- Stock Picker's Corner

- Posts

- The 10 Winning Maxims of John Templeton

The 10 Winning Maxims of John Templeton

If you learn from the best — you'll outrun the rest ...

In the All-Time Investors “Hall of Fame,” some of the plaques lining the wall honor such heavy hitters as Benjamin Graham, Warren Buffett, and Peter Lynch.

And rightfully so …

Graham is considered the “father of value investing.” Buffett is his most-heralded acolyte (also a onetime employee) and one of the richest people on the planet.

And Lynch achieved fame as the best-selling author of One Up on Wall Street and was the steward of an average annual return of 29.2% during his 1977 to 1990 tenure as the manager of the Fidelity Magellan Fund — a return that clobbered the S&P 500.

But one often-overlooked name in this “Murderer’s Row” of big swingers is Sir John Templeton.

Source: Brent Moore, Flicker

Most of Templeton’s investing success came in the earlier part of the 20th century, making Lynch and Buffett more contemporary and top of mind.

But that still doesn’t water down Templeton’s investing success.

Forbes magazine described him as “one of the most successful money managers in history”.

His fund averaged 15% returns per year for 38 years.

And he sold it for $913 million in 1992 — the equivalent of $2.08 billion today.

Although Templeton passed away in 2008, the asset management firm which bears his last name, Franklin Templeton, lists 10 maxims that are as relevant today as they were when he created the Templeton Growth Fund in 1954.

These maxims are powerful prisms into the human psyche — and they’re also great investment strategies that help improve our decision-making and motivate us to stay on the Wealth Builder path.

We’re going to share each one — as well our our take on how you can use them today.

John Templeton’s 10 Maxims

No. 1: Invest for Real Returns

The key to investing is just getting started. So just considering something like the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), which “measures performance of the Top 80 high dividend-yielding companies within the S&P,” is a good starting point.

The yield is a respectable 3.92%.

But as you progress on your investing journey, it’s important to understand the “real returns” from income investing.

Chief Stock Picker Bill Patalon says this simply means finding the flow of cash that ends up in your brokerage account … or your pocket … after taxes, inflation or other “afterthought” costs are backed out.

He has a report on seven income stocks — each with yields above 10% — available here.

No. 2: Keep an Open Mind

We always tell people with our Model Portfolio or Special-Situation Portfolio in SPC Premium that they can invest in the companies they understand and like the best and pass on the ones they don’t.

If someone ultimately passes on an investment from one of our portfolios, they at least are a more informed investor by keeping an open mind about different opportunities.

It’s important to stay in what Buffett calls your “circle of competence,” but it’s also important to keep an open mind about new ideas or topics you may not be familiar with to at least stay informed.

No. 3: Never Follow the Crowd

There’s a lot of mistakes that can be made from following the crowd, but one of the most common mistakes of the investing masses is sitting on the sidelines and “waiting for things to get better.”

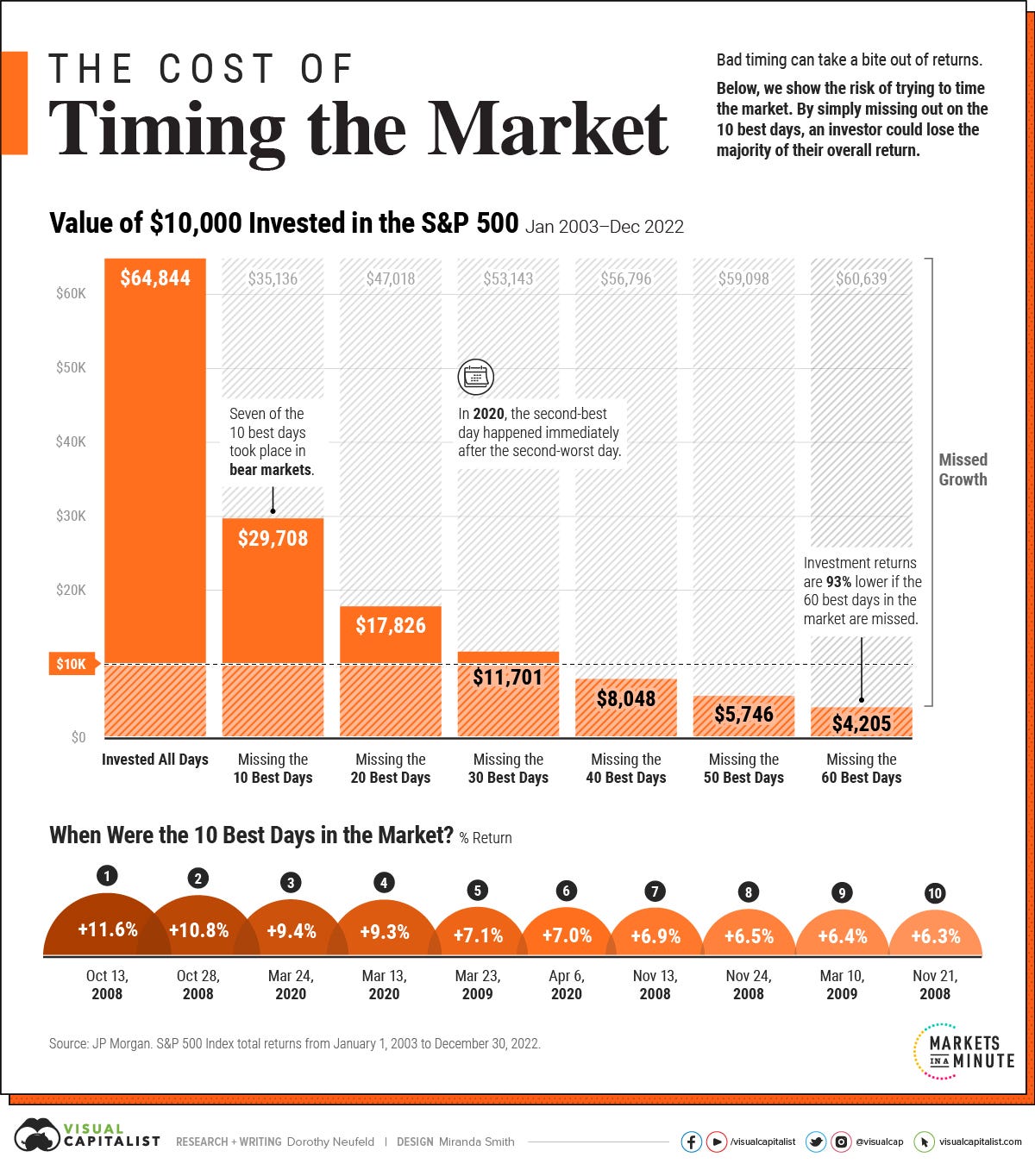

If you look at the data below, you’ll see how costly that mistake can be:

Missing just the 10 best days compared to always having skin in the game eroded total returns by more than half — slashing the end result from nearly $65,000 to roughly $30,000.

Following the crowd and waiting for an “opportune investing time” turns you into a Wealth Killer.

No. 4: Everything Changes

Everything is changing on a second-by-second basis — the markets go up and the markets go down.

The constant change is just part of the daily “noise” we all face as investors.

The key is to not obsess over the market’s daily meanderings (or whipsawing) by staring at a screen to see where prices are at that exact moment.

If you have a long-term plan, it’s easier to tune out that “noise” and where shares closed at any particular moment.

No. 5: Avoid the Popular

Investing in a company that’s top of mind for a lot of investors in and of itself isn’t necessarily a bad thing, but where people get in trouble is investing in companies or assets they don’t understand or never heard of just a few months prior.

If you believe in a company for the long haul and the stock price has ripped higher, you can follow Bill’s “Accumulate” strategy to buy on pullbacks.

You can also create an automated dollar-cost average (DCA) strategy by buying shares at specific time intervals - like every week, bi-weekly, or monthly.

No. 6: Learn from Your Mistakes

“‘This time is different’ are among the most costly four words in market history.”

Understanding financial history can help folks avoid a lot of mistakes in the first place.

For example, in the 1900s, investors would form “pools” to target stocks — inflating the volume to send their share prices higher. The early investors would get out at the peak, leaving everyone else who bought at the height of the “mania” with significant losses.

Meme stock mania in 2021 seemed novel. But as you just saw, there was already a reference point for how things would end.

To be fair, there still will be times when even the best-intentioned decisions go south. But making mistakes is part of investing.

It’s okay to make them — as long as you learn: Experience is one of the best teachers.

But wealth erosion is caused by making the same mistakes over and over again.

No. 7: Buy During Times of Pessimism

Our natural instinct is to run from danger, and a falling stock price looks like danger.

We want safety, and nothing at the time looks safer than shares of a company on a hot run of record highs; a hot run that will never seem to end.

So even though everyone understands we should “buy low and sell high,” it’s an easier mantra to say than to follow.

But if you tap into the Accumulate strategy mentioned earlier, you’ll be on the road of the Wealth Builder.

You’ll start to see pullbacks in prices as opportunities.

No. 8: Hunt for Value and Bargains

It’s up to each individual investor to define “value” and “bargains” for themselves.

Our top-rated positions are in our Model Portfolio.

No. 9: Search Worldwide

Templteon believed that investing internationally allows you to find more bargains and add diversity to your portfolio.

If you just want to dip your toes into the international investing waters and not buy individual stocks, check out the Vanguard FTSE Developed Markets ETF (VEA).

The fund’s holdings consist of companies from developed markets outside of North America — nations like Australia, Japan and Western Europe. You can also use a site like ETFDB.com to view the holdings of the ETF to make sure you know what’s “under the hood” before making an investment.

Looking at the holdings is also a great resource: It’s a way of identifying new companies to research to see if you eventually want to buy individual international stocks.

No. 10: No-One Knows Everything

“An investor who has all the answers doesn't even understand the questions.”

Going back to several of Templeton’s ideas, you have to keep an open mind and be a life-long learner.

You also have to continuously challenge your own assumptions.

For any company or asset we add to any of our portfolios, we try to poke as many holes as possible in the investment case and see if it can hold up to the scrutiny. If it does, it gets added. If it doesn’t, it won’t make the cut even if we still believe there’s a lot of upside potential.

That’s because overconfidence gets you into trouble.