- Stock Picker's Corner

- Posts

- The Two “DOGE-genda” Stocks You Need to Own

The Two “DOGE-genda” Stocks You Need to Own

One momentum play ... one "bargain-basement buy" ... two DOGE winners ...

America’s New Cost Cutters are gunning for the Pentagon.

Most investors see it as a threat (as evidenced by the sell-off in defense stocks).

But I see a huge opportunity.

As part of his platform, U.S. President Donald Trump created the Department of Government Efficiency (DOGE) — a task force charged with cutting the federal spending, the government work force and (ultimately) the massive national debt.

DOGE is headed by billionaire Elon Musk, who wants to slash U.S. spending by $2 trillion a year. The task force has already restructured a number of federal agencies, launched a plan for mass layoffs and triggered outcries, court cases and controversy.

Online prediction platform Polymarket — which vaulted to prominence by predicting Trump’s November victory — has launched a “DOGE Tracker” to tally the cuts and cost savings … and to forecast what comes next.

As of Monday, the “DOGE Score” stood at $49.09 billion, Newsweek says.

But those results aren’t based on official data — at least, not yet. And since the numbers are taken from DOGE’s official X/Twitter account — it’s not clear that they’re objective, either.

At least, not yet.

One thing is clear, however: Those cuts will get harder from here.

Cutting foreign aid — as it’s doing with the U.S. Agency for International Development (USAID) — is one thing. Cutting domestic programs — in a way that everyday Americans can see and feel — will be another.

Then there’s defense spending — which enjoyed a special protected status since the first Cold War.

That’s not just a different challenge. It’s a whole different reality.

As of Friday, Team Musk has turned its targeting reticle on the Pentagon budget.

And it sees military spending as a “target-rich environment.”

I’m devoting today’s issue of Stock Picker’s Corner (SPC) to the “DOGE Agenda” — which I’m calling the “DOGE-genda.”

And two companies whose technologies are catapulting them to the front of the line as DOGE Winners.

YOUR DEFENSE DOLLARS AT WORK

Let’s start with a little context — courtesy of a Wall Street Journal report.

USAID — which DOGE went through like a railgun-fired tungsten rod — had about 10,000 workers and a $40 billion budget.

But the U.S. Department of Defense (DoD) has 20 times the budget and 300 times the workers. We’re talking about more than 3 million personnel – and, for Fiscal 2025 – a budget of $849.8 billion.

That’s about 13.3% of the of the $6.9 trillion U.S. spending plan.

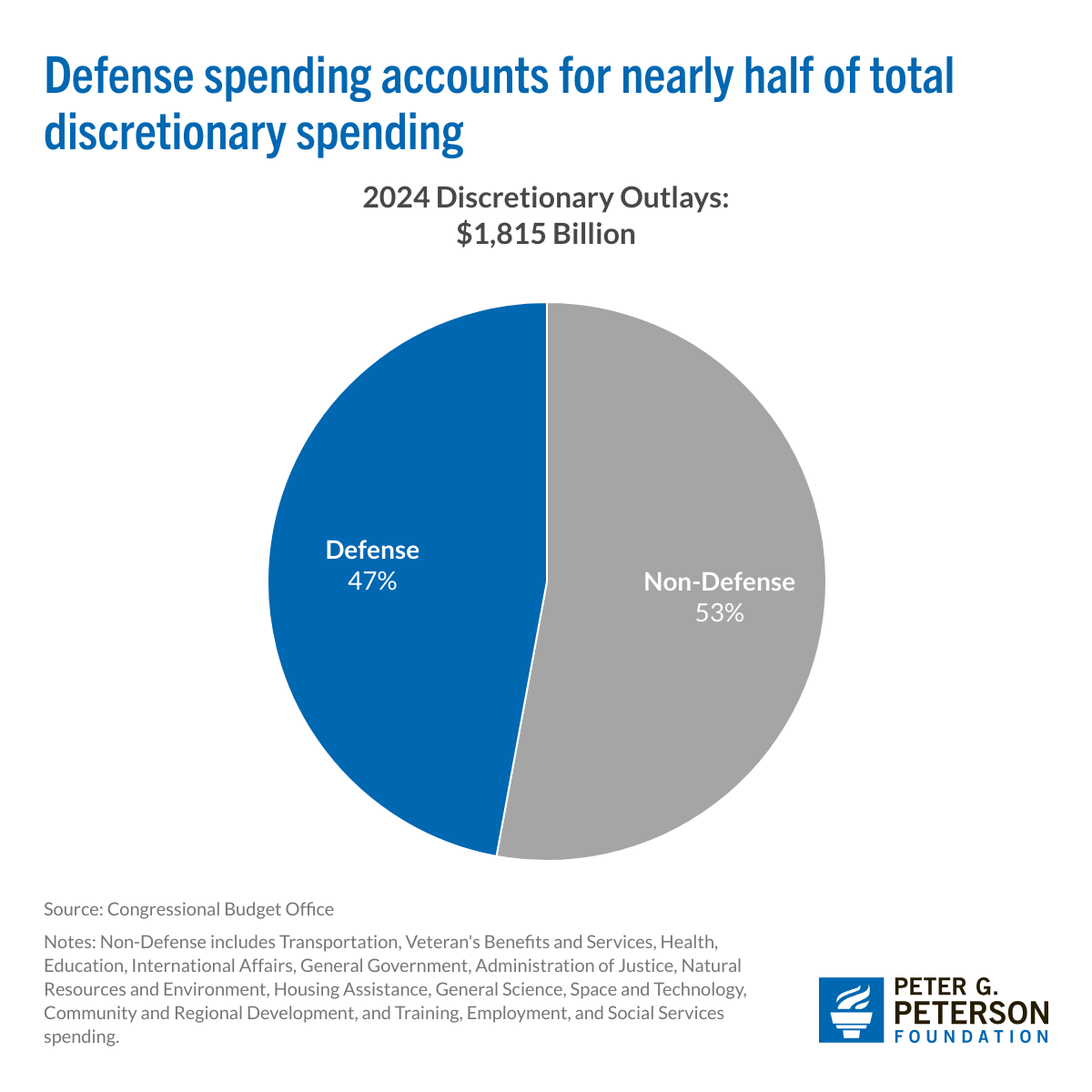

According to the Peter G. Peterson Foundation, those defense outlays account for almost half (47%) of America’s discretionary spending, CBS News reported.

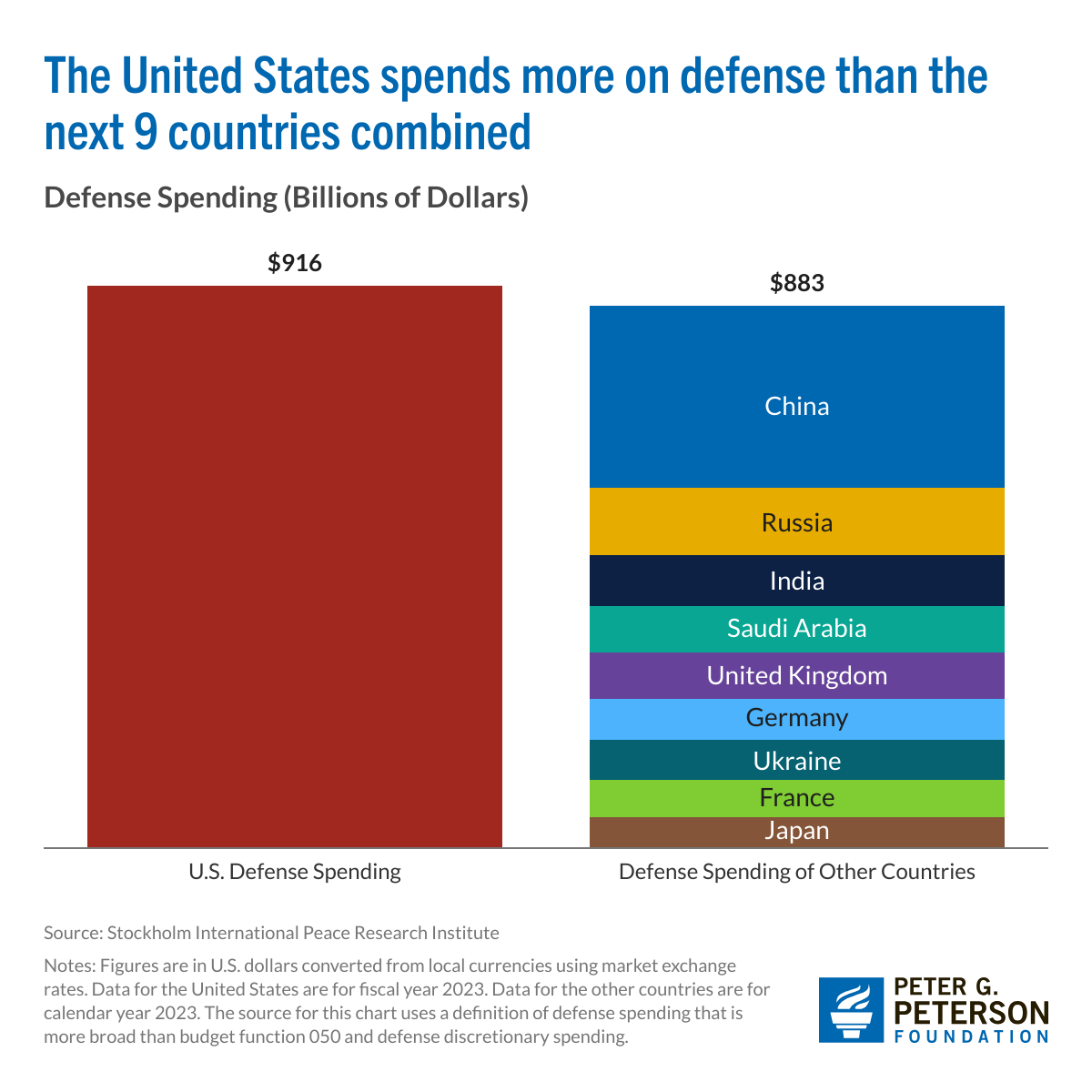

What America spends on defense by itself is more than what the next nine countries spend — combined.

So where does that money go?

The $850 billion Pentagon budget for Fiscal Year 2025 is allocated across various areas to support the operations, readiness and modernization of America’s armed forces. Here's a breakdown of how the budget is typically distributed:

Payroll: The salaries, benefits and healthcare for soldiers — and the civilians who support them.

Keeping Things Running: Money for operating ships, planes, tanks and more, the maintenance to keep them going and the training to make sure they’re operated safely.

Buying New “Stuff:” Procuring new vehicles, weapons systems and the gear to arm our soldiers.

Procurement: Acquisition of new weapons, vehicles, and other equipment.

R&D: Improving existing weapons systems and developing new ones.

Military Construction: Building and upgrading military facilities.

Family Housing: All those soldiers are hard-working civilians who need to live somewhere.

And All the “Other” Stuff Not Covered Here: Miscellaneous expenses — which includes allied support.

The military branches are trying to gets in front of this — and are offering up their “sacrifice list” of suggested cuts. The U.S. Navy is targeting its Littoral Combat Ships (LCS) and Constellation-class Frigates — two programs that have seen their share of disappointments, The WSJ reported. The U.S. Army list includes vehicles that were overproduced and obsolete drones.

“We’re taking a proactive approach to making our spending more efficient,” Army spokesman Col. Dave Butler told the newspaper. “There are several systems that we know won’t survive on the modern battlefield.”

Experts think Musk will go after the Air Force’s F-35 stealth jets — a multi-decade program whose total costs could exceed $2 trillion. It’s a frontline jet for the Air Force, Navy and Marines — and is an aircraft that’s able to go up against the increasingly advanced combat jets being fielded by Mainland China.

The threat of defense cuts hangs over the defense market like a digital Damocles Sword: Stocks in that sector fell about 6% last week and are down about 12% in the last three weeks, says Vertical Research Partners.

Shares of Lockheed Martin Corp. (LMT), maker of the F-35 and a company I wrote about here last year, are down about 4.4% in the last five days — but were down even more before they rebounded 1.26% on Tuesday.

An overhaul of military spending — if executed correctly — would be a good thing. Weapons programs — once they get going — can be hard to kill, especially since so many political districts are beneficiaries.

Want an example? That afore-mentioned F-35? Work on the jet gets done in 48 states.

And because of their sophistication, the development, prototyping and testing can take years before full production runs begin.

Against this backdrop, the global-security market doesn’t stand still. China continues to gain global power, its aircraft, ships and missiles keep growing in sophistication, and new “stateless threats” are emerging.

New weapons systems are emerging — including aerial and seagoing drones, hypersonic missiles and digital cyberweapons, including those powered by artificial intelligence (AI).

And new “battlefields” have emerged — including outer space and cyberspace.

So whatever cuts that come must happen — even as development of these new technologies continue.

Here’s my quick take: In the long run, I believe those programs will continue — they have to.

In the near-term, certain “types” of defense companies will thrive.

And I’ll share two “DOGEgenda” defense companies with you here today: One a white-hot AI stock that’s risen while other stocks fell; the second a “bargain-basement buy,” after a hefty sell-off.

In fact, I’ll give you the full story on both … right now.

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.