

Current Status: Border tensions over Kashmir, with frequent skirmishes.

Trigger: A terrorist attack linked to Pakistan or military escalation.

Fallout: Nuclear risk, regional instability, economic downturn in South Asia.

Probability: Probable – Kashmir remains a flashpoint.

Key Point to Watch: Cross-border skirmishes—any escalation could trigger war.

Winners: Defense industries, gold markets (safe-haven asset).

Losers: South Asian economies, tourism, trade.

5. Iran-Israel (Beyond Current Conflict)

Current Status: Iran continues proxy warfare through Hezbollah and Houthis.

Trigger: A direct Iranian attack on Israel or Israeli strike on Iran’s nuclear sites.

Fallout: Middle East war, oil price surge, U.S. intervention.

Probability: Highly likely – Proxy warfare is ongoing.

Key Point to Watch: Iran’s nuclear program—a breakthrough could provoke Israel.

Winners: Oil producers, defense firms.

Losers: Middle Eastern economies, global energy markets.

6. Russia-NATO (Baltic States)

Current Status: NATO strengthens Baltic defenses, fearing Russian aggression.

Trigger: A Russian incursion into Estonia, Latvia, or Lithuania.

Fallout: NATO-Russia war, European economic collapse, global instability.

Probability: Super likely – Cyberattacks are increasing.

Key Point to Watch: Major financial system breaches—could trigger global panic.

Winners: Cybersecurity firms, blockchain technology.

Losers: Banks, tech giants, consumer confidence.

7. Cyber Warfare (U.S.-China-Russia)

Current Status: Increasing cyberattacks on infrastructure and financial systems.

Trigger: A massive cyberattack crippling U.S. or European banking systems.

Fallout: Financial market crash, loss of critical infrastructure, global panic.

Probability: Super likely – Cyberattacks are increasing.

Key Point to Watch: Major financial system breaches—could trigger global panic.

Winners: Cybersecurity firms, blockchain technology.

Losers: Banks, tech giants, consumer confidence.

8. Middle East Proxy Wars (Saudi Arabia-Iran)

Current Status: Ongoing proxy conflicts in Yemen, Syria, and Iraq.

Trigger: A direct Saudi-Iranian military clash.

Fallout: Oil price surge, regional instability, refugee crisis.

Probability: Highly likely – Proxy conflicts remain active.

Key Point to Watch: Yemen peace talks—failure could escalate tensions.

Winners: Oil exporters, arms manufacturers.

Losers: Middle Eastern economies, global trade.

9. Venezuela-Colombia

Current Status: Border tensions and economic collapse in Venezuela.

Trigger: A military coup in Venezuela or border conflict with Colombia.

Fallout: Refugee crisis, U.S. intervention, Latin American instability.

Probability: Unlikely – Tensions exist but war is improbable.

Key Point to Watch: Venezuelan political stability—a coup could change dynamics.

Winners: Oil markets, regional defense firms.

Losers: Latin American economies, trade.

10. Armenia-Azerbaijan

Current Status: Ongoing tensions over Nagorno-Karabakh.

Trigger: A renewed Azerbaijani offensive.

Fallout: Regional war, Russian involvement, economic disruption.

Probability: Probable – Nagorno-Karabakh remains volatile.

Key Point to Watch: Russian involvement—could escalate the conflict.

Winners: Defense industries, regional security firms.

Losers: Caucasus economies, trade routes.

11. Kosovo-Serbia

Current Status: Serbia refuses to recognize Kosovo’s independence.

Trigger: A Serbian military incursion into Kosovo.

Fallout: European instability, NATO intervention, refugee crisis.

Probability: Unlikely – Serbia avoids direct confrontation.

Key Point to Watch: EU diplomatic efforts—could prevent escalation.

Winners: European defense firms, security contractors.

Losers: Balkan economies, EU stability.

12. Ethiopia-Egypt (Nile Water Dispute)

Current Status: Ethiopia’s Grand Renaissance Dam threatens Egypt’s water supply.

Trigger: An Egyptian military strike on the dam.

Fallout: Regional war, food shortages, economic collapse in East Africa

Probability: Probable – Water scarcity remains a major issue.

Key Point to Watch: Egypt’s military stance—could signal escalation.

Winners: Infrastructure firms, water technology companies.

Losers: Agriculture, regional stability.

13. Algeria-Morocco

Current Status: Border tensions over Western Sahara.

Trigger: A military clash over disputed territory.

Fallout: North African instability, economic downturn.

Probability: Unlikely – Tensions exist but war is improbable.

Key Point to Watch: Western Sahara developments—could trigger conflict.

Winners: Defense firms, regional security.

Losers: North African economies, trade.

14. Space-Based Conflict (U.S.-China-Russia)

Current Status: Militarization of satellites and space assets.

Trigger: A satellite attack disabling global communications.

Fallout: Financial market crash, military escalation, global panic.

Probability: Probable – Militarization of space is accelerating.

Key Point to Watch: Satellite disruptions—could trigger global panic.

Winners: Aerospace firms, defense contractors.

Losers: Telecommunications, financial markets.

15. Yemen Civil War

Current Status: Ongoing war between Houthis and Saudi-backed forces.

Trigger: A major Houthi attack on Saudi oil facilities.

Fallout: Oil price surge, humanitarian crisis, regional instability.

Probability: Highly likely – Conflict remains unresolved.

Key Point to Watch: Saudi-Houthi negotiations—failure could escalate war.

Winners: Oil exporters, arms manufacturers.

Losers: Middle Eastern economies, humanitarian aid.

16. Afghanistan Instability

Current Status: Taliban rule, rising terrorist activity.

Trigger: A major ISIS-K attack or civil war.

Fallout: Refugee crisis, regional instability, U.S. intervention.

Probability: Probable – Taliban rule remains fragile.

Key Point to Watch: ISIS-K resurgence—could destabilize the region.

Winners: Defense firms, security contractors.

Losers: Afghan economy, regional trade.

17. South China Sea Territorial Disputes

Current Status: China claims disputed islands, facing opposition from Vietnam, Philippines, and Malaysia.

Trigger: A Chinese military takeover of disputed islands.

Fallout: U.S. military response, trade disruptions, regional instability.

Probability: Highly likely – China continues aggressive expansion.

Key Point to Watch: U.S. naval presence—could provoke Chinese response.

Winners: Defense firms, shipping security.

Losers: Global trade, Asian economies.

18. Russia-Arctic Militarization

Current Status: Russia expands military presence in the Arctic.

Trigger: A clash over Arctic resources with NATO nations.

Fallout: Energy crisis, military escalation, environmental damage.

Probability: Unlikely – Arctic tensions exist but war is improbable.

Key Point to Watch: Resource claims—could trigger geopolitical disputes.

Winners: Energy firms, Arctic infrastructure.

Losers: Environmental stability, global trade.

19. Burkina Faso-Côte d’Ivoire Conflict

Current Status: Rising terrorist activity and border tensions.

Trigger: A cross-border militant attack.

Fallout: West African instability, refugee crisis.

Probability: Probable – Terrorism is rising.

Key Point to Watch: Cross-border militant activity—could escalate tensions.

Winners: Security firms, regional defense.

Losers: West African economies, trade.

20. Libya Civil War

Current Status: Ongoing conflict between rival factions.

Trigger: A foreign military intervention or terrorist resurgence.

Fallout: Refugee crisis, oil market instability, regional war.

Probability: Highly likely – Conflict remains unresolved.

Key Point to Watch: Foreign military involvement—could escalate war.

Winners: Oil exporters, arms manufacturers.

Losers: Libyan economy, humanitarian aid.

There you have it …

Put this aside … save it: The reality is … it’ll come in handy.

And I’ll see you next time;

Before You Go

Our SPC Premium newsletter, launched on May 7, 2024, contains our Model Portfolio, which holds our highest-conviction stocks. Excluding our income stocks, the Model Portfolio is now up 31.16% compared to the 16.14% gain from the S&P 500 over the same time. Because we play that “long game,” these market-beating profits in the near term are gravy on top of the real gains we believe are still to come. If you're looking for deeper insight into navigating a world marked by uncertainty and accelerating change, join us as our newest SPC Premium member today.