- Stock Picker's Corner

- Posts

- This Stock Is a "Tariff Insulator"

This Stock Is a "Tariff Insulator"

And if you're an SPC Premium member, you probably own it ...

I’ve read that when people research a problem online, they’re not really looking for a solution as much as they are a “hero” tale.

Someone might search for “how to set up a fishing pole,” but what a parent is really seeking is a cherished bonding moment with their child.

When you ask “how to fix a leaky sink,” you’re really looking to save on plumbing costs and gain greater confidence in your DIY abilities.

Or when anyone hits the search button for “new best authors,” they’re really hoping to become the person everyone seeks out for book recommendations.

In other words, they’re looking to be that “hero” of their own story.

When it comes to their own investments, unfortunately, the dynamic breaks down: Folks try to be heroes of their own narrative, but too often end up as the villains. They try to find near-term fixes instead of pursuing a long-term plan.

During the Great Recession (2007-2009), that desire for short-term fixes meant that some of the top search terms were:

Recession-proof stocks.

Defensive stocks.

And safe investments.

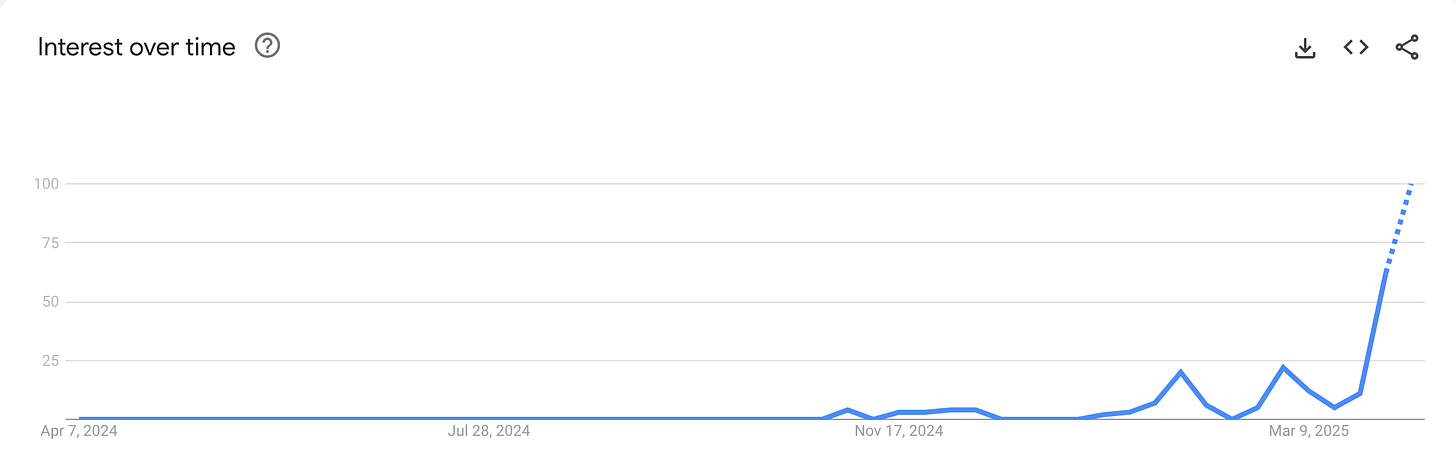

We’re seeing that again amid the economic uncertainty of 2025, as the term “tariff stocks” is gaining search traction.

It picked up a little steam after Donald Trump won the 2024 U.S. Presidential Election and again in February and March, but it essentially went from a term no one was looking for to reaching peak popularity (the “height” of term being searched for) between April 6 through April 12.

Source: Google Trends

What people are doing here is trying to find how to protect their portfolios and the investments that can withstand tariffs and trade war uncertainty. As we all know over the last few weeks, seemingly everything has been routed, with $10 trillion in global stock market wealth evaporating in three days.

Gold is marching higher now, but even it “flinched” from the tariff uncertainty fists swinging around it for a few days and dipped 6% between April 2 and April 7.

So everyone is trying to be the “hero” of their portfolios, and rightfully so, with how much is on the line for all of us.

Now, as we saw from that $10 trillion in wiped out wealth, there isn’t going to be a “perfect” investment or asset to own to protect any of us from being completely unscathed during a period of uncertainty with no end in sight.

Here’s the good news: If you are already focused on the long haul, sometimes those profits get delivered right into your hands.

When you follow the strongest, long-term storylines, as we do, you’ll sometimes intersect with near-term developments. For instance, we’ve told you we’re following the New Cold War and the Artificial Intelligence (AI) Era.

So you don’t have to go searching for “tariff stocks” because you may already own a company in our Model Portfolio that is less susceptible to tariffs.

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.