- Stock Picker's Corner

- Posts

- Satellites, Missiles and Drones — And Two Tiny Firms Wall Street Isn't Wise To

Satellites, Missiles and Drones — And Two Tiny Firms Wall Street Isn't Wise To

There's a new arms race, and these two players are winning ...

“We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard.”

Fifty-six years ago this month — on July 21, 1969 — my folks, sisters and I gathered around our black-and-white Zenith TV in our family room in Murrysville, Pa., and watched Apollo 11 astronaut Neil Armstrong take that “one small step for man, one giant leap for mankind.”

I still get chills remembering those words — and the grainy video — and what it meant then … and now.

Like millions of kids — and tens of millions of Americans — I was obsessed with the Apollo space program.

I was already an avid airplane nut — my Dad was an engineer, and had worked on aircraft programs — so bolting spaceflight onto my list of passions was only natural. I built plastic model spacecraft, launched Estes rocket models, visited science and and aviation museums, clipped stories from The Pittsburgh Press (which I still have), and wrote to aerospace companies asking for photos, plans and other mementos (still have them, too).

The “Space Race” was a magic moment. After U.S. President John F. Kennedy made it a national edict to land a man on the moon by the end of the 1960s, success was a beam of warming sunlight bursting through the roiling thunderheads of the first Cold War. Americans loved it — because we won.

Not surprisingly, astronauts like Armstrong, Buzz Aldrin, Gus Grissom, Alan Shepard and John Glenn became more than mere celebrities. They became heroes.

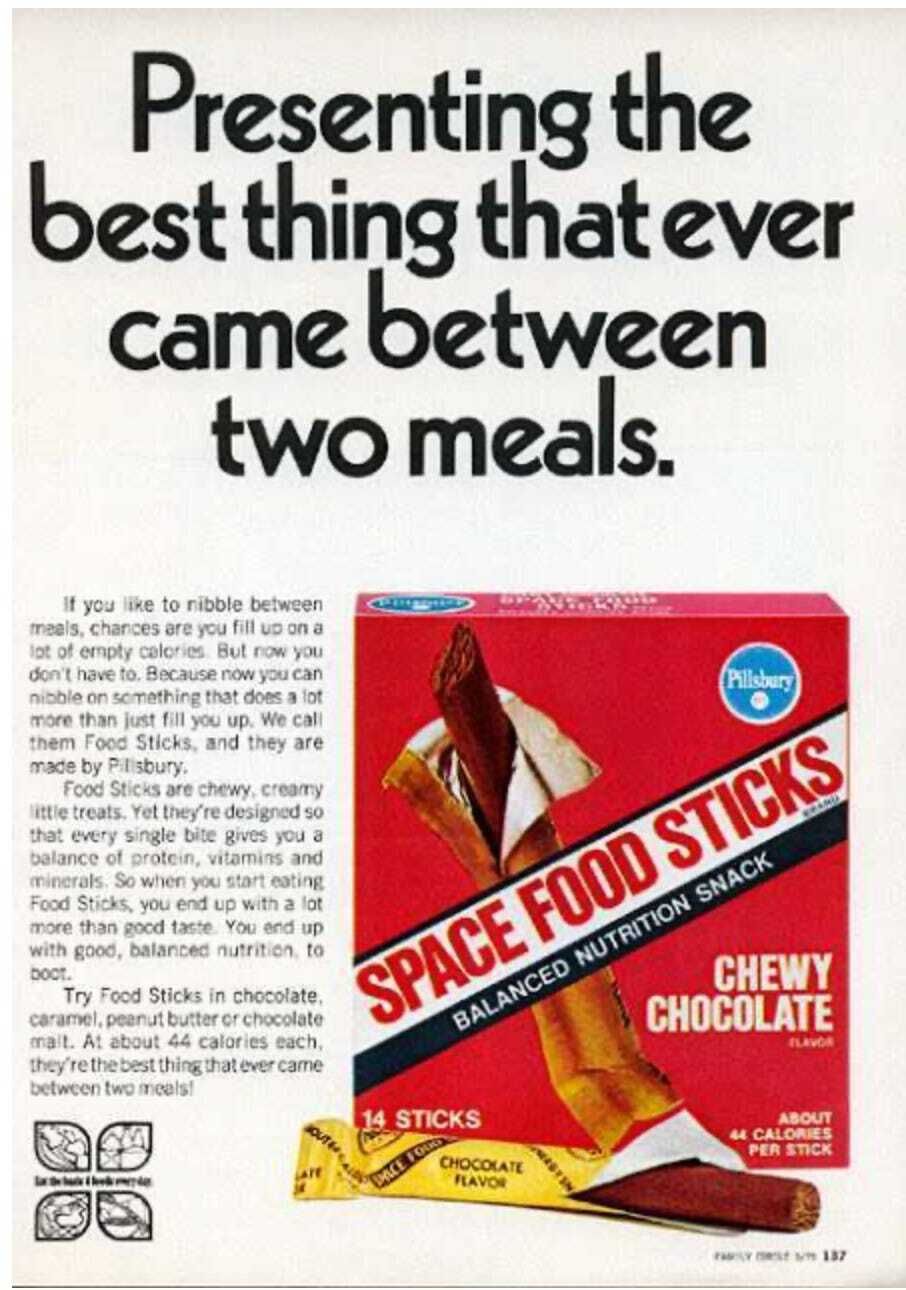

The pop-culture influence was huge: Tang and “space-food sticks” were in every pantry — and on every table.

Source: Reddit

The word “space” conveyed the same marketing muscle that “dot.com” or “coin” or “AI” has assumed today. Back then, everyone knew that “space sells.”

And folks today forget: The Space Race supercharged the American economy.

And I mean … supercharged it for a generation … for decades. We’re reaping the benefit — and the wealth — even today.

That U.S./USSR rivalry fueled rapid advances in rocketry, super-fast computing and satellite systems. It redefined what was possible. It inspired generations of scientists, inventors … and dreamers. Stuff we take for granted today took root back then:

The camera phone — created by the miniature imaging systems created for space missions.

GPS — which now gets us to that museum or new Thai food joint, was created for military space tracking.

CAT scans, portable ultrasound units and other medical-imaging technologies — was spawned by space-based, digital-imaging technology.

Firefighting gear, air purifiers and building “shock absorbers” were adapted from space suits and space shuttle developments.

Scratch-resistant lenses, freeze-dried foods and memory foam — all evolved from the need for tough, lightweight, adaptable advanced materials.

Here’s a tip for you folks.

It’s all happening again. You have a second bite of that very big wealth window.

We use the best storylines to find the best stocks. But when multiple storylines converge, those are the best opportunities of all.

This time around those storylines include the New Space Race. A New Golden Age of Aviation. A New Cold War. A New Arms Race. The AI Era. And Deglobalization.

This isn’t hyperbole: The opportunity is massive. But unlike the First Space Race, which was focused solely on a moon landing, the New Space Race is so much more.

The "One Big Beautiful Bill Act,” signed into law July 4, injects nearly $10 billion into NASA’s Artemis program—reviving and expanding plans for manned moon missions before decade’s end. (Sound familiar?) But we’re also talking about:

Missile defense.

Space-based weapons.

Space-based Internet.

Hypersonic missiles, spy planes and passenger jets.

Factories in space.

Space tourism.

And more.

This is a worldwide “space economy” that's worth between $350 billion and $423 billion right now, according to several reports. It’ll likely exceed $1 trillion by 2030, says a 2022 joint study between Oregon Consulting Group and the University of Oregon’s Lundquist College of Business. And it could grow to $5 trillion by 2040.

And yet … most investors still don’t see it — and it’s easy to understand why.

Back in 1969, most folks had access to three TV channels (in Pittsburgh, it was KDKA TV-2, WTAE TV-4 and WIIC TV-11). A few local radio stations. A newspaper or two. And the neighborhood gossip over the back fence.

There was no Facebook, no X, no Internet, no texting. So stories like the Space Race were focused … centralized … in the spotlight.

The landscape is different today. We have information overload. There’s too much noise. Big storylines are missed — and that means opportunities are missed, too.

Today’s New Space Race storyline is diffuse … on the periphery … and that gives you a hefty head start on everyone else.

Let me give you a boost …

In today’s issue of Stock Picker’s Corner (SPC), I’ll show you two of the leading-edge beneficiaries — both small companies that we’ve already researched for you. Both these “space stocks” have already surged. A lot.

One has zoomed 194% in a mere 16 weeks. The other has soared 213% in 17 months.

But as the old Bachman-Turner Overdrive tune tells us: Baby, you ain’t seen nothing yet.

Our research shows that — for long-term Wealth Builders like us — we’re still in the first or second inning with each company. In fact, having covered defense/aerospace firms just like these two as a reporter and stock picker, I know there’s a good chance one or both end up as takeover plays.

Over the last month alone, each company has made some major moves …

And it brings back memories … to that “Summer of ‘69” — and all the innovation and wealth that followed.

Let’s take a look at those companies …

RKLB: The Underdog That’s Catching Up Fast

The first is Rocket Lab USA Corp. $RKLB ( ▼ 4.89% ), a small-and-feisty rival to Elon Musk’s vaunted SpaceX commercial-launch company. Unlike SpaceX, which is privately held and will likely stay that way for a long time to come, you can invest in Rocket Lab, since it’s a public company. And it’s relatively small, with a market value of $23 billion.

We gave SPC Premium subscribers our first report on Rocket Lab back on March 20.

On April 4, we followed up with this even-more-thorough report — where we said Rocket Lab had double-your-money potential.

We were right: Rocket Lab’s shares zoomed from $16.37 at that day’s close to $48.13 yesterday (Thursday). That’s a 194% surge in 79 trading days — or an annualized equivalent of 619%.

Some big developments have been driving the stock — which has “rocketed” 48% over the past month (sorry, couldn’t resist).

In case you missed it, Rocket Lab:

Launched three missions in July, including its 68th launch of its low-cost, quick-turnaround Electron booster, including two missions in just 48 hours — a record.

Partnered with the European Space Agency (ESA) (sort of the European NASA) to launch next-generation navigation satellites — a mission we’ll see in December.

Struck a $275 million deal to buy LightRidge Solutions, the parent company of Geost, a provider of payloads and space sensors that can track missiles, ground-based threats and perform other intelligence-gathering missions. It will position Rocket Lab as a “prime” defense contractor, and gives it the space race trifecta: Launch, spacecraft and payloads.

Continues to gain a mainstream institutional following: Sell-siders at Citigroup and Bank of America both boosted their Rocket Lab target prices to $50 a share.

And secured $7 million in funding for its Air Force Research Lab (AFRL) program at Edwards Air Force Base, a center for advanced space propulsion systems – another move that bolsters RKLB’s growing Pentagon profile.

There’s more. But these are the highlights. Check out the report I shared above. And look to “Accumulate” shares — especially if the markets get rocky and Rocket Lab pulls back before New Year’s Eve, a scenario that’s certainly possible.

Now let’s turn our attention to the second New Space Race company — which has landed new contracts, expanded its product line and linked up with some defense-industry heavyweights outside America’s borders. This company is a play on missile defense, the new weapons realm known as hypersonics, robotic combat planes, microwave technology, satellite-based Internet — and more.

I’ve followed this company for a decade. I know it well — which is why it was an inaugural member of the SPC Premium Model Portfolio.

It’s already rewarded our members with a 212% return as of this morning, and I expect there will be more gains on the way …

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.