- Stock Picker's Corner

- Posts

- The Ideal Holding Period for Investing

The Ideal Holding Period for Investing

Plus five pullback stocks and the AI Era ...

It says something about our work here at Stock Picker’s Corner (SPC) that the things we believe in … the strategies we use … and the ideas we’ve spotlighted …. are being proved in the financial markets — in real-time.

And especially in this past week.

In this weekend's issue of SPC, I’ll revisit three ideas you can put to work immediately.

I’ll show you:

The profit-boosting/risk-squeezing holding periods for Wealth Builders.

Five stocks at newly “discounted” prices.

And (despite the flood of headlines to the contrary), the “AI Era” isn’t over.

🕰️Make Time an Ally

Whenever I add a new investment to the SPC Premium Model Portfolio, I also give folks a specific “holding period” — ranging from three to 10 years.

The holding periods do vary — based on the specifics of the stock, fund or asset.

But that longer-holding-period philosophy is based on two key pieces of hard data.

The first isn’t all that surprising: Generally speaking, the longer you hold a stock, the more likely you are to reap a positive return.

The second (and one that a lot of investors don’t think about in this way): The shorter the holding period, the more likely you are to record a loss.

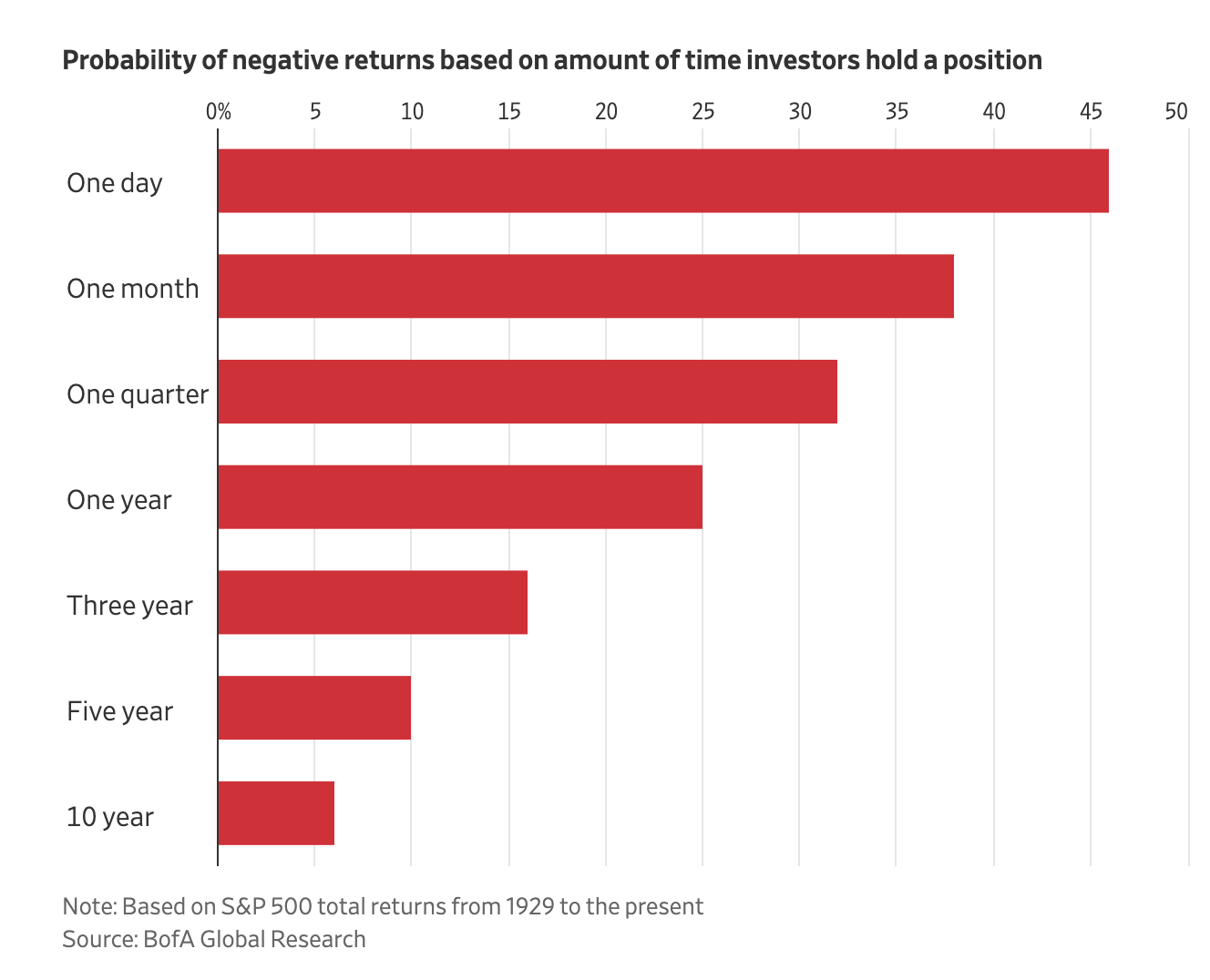

Just check out the chart below:

Source: The Wall Street Journal

Giving yourself an investment horizon of just one month puts the probability of a negative return at 38%. But if you hold a stock for five years, the probability of that loss plummets to just 10%.

The real Wealth Killer factoid: If you hold that stock for just one day, your probability of a loss is 46%.

So … basically a coin flip — almost a “heads I make money, tails I lose.”

But give yourself 10 years, and the probability of a negative return is a mere 6%.

Now you see why I am such a vocal critic of the trading mindset.

This bit of knowledge is a protective shield in the form of a confidence booster that lets you tune out the crowd on days like Monday, when the S&P 500 had its worst performance since September 2022 — and people were panic-selling in droves.

👀Revisiting the Pullback Watch List

Returning to current events and being a Wealth Builder: Back on July 22, I talked about the market’s pullback potential and two days later followed up with five companies worth watching if that sell-off took place. Now that we’ve seen stock prices seesawing, I wanted to share that list again.

Those companies are:

Apple Inc. $AAPL ( ▲ 0.61% )

Blackstone Inc. $BX ( ▼ 6.23% )

Broadcom Inc. $AVGO ( ▼ 0.69% )

Goldman Sachs Group $GS ( ▼ 3.25% )

Hallador Energy Co. $HNRG ( ▼ 2.55% )

🤖Unrelenting AI Demand

Returning yet again to being a Wealth Builder, the powerful storylines I like and the power of longer holding periods, I focus your attention on the AI Era.

Over the last two weeks, analysts, investment pros and the media crowd started punishing companies whose earnings reports didn’t show “enough” progress turning all their AI research and development into sales and profits.

In the jargon of Wall Street, these companies weren’t “monetizing” AI fast enough.

The following headline was one of the more desolate examples:

But as we also saw this past week, “Wall Street” didn’t have to wonder for long after Palantir Technologies Inc. $PLTR ( ▼ 3.43% ) released earnings.

Its government segment hauled in $371 million in revenue - an increase of 23% that easily toppled analyst expectations of $346.6 million. Total revenue reached $678 million, with $134 million in net income - the largest quarterly profit in the company’s history.

“Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic,” CEO Alexander Karp said in a shareholder letter.

It’s a company I am and have been following closely.

And in our July 31 issue, I made the case for why folks may want to consider starting a foundational investment in the Colorado-based company.

I’ll see you back here next week;