- Stock Picker's Corner

- Posts

- An Insider Just Bought $1.5 Million of This Beaten-Down Tech Stock

An Insider Just Bought $1.5 Million of This Beaten-Down Tech Stock

It's a powerful signal for a company riding a powerful AI wave ...

Before we get into this issue, we have a quick message from today’s partner:

There’s a reason Morning Brew is the gold standard of business news—it’s the easiest and most enjoyable way to stay in the loop on all the headlines impacting your world.

Tech, finance, sales, marketing, and everything in between—we’ve got it all. Just the stuff that matters, served up in a fast, fun read.

Look—over 4 million professionals start their day with Morning Brew’s daily newsletter, and it only takes 5 minutes to read. Sign up for free and see for yourself!

I’ve been covering public companies for the better part of my 40-year professional career.

And I’ve seen and learned many things.

And one of the best Wealth Builder lessons I’ve learned has to do with the “behavior” of corporate insiders — the top execs like the CEO and CFO who run the company … as well as the “inside” and “external” directors who are there to provide guidance.

And that behavior is related to something known as “legal insider trading.”

To be clear, I’m not talking about the skullduggery engaged in by folks like Ivan Boesky, a prominent Wall Streeter who was nailed for illegal insider trading back in the 1980s — actions that led to a conviction, a $100 million fine and a three-and-a-half year prison term. (Boesky, who only served 20 months, inspired the Gordon Gekko character in the 1987 flick Wall Street. He died last year at 87, having never really rehabilitated his reputation.)

That’s illegal insider trading.

I’m talking about legal insider trading, when those insiders buy or sell shares of their own company — transactions that are recorded in official filings with the U.S. Securities and Exchange Commission (SEC).

Fact is, insiders sell shares they hold for a whole bunch of reasons — estate planning, diversification, tax issues, philanthropy and more.

But they buy shares pretty much for one reason: They think their company’s shares are trading at bargain price levels.

They see upside. They see a chance to make money.

And who has a better view of how a company is operating than the insiders who run it.

Once you understand that you’ve also found yourself a terrific indicator of a company whose shares are cheap. Time it right, and you can profit right along those millionaire execs who run the best companies.

In today’s issue, I’m going to share my “Good/Better/Best” rule for screening “Insider Buying Stocks.” I’ll tell you a about a time I used that to my subscribers’ advantage years back. And I’ll share a brand-new “Insider Buying Stock.”

The Best Signal

In our 1998 Prentice Hall book Contrarian Investing: How to Buy and Sell When Others Won't and Make Money Doing It, my New York money-manager co-author Anthony Gallea and I found that — on a beaten-down stock — insider buying was the single-best "Buy" signal you can find.

In fact, some very good research supports this.

In one paper, professors Carr Bettis, Don Vickrey and Donn W. Vickrey found that "outside" investors who mimicked the moves of insiders would have outperformed other stocks of the same size and risk by nearly 7% per year — even after factoring in transaction costs.

That kind of outperformance is huge …

In a second study, University of Houston Prof. R. Richardson Pettit and P.C. Venkatesh from the Office of the Comptroller of the U.S. Currency found that insiders tend to increase their net purchases up to 24 months before a stock generates an above-average return.

New research that's appeared since Prentice Hall published our book continues to make a bullish case for insider buying.

Independent researcher Market Profile Theorem (MPT) showed that insider trading trends signal an up-and-coming shift in market sentiment. To spotlight those trends, MPT analysts use a device known as the "Brooks Ratio," which divides total insider sales of a company by total insider trades (purchases and sales) and then averages this ratio for 2,500 stocks. If the average Brooks Ratio is less than 40%, the market outlook is bullish. But a ratio that exceeds 60% is bearish.

Obviously, MPT's research is focused on the overall market. But it lends credence to what Tony and I found for individual stocks.

And University of Michigan Professor Nejat Seyhun, author of Investment Intelligence from Insider Trading, came to the same conclusion that Tony and I reached: Stock prices rise more after insiders add to their holdings than they do after insiders sell.

The bottom line: Insiders make money from this legal type of "insider trading." And the returns they reap exceed those of the general market.

Tony and I developed a “Good/Better/Best Rule” to help our readers:

Good: A single insider buys $120,000 worth of their company’s shares on the open market.

Better: Two insiders buy an aggregate $300,000 worth of company stock.

Best: Six insiders buy an aggregate $400,000 worth of stock.

In short, more purchases by more insiders is best. But once we did the math, we found that $67,000 by an insider was a good starting-point threshold.

Let me tell you about a time – years ago, at my previous newsletter, Private Briefing — where I put this to good use.

A Past Winner

One of the companies I followed closely — and had in my newsletter portfolio — was Kratos Defense & Security Solutions Inc. $KTOS ( ▲ 4.43% ), a defense-and-aerospace firm with specialties in drones, cybersecurity, missiles and more.

In December 2013, I saw that Kratos CEO Eric M. DeMarco picked up 31,273 shares of his company's stock at an average price of $6.40, spending about $200,150 to do so. Following the purchase, DeMarco directly owned 326,468 shares of Kratos stock with an approximate value of $2.1 million.

Then, in March 2014, he bought another 10,000 shares — at an average price of $7.17.

Over the next several years, from that first purchase price, Kratos shares would more than double.

Some other “Insider Buying Stocks” I’ve recommended have done even better.

And there’s one that’s worth looking at right now — a company that saw insider buying right after the “Trump Tariff Wipeout.”

The Insider Buying Stock I’m talking about is Salesforce Inc. $CRM ( ▲ 4.03% ).

The San Francisco-based Salesforce is a leader in cloud-based software and focused artificial intelligence (AI) for businesses.

Salesforce shares were already down year-to-date even before the Trump Administration unveiled those market-hammering tariffs.

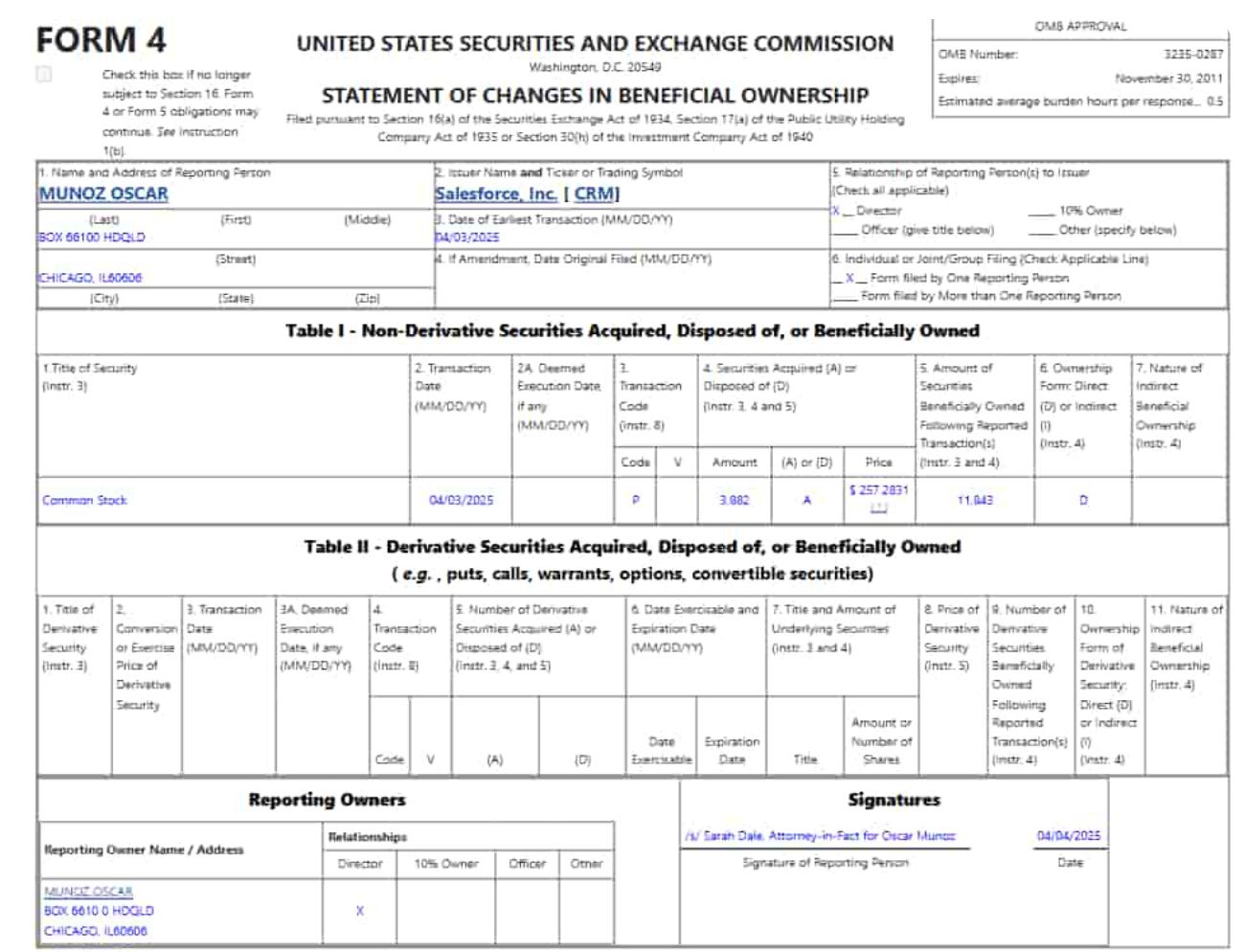

On April 3, Salesforce Director Oscar Munoz dropped nearly $1 million on CRM stock, snapping up 3,882 shares at an average price of $257.28 each.

A former CEO of United Airlines Holdings Inc. $UAL ( ▲ 3.15% ) , Munoz has been on the Salesforce board since January 2022. And Barron’s reported that he also bought 2,051 shares back in June, an at average price of $243.69 each — an outlay of about $500,000.

“He bought into weakness then, as well,” Barron’s reported. “At the time, investors were bailing on software firms to move funds into makers of artificial-intelligence chips.”

Source: SEC

Salesforce shares rebounded a bit Wednesday — and now trade at $266.

That’s less than 5% above where Munoz bought the stock.

That’s two purchases (albeit by one insider) totaling $1.5 million — which definitely puts it in the “Best” category of the rules that Tony and I came up with.

It’s also definitely “beaten down.” From its 52-week-high of $369, we’re talking about a stock that’s still down about 28% from its peak. That means Salesforce is in a bear market all its own.

A Massive Trigger

And here’s the key thing to remember: When insiders buy, they aren’t buying to make a point or two or three — they’re doing it believing the company they can “see the inside” of is poised to generate big returns over the next six, 12 or 24 months.

And there are some amazing opportunities Salesforce is positioned to cash in on.

Businesses tap into “Agentforce” — the AI Agent that can handle customer service questions and resolve issues, freeing up human workers for larger and more meaningful tasks.

AI Agents through Salesforce can also:

✅Engage with sales leads and schedule appointments.

✅Help with shipping and ordering through providing tracking information, handling returns, and issuing refunds.

✅Provide pricing and product specifications.

✅And resolve system and software issues.

Just recently, Singapore Airlines Inc. used Agentforce for its customer-case-management system, which the carrier says delivered more-consistent and personalized service to its patrons.

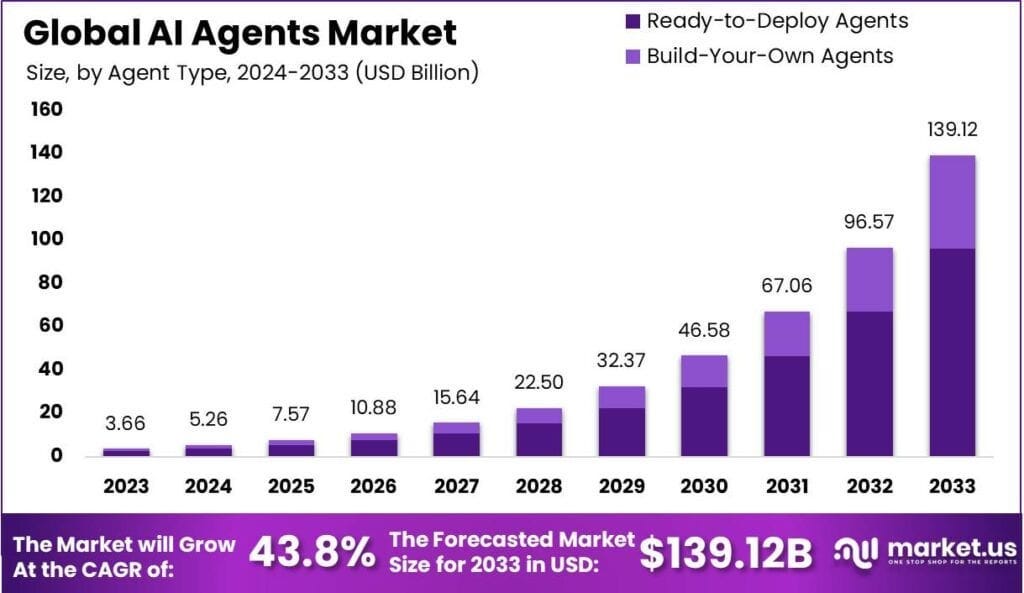

Salesforce has established itself as a leader — and we’re still in the early innings of the AI Agents Boom. MarketsAndMarkets says it was just a $5.1 billion market last year. But, by 2030, that value is expected to jump to $47.1 billion. In a six-year span, that’s a compound annual growth rate (CAGR) of 44.8%.

The 2030 forecast from Market.Us comes in slightly lower at $46.58 billion, but its outlook extends out to 2033, which sees the AI Agent market valued at $139.12 billion.

Over a 10-year span (2023-2033), that’s a 43.8% CAGR.

Source: Market.Us

Analysts have a one-year target price of $374 on Salesforce shares, which would represent a 40% gain from where they are trading at now.

Longer term the gains could be much greater. Earnings could double in less than five years. And since share prices tend to follow earnings, the stock price could double, too.

That’s the potential — and the power — of Insider Buying Stocks.

I’ll keep following this for you.

See you next time;