- Stock Picker's Corner

- Posts

- These "Cash Flow" Income Stocks Will Save You From the Middle Class Pinch

These "Cash Flow" Income Stocks Will Save You From the Middle Class Pinch

Understanding the new income imperative ...

When the best-seller “The Millionaire Next Door” debuted in 1996, approximately 5.3 million American households had a net worth of $1 million or more.

To have the million-dollar equivalent from 1996 here in 2025, you’d need about $2 million. As Chief Stock Picker Bill Patalon said in his American Retirement Challenge report back in February, “that millionaire status ain’t what it used to be.”

That means you need more money to live a nice life and feel financially secure. And you need more money to leave a “legacy” — meaning you have enough “wealth” to pass down to your kids or grandkids, close friends, and the charities and special causes that were important during your life.

But this “needing more” has become a true financial pressure and is also pinching the working middle class like never before.

According to Bureau of Labor Statistics, the median annual wage for individuals at the end of 2024 was $62,000. But according to a recent study from the financial tech and publishing company SmartAsset, it takes over $80,000 for an individual to feel “comfortable” in West Virginia, the most affordable state in the country.

SmartAsset outlined a blueprint for “comfortable” as a 50/30/20 budget:

50% of income goes to essentials, like rent and food.

30% goes towards discretionary spending.

And 20% goes toward savings, investing and paying down debt.

Here’s what that income “comfort” level looks like across each state:

State | Income Needed (2025) | Change from 2024 (%) |

|---|---|---|

Alabama | $85,280 | 1.74% |

Alaska | $100,298 | 3.65% |

Arizona | $101,587 | 4.36% |

Arkansas | $81,078 | 2.04% |

California | $119,475 | 5.12% |

Colorado | $105,955 | 2.58% |

Connecticut | $105,165 | 4.77% |

Delaware | $97,469 | 3.54% |

Florida | $97,386 | 4.37% |

Georgia | $99,590 | 2.79% |

Hawaii | $124,467 | 9.48% |

Idaho | $96,429 | 8.67% |

Illinois | $98,010 | 3.06% |

Indiana | $86,570 | 1.81% |

Iowa | $86,902 | 4.24% |

Kansas | $87,610 | 3.49% |

Kentucky | $83,574 | 3.56% |

Louisiana | $85,322 | 3.48% |

Maine | $96,595 | 5.35% |

Maryland | $108,867 | 5.78% |

Massachusetts | $120,141 | 3.55% |

Michigan | $87,235 | 3.40% |

Minnesota | $91,728 | 2.80% |

Mississippi | $86,320 | 4.32% |

Missouri | $86,819 | 3.32% |

Montana | $92,851 | 9.57% |

Nebraska | $87,318 | 4.32% |

Nevada | $99,216 | 6.19% |

New Hampshire | $103,085 | 5.09% |

New Jersey | $108,992 | 5.82% |

New Mexico | $87,402 | 4.53% |

New York | $114,691 | 2.64% |

North Carolina | $93,766 | 4.55% |

North Dakota | $82,285 | 2.17% |

Ohio | $84,781 | 5.05% |

Oklahoma | $84,282 | 4.81% |

Oregon | $104,666 | 3.54% |

Pennsylvania | $95,306 | 4.37% |

Rhode Island | $101,338 | 0.50% |

South Carolina | $92,144 | 4.33% |

South Dakota | $82,160 | 0.87% |

Tennessee | $91,478 | 5.87% |

Texas | $90,771 | 4.30% |

Utah | $99,466 | 6.17% |

Vermont | $99,632 | 4.04% |

Virginia | $106,704 | 6.74% |

Washington | $109,658 | 2.97% |

West Virginia | $80,829 | 2.59% |

Wisconsin | $87,194 | 3.66% |

Wyoming | $87,942 | 0.33% |

Think about that again: You need 80 grand to feel “comfortable” in the “most affordable state” in the country. But, at that median wage of $62,000, you’re $18,000 behind at the outset.

It’s like you’re running a race for your life but starting a lap down.

And that’s before something “unexpected” happens.

Tackle your credit card debt by paying 0% interest until nearly 2027

Reduce interest: 0% intro APR helps lower debt costs.

Stay debt-free: Designed for managing debt, not adding.

Top picks: Expert-selected cards for debt reduction.

There is a solution, though. There is a way to overcome that challenge. And it begins with a key starting point for any “action plan.”

Since the launch of SPC, Bill has said that generating extra income isn’t a requirement — it’s an imperative. Creating your own “income spigot” means you aren’t relying on your employer, the government, or anyone else to make sure you’re protected.

That personalized income stream makes you self-reliant.

But when we talk about generating income, we’re talking about “real income” — or “cash flow.” It’s what’s actually left after taking taxes and inflation into account.

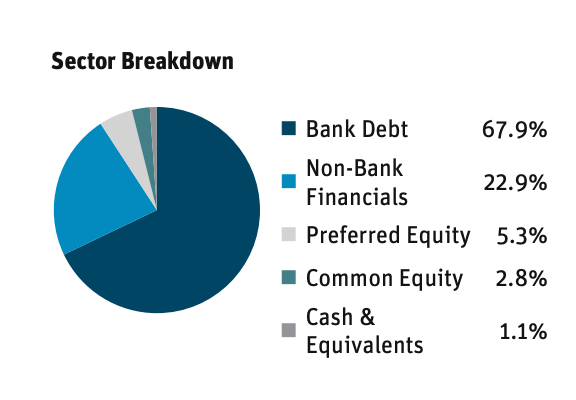

One of those income investments to consider is Angel Oak Financial Strategies Income Term Trust $FINS ( ▼ 0.15% ) , a closed-end fund listed on the New York Stock Exchange (NYSE).

With an investment focus on debt from the financial sector (like mortgage-backed securities and community-bank debt), Angel Oak receives higher yields than it would from large corporate bonds or government debt.

Source: Angel Oak

In turn, the company passes those yields along to shareholders; Angel Oak pays a dividend each month wiith an annual yield of 10.3%.

In this free report, we also have six other income-generating opportunities, all with yields above 10%.

Take care,