- Stock Picker's Corner

- Posts

- How You Can Profit From the World's Biggest Shopping Spree

How You Can Profit From the World's Biggest Shopping Spree

And one company is the king of them all ...

I was working in our back yard Saturday night — tending to my Giant Sequoia trees, my blueberry bushes and my wife’s flowers — when my next-door neighbor Allen strolled over to catch up, hear the latest on my “old hot rod” project … and to let me know he’d have some pulled pork ready at about 10:30, and to see if I wanted some.

As if he had to ask (lol).

Allen is the kind of next-door neighbor we all dream of having. He’s in his mid-30s, with a lovely wife, a toddler daughter and another baby girl due this summer.

He’s also a master plumber — who operates his own company.

If you can’t tell already, my wife RK, son Joey and I think very highly of Allen and his family. They’re nice folks.

In fact, if you listen to him talk about his company, you can tell that despite his age, Allen is definitely Old School. His values drive his way of doing business:

He does his work correctly.

He treats his customers well.

He maintains fair rates.

And he takes pride in what he does …

Now Allen is looking to rev up revenue growth – and he shared several well-thought-out options he’s considering.

I’m sharing this for a reason: As part of our chat, Allen told me about a fascinating trend.

“Bill, private-equity firms are buying up plumbing, electrical and HVAC firms – it’s a national trend,” he told me. “They see these as businesses that are essential to the American economy. PLUS, they seem as being, well, kinda recession-proof.”

He’s right about this being a trend.

Private-equity (PE) investors have grabbed nearly 800 HVAC, plumbing and electrical companies since 2022, The Wall Street Journal reported last fall, citing data from PitchBook.

And those are just the really big deals: The smaller ones aren’t tracked because, as private companies, they’re often not disclosed, the newspaper reported.

“Everybody and their uncle owns an HVAC business in the private-equity space today,” Adam Hanover, chairman of Redwood Services, a PE-backed home-services firm, told the newspaper.

Redwood has snapped up 35 businesses in the past four years – the smallest outright for $1 million in cash, though the average valuation was $20 million, the WSJ reported in that story, penned by staffer Te-Ping Chen.

As Chen told Marketplace in an interview late last year: “You might think about private equity typically going after the bigger fish. This is a moment where we’re seeing a lot of (PE) companies, bigger and smaller, going after companies in the skilled trades, really of all sizes.”

This surge in so-called “skilled trades” deals is the latest proof point in what I dubbed “The Private Equity Tidal Wave” has yet to crest.

Which means plenty of opportunities remain …

Indeed, if you haven’t already done so, now may be the best chance you’ll get to establish a “Foundational Position” in a top PE play.

Here in today’s issue of Stock Picker’s Corner (SPC), I will detail all of this for you …

Massive Growth

The Journal’s reports on private equity’s appetite for plumbing, electrical and HVAC contractors were superbly executed.

But we’ve been talking about the PE industry’s growing appetite for companies of all types since we launched SPC early last year. And I’ve been covering PE for about 40 years — going all the way back to the “LBO” (leveraged buyout) and junk-bond era of the “Go-Go ‘80s.”

During that time, I’ve watched as private equity grew from fascination headlines into a financial monster that’s almost like an economy unto itself.

In terms of assets under management (AUM) — money that’s invested and uninvested — the global PE business controls about $8.2 trillion, consultant McKinsey reported last year. If you transformed that into GDP, you’d have an economy bigger than Japan and Great Britain combined.

It’s a heavy hitter operationally, too.

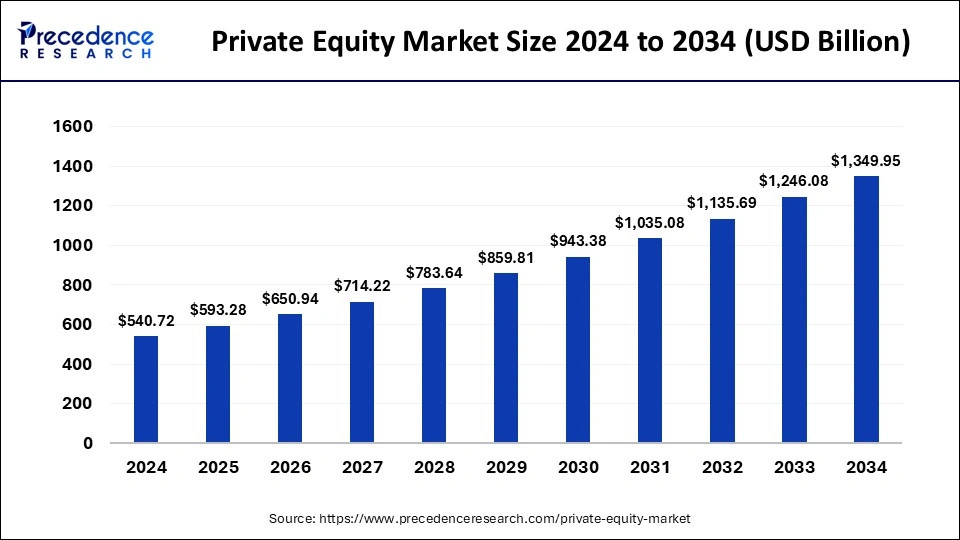

According to Precedence Research, the global PE market was worth about $540.7 billion last year and will grow from an estimated $593.3 billion this year to a projected $1.35 trillion in 2034.

The surging “startup culture” is viewed as one of the “triggers.”

Source: Precedence Research

Just what are these private-equity players, how do they operate and why are they seeing all this growth?

Let’s start with the basics – and “Private Equity 101.”

We’re talking here about investment firms that largely operate outside the public markets (although many of them are publicly traded themselves). Unlike fund managers who invest in stocks, PE firms mostly invest in privately held companies — often buying them outright. They run them ruthlessly, getting growth even as they cut costs and boost efficiencies — and then flip them for a profit later on.

The “financial fuel” for all this dealmaking comes from wealthy investors, university endowments and institutional players like insurance companies and pension funds. These investors are drawn in by the potential for higher returns — and the fact that these types of investments can provide diversification. Their growing interest — coupled with the fact that the global pools of investable money just keep growing – are helping fuel the PE sector’s surge.

As I’ve been saying, the lever-puller leaders in PE are “big-footing” just about every business you can think of. And we’ve been all over this story, telling you about how these heavyweight financiers are sending those tidal waves of cash into:

Your kids’ baseball and softball rec leagues.

All major pro sports – the latest being the National Football League, which now allows teams to sell stakes as large as 10% to PE firms.

The building boom in artificial-intelligence (AI) data centers.

And now the consolidation of the so-called “skilled trades.”

There’s more coming, too. Last year, for instance, Bloomberg reported that PE firms are “muscling into the world of insurance and retirement savings and shaking up the business.”

Trust me when I say this: It won’t be long until some forms of “private investing” or “private equity” show up as menu options in your 401(K).

The move into plumbing, electrical-contracting and HVAC is the latest foray — and makes lots of sense. In fact, it fits the private-equity formula perfectly.

PE firms love to buy into highly “fragmented” industries — sectors with scads of unaffiliated players that can be “rolled up” (consolidated) into a smaller number of bigger players.

Think about my neighbor’s plumbing business. He’s a sole proprietor. He does everything himself – the marketing, scheduling, service calls, installations and repairs, parts ordering and billing.

That’s a great rollup opportunity. Heck, you could even combine those plumbing, electrical and HVAC firms into a “full-service” company.

Pulling this off achieves several things:

It creates “efficiencies:” Companies can pool their purchasing power to get better prices on equipment, vehicle fleets and even redundant positions like accounting, human resources, purchasing, and customer service.

It reduces competition: Instead of dozens of firms beating on each other over customers and undercutting each other on pricing, you end up with a smaller number of firms, which are able to raise prices and (therefore) boost profits.

It creates profitable, efficient businesses that someone else will want to buy: This is the PE firm’s end game — the “cash out.”

Thanks to Allen’s tale — a great “how-it-works” case study — we now have a general understanding of how private equity works.

Thanks to the McKinsey and Precedence statistics, we understand the industry’s potential for Wealth Builders.

Thanks to our ongoing work at SPC, we understand the industry’s growing economic influence.

And, thanks to my decades of experience — and the research updates our team here has done — we also know which PE player to start with …

The “Cashout King”

I’m talking here about Blackstone Inc. $BX ( ▼ 4.19% ) .

I’ve followed this company for more than a decade: I recommended it to my subscribers at the newsletter I ran for 11 years, Private Briefing.

So I know one thing about Blackstone: It knows how to make money.

Despite its size, the company is nimble — and opportunistic: For instance, as I previously chronicled, it snapped up distressed houses during the Great Financial Crisis — and made at least $7 billion when it sold them off when real estate rebounded.

Founded in 1985 and based right on Park Avenue in New York City, Blackstone has $1.1 trillion in assets under management — which makes it the world’s largest manager of “alternative” assets.

The company’s vast portfolio is built on:

Real Estate: It’s the world’s largest commercial property owner. It controls about $596 billion in real-estate assets and $320 billion worth of investor capital. It holds an estimated 12,500 properties.

Companies: Blackstone has been a busy buyer. As of May 2025, Blackstone owns 502 companies, up from the 250 we cited last year. The firm has been actively acquiring businesses across various sectors, including technology, energy, healthcare, hospitality and entertainment. Some notable holdings include Hilton Worldwide, Ancestry.com and SeaWorld Parks & Entertainment.

Infrastructure: With $60 billion in assets, this unit focuses on energy, transportation, sustainability and digital infrastructure, Blackstone is setting itself up to be a player in the tech-defined future. One of its latest deals is the $11.5 billion (total value) acquisition of TXNM Energy, a utility serving 800,000 customers in New Mexico and Texas. It also owns Carrix, North America’s largest marine terminal operator — a move that makes it a major beneficiary of the “Deglobalization” storyline we’ve been following for you. And it's positioning itself as a big developer of AI data centers.

It's a good time to look at the stock. At a recent price of $145, Blackstone shares are down about 28% from their 52-week high up near $201.

That’s not far from the stock’s 12-month low of $115.66.

And while Blackstone shares are up nearly 16% over the past year, the stock is down about 16% year to date. While other stocks have rebounded of late, Blackstone has lagged. Those are the types of stocks that get me interested: Great companies with massive long-term prospects.

Current forecasts call for profits to advance by 26.4% a year over the next five years. Earnings per share (EPS) are forecast to advance 20.9% a year. Revenue is projected to increase at a 15.7% annual pace during that time frame.

Stocks tend to follow earnings over the long haul. At a 26.4% clip, profits would double in less than three years. If you don’t own it already, consider establishing a foundational stake here. Add to that position as you get more cash — or via “dollar-cost averaging.”

Better still, add to that stake on pullbacks. For instance, set “buy points” — with each 10% or 20% drop, for example — and use those to “Accumulate” more shares.

Blackstone’s blueprint is the kind I look for — especially since it’s one most investors will overlook.

I’ll leave you folks to think about this a bit more; I need to finish the last of that pulled pork. On some fresh white bread, with some Arby’s horsey sauce I had in the fridge, it made for an amazing dinner.

Thanks to Allen for the food, for being a great neighbor — and for inspiring this issue of SPC.

See you next time;

News you’re not getting—until now

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.