- Stock Picker's Corner

- Posts

- Are We Headed for the First-Ever "Reddit Recession?"

Are We Headed for the First-Ever "Reddit Recession?"

After "No-Buy July," here's what to watch ...

No Buy July didn’t start on Reddit Inc. $RDDT ( ▼ 3.03% ).

But the r/nobuy “subreddit” — with its 70,400 members — absolutely supercharged the anti-spending social-media movement.

Source: Reddit

TikTok is abuzz with it, too. Right now, there are more than 94 million “No Buy” posts there: The hashtag #nobuyjuly alone has racked up 2.7 million views.

We’re talking about a broad “community” — a giant support system for folks who want to squeeze their spending, focus their finances and put a stop to “impulse” purchases.

Peruse this (as I did) and you’ll see some pretty cool things — stuff like:

Goals for “no-buy” periods – and rules for success.

Candid confessions about the emotional spending “triggers.”

Tips for resisting impulse purchases.

Success stories and slip-ups (with encouragement for each).

And even an “Anti-Amazon” movement (see the image below).

Source: Reddit

Before you dismiss #NoBuyJuly as “just another social-media fad” — like the Ice Bucket Challenge or a TikTok dance trend — remember one very important thing:

Reddit (via r/WallStreetBets) lit the fuse for “Meme Stock Mania.” And YouTube and TikTok helped fan the flames with a focus on heavily shorted stocks like GameStop Corp. $GME ( ▼ 0.21% ) and AMC Entertainment Holdings $AMC ( ▼ 2.02% ) — creating a viral movement that delivered a bratty, painful kick to the shins of some big hedge funds.

In fact, it created a new era — one where the power dynamic shifted from the big institutions to the everyday retail investor.

I grant you: The circumstances back in 2020-21 were unique — what the lay person might refer to as a “perfect storm” where a bunch of catalysts lined up in just the right way.

Fast-forward four years to the present. The Reddit/TikTok/YouTube folks are it again. Only this time they’ve turned their laser focus on the entire economy — and not just on a few stocks.

And it’s already having an impact.

Participants are skipping meals out, online shopping and entertainment. And they’re even delaying back-to-school purchases or birthday-gift buying. Some folks say they’ve saved between $400 to $850 in just one month — and believe their newfound frugality will persist even after the “no-buy challenge” ends.

Consumer sentiment is falling. Mix in lingering tariff worries and inflationary uncertainty, and it’s no wonder retail execs say they are struggling to forecast future consumer demand.

In an economy that draws 70% of its power from consumer spending, No Buy July — and its offshoots — could have a lasting impact over the rest of the year.

And that begs the question: Are we looking at the first-ever “Reddit Recession?”*

Or the first “Meme Economy Moment?”*

It’s not as far-fetched as it sounds.

It’s not far-fetched at all.

Between now and the end of the year — and into early 2026 — we need to be watching for:

A greater surge in uncertainty — both in the U.S. and global economies and in the stock and financial markets, too.

The big spike in volatility that accompanies that escalated uncertainty.

A slowdown in that $27.5 trillion juggernaut we all know as the U.S. economy.

Perhaps even an outright recession — the first “cyclical” (non-Black Swan) downturn we’ve had in decades.

A new inflationary surge — one potentially revved up by the one-two punch of tariff travails and central bank interest-rate cuts.

And – if that inflation is mated with a recession – the first sighting of “stagflation” since the 1970s.

It’s a scary time — for others.

For us, this represents an opportunity. A big one.

So here’s what I’m going to do for you in this issue.

Today I’ll help you understand the key “variables” to watch — and explain why you should watch them.

And I’ll show you how they influenced past recessions — and past market corrections.

Then I’ll circle back tomorrow and help you start to build a “Watch List” of stocks to “Accumulate” if that sell-off does, indeed, come our way.

Let me be clear: We win either way here.

If that slowdown doesn’t come … if we don’t see that next recession for a long time … if stocks continue their hot run, well folks, we’ll continue to play our “current hand” — making money on the stocks we already own.

But if the economy and/or the stock market rolls over, the “Accumulate” strategy will let us shop for some bargains.

Recessions, Corrections and Speculations

I’m not advocating (or wishing for) a correction or recession. I wouldn’t wish the accompanying pain (layoffs, lost wealth, inevitable investing mistakes) on the regular folks who suffer the most.

But it’s just as unhealthy to careen ahead blithely and blindly.

And I see a ton of risk right now.

I’ve learned many lessons during my 40 years as an award-winning business reporter, financial columnist, analyst and stock picker. And one of the benefits of being an SPC reader is that you get to quickly absorb some of those lessons that took years to learn.

Two of those lessons apply here:

First, recessions aren’t all bad. I grant you: They do cause pain, especially for the folks who see their hours get cut or who lose their jobs outright when companies start cutting costs. But these economic downturns play an important role: They’re like a big “reset button” that squeezes out the waste, gets companies refocused on fundamentals and establishes a powerful base for the economy’s next growth spurt.

Second, what’s true of economic recessions is true of stock market sell-offs, corrections and bear markets. Shakeouts are painful in the near term. But they’re strong in the long term as they eliminate the “weak hands,” placing stocks back into the “strong hands” that see the big picture — Wealth Builders like you and me. In short, sell-offs are “table-setters” for the bull markets to come.

Our goal here is to give you folks some “what-comes-next” insights.

Let’s start with stocks, which have been white-hot since experiencing their early-April bloodbath and major indices are up near all-time highs:

✅The S&P 500 is up 8.8% year to date, 15.5% in the last three months and 17.2% in the last 12.

✅The Nasdaq Composite is up 9.7% year to date, 21.4% in the last three months and 22% in the last 12.

✅And the Dow Jones Industrial Average — the index most retail investors see as “the stock market” — is up 5.6% this year, 11.8% in the last three months and 10.7% over the past year.

Clearly, we’ve made a lot of money thanks to this great run in stocks. But if you exclude the “Tariff Tantrum” correction from early April — which was more of a V-shaped drop and rebound — we haven’t really experienced a classic (extended) downturn in stocks since the 2022-23 correction/bear market.

We’re overdue. And we’re vulnerable.

While trouble bubbles on the peripheries, a lot of retail investors are complacent.

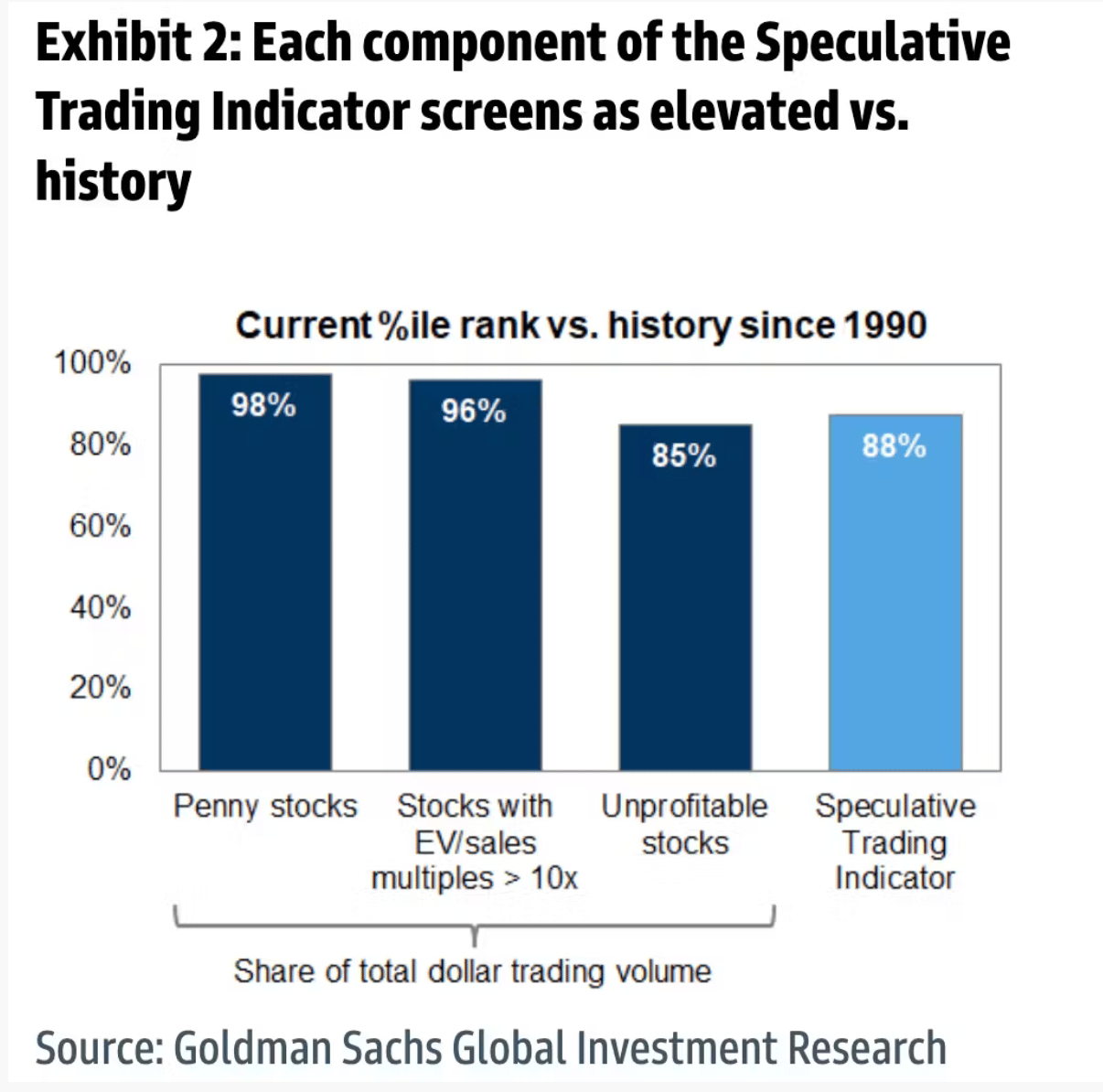

Indeed, many retail investors are SO complacent that they’re speculating like they’ve got money to throw away. Want proof? Goldman Sachs analyst Ben Snider said Friday that the investment bank’s Speculative Trading Indicator is near historic extremes — extremes last seen during the dot-com and meme-stock eras.

Call options now account for 61% of all options activity — the highest since 2021.

The retail speculative frenzy is going strong: AI-tech names, penny stocks, crypto-crud and short-squeeze candidates are on super-hot runs.

While retail investors are careening ahead blithely, Big Money Pros are making bearish wagers — setting up trades that will soar in value if stocks sell off.

The “Worry Points” to Watch

Now let’s look at the economy. First at the “worry points” to watch now. And then we’ll see how those worry points presaged past recessions.

Here are some of the factors we are watching here at SPC right now.

Consumer Sentiment & Spending

Sharp decline in consumer confidence indexes (University of Michigan, Conference Board) → April 2025 saw the lowest sentiment since June 2022.

Drop in life satisfaction scores → Consumers reported lower scores across generations and income levels.

Reduced discretionary spending → Shoppers are cutting back on non-essential goods, especially imports.

Labor Market Stress

Hiring plans hit post-COVID lows → Only 42% of CEOs plan to expand headcount in 2025.

Federal job cuts and hiring freezes → 22,000 federal jobs lost in May 2025, the most since 2020.

Layoff spillover effects → Research shows concentrated job cuts reduce earnings across entire regions.

Decline in job postings in key sectors → Scientific research & consulting roles down 18% since January.

Inflation & Price Pressures

Rising inflation expectations → University of Michigan survey showed year-ahead inflation rising to 4.9%.

Sticky core inflation despite Fed targets → Core CPI remains above 2%, with tariffs adding new pressure.

Price hikes on essentials → Domestic goods and services seeing persistent cost increases.

GDP & Business Activity

Slowing GDP growth → Forecasts suggest GDP will trough in 2025–2026 before recovering.

Unintended inventory buildup → Businesses overestimating demand, leading to excess stock.

Decline in industrial production → Manufacturing jobs fell by 8,000 in May 2025 amid trade war fallout.

Financial Market Signals

Yield curve inversion → Short-term bond yields exceed long-term, historically a recession precursor.

Tight credit spreads → Investors demanding higher risk premiums, signaling caution.

Surge in gold prices → Gold hit record highs in 2025 as investors seek safe havens.

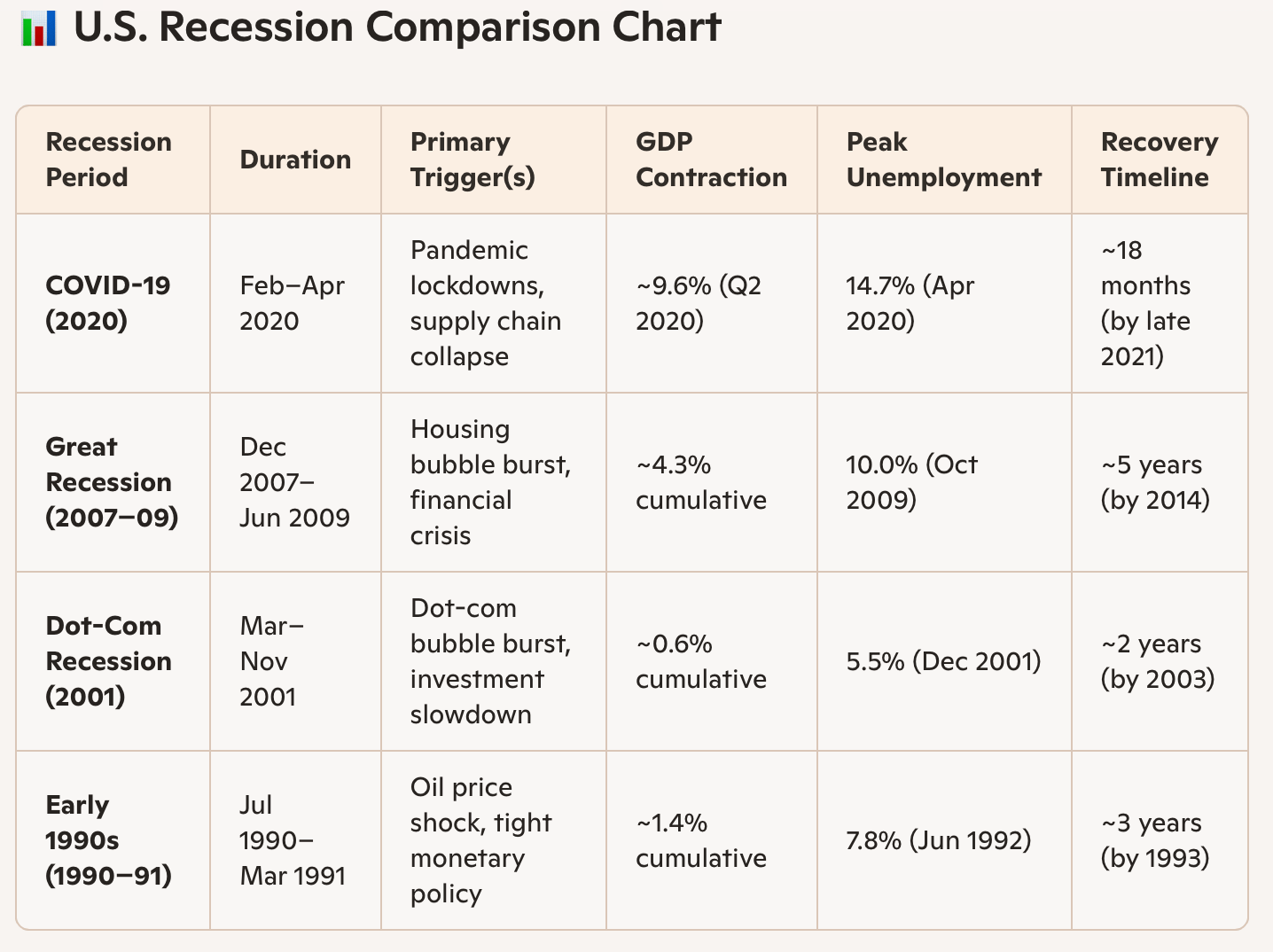

Here’s how some of those indicators have lined up with past recessions:

Indicator | Historical Behavior Before Recessions |

Consumer Sentiment | Sharp drops often precede recessions (2008, 2020); pessimism spikes before unemployment rises. |

Job Cuts / Hiring Freezes | Layoffs and reduced hiring typically begin 3 months to 6 months before GDP contracts (The dot-com bust, COVID). |

Inflation Expectations | Inflationary surges often trigger Fed tightening, which can lead to recession (1980s, 2022). |

GDP Slowdown | Near-zero GDP growth, or declines, is a classic recession signal (2001, 2008, 2020). |

Yield Curve Inversion | One of the most reliable predictors—often inverts 6 months to 18 months before a recession (2000, 2006, 2019). |

Credit Spreads Widening | Investors demand higher risk premiums—seen before 2008 and 2020 downturns. |

Gold Price Surge | Investors flock to safe havens—gold spiked before/during 2008 and 2020 recessions. |

Industrial Production Drop | Manufacturing output often drops ahead of recessions (2001, 2008). |

Inventory Buildup | Excess inventory signals overestimated demand—common before 2001 and 2008 recessions. |

Decline in Job Postings | Hiring slowdown is an early labor market stress signal (2022 tech layoffs). |

Believing that “it’s better to show than to tell,” let me show you how some of this played out in the real world – in past recessions.

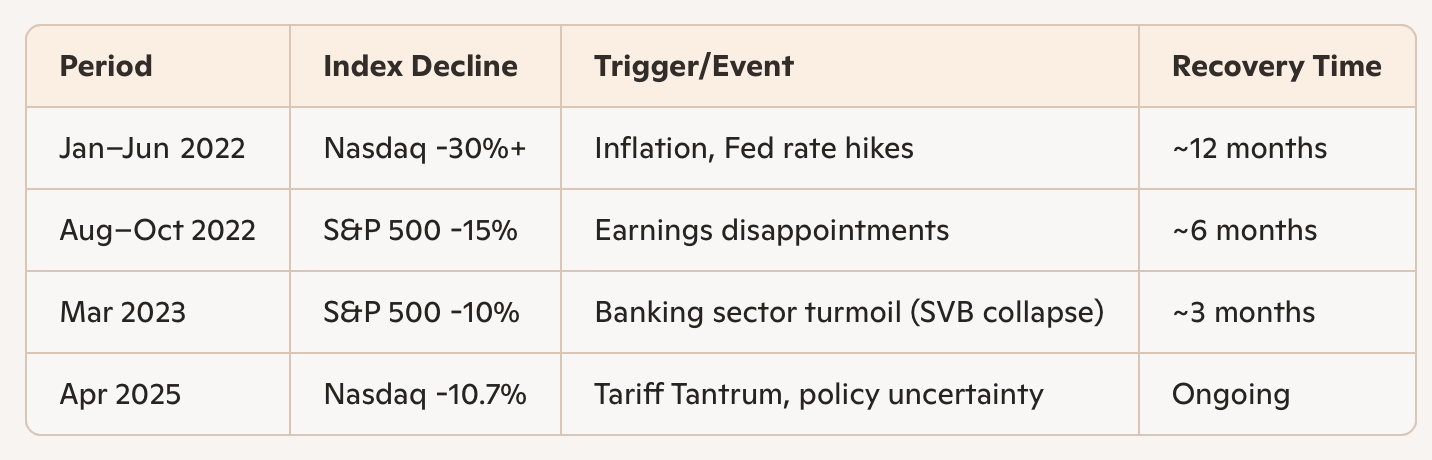

And here are the last four major sell-off/correction/bear markets in stocks.

The Takeaway

The risks we face from an end-of-the-economic-cycle recession keep growing higher.

That recession is inevitable. At some point.

I won’t predict if — or when — that’ll happen. But forewarned is forearmed. It pays to be prepared. Like Wealth Builders, you can make it work for you by being prepared — and acting ahead of time.

You don’t want to “let it happen to you” — reacting, like a Wealth Killer.

I’ll be back tomorrow with the start of that promised “Watch List.”

And I’ll keep watching this — no matter how it unfolds.

See you then;

1 *I came up with those terms myself — they’re Stock Picker’s Corner originals. So if you see them floating around elsewhere, just know where they started.