- Stock Picker's Corner

- Posts

- The SPC Silver Guide: How to Invest Ahead of the Looming "Supply Squeeze"

The SPC Silver Guide: How to Invest Ahead of the Looming "Supply Squeeze"

This SPC Network expert sees $300 silver — up 830% from here ...

We’re following the “Commodity Shortfall” storyline for one good reason: We see massive long-term “supply deficits” looming across many key commodities — including copper, lithium, nickel, and palladium.

It’s an “Econ 101” dynamic: If long-term supplies fall short of demand (which is growing, in most cases), you’re looking at a stretch of sticky, higher prices.

And one of those Econ 101 lesson is playing out in real time with silver.

The Silver Institute projects 2025 will be the fifth consecutive year where supply can’t keep up with demand, because there are more ways to use the metal than ever before.

And demand for silver as a retail investment also is projected to climb as folks look for a safe haven from economic and global uncertainty.

So if silver supplies can’t keep up with demand from all these different sources, shrewd, forward-thinking investors like you can be the beneficiary.

That’s why, since the launch of Stock Picker’s Corner (SPC), Chief Stock Picker Bill Patalon has collaborated closely with metals-and-mining expert Peter Krauth. Peter is the author of The Great Silver Bull , the publisher of the Silver Stock Investor newsletter and a longtime colleague of Bill’s.

And Peter ardently believes a multitude of forces and events will send silver to $300 an ounce — nearly a 10X jump in five short years.

So for all the folks who are new to the world of silver investing, we created this guide as a starting point for your research. While we positioned this as an “introductory” guide, the fact is that our research is deep enough and current enough for any metals investors to benefit.

We’’ll start things off with “The Why” behind the investment case for the “white metal,” as it will reinforce why Peter’s projection carries real weight.

Why Silver?

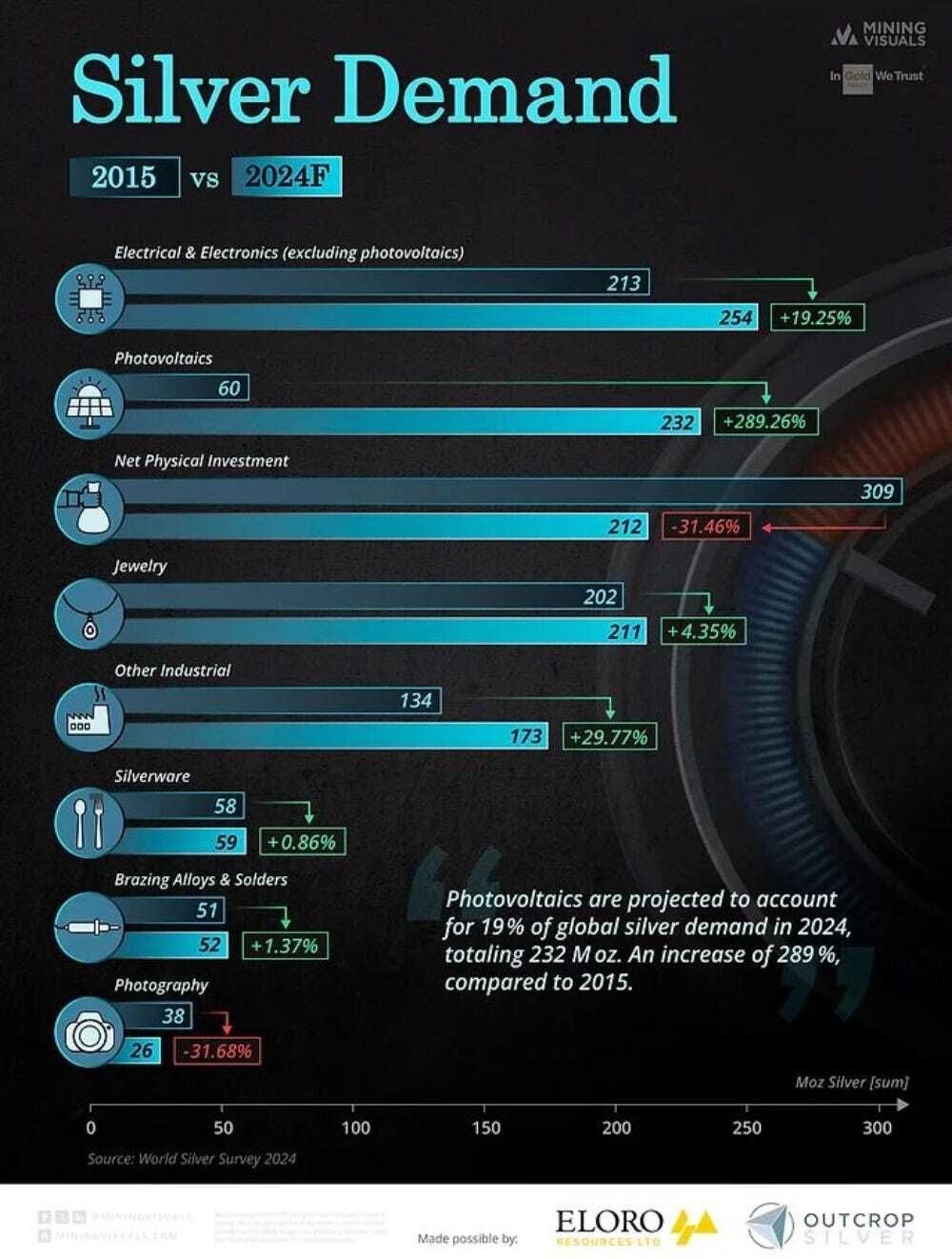

Dual Role: Like gold, silver is viewed as a store of value, but it has a broader range of industrial uses.

Demand: It’s estimated around 60% of silver demand is driven by those industrial uses.

Industrial Uses: Significant in solar panels, electronics, automobiles, and medical applications.

Source: Mining Visuals

Outlooks: Past and Present

Price Prediction 2024: In Peter’s first interview with SPC in March 2024, when silver was trading for around $24 an ounce, he said it would reach $30 by the end of 2024. He was right: In late October 2024, silver traded to nearly $35 an ounce before settling back a bit.

Price Prediction 2025: Silver to reach $35 in the first quarter and $40 by the end of the year. A potential recession could impact demand, but gold prices and economic factors will be key triggers.

$300 Silver: Expected within the next five years, due to inflation and increased investor interest.

Now that you have the backstory, we’ve compiled a list of investable ideas, starting with physical silver.

Investing in Silver Coins

With physical silver, you can buy coins or bullion, but we’ll focus on investing in coins because of their liquidity (easier to sell) and collectable appeal.

Among the most globally recognizable silver coins are American Silver Eagles and Canadian Maple Leafs.

For this guide, we’ll just focus on Silver Eagles and use the precious metal dealer JM Bullion’s website because of its ease of use.

If you go to JM Bullion’s silver page, you’ll find American Silver Eagles.

From there, these are the first few options:

Source: JM Bullion

🔵Uncirculated Silver: Has never been used in transactions.

🔵MintSealed Uncirculated Silver: Just like regular uncirculated coins, these have never been used in transactions. But MintSealed silver is sealed by a mint or distributor.

🔵American Eagles Star Privy: Features a small, star-shaped mark. These are sought after by collectors for their rarity. For example, the 2024 Star Privy American Eagle had a limited mintage of 500,000.

🔵NCG American Silver Eagles: A coin-grading company that’s been in business since 1987 and says its the world’s largest third-party coin grading service.

🔵Special Occasion Silver Eagles: Comes in packaging for birthdays, graduations, and other special situations.

🔵Proof Silver Eagles: Struck using a unique minting process that sometimes features a letter from the mint where it is struck: “P” for Philadelphia, W for “West Point,” and “S” for San Francisco.

🔵PCGS American Silver Eagles: Another coin-grading company that’s been in operation since 1986.

Uncirculated silver will usually be the cheapest option, with proof Silver Eagles commanding higher premiums.

MintSealed is slightly more expensive, but you’ll have a seal around the coin that helps verify its authenticity.

For graded coins, NCG and PCGS are both reputable companies, and buying graded coins offers authenticity insurance and protects the coin. You can also get a higher resale value. But you will pay more for those benefits, with the highest grade, MS70, being the most expensive option. Each grading service also has different labels, so if you are also buying silver coins for collectability, make sure to see the labels to find the designs you prefer.

There are benefits and drawbacks for all those categories, but the most budget-friendly option to just get started is usually buying the uncirculated silver.

A spot price is what you would pay for a precious metal (or other commodities) for immediate delivery.

A precious metals dealer has to make their money, so they’re going to charge a premium above that spot price. You’ll normally see that listed as something like, “X dollars per ounce above spot.”

To find the best price, shop around.

And we have a few places for you to start your research.

Where to Buy

Investopedia’s list of best online dealers is a great place to find an online dealer, as it ranks companies by six categories for you to prioritize what you value the most:

Best Overall: JM Bullion.

Best Low-Price Option: BGASC.

Best for Product Selection: Money Metals Exchange.

Best for Buybacks: APMEX.

Best for Customer Service: Orion Metal Exchange.

Best for Transparency: SD Bullion .

You can check out the full list of pros and cons of each service from Investopedia here.

We’d suggest that you try a few different services to see what you feel has the best customer service, fastest and most-secure deliveries, and the most-competitive prices.

If you really like a service but feel it’s just a little more expensive than the competition, those other factors (like comfort and customer service) might be worth the tradeoff.

Security & Storage

When it comes to protecting your precious metals, you’re really looking at a trio of options:

Renting a safe deposit box.

Buying a home safe.

Or using a security and storage service from a precious metals dealer.

All options are straightforward.

With a safe deposit box, you’d visit a bank branch that offers the service and sign a contract. Depending on the size of the space, a year-long rental can cost anywhere from $40 to $300.

For buying a safe, you could shop on Amazon or Walmart.

And for security and storage from a dealer, start your research on their website and be sure to ask questions about anything you’re not sure of. (As Bill likes to say from his journalism days, “the only stupid question is the one that’s never asked.” It’s your money … you’re the customer … make sure they give you all the information you need.)

But the three options are accompanied by a few considerations you’ll need to plan around before making a final decision.

For safe deposit boxes, make sure your beneficiaries know about them and are authorized to access them in case of your passing. Also understand that you likely won’t have 24/7 access to your bars, coins, or bullion since you’ll have to work with the bank’s hours of operation. You’ll also be paying rental fees each year. And The Wall Street Journal recently reported that deposit boxes are getting harder to find in the United States. So you may have to do a bit of searching.

Buying an actual safe does give you quicker-and-easier access to your silver but comes with obvious tradeoffs when it comes to security. Many people just aren ‘t comfortable having tens of thousands, hundreds of thousands (or more) in coins, bars, bullion, or other forms of precious metals in their home.

A precious-metals dealer’s storage service is similar to a bank, with a potential bonus: If stored there, some dealers will buy back metals you bought from them in the first place. You have to look into the reputation of the dealer (or third-party service they use). And if you decide you’d rather have easy access to your precious metals, you’ll have to wait for them to be shipped back to you.

You may find a mix of two our of three of those options is what works best for you.

Stocks

For stocks, the four main investment vehicles through silver are:

Mining companies.

Junior miners.

And streaming and royalty plays.

A mining company does some — or all — of the following: Exploring and developing areas for mining operations and extracting and refining the precious metals to sell to privately run or government-operated mints.

A junior miner is less established and focuses more on exploration and development. The potential rewards (investing returns) are high as the number of new mines getting up and operational is limited. But that higher possible upside is accompanied by higher risks.

A streaming company pays a miner an upfront price to receive a portion of the mine’s production and receives the actual physical metal.

And a royalty company typically offers an upfront price to a miner, as well, but doesn’t receive the physical metal; it receives a percentage of the revenue generated from the mine instead.

The returns on mining stocks and junior miners can offer higher returns. But streaming and royalty companies are considered “lower-risk investments” because they are only paying for silver that is being produced rather than the costs for exploring and developing a mine that may never become operational.

ETFs

Silver exchange-traded funds (ETFs) come in a few forms that either track the price of silver or miners.

Some examples include iShares Silver Trust (SLV), which holds physical silver bars to offer exposure to silver.

The Global X Silver Miners ETF (SIL) holds global silver mining companies. You can find SIL’s holdings here.

And the Amplify Junior Silver Miners ETF (SILJ) is the first and only ETF to target small-cap miners, according to Amplify ETFs. A list of SILJ’s holdings is available here.

Final Thoughts

As a recap, The Silver Institute projects 2025 will be the fifth consecutive year where supply can’t keep up with demand because of the growing number of industrial uses.

Retail investing demand is also projected to climb, as folks look for a safe haven from economic and global uncertainty.

Put that all together, and you have the perfect formula for prices to skyrocket … like with Peter’s forecast shared earlier.

If silver prices reach $300 an ounce by 2030 — as he predicts — you’d be looking at an 831% gain from today’s prices of $32.19.

The key is to position yourself now, ahead of that run-up in prices.

And you can do that with several of the investable ideas the SPC team shared with you today.