- Stock Picker's Corner

- Posts

- How China and Russia's "Secret" Buying Could Create $6,000 Gold

How China and Russia's "Secret" Buying Could Create $6,000 Gold

Central bank "hoarding" ... and six other yellow metal triggers ...

Warren Buffett’s specialty — one of the keys to the massive success he’s enjoyed with Berkshire Hathaway Inc. $BRK.B ( ▲ 0.33% ) — is accumulating big blocks of undervalued companies, then letting the market play “catch up” in the years to come.

By “playing catch up,” you know what I mean: After Berkshire built its big stake, all the other investors who make up “the stock market” have a belated “investment epiphany.” They finally see what Team Buffett understood long before them (“Hey, this stock that Warren bought is really cheap”), and then start buying en masse for themselves.

In the months, years and decades that follow, all that massed liquidity, all that focused purchasing power, lights a fuse beneath that stock, and drives it higher. Berkshire “makes bank” and Buffett adds additional oak-leaf clusters to his Medal of Investing Genius.

And rightly so. (After all, this is America, the global capital of global capitalism.)

That bit of “Berkshire 101” is a super simple explanation of how this works (a core strength of the team here at Stock Picker’s Corner (SPC)). But the execution: That’s actually quite tricky.

For one thing, investors are now wise to Buffett’s game. So when he buys, masses of investors follow. For another, Berkshire has grown so large (the cash pile alone is a record $348 billion) that it takes massive stock purchases to “move the needle.”

Stock purchases of that magnitude can’t be done all at once — it’s just too ponderous; and it’ll end up with Berkshire pushing up the price of — and then “chasing” the very stock it’s trying to buy.

So the Oracle of Omaha and his Merry Band of Value Investors employ some very shrewd strategies. By that I mean that Berkshire:

Spaces its buys over time — and watches for the “right” prices.

Takes big advantage of big pullbacks in stocks in general.

Delays its required Securities and Exchange Commission (SEC) disclosures as long as possible — sometimes even filing after the close of business on the final day the filings can be made.

And even resorts to a “confidential treatment tag,” a special disclosure exception that allows Berkshire to build a big position … in secret. (It recently used this with insurer Chubb LTD CB 0.00%↑; the tag let Berkshire secretly buy 26 million shares — worth $6.7 billion — over a nine-month span.)

Buying clandestinely — so you can build a big position before anyone else knows it — is a great strategy … especially because you know the “news” will ultimately leak out. You see, once it does leak out — and everyone else hears about it — those millions of other investors will be infected with a massive case of FOMO (Fear of Missing Out). Over time, their “liquidity” will drive the stock higher.

To Summarize: Buy in secret; and make everyone else play “catch up.”

Buffett and Berkshire have done it with stocks.

And now central banks around the world — especially in China and Russia — are allegedly doing the same thing … with gold.

It’s a reality that adds additional muscle to one of the seven “Triggers” (a “Baker’s Half Dozen”) I see for continued strength in gold prices.

Some analysts see $6,000 gold as an attainable price point.

The Secret Shopping Spree

At its current price of roughly $3,345, gold is only about 4% below its all-time peak of $3,500, reached back in April.

The latest reports say that the world’s central banks aren't selling the gold they’ve accumulated. And they’re still buying — just not at the lickety-split pace of before, the “official” reports say.

Here’s where the tale gets interesting.

A core SPC belief — one we repeat over and over and over again here is: “If you find the best stories, you’ll find the best stocks.” Put another way: Find the most-powerful narratives and it’ll lead you to the biggest payoffs.

From a starting point at about $2,850 an ounce back in January, gold zoomed about 23% to that April record high – a hefty gain in three short months. And if you go all the way back to September 2022, when gold traded down around $1,620, the metal has more than doubled.

And one of the biggest drivers of that precious-metal surge has been one of SPC’s top storylines: Deglobalization.

You see, central banks have been a major catalyst for gold’s rally. Economic sanctions, geopolitical tensions, trade spats, a desire to shift away from the U.S. dollar as a reserve currency, inflationary fears, military actions in The Ukraine and the Middle East and more have boosted central bank appetites for gold.

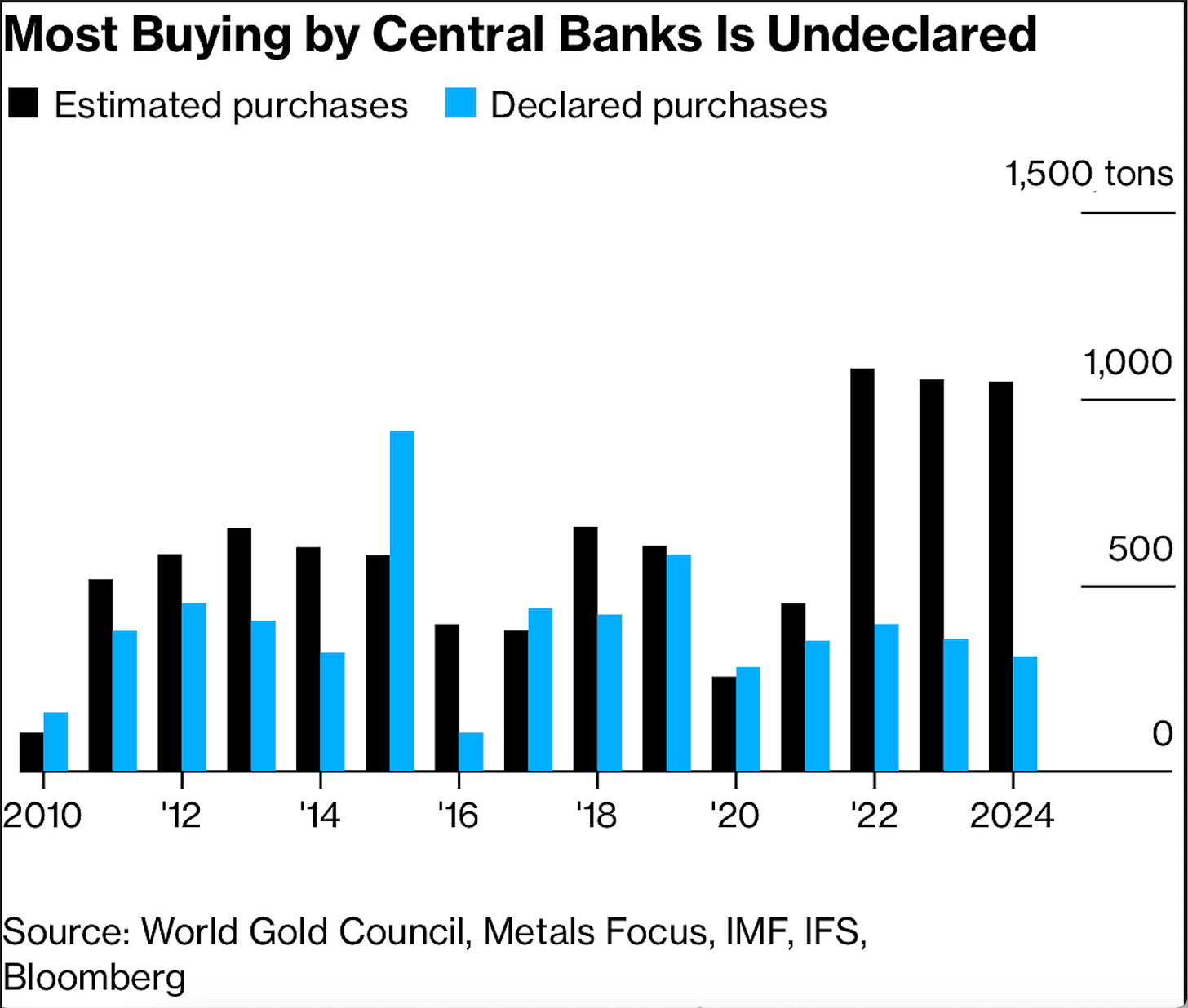

But it’s become increasingly clear that those purchases are understated – perhaps by a lot.

According to Goldman Sachs Group Inc. $GS ( ▼ 5.33% ) , central banks are vacuuming up about 80 metric tons of gold a month. The value at current prices: About $8.5 billion, Bloomberg says. If you combine central banks and sovereign wealth funds (think of them as government-owned investment-vehicle/venture-capital funds), you’re talking about purchases of about 1,000 tons a year — or at least a quarter of the gold mined annually, says the World Gold Council.

Don’t expect that to change. In a January survey of 72 central banks by HSBC Holdings PLC, more than a third said they were planning to buy more gold this year — with none planning to sell.

China is the world’s largest gold producer (380 metric tons last year) – and second-largest buyer on all fronts. Russia is the No. 2 producer (310 metric tons in 2024) – and intends to boost production 4% a year through next year.

Analysts believe the Russian Ministry of Finance is buying gold from domestic producers without reporting it. China’s central bank is boosting its gold reserves (Goldman believes the PBOC has been buying 40 metric tons a month since 2022). But it may be “hiding” them in a different official agency – meaning its true holdings vastly exceed official disclosures.

Unlike my story about Berkshire, the SEC and stock-purchase disclosures, the trans-boundary nature of central banks and gold purchases means there aren’t any international regulations that require different countries to fully announce their gold purchases or bullion holdings. Organizations like the International Monetary Fund (IMF) and World Gold Council encourage it, but there’s no way to compel full disclosure.

And as this Bloomberg chart shows, much of those purchases are secret — and go unreported.

And just as Berkshire and Buffett eventually reveal their stock purchases — creating FOMO — big central banks like China will eventually disclose their gold purchases.

“The reported purchases of the People’s Bank of China are frequently viewed as out-of-date or incomplete by market participants,” Bloomberg said in that report this week. “In 2015, for instance, the PBOC revealed a whopping 600-ton jump in its bullion reserves, shocking market-watchers after six years of silence.”

Dissing the Dollar

With today’s data analytics and digital-sleuthing scrutiny, a similar period of silence won’t be as long. And the impact will be seen much sooner: Those purchases will put a floor under gold prices — and probably prices higher over time — whether they’re revealed or not.

While the global average is roughly 20%, the United States, France, Germany and Italy hold about 75% of their reserves in gold. China’s gold holdings equate to about 6% of reserves — and Goldman believes China has an incentive to keep acquiring the metal to reach a ratio that’s more in line with global averages. Other countries — in the Middle East and the former Eastern bloc — also are boosting gold holdings, diversifying reserves away from the dollar.

As part of this yellow-metal calculus, JPMorgan Chase & Co. $JPM ( ▼ 2.84% ) says that a shift of just half a percent of global reserves out of the greenback and into gold would rocket the metal to $6,000 an ounce by 2029.

And that’s just one of the “Triggers” I see. If “Central Bankers/Central Hoarders” is Trigger No. 1, here are six more — giving you that “Baker’s Half Dozen” of gold-price catalysts.

Trigger No. 2: Deglobalization and the Age of Permanent Uncertainty

If the “Trump Tariff Tantrum of 2025” taught us anything, it’s that we’re deep into an “Age of Permanent Uncertainty.” Deglobalization — a fracturing of the global economy that’s sending the world back to regional “trading blocs” — has been underway for years. But it’s now accelerating – triggering more and faster uncertainty that we’ve seen in modern times. In a global marketplace, it made sense for the U.S. dollar — the currency of the country with the biggest and most-stable economy, as well as the most-stable political system — to serve as the “global standard” … otherwise known as the “world reserve currency.”

But the return to regional trading blocs — exacerbated by a New Cold War flintiness — has non-U.S. countries looking at alternatives. It also doesn’t help that America can’t get its financial house in order: With our $36 trillion in U.S. debt, we’re looking at annual interest payments of about $1 trillion. And that’s just making minimum payments — like an overextended consumer who’s paying the minimum on their Visa card.

A little “market context” is necessary.

The “stock market” — which dominates the mainstream headlines — has a market value of about $100 trillion. The bond market is even bigger — at an estimated $250 trillion.

But the currency markets, the global foreign-exchange, or FOREX, market, dwarfs them both. It has a daily trading volume of more than $6.6 trillion — which works out to $1.6 quadrillion on an annualized basis.

The appetite for U.S. government bonds — for decades viewed as “risk-free” assets — is shifting. The share of U.S. Treasuries held by money-market, mutual and hedge funds has risen to more than 27%, while the share held by foreign investors has plunged from about 50% 10 years ago to 30% now, says a brand-new report by the Brookings Institution.

Heck, as I told you before, the U.S. greenback ain’t what it used to be: In that same 50-year span that saw gold soar 2,200% to its recent $3,500 peak, the U.S. dollar has lost more than 94% of its purchasing power.

That’s led to something experts refer to as “de-dollarization.”

Russia and Iran last year ditched the dollar for bilateral trade. And that was before the election and the Trump Tariffs. Now the 11 (former Soviet) members of the Commonwealth of Independent States (CIS) say they’re done with the U.S. dollar.

Members of the Commonwealth of Independent States (CIS), including Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan and The Ukraine, have also announced plans to reduce their dependence on the dollar Additionally, some ASEAN nations, like Indonesia, Thailand and Malaysia are continuing to work out plans for use of local currencies for trade.

They’ll look for other non-dollar sources of stability, too. Which brings us to …

Trigger No. 3: Recession and the Unexpected

We’re going to have a recession: We know that — it’s inevitable … a natural part of the economic cycle. What we don’t know is when it will happen … how long it will last … and how severe it will be.

America has experienced eight recessions between 1973 and 2020, the last one we experienced. In all but two, gold trounced the S&P 500. And those two “exceptions” — 1981 and 1990 — were exceptional. Both were caused by “shocks” to the economy — one from interest rates … the other from energy.

In the recession of ’81, Federal Reserve Chair Paul A. Volcker took interest rates into the 19% range to crush the inflation of the 1979s. The recession of 1990s was triggered by an oil shock caused by the start of the Gulf War.

In the other six cases, gold performed very well.

Source: CME GROUP

From six months before the start of the recession to six months after the end, gold has rallied 28% on average and outperformed the S&P 500 by 37%.

That’s definitely a near-term gold-price “Trigger” to anticipate.

And there are additional, longer-term “structural” catalysts to watch for, including …

Trigger No. 4: Hungry Gold ETFs

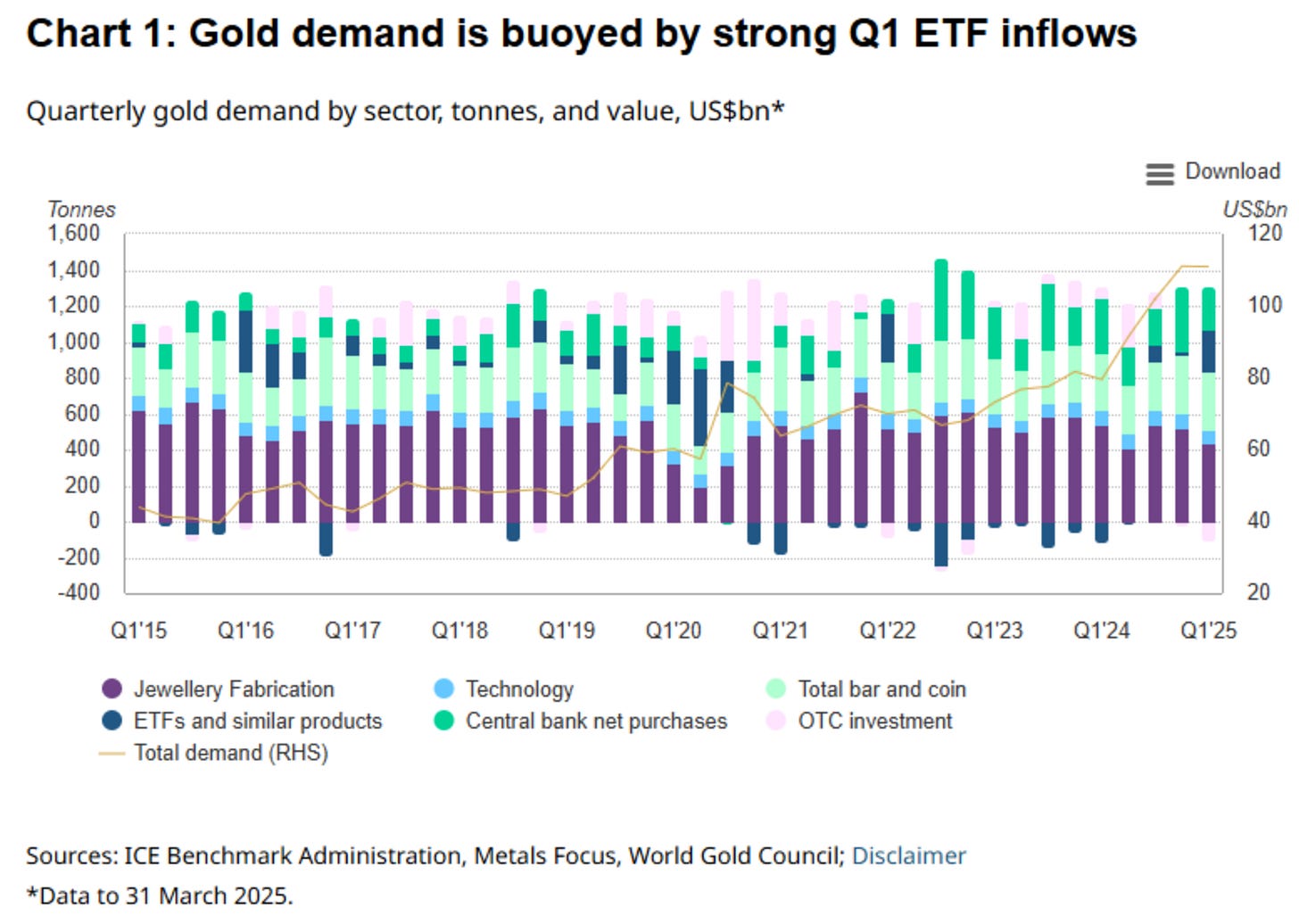

The debut of gold-focused exchange-traded funds (ETFs) back in November 2004 created a new source of yellow-metal demand by giving everyday investors easier access. The first ETF – the SPDR Gold Shares ETF $GLD ( ▲ 1.17% ) , which trades on the Big Board – was the first. And it’s the most-widely followed. In the first quarter, when total investment demand doubled to 552 metric tons, demand from gold ETFs was seen as a major contributor.

As you can see in the chart below from XTB Group, ETFs right now account for a bigger-than-usual slice of gold demand. That’s part and parcel of the rising demand for so-called “Real-World Assets,” or RWAs.

Gold is an RWA. And, as we see with ETFs, there are other ways to structure gold, including …

Trigger No. 5: “Tokenized” Gold

Alexandr Kerya, vice president of product development at CEX.IO, a digital-asset platform, says surging “geopolitical tensions” have folks looking for safe-haven investments. But technology — including the blockchain — is making that menu a lot more appetizing.

Kerya says “Tokenized Gold” is already a favored safe-haven play among “crypto-native investors.” And it’s part of the future of investing — and is yet another type of asset that’s trickling down to everyday investors. It’s a way of representing physical gold using digital tokens on a blockchain. Physical gold is stored in secure vault, while digital tokens (each representing specific amounts of gold) are created and managed on a blockchain — itself a secure-and-transparent ledger.

We’re watching this mini-revolution emerge in real time.

The market cap for gold-backed tokens – like “stable-coin” cryptocurrencies – jumped above $2 billion for the first time last week, says CoinGecko. And weekly trading volumes in tokenized gold eclipsed the $1 billion mark, the first time we’ve seen that since the American banking crisis of early 2023, says CEX.IO. We’ve seen big trading surges in individual assets: Trading volumes in Paxos Gold and Tether Gold zoomed 900% and 300%, respectively, since Inauguration Day, CEX.IO said in a recently report.

Tokenizing gold makes it possible to slice gold up in new ways. But there’s still a question of long-term supply …

Trigger No. 6: The Long-Term Supply Shortfall

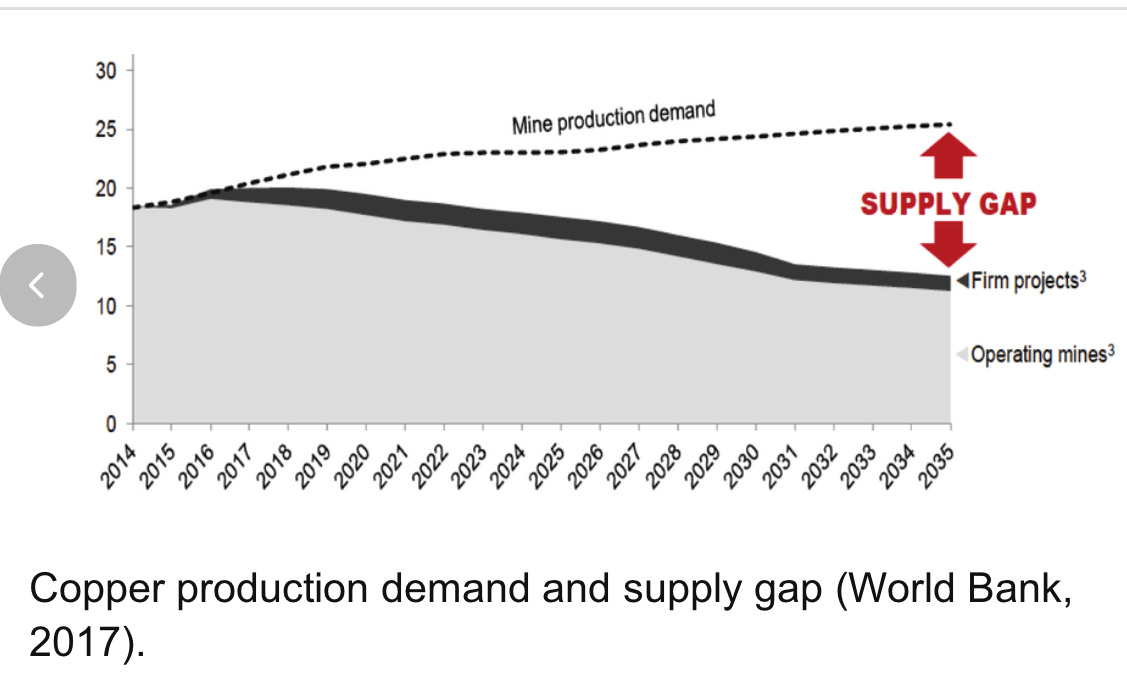

I joke that the commodities storyline is like that Mad Libs game some people played as kids … where you have a narrative and each player fills in the blanks to make it interesting.

And if we played “Mad Libs: The Commodities Supply Shortfall Edition,” we could use resources like copper, cobalt, lithium and silver to “fill in the blanks.”

For each of those critical materials, the long-term storyline is the same — and this picture tells the story.

For gold, that long view is a bit more nuanced. The largest single source of gold in history has been the Witwatersrand Basin of South Africa, a gold deposit influenced by the Vredefort meteor impact 2 billion years ago and discovered in the middle 1880s. Witwatersrand accounts for about 40% of the gold ever mined — or about 2 billion ounces – but production has been declining since the 1970s. China, Australia, Indonesia, Russia, Peru and the United States are all important gold producers. But recent reports point to a possible production slowdown at some point — thanks to declining ore grades, tougher regulatory hurdles and surging mining costs. Some forecasters predict that gold mining could be economically unsustainable by 2050, and that (with current deposits and current technologies) large-scale mining of the yellow metal will be impossible by the middle 2070s — after some of the other metals, but something that will affect prices well before that.

Trigger No. 7: The “Mainstreaming” of Gold

Over the last 40 years, I watched the “mainstreaming” of stocks.

In the 1970s, most folks my family knew wouldn't think of owning stocks — and only 13% of households owned stocks directly. I watched as ownership “went mainstream” — taking off in the “Go-Go ‘80s,” thanks to 401(k)s and mutual funds and Peter Lynch. Online trading and index funds kept that interest going in the 1990s and 2000s. Today: More than 50% of households own stocks in some form.

Now we’re seeing the same thing happen with silver and gold. Costco Wholesale Corp. COST 0.00%↑, the giant warehouse retailer, supercharged its business by selling physical silver and gold to its members. At one point last year, it was selling $200 million worth of metals a month.

And check out this recent headlines from CBS News — about as Mainstream America as a media company can get.

This all tells us one thing: More “regular Americans” than ever before want to own gold and silver.

Check out our report: “The Bullion Bulletin: 50 Gold and Silver Stock Investments” — which will give you a starting point for your personal precious metals research.

Do the research … it’s worth your time.

Despite the record surge in gold, analysts at the investment bank Jefferies recently said that many of those mining companies are still trading at historically low valuations — as if gold were trading at $2,500 an ounce or less. It’s a “disconnect” that may not last.

See you next time;