- Stock Picker's Corner

- Posts

- Facing the Bear: I Just Bought Stocks

Facing the Bear: I Just Bought Stocks

Here's what I bought for my son and myself ...

When you're goin' through hell keep on movin'

Face that fire walk right through it

You might get out before the devil even knows you're there.

We tell you folks that at Stock Picker’s Corner (SPC), we’re Wealth Builders — not Wealth Killers.

That we play the “Long Game.”

That we be believe in the “Accumulate” strategy — meaning we buy stocks we like on pullbacks, or even when there’s “Blood in the Streets.”

Those aren’t empty words to sound tough.

That’s what we’ve learned over the decades. That’s what we believe. That’s what works.

If you want proof, let me back up my words with personal actions.

You see, I bought stocks this week.

For myself … and for my son Joey, a high-school senior who just got accepted to the Berklee College of Music in Boston.

Let me tell you what stocks I bought … why I bought them … and why I’m okay doing what I did …

Even if stock prices fall more.

And even if the U.S. economy tumbles into a recession.

And even if both those dour situations were to stretch out over several years.

I’m not being flippant when I say that “I don’t care.”

It’s just that I’m after Bigger Game.

Wipeout

Last week, I told you about the “Trump Tariff Wipeout.” I chose that headline well: In the days that followed, a bunch of other news organizations chose that same “wipeout” descriptor — including The Wall Street Journal.

It’s an accurate portrayal: Two terrible days of trading eradicated a record $6.6 trillion in shareholder wealth, which was 50% more than the previous record $4.4 trillion blasted away over two days in March 2020, during the COVID-19 Pandemic.

Stocks plunged for a fourth-straight day Tuesday, a day that initially included a hopeful rally but ended with the S&P 500 skidding 1.57%, the Nasdaq Composite falling more than 2.1% and the Dow Jones Industrial Average about 0.8% (after climbing as much as 1,300 points during the trading day).

It’ll almost certainly get worse before it gets better. But how much worse, where or when this all ends, and how broad reaching the fallout proves to be just can’t be known.

I’m still a true believer in the “Accumulate Strategy,” where you buy shares on pullbacks and over time. (At this point, the S&P 500 is down about 19% from its peak, and the Nasdaq more than 24% — meaning stocks are pretty much in bear market territory.)

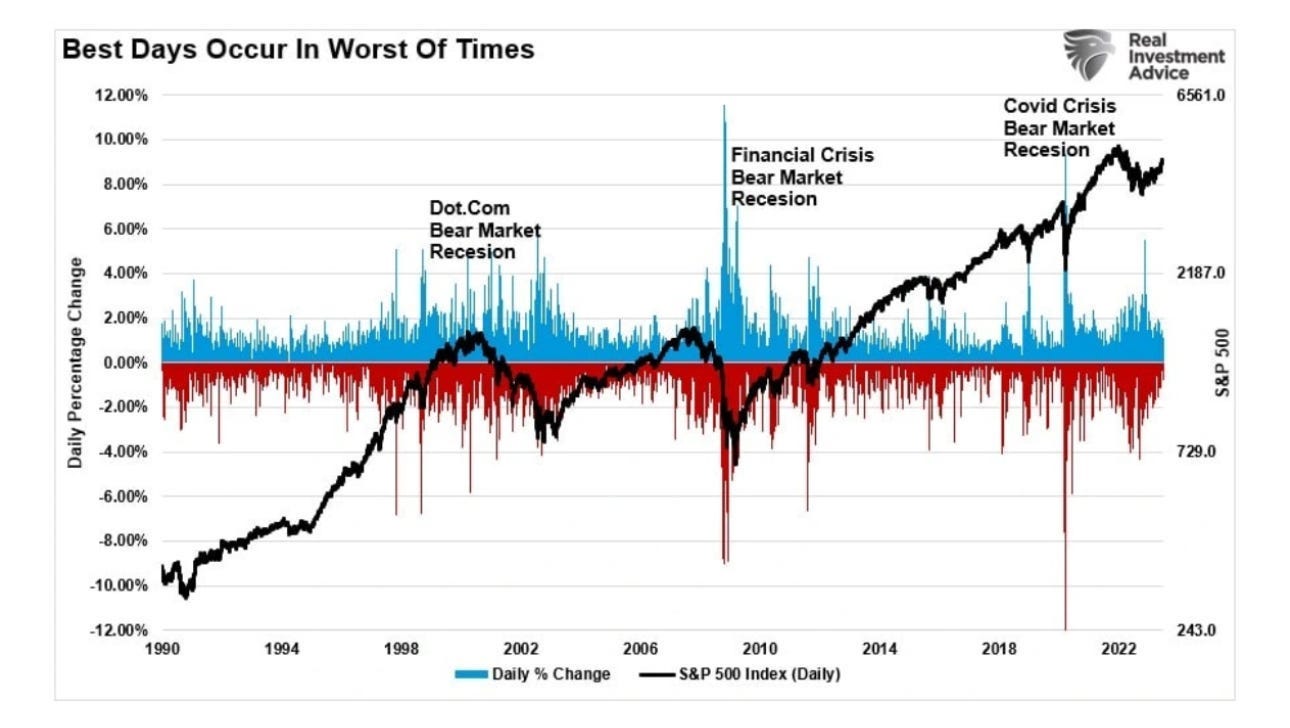

Here’s why: Bull markets create profits … but bear markets create fortunes.

Three, five, seven years from now … most investors will look back on the bear market that’s got them freaked out now as the woulda/coulda/shoulda opportunity they missed out on. Remember, over those same longer spans:

Crises end and bear markets rebound.

Recessions end and economies grow.

And stocks go up — way up.

In 1900, the U.S. economy was worth $590 billion. And the Dow Jones Industrial Average — not quite four years old at the time — opened that New Century at 66.08.

Since that time, we’ve been through World War I and World War II, the Korea and Vietnam wars, two Gulf Wars, the beginning and end of the first Cold War, and the start of the New Cold War, 9/11, countless presidential elections, the Panic of 1907, the Great Depression, the Great Financial Crisis and the Great Recession, the Crash of ’29, the Crash of ’87, Watergate, the Savings and Loan Crisis, the Dot-Com Bubble, the COVID-19 Pandemic … and those are just the highlights (or lowlights).

In nominal dollars, the U.S. economy has grown to $30.3 trillion — about 51.4 times bigger than it was back in 1900.

And the bellwether Dow marched onward: It peaked this year at 45,073.63 — about 683 times higher than in 1900.

Source: Real Investment Advice

So I bought stocks.

For Joey … and for myself.

MY SON’S FUTURE

Joey and Chase ….

I got Joey started with stocks six years ago, when he was 12. We talked about the activities he enjoyed, foods he ate and products and services he used. That led us to stocks like Microsoft Corp. MSFT -0.03%↓ (xBox and Minecraft), Apple Inc. AAPL 0.61%↑ (iPad and iTunes), Netflix Inc. NFLX 0.16%↑ (movies), Berkshire Hathaway Inc. BRK.B (Kraft mac and cheese) and more.

With the pullback in stocks, we had that talk again late last week. And we zeroed in on these companies.

Formula One Group Inc. $FWONK ( ▲ 1.39% ): It’s a hot global brand and is about to get hotter: In late June, the Brad Pitt-starring F1 hits theaters. Joey loves auto racing — both NASCAR and Formula One — and the opportunity to be an “owner” was too cool to pass up, especially at bargain prices. Joey builds models of F1 race cars, sets his alarm to watch overseas races during the overnight hours and binge-watched the hit Netflix series — linking two of his stocks.

Amazon.com Inc. $AMZN ( ▲ 1.19% ): It’s everywhere. The Patalon family is as “Prime-addicted” as any American household. Over the next five years, sales are projected to grow at a 12% clip and profits at 17%, meaning Amazon’s bottom line would double in a bit more than four years. Since stock prices tend to follow earnings, that means Amazon’s shares could double, too. The stock’s down 30%. This will be a good one for my son.

Zoetis Inc. $ZTS ( ▼ 0.86% ): Chase, our Border Collie, spends a lot of happy nights curled up on Joey’s bed — and escapes there during stormy days while my son is at school. We love our pets —a dog, a cat and a bunny rabbit. And we’re proactive when they’re ill. And Zoetis — our “Pet Biotech” stock — is an innovator: Its monoclonal antibody drugs are breakthroughs. And we’ve used Zoetis medicines to treat each of them. The stock is down 28% from its high.

Nu Holdings $NU ( 0.0% ): This Brazil-based fintech is a play on my son’s Latin American heritage. Latin America is still massively “underbanked,” and its Nubank operating unit is finding ways to change that. A recent “vertical credit card” has become a fashion item. And the company has inked some interesting partnerships. Over the next five years, sales are projected to grow at an average annual clip of 25%, while profits will surge an-even faster 30%. At that rate, this stock could double in less than three years. Even if it takes twice that long, I’m fine with that.

Alphabet Inc. $GOOGL ( ▼ 1.21% ): I’ve talked about this one a lot. It’s undervalued vis a vis its peers, just announced a big acquisition, has a powerful cloud-storage business, is a player in quantum computing and is getting positive feedback on its Gemini 2.0 AI model. The stock is down 30% from its peak. Before the current ugliness, the consensus target was $225 — 55% higher than its bashed-down price right now.

That’s what Joey and I did. I’m happy to let these companies (and their shares) rebound, build and grow while my son’s doing his thing up in Boston. That’s a “Wealth Builder Mindset.” Maybe when he gets out of school in 2029 there’s a nice little nest egg available for a house down payment. Or, even better, he lets it ride — and remembers me when he puts it to use long after I’m gone (hopefully years from now).

Now here are the moves that I made …

Bargain Hunting

I used this to add to some things I already own. And to make some interesting new purchases.

I had cash sitting in IRA or SEP-IRA accounts. And that cash included the proceeds of a recent sale of Kellanova Inc. $K ( ▼ 0.01% ), the target of a buyout after it was spun off from W.K. Kellogg & Co. $KLG ( 0.0% ) (which has seen insider buying and which was just upgraded to “Buy” status by Zacks Investment Research). I love breakups and our paid-up subscribers have access to several in our “Special-Situation Portfolio.”

Let me be clear: I used some of my cash — but I kept plenty of powder dry in case this bear market turns into something worse.

I like what I was already holding. I’ll be standing pat.

Eli Lilly & Co. $LLY ( ▼ 0.38% ): I’ve covered biotech for a hefty slice of my professional career — as a nationally known business reporter and as an analyst, stock-picker and financial columnist. So I know the power of “The Blockbuster” drug. Lilly’s “Less-Is-More” biotech strategy — for its market-leading weight-loss drugs and more — positions it for a decade of growth. With the stock down 26% from its 52-week high, I like where I’m starting from.

Nu Holdings: I grabbed this for myself for the same reasons I snagged it for Joey.

MercadoLibre Inc. $MELI ( ▼ 0.64% ): It’s a stock I’ve followed for a decade — having recommended MercadoLibre shares to my other newsletter subscribers when the stock was trading at a tenth of its current price. If you combined Amazon with Paypal Inc. $PYPL ( ▲ 1.29% ) and Meta Inc. $META ( ▼ 0.08% ) and Alphabet — and you planted it in Latin America — you’d have MercadoLibre. That region is underserved by e-commerce — and it’s underbanked — which gives this company a sturdy long-term allure.

Salesforce Inc. $CRM ( ▼ 2.86% ) : So-called “AI Agents” are part of our future. And Salesforce is a leader in bringing those “agents” to businesses. The company’s Agentforce AI agent helps companies with scheduling, shipping, customer service and troubleshooting. The shares are down by a third. Earnings could double in less than five years.

Hallador Energy Inc. $HNRG ( ▼ 5.63% ): I like what this “utility-in-the-making” is doing. I told folks to snag it when it dipped to $6 last year. It’s at $11 now, which still is down from its $14 peak last year. And The Coal Trader’s Joe Aldina put a “Buy” on the stock late last year, saying $16 is a reasonable initial target. Longer-term, the upside could be double that — so call it a triple from here. I like the story. So I’ll tuck this one away for a few years as the company fulfills its new Prime Directive.

And one other “special-situation” stock.

Understand, that I’m sharing my own activities to show how seriously we take the strategy that we advocate. Don’t view these as recommendations or endorsements, but rather as insights shared to give you a starting point for your own research.

In one of our next issues, I’ll share some of the history and psychology of bear markets, corrections and economic downturns. And some insights on trade wars through history.

It’s a tough stretch.

It’s investing hell.

But keep moving. Take the long view.

You’ll avoid getting burned.

See you next time;