- Stock Picker's Corner

- Posts

- I Said Rocket Lab Could Double — And It Only Took Three Months

I Said Rocket Lab Could Double — And It Only Took Three Months

Why Russia's "Killer Satellites," Space War I and the LEO Satellite Race has SpaceX looking over its shoulder ...

I spent most of my 22-year career as a reporter scrutinizing public companies — in essence, “taking them apart” so that I could systematically analyze the pieces.

While investment pros and Wall Street’s sell-side analyst crowd obsessed over numbers and analytics — certainly important — I was able to “tell each company’s story.”

The full story.

One that included each company’s management, its culture, its technology and inventiveness, corporate strategies, powering trends, the competitive landscape, the all-important “what-comes-next” projection … and, of course, the numbers.

It’s a great approach:

It’s served me for 40 years — those 22 as a reporter … and the 20 years (and counting) that followed as an analyst, stock picker and newsletter writer.

It fostered the credo here at Stock Picker’s Corner (SPC) — that “if you find the best storylines, you’ll find the best stocks.”

And it works – it gets us into the shares of great companies long before “The Crowd” catches on … as I’ll show you today.

Let’s look at one that we gave to all SPC subscribers that’s delivered a 13-week gain of 139% … roughly the annual equivalent of 550%. I brought it to you using the analytical “take-it-apart” approach that I detailed above.

And it’s suddenly grabbing headlines for the hot run you’ve already pocketed.

A Tale of Two Headlines

The company that we’re going to talk about is Rocket Lab USA Corp. $RKLB ( ▲ 2.9% ) , a small-and-feisty rival to Elon Musk’s vaunted SpaceX commercial-launch company — but one you can actually invest in, since Rocket Lab is public and Musk’s SpaceX is privately held and will likely stay that way for a long time to come.

Over the July 4 holiday weekend, I happened across this Rocket Lab report from Zacks Equity Research.

Source: Zack’s

It’s a thorough report — typical of the work that Zacks turns out.

But take note of the date (July 4) and of the fact that RKLB shares had already zoomed 104%.

Then look at our (even-more thorough) report — published April 4.

And take note that we told you the stock had double-your-money potential. And note that we gave it to you before Rocket Lab’s shares zoomed from $16.37 at that day’s close to $39.14 yesterday (Wednesday). That’s a 139% surge in 13 weeks — or an annualized equivalent of better than 550%.

(What’s more, we’d given SPC Premium subscribers the first report on Rocket Lab back on March 20.)

That, folks, is the power of our “storyline” approach.

We find those best storylines to find the best-positioned beneficiaries.

And then we break those companies apart: We look at all the pieces I mentioned above, meaning we “tell the company’s story.” And we do this for a couple of reasons:

First, to be sure that we’re really-and-truly looking at all the “story elements” — and not just the numbers — to fully analyze the company’s strengths, weaknesses, opportunities and threats (the classic “SWOT Analysis”).

And, second, to make that analysis interesting and understandable for our readers so that it’s actually useful and actionable. As I learned during my professional reporting days, it’s better (whenever possible) to “show” rather than “tell.” By shifting the company’s “tale” from mind-numbing analytics and institutional insider “jargon” (YoY, Q1, TAM, pro forma, CapEx) to “I can see it!” narratives, we shift the advantage to our readers and turn them into Wealth Builders.

I did that with Rocket Lab.

Powerful Narratives

We started with our core belief: If you find the best storylines, you’ll find the best stocks …

Sometimes, two or more “storylines” intersect.

And two storylines are intersecting here:

The New Cold War – Deglobalization, the return of old enemies and the emergence of new ones, new technologies and new battlefields (including outer space and cyberspace) will fuel continued surges in global military spending. And it’s driving investors to think about “defense contractors” in new ways. One example: Palantir Technologies Inc. $PLTR ( ▼ 0.36% ) .

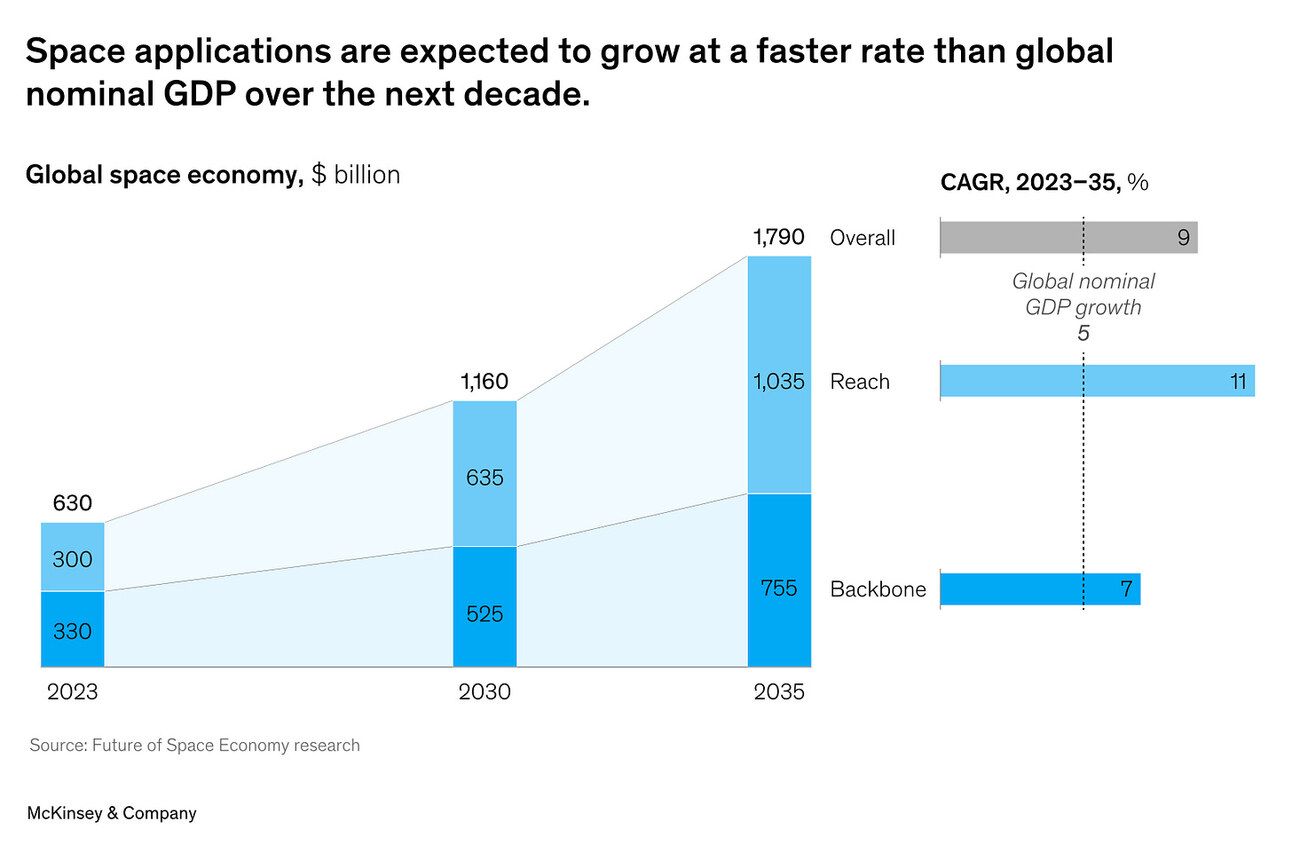

And the Space Economy: The worldwide commercial-space business is worth between $350 billion and $423 billion right now, according to several reports. And it could grow to $1 trillion to $5 trillion by 2040 — and will likely exceed $1 trillion by 2030, says a 2022 joint study between Oregon Consulting Group and the University of Oregon’s Lundquist College of Business. As the chart below shows, we’re talking about a truly “new” economy that’ll grow at a faster clip than its terrestrial rival. Rocket Lab is perfectly positioned to benefit — on both the commercial and defense sides of the business. And given its relatively tiny market value — of $18 billion — it dangles plenty of upside for Wealth Builders who are willing to play the long game, and “Accumulate” as it ebbs and flows along the way.

That’s the overarching part.

Then there are those company story “pieces” I mentioned earlier. Rocket Labs has:

Strong-and-Feisty Management — Headed by Peter Beck, an impresario New Zealander and engineer who skipped college, worked as a machinist and then turned his hyper-detailed, focus-on-the-long haul efforts on Rocket Lab. He created a culture that reflects those values — one reason the company has a launch record that’s dramatically better than its rivals.

Great Inventiveness — Surfing the powerful commercial-launch wave, Rocket Lab is already developing two “quick-launch” vehicles (space-speak for “booster rockets”). And the bigger one — called Neutron — is a two-stage booster that’s possible for human spaceflight and deep-space missions. The second is Electron, a small, reusable rocket that can boost small satellites into Low-Earth Orbit (LEO). It’s already the second-most-used U.S. satellite booster, trailing only the SpaceX Falcon 9.

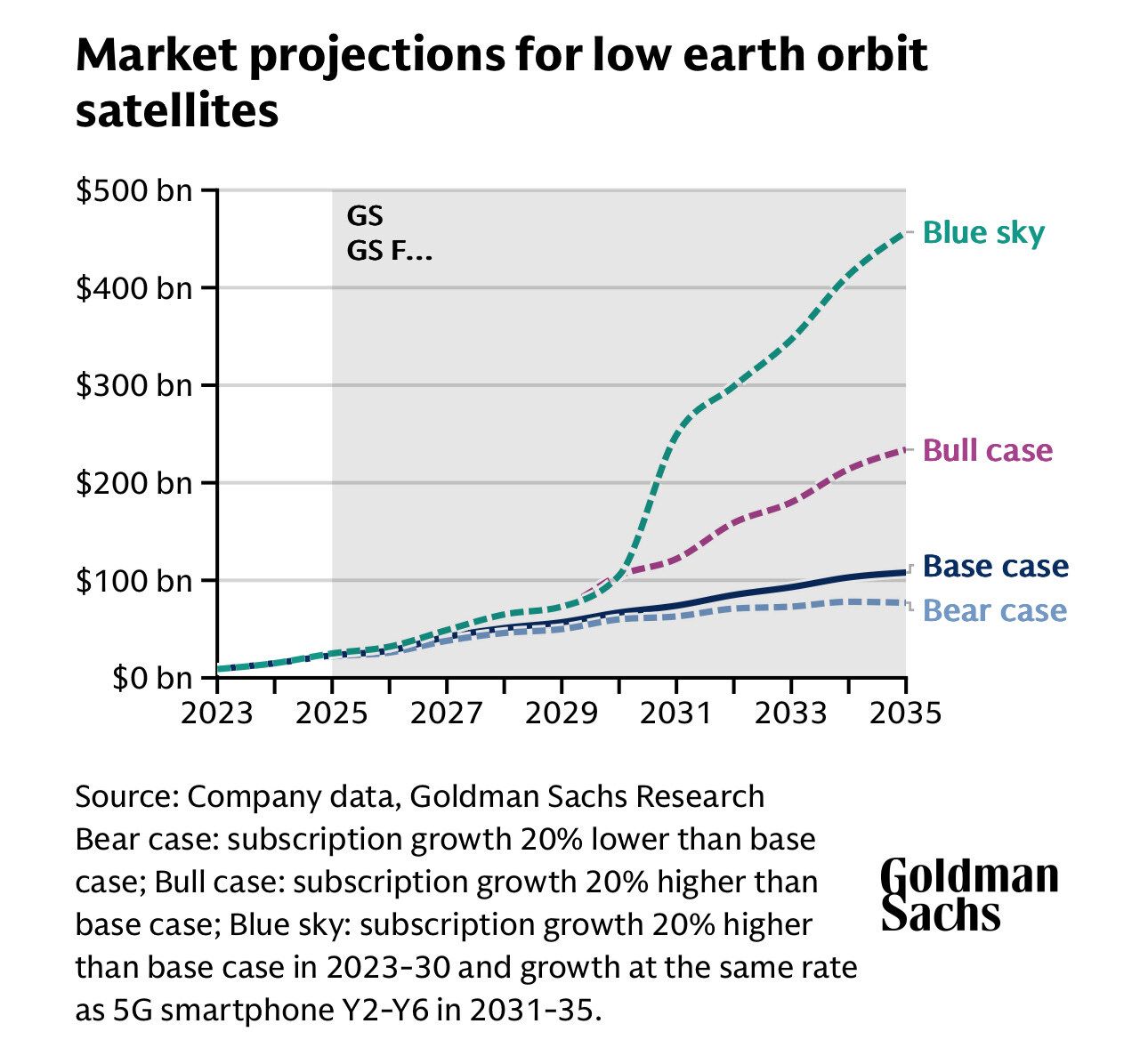

And it’s a Trend Rider — I already mentioned the LEO satellite market. As many as 70,000 LEO spacecraft over the next five years, Goldman Sachs Research said in a March report (see chart below). Then there’s defense. Russia has allegedly launched “killer satellites.” So the Pentagon is standing up a “quick-launch” program, where replacements can be put in orbit in days after a loss. Then there’s a new category of space weapons: Hypersonics. New offensive and defensive systems must be created. Contracts and being awarded – and money’s being spent. Back in January, the Pentagon announced a $1.45 billion pact to help America speed development of hypersonic weapons systems. And with both of these “sub-storylines” — commercial launches and hypersonics — Rocket Lab is a player.

The Road Ahead

It’s the “what-comes-next” part of the Rocket Lab story that’s key from here.

In that April 4 report, I told you folks that the stock “could double — or more.”

And it’s done exactly that.

That’s terrific — especially when you annualize it.

And it’s even more terrific when you remember that we told you the stock would double … whereas Zacks came after the fact — essentially saying “hey folks, the stock has doubled.”

With our approach, you’re in front of “The Crowd.”

With the Wall Street approach, you end up chasing the money.

Our way — the Wealth Builder way — is the right one. We play the long game.

In the near term, Rocket Lab — having raced a long way in a short stretch — could be volatile … and could drop back to “consolidate.”

That’s an opportunity to “Accumulate” if that happens.

Long term, I really like the Rocket Lab story. (Go back and check out that full April 4 report. And for our paid-up members, check out another New Cold War stock here that’s up 145% since we added it to our Model Portfolio.)

You scored. And we helped you. That’s what we do.

See you next time;