- Stock Picker's Corner

- Posts

- Check Out This Software Firm — Before Everyone Else Gets Wise

Check Out This Software Firm — Before Everyone Else Gets Wise

Will Microsoft, Salesforce or deep-pocketed Private Equity come calling?

I wrote my very first news story on a microcomputer called a Tandy TRS-80 — a workplace abomination that the other reporters referred to as the “Trash 80.”

Source: OldComputers.net

That was 40 years ago.

And that first story on that “boat-anchor-with-a-floppy drive” launched a career that’s seen me live through, work through, analyze and write about the best inventions, best companies and best stocks emerging from the PC Revolution, the Dot-Com Boom and (now) the AI Era.

Along the way, I’ve witnessed scores of innovations that were billed as “The Next Great Thing.”

You folks know what I’m talking about: Bunches of “more/better/faster” inventions that were supposed to make our lives better, work easier and companies more profitable.

And you folks also know, as I do, that most of these inventions could be summed up with the single word that my Dad liked to use: Malarkey.

Most of those innovations were total bollocks … didn’t work … didn’t do what they claim … and didn’t make our lives easier. And the only money they made? It was pocketed by the huckster inventors who conned us.

Maybe it’s the cynical ex-reporter in me, but when someone comes to me and says “Hey Bill, try this writing device/data analyzer/workflow enhance” … well, I’m typically skeptical.

A few years back, a colleague persuaded me to try this “productivity suite.” It was like cheap bubble gum: The more you chewed, the tougher and less flavorful it got.

But when I co-founded Stock Picker’s Corner (SPC), I was turned onto a productivity software “invention” called Monday.

Here’s where it gets interesting.

I not only dig Monday’s software — which has made me more effective.

I also kinda dig the company Monday.com Ltd $MNDY ( ▼ 1.7% ) as a long-term “Accumulate” play: It’s an off-the-radar growth company — and a possible future takeover target.

And today I’m going to tell you all about it …

Leader From the Pack

That “off-the-radar” label won’t last much longer. Earlier this month, Zacks Investment Research said Monday was appearing on its list of most-searched stocks.

Let’s go back in time … not 40 years (I never want to see a Trash 80 again) … but to 2012, when Monday was launched as a software-as-a-service (SaaS) company. That’s not just a historical footnote; it’s a competitive one: That year is often referred to as the “Year of SaaS” by industry thought leaders, including venture-capitalist Marc Andreesen.

What they mean is that 2012 was the year a lot of big companies began the transition to cloud-based enterprise offerings. That’s a pivotal point. But it also says something about Monday: The company’s leaders somehow navigated it out of that overcrowded morass — and created a company that’s made its own mark.

Monday got its start that year as an internal project-management tool called Dapulse for website builder Wix.com. Wix spun it off that same year.

The product was launched commercially two years later; the name change to Monday.com came in 2017. It went public in 2021.

Monday’s Tel Aviv home base grabbed my attention, since — from my years writing about stocks, I know that Israel is a hot bed of innovation. And it does a good job commercializing military technology. One of my early favorite cybersecurity plays: Check Point Software Technologies Ltd CHKP 0.00%↑ — up 6,700% all time – is an Israeli tech firm. And one of the companies I wrote about years ago while at Stansberry Research created a swallowable GI-imaging system called “Pill Cam” — which was (if I recall) adapted from missile-camera targeting cameras.

But that’s what innovation is supposed to do, right? Make all the “code” and other “make it work” tech disappear for the end-user?

I’m definitely not an early adopter. But neither am I a total technophobe.

What I want is an app, or a device or a technology that someone can show me and that’s easy to use.

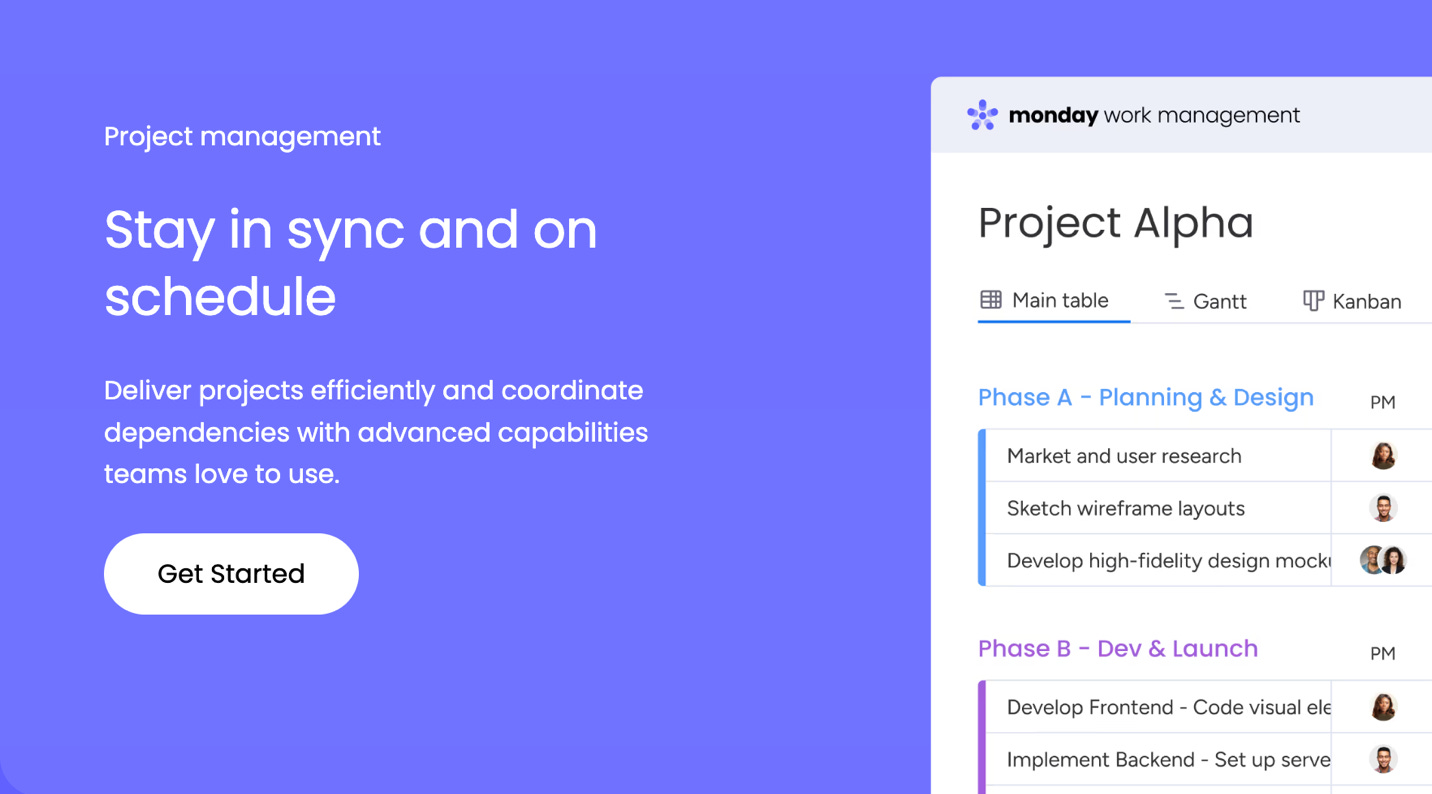

As I said, I’ve tried a few over the past few years – too many to list. One Monday rival, called Smartsheet, seemed like a pile of Post-It Notes that never ended. I liked it okay at the time. But Monday is exponentially simpler: Easier to set up, easier to onboard people, easier to set up those automated “reminders” (“Hey Bill, that Monday analysis is due Friday”… or “Hey Bill, that ‘Global Hot Spots’ follow to the Israel/Iran report runs on Tuesday”).

Source: Monday

The bottom line: It gets everyone on the same page … and it does this in a single glance.

That’s what I want.

I don’t want to chew lousy bubble gum.

That’s “Monday the Technology.”

Let’s next talk about “Monday the Business.”

Numbers with Muscle

Substacker Rijnberk InvestInsights last year ID’d Monday as a rare “Rule of 50” stock — referring to a company that has a revenue-growth rate and free-cash-flow (FCF) margin adding up to 60% or better. Rijnberk argues this metric means the company has fast growth and solid profitability — a tough-to-achieve balance that’s a sign of effective, hand-on-the-tiller management.

“Monday.com (aka Monday) is a company you will have most likely never heard of,” Rijnkberk wrote. “And that makes a lot of sense … however, the company has rapidly emerged as a fierce competitor for established peers, with its work [operating system] seeing rapid adoption.”

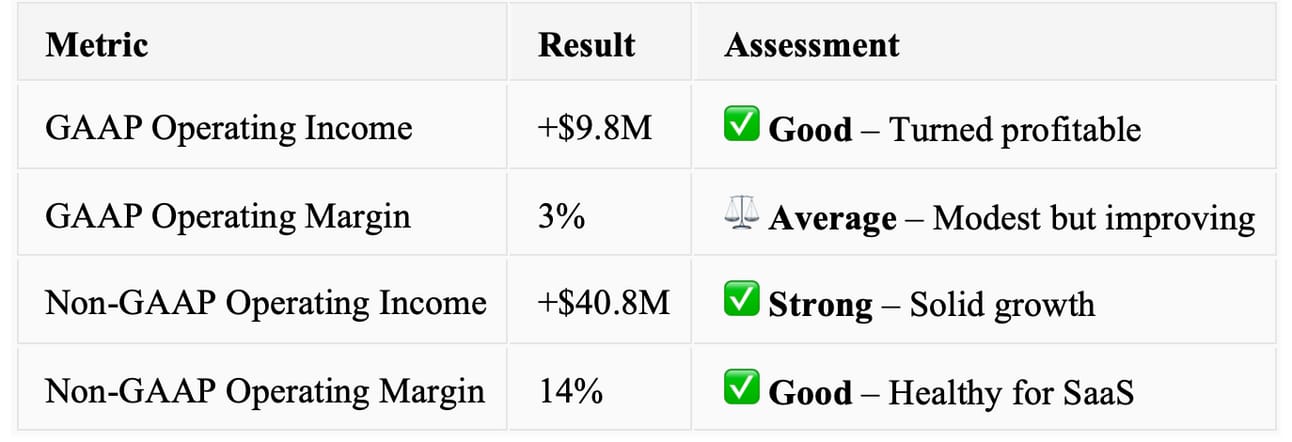

When it reported first-quarter results back in May, Monday delivered a “near earnings trifecta.”

Revenue rose 30% on a year-over-year basis to reach $282.3 million. Non-GAAP earnings per share rocketed 80.33%. Both exceeded estimates.

(Though I’m always leery of firms going “off script” and inventing metrics that veer away from generally accepted rules of accounting; but non-GAAP numbers are used by lots of firms to try and present “normalized” results.)

The third piece of that “earnings trifecta” — boosting forward guidance — was sorta/kinda there.

For the second quarter, Monday expects total revenue in a range of $292 million to $294 million (with a “midpoint” estimate of $293 million) — which is a bit “light” compared with the consensus estimate of $294.14 million.

For the full year, though, Monday raised its total revenue forecast from $1.22 billion to $1.226 billion (with a midpoint of about $1.223 billion), a boost from the prior forecast range of $1.208 billion to $1.221 billion. That’s a bit above the consensus of $1.21 billion.

Monday CFO Eliran Glazer says demand remains strong despite economic uncertainty.

That fits with other reports we’ve seen of late; forecasts call for software firms to continue seeing revenue growth — despite tariffs. And for the rest of this year, analysts expect companies to keep investing in the cloud — with demand surging in the mid-30% range.

Both outlooks bode well for Monday.com.

And it fits with the company’s underlying numbers.

As part of that first-quarter report, Monday said the number of paid customers with more than 10 users rose 9% year over year. The number of paid customers with more than $50,000 in annual recurring revenue (ARR) rose 38% to 3,444. And the number of paid customers with more than $100,000 in ARR soared 46% to 1,328.

Analysts remain bullish. In fact, that bullishness has edged higher.

Source: MSN

And as near-term ratings have edged higher, so, too, have long-term earnings forecasts, as this Zacks chart shows.

In fact, Zacks has its top (No. 1 “Strong Buy”) rating on Monday’s shares.

This previously was called the “Zacks Effect” — a portfolio of Zacks No. 1 ranked stocks has beaten the market in 29 of the last 37 years with an average annual return of 23.6% a year — more than double that of the S&P 500's 11.2% return, the investment-research firm says.

That brings us to the all-important “What’s Next” for Monday.

And part of that story — no surprise — involves artificial-intelligence (AI) tech.

Here’s What Comes Next

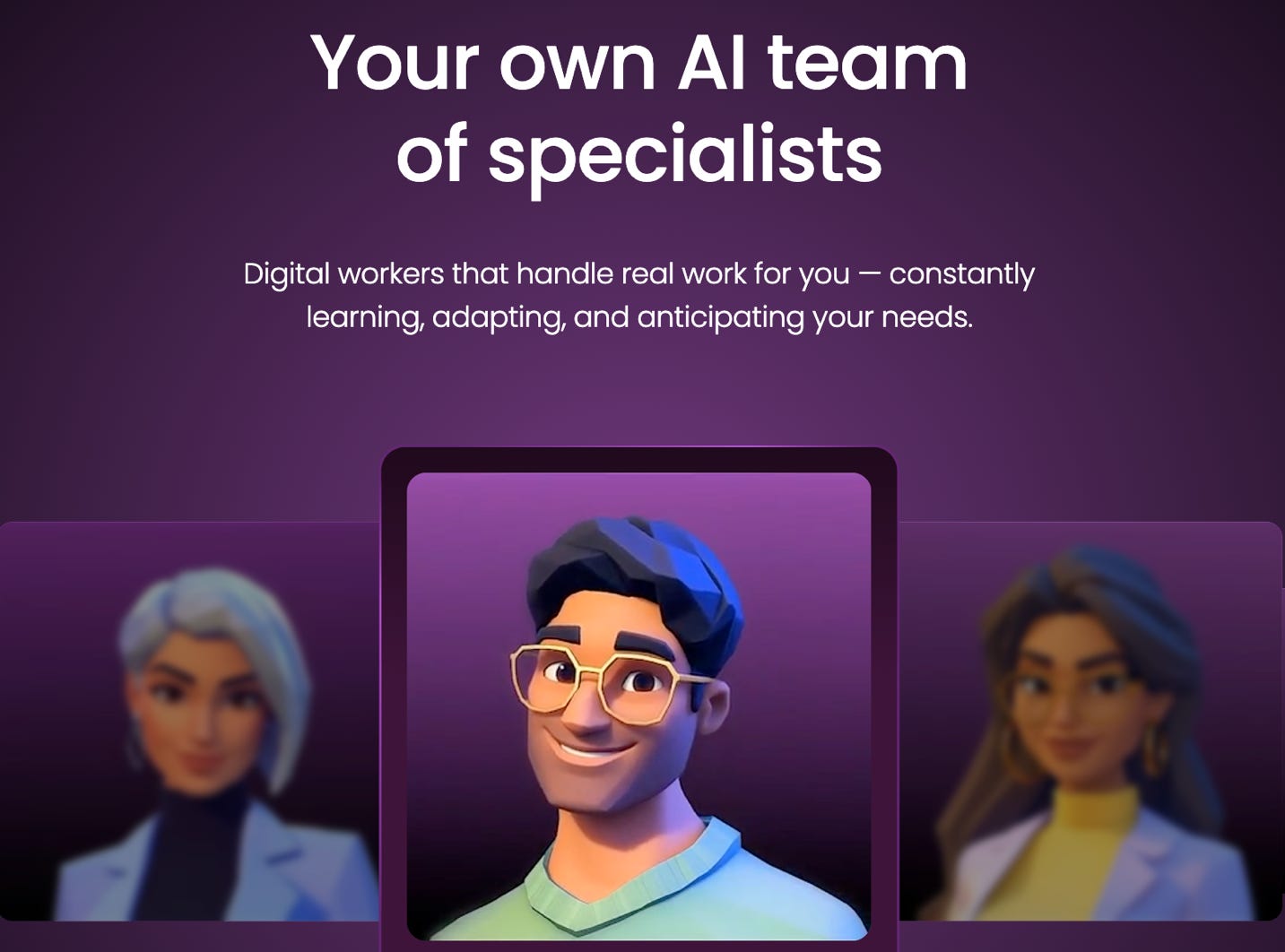

Monday is now launching AI integrations. But it can have an AI Agent handle the tedious tasks so workers can work on higher-level work.

“So, instead of spending time on task-heavy bottlenecks like follow-ups, reminders, and status updates, teams can leave the repetitive work to AI while spending more time focusing on high-value initiatives, like creating new marketing strategies and pursuing creative projects,” Monday wrote in a note to customers. “By analyzing project timelines, task statuses, and resource availability, the platform can predict potential project delays, workload bottlenecks, and even missed deadlines before they occur.”

Source: Monday

That’s stuff about AI Agents is super-interesting, since CNBC stock impresario Jim Cramer once described Monday.com as a junior version of Salesforce Inc. CRM 0.00%↑, a company that’s made folks risk (up 6,800% all time) by injecting AI into the workplace.

“I know a lot of people feel that it’s going to get a takeover bid — I can’t acknowledge anything, I don’t know anything about a takeover bid,” Cramer said in August 2013. “I do know this: My Monday is a very good Salesforce.com — mini Salesforce.com. You could call it maybe a junior Salesforce.com is the way to put it. And they’re very smart people. I would not bet against them.”

That buyout buzz resurfaces from time to time.

How’s this for ironies? Monday — a company that could be a takeover play — has a software offering that’s designed to make it easier for acquisitive companies to integrate their buyout targets.

Who might buy it?

Salesforce has a history of acquiring productivity tools (in 2021, it grabbed Slack for $27.7 billion — two years after it snagged data-visualization company Tableau for $15.7 billion).

Microsoft Corp. MSFT 0.00%↑ could use it strengthen its Microsoft Teams offering.

And don’t forget the “Private Equity Tidal Wave,” one of the top storylines we’re following: In January, Blackstone Inc. BX 0.00%↑ and Vista Equity Partners closed an $8.4 billion deal for Smartsheet. The buyout premium was as much as 41%.

At a recent price of about $286, Monday.com is about 16% below its 52-week high of $342.64, and about 52% above its 52-week low of $188.01.

The consensus one-year target price of $349 would give folks a 22% gain from here. But, as always, it’s the longer-term, higher-upside Wealth Builder returns we’re after. That’s why you make this an “Accumulate” play.

What do you think about Monday as an investment?

Let us know in the poll below.

Would you invest in Monday.com? |

And if you buy bubblegum, pay for the good stuff.

See you next time;