- Stock Picker's Corner

- Posts

- SPC Premium: Why We're Dumping the Golden Arches

SPC Premium: Why We're Dumping the Golden Arches

And why we're adding a company "consumers can't get enough of" to the Farm Team ...

In today’s Monday Morning Kickoff, we’re doing some housekeeping and removing McDonald’s Corp. $MCD ( ▼ 0.24% ) from our Farm Team roster.

What we refer to as the Farm Team, other financial publishers might refer to as a “watch list” for stocks.

Except we devote a lot more time, energy, and discipline to the workups we do before we bring them to you.

When we remove a company and its shares from that “watch list,” it means we’ve reached several conclusions about its wealth potential.

Take that removal to mean:

Our intermediate-term view of the company has changed.

We’re no longer considering it for inclusion in our Model Portfolio.

We won't be covering it in our issues and updates.

And we’ll turn our attention to (and focus our energy on) better opportunities.

As Wealth Builders, we concentrate on storylines (what Wall Streeters refer to as their “investing thesis”). And we take the long view.

What we don’t do is let ourselves get “stuck.” If a story changes … if we were wrong … and if that “long view” won’t translate into strong gains … we’re willing to say so and move on.

This methodology has served us well.

And that means we’ve served you well.

Although our SPC Premium service has been up and running for just over a year, our rigorous approach has paid off. Since its launch on May 9, our Model Portfolio is up 30.14% (excluding our income stocks) — almost double the 15.21% gain of the S&P 500 during that same span.

Because we play that “long game,” these market-beating profits in the near term are gravy on top of the real gains we believe are still to come.

That’s how storyline investing works.

And it’s why the biggest gains start arriving after a couple of years and are magnified as we hold that stock for three, five, seven years … or longer.

We know it’s discipline and time that builds wealth. So we don’t obsess over short-term stumbles.

With that said, we do watch the companies we’ve spotlighted. And when something changes, we can change, too.

McDonald’s changed.

We saw it.

So it’s getting “cut” from the Farm Team for three reasons.

Reason No. 1: CosMc’s Gets Cancelled

In a December 2023 presentation, McDonald’s CEO Chris Kempczinski said that his company doesn’t have a strong presence in the “afternoon beverage pick-me-up” market, which he considered a $100 billion opportunity.

Enter CosMc’s, a drive-thru-only venture that Kempczinski described as "what would happen if a McDonald's character from the 1980s that was part alien, part surfer, part robot" opens a restaurant.

Launched in Illinois in December 2023, CosMc's menu focused mostly on drinks ... with a few sandwiches and snacks available.

Source: CosMc’s

The launch in Illinois resulted in absolute pandemonium, with some folks willingly waiting two hours to go through the drive-thru. Especially for a company as big as McDonald’s, this is the kind of innovative thinking and revenue energizer that gets us excited.

CosMc’s wasn’t just thinking outside the box, it was creating a whole new box.

If this “invention” worked, we believed other great ideas could follow.

So imagine our disappointment when McDonald’s shuttered all five CosMc’s locations this month — without much explanation or fanfare — less than two years into its launch.

Some of those CosMc’s drinks that had all those Illinois consumers so fired up could well appear on the regular McDonald’s menu as “test items” or “limited-time opportunities.”

But it may be a sign the “pick-me-up” refreshment business wasn’t as big as the company believed it could be.

Or the company could’ve discovered there were very real logistical obstacles. Consumers said they liked how CosMc’s allowed them to customize their drinks, but that may be unmanageable at a typical McDonald’s. Starbucks Corp. $SBUX ( ▲ 0.04% ) has been rolling back its customization options because of long wait times.

Therefore, the new revenue engine we hoped for won’t materialize from CosMc’s. We hope the way this experiment ended won’t blunt McDonald’s future innovation attempts.

Chief Stock Picker Bill Patalon is a bit troubled that the company, at the very least, didn’t voice some excitement about lessons learned, or discoveries that will help other ventures in the future.

Reason No. 2: Pricey Food, Slowing Traffic

McDonald’s has never been known as a “healthy option” or one that offered the best burgers money can buy. But its reputation was as an inexpensive option that could feed a family.

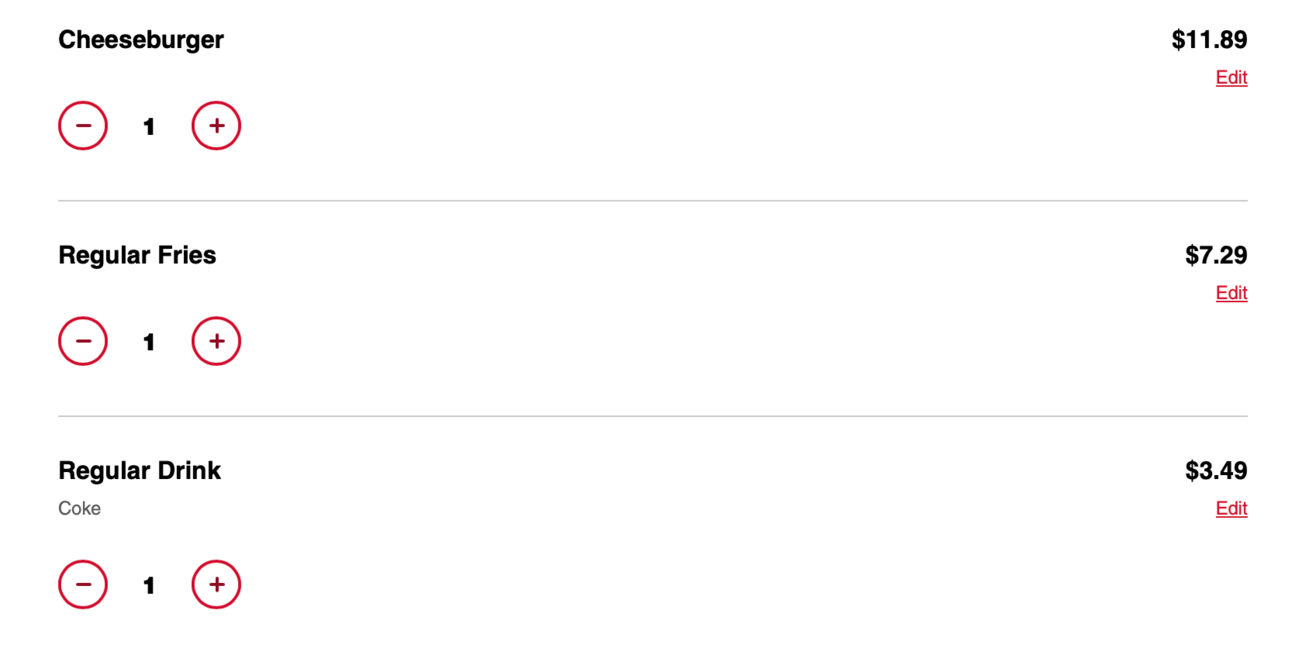

During the Great Financial Crisis in 2008, a Big Mac Meal was $4.59. And that affordability helped fuel MCD shares jumping 45% from 2007 to 2009. In comparison, the S&P 500 lost 21.96% during that two-year span.

Somewhere along the way, the affordability factor sizzled away. Menu prices surged and “sticker shock” during the 2022-2024 stretch ignited consumer outrage.

Some of that sticker shock was exaggerated. It’s a fact that inflation means that McDonald’s burgers will cost more today than they did 17 years ago.

But remember that Big Mac Meal price ($4.59 in 2008) I mentioned a moment ago?

The same meal today is more than twice as expensive:

Source: DoorDash

In comparison, Applebee’s offers a cheaper burger meal with unlimited fries and soda for just $9.99:

Source: Applebee’s

If someone is already shelling out $14 for a burger meal, they just may want to pay up for a more “premium” offering from a place like Five Guys for around $22:

Source: Five Guys

So while other dining chains seem to have found their footing in the face of higher ingredient costs, McDonald’s seems to still be struggling.

You can see it in the numbers.

In the first quarter, the company saw same-store sales slump 3.6%, which is the biggest decline since the COVID-19 Pandemic shuttered stores in 2020.

If McDonald’s can’t — or won’t — lower prices, it must find new ways to bring people in. And by shutting down CosMc’s, it just sacrificed one option.

Reason No. 3: Stronger Opportunities

McDonald’s isn’t a bad company or a losing investment. Shares are up nearly 13% since we added it to the Farm Team.

But as mentioned earlier, there are better options for us to research and bring your way.

We have one for you today …

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.