- Stock Picker's Corner

- Posts

- What We've Learned From the Israel/Iran Conflict

What We've Learned From the Israel/Iran Conflict

And why a VIX victor, a drone pioneer and an AI leader will be long-term winners ...

If the Israel/Iran Conflict teaches us one big lesson, it’s this: Like its namesake of decades ago, today’s “New Cold War” can turn hot with stunning rapidity.

It’s “what comes next” that matters most.

(In that same “what-comes-next” spirit, I’ll follow up with a “Global Hot Spots Watch List” — a Stock Picker’s Corner (SPC) briefing that’ll keep you in the know — early next week.)

But here in today’s issue, I’ll share four lessons. And from there I will spotlight three long-term beneficiaries.

So let’s get started …

Lesson 1: Beware of Proxy Fights

As the son of a defense contractor/engineer and later as a business reporter who covered that industry, I lived through, analyzed and wrote about the first Cold War, which pitted the United States against the Soviet Union, and ran from 1947 to 1991. That “war” got its name from the fact that those two superpowers never exchanged direct fire. But the two heavyweights did fight “proxy wars” in Korea, Vietnam and Afghanistan, skirmishes both sides used to test weapons, gather intelligence and sharpen tactics.

But with proxy wars — as we say about investing — there’s no “free lunch;” any gains came at a price. For America, the Vietnam War started with us sending advisors, aid and some weapons. We ended up losing nearly 60,000 soldiers. And the $170 billion we spent doesn’t include the fallout costs of rampant domestic inflation, budget deficits and a loss of public trust in the government that continues to this day. (Also usually overlooked: The fact that millions of Vietnamese were killed during a war that lasted decades.)

Before becoming a “shooting war” on Friday, the Israel/Iran Conflict was a proxy fight, with Iran hitting Israel through proxies like Hezbollah and Hamas. The Hamas assault on Israel on Oct. 7, 2023, triggered the Gaza War, also a proxy conflict. And now the two countries are battling directly.

Proxy wars to keep watching include the Russia/Ukraine War, which has the latter getting Western aid; the Yemen Civil War, where Iran backs the Houthi rebels; and the Syria War — one of the most-complicated proxy battlegrounds, with the United States, Russia, Turkey and Iran backing different factions.

Keeping track of “proxy wars” to avoid that “cold-war-to-hot-war surprise” makes sense. Except …

Lesson 2: Today’s Technologies Are “Blurring the Lines”

In the first Cold War, the “rules of engagement” were well understood: No direct attacks against your enemy’s “home turf.”

Espionage (spying) was “look-the-other-way” acceptable — since both sides did it.

But new technologies are blurring the boundaries between:

What constitutes “home turf?”

What constitutes an “attack?”

And, most crucial of all: At what point does a “war” really begin?

During the first Cold War, in a series of spying missions known as “Operation Ivy Bells,” the U.S. Navy sent special spy subs inside claimed territorial limits in Russia’s Sea of Okhotsk and placed giant “tapping pods” atop subsea Soviet telephone cables. It was immensely risky — so much so that the Navy allegedly placed self-destruct charges on the nuclear-powered USS Parche (SSN-683) — to keep the sub and its crew of 112 to 180 from being captured.

The United States thought the risk worthwhile — especially after repeated spy forays netted what insiders referred to as “The Crown Jewels.” And when the Soviets eventually discovered and recovered the massive tapping pod, it raised no stink; it uncovered the operation thanks to its own spy: Ronald Pelton, an analyst with the National Security Agency (NSA), whose cover Moscow didn’t want to blow.

But as technology advances in complexity, so do the schemes to use it — and the risks.

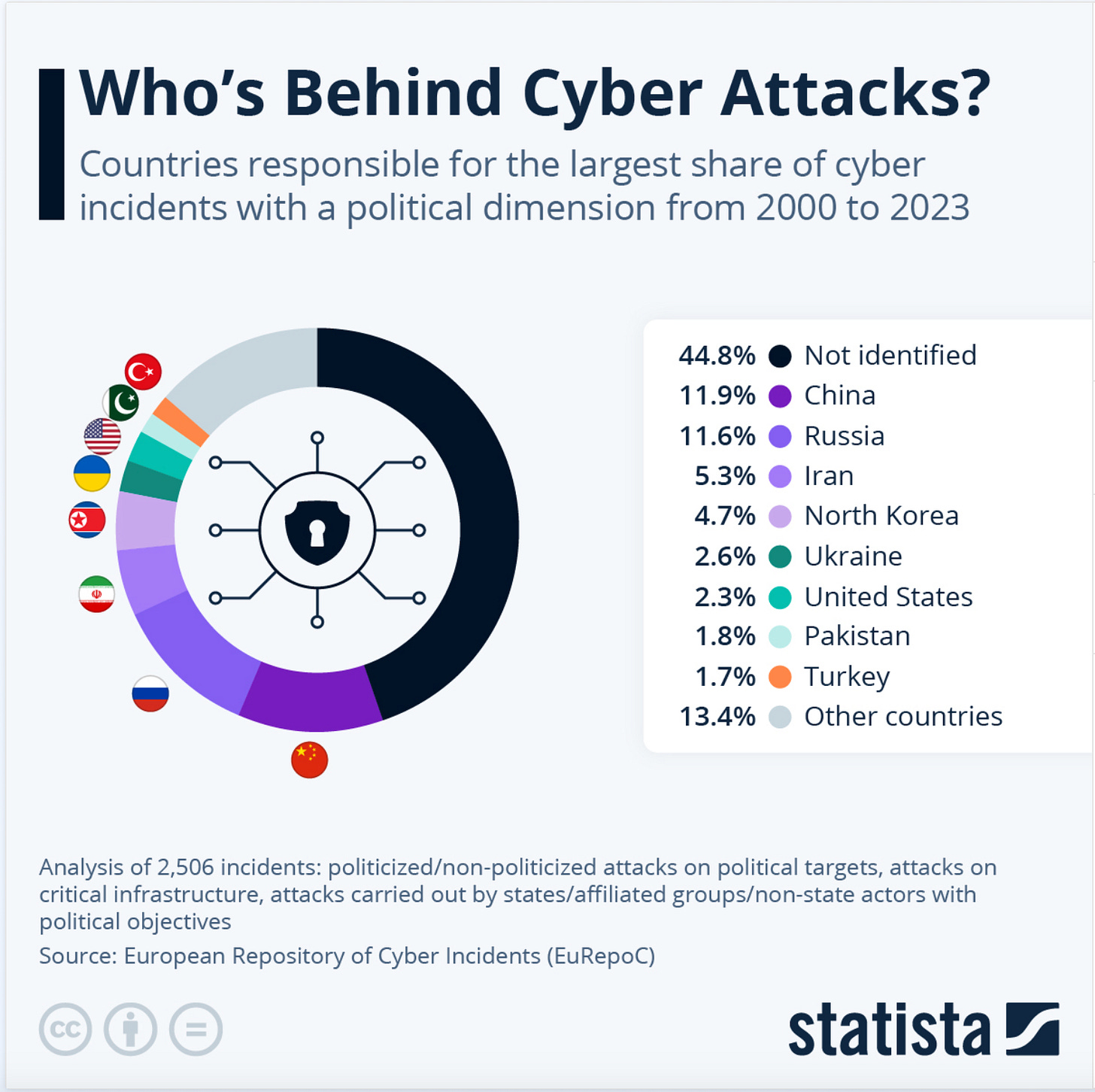

In June 2010, Iran discovered that a self-replicating “computer worm” called Stuxnet had substantially damaged its nuclear program. It responded by bolstering its cyber defenses and massively bulking up its cyberwarfare arsenal — by one account boosting its cybersecurity budget by 1,200%.

Today Iran is ranked as one of the top bad actors in cyberwarfare and cybercrime: It’s been linked to attacks on Saudi Aramco, U.S. banks and critical infrastructure in Israel.

Here in the New Cold War, that “escalation factor” is a bigger risk than ever.

One example: In “Operation Rising Lion,” the military action to denude Iran’s nuclear program, Israel reportedly used spies, artificial intelligence and special armed drones that it smuggled into Iran as part of Tel Aviv’s targeting program.

But experts like Prof. Robert Kelly, a nuclear-proliferation specialist at South Korea’s Pusan National University, worries this will accelerate the “horizontal” and “vertical” push for nukes — nuclear powers will build more weapons, while non-nuclear ones will do all they can to obtain them.

“If you look at the last five or six years, you’ve got a repeated series of incidents that demonstrate nuclear weapons are a really, really powerful deterrence,” Prof. Kelly told NBC News. Especially since, as Iran has discovered, “if you don’t have them, you get bombed.”

And, as Israel found, if you do have them, you get bombed. Which means:

Lesson 3: You Need “Air Supremacy”

It’s a nuanced topic. But it’s relevant, so I’m intentionally oversimplifying this.

During World War II, the generals focused on achieving air superiority — where you conduct operations with no interference from enemy aircraft — versus full air supremacy, a higher level where the enemy air force can’t effectively stop you.

If you look at the Allied bombing campaign over Europe, the fighter-escorted bombers had air superiority, letting the American Boeing B-17 Flying Fortresses pound aircraft factories, ball-bearing plants, oil refineries and more. By D-Day, Allies had pulverized Germany to achieve air supremacy.

In fact, in talking to troops right before the invasion of Europe, Gen. Dwight D. Eisenhower reportedly said: “If you see fighter aircraft over you, they will be ours.”

Late in the war, U.S. Army Air Force bombers were flying daylight missions against strategic targets, while the British Royal Air Force flew incendiary raids at night. That paired strategy, coupled with Allied air superiority and the near absence of the German Luftwaffe, spawned a grim joke among German troops, who ruefully noted: “If you see a white plane, it’s American. If you see a black plane, it’s the RAF. If you see no planes at all, it’s the Luftwaffe.”

As the Iran/Israel affair has demonstrated, here in the New Cold War era – when the battle turns “hot,” or when surgical strikes are launched – technology can deliver de facto air supremacy, without having to establish air superiority.

On the first night of Operation Rising Lion, the Israeli Air Force flew about 200 combat planes for two hours in Iranian air space — 70 of them flying high over Iran — with no losses. With focused technologies, Israel created a temporary “operational corridor” to fly in by jamming radars, blinding air defenses, disrupting cybertools and blocking command communications. That meant it didn’t do it dominate all of Iran’s air space – just the area needed to fly the mission.

A lot of this echoes “Operation Spider Web,” the early-June strike where The Ukraine used an array of sub-$1,000 drones, launched from wooden carriers on the backs of trucks, to damage or destroy as many as 40 warplanes across the Russian continent.

The raid — which caused $7 billion in damage, according to some claims — is viewed as a wakeup call for aerial-strategy traditionalists. It demonstrated the here-and-now reality of massed, low-cost attack drones.

And it demonstrates the fallibility of many modern air-defense systems.

Video of missile strikes inside Israel have also ignited discussions of missile-defense systems, missile interceptors — and an emerging class of warheads known as “hypersonic glide vehicles,” or HGVs. As the term implies, these warheads are boosted to apogee by a ballistic missile. But they fly toward their targets at hypersonic speeds and are capable of enough maneuvering to evade today’s missile defenses. Iran claims to have one. And so do Russia and China.

Lesson 4: Expect Major Financial Blowback

Investors hate uncertainty. They tend to overreact on the upside and downside. And with faster access to more information than ever before, information overload is a reality and overreaction the norm.

That means economic and financial aftershocks are immediate.

Here are a few “fun factoids” that show those reactions.

Oil Prices Spiked: Brent crude jumped more than 10%, reaching its highest level in five months.

Stocks Plunged: The Dow dropped 800 points and the S&P 500 and Nasdaq each dropped more than 1%.

Currencies Shifted: The dollar rebounded and the Israeli shekel fell 3.4%.

Fear Surged: The CBOE Volatility (VIX) — usually known as the “Fear Ga,” jumped 16%, to its highest level since October.

Gold Jumped: The “yellow metal” hit a record $3,500 an ounce – as investors moved into safe-haven assets.

Traders Freaked: Defense stocks surged, while Middle Eastern markets plummeted.

We’ve seen it before.

Examples include:

Russia’s Invasion of Ukraine (2022): Oil prices surged 30%, reaching $130 per barrel, while global stock markets fell more than 10% in the weeks following the invasion.

9/11 Attacks (2001): The Dow skidded 7.1% in a single day, while gold prices spiked 6% in another scamper to safety.

Gulf War (1990): Oil prices doubled within months, reaching $40 per barrel; stocks dropped temporarily but later rebounded.

COVID-19 Market Crash (2020): The S&P 500 fell 34% in just one month, one of the fastest declines in history.

Analysts expect continued market volatility from continued Middle East skirmishes. And big surges in volatility will be the new normal in the New Cold War. All these “lessons” I’ve outlined here will fuel periodic surges of uncertainty and instability — leading to volatility spikes in the financial markets.

The Winners

In my 40 years writing about the economy, the financial markets, stocks and global events, I’ve seen this happen time and again: A big story breaks … and surprises investors and traders … and folks respond in knee-jerk fashion.

But here’s the reality: When you “respond,” you’re chasing the market. You’re not acting — you’re reacting. And that’s a strategy for Wealth Killers.

Wealth Builders like us play it smart: We search out the underlying trends, the big storylines — or the “lessons” like those I’ve detailed here today.

And here in the New Cold War, those lessons are synonymous with opportunity.

Opportunity No. 1: The Volatility Victor

There’s a reason most folks are Wealth Killers, not Wealth Builders: They’re lousy investors. Or lousy traders.

Something happens — and those Wealth Killers feel the need to respond.

They just can’t help themselves.

They live by the motto: “When in doubt, do anything.”

Even if doing something — doing anything — is the wrong move to make.

That’s fueled what I’ve nicknamed a “DraftKing’s Mindset” — a gambling mentality that’s infected the stock, bond and options markets.

And there’s a terrible reality about the world of wagering: When it comes to the world of gambling, “The House” always wins.

So why not own “The House.”

In Vegas or other gambling centers, the casino is The House. In the financial markets, the casinos are the “financial exchanges.”

One of those exchanges is my favorite: CBOE Global Markets Inc. CBOE 0.00%↑ .

When volatility surges, CBOE benefits. And powerful long-term trends will benefit CBOE over that same long-haul run.

Trends that include:

Deglobalization, which is helping trigger some of the impacts I’ve detailed here today.

A surge in options trading, with retail investors falling under their spell.

A growing sophistication in weapons technology, which is boosting global risks even as the lines get blurred.

Buy a “foundational stake” — and add to it on pullbacks. I’m going to do exactly that for my son Joey on the next pullback.

Opportunity No. 2: Attack and Defense

Think back to all that damage those drones inflicted — in Russia and then in Iran.

They avoided those “superior” air defenses — and hammered their targets.

Drones will play other roles, too. For instance, low-cost, jet-powered versions of pilotless aircraft can serve as “loyal wingmen” to their more-expensive, human-piloted counterparts.

In that role, they can serve as “advance scouts,” provide real-time information about targets, fly ahead of combat formations to draw away enemy fire, or even serve as semi-sacrificial “screens” to protect piloted jets.

The Boeing Co. BA 0.00%↑ has experimented with drones as robotic aerial tankers, which could loiter just outside the combat area and refuel U.S. jets heading into, and returning from, their long flights to fight over the South China Sea.

One of our Model Portfolio companies can help America find “air supremacy” over enemy targets, and help protect the country’s home skies from rivals.

Shares are already up 130% since we added it to our Model Portfolio last May, climbing from $18.76 to $43.23.

And there is plenty of upside left …

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.