- Stock Picker's Corner

- Posts

- Hot IPOs: The Three Things to Look at Before You Leap

Hot IPOs: The Three Things to Look at Before You Leap

Here's how to avoid getting burned ...

There’s a flood of enthusiasm, shares go parabolic, the euphoria disappears, and the stock craters in a metal-clanging crash.

That happens all too often with a penny stock or a newly minted crypto. But that whiplashing pattern is suddenly showing up someplace new: With initial public offerings (IPOs).

It’s one that entrepreneur Mark Cuban has recently questioned:

Source: X

And for good reason …

With IPO activity up 86.5% this year over last, investors have been flooded with “new opportunities.” And they’re being seduced by headlines touting massive gains:

Source: Fortune

Source: Yahoo Finance

Source: Yahoo Finance

Let’s be clear: We’re not anti-IPO here at Stock Picker’s Corner (SPC).

After all, today’s successes (from Amazon.com Inc. $AMZN ( ▲ 2.56% ) to Nvidia Corp. $NVDA ( ▲ 1.02% )) were yesterday’s IPOs.

But we generally don’t cover new publicly traded companies. We know if we don’t rush out and buy shares their first day of trading that we’re not likely to miss out on anything.

Here’s why.

Why It Pays to Wait on IPOs

As tantalizing as those headline returns may seem, it’s not the average retail investor who’s making them.

For a couple reasons.

The first is “access.” The folks who get in at the actual IPO price — before they “go hot” and actually start trading — are big institutions (hedge funds or mutual funds), high-net-worth accredited investors, the underwriter’s preferred clients, and (sometimes) the favorite clients of a broker who’s allotted a few shares. Everyday investors are way down that list.

The second is “timing.” There are lock-up periods that define how long investors must wait to sell their shares, which is usually between 90 and 180 days after the IPO. For retail investors who buy into a hot IPO after the shares have run up a lot (even on the first day of trading), this can create a stock-market version of a “spike pit” booby trap. When those lockups end, and insiders or early investors are free to sell, that formerly hot stock can take a big hit as a bunch of new shares hit the open market with little demand. And late-to-the-party retail investors can get bloodied by the spikes at the bottom of that stumble.

Just take a look at the recent IPO from CoreWeave Inc. $CRWV ( ▼ 8.12% ) and its August 14 lock-up expiration; the day after that happened, trading volume spiked as those early investors dumped their shares and the stock price dropped 16.7%.

Date | Opening Price | Trading Volume |

August 11 | $134.80 | 19 million |

August 12 | $135.82 | 28 million |

August 13 | $132.98 | 37 million |

August 14 | $115.26 | 51 million |

August 15 | $95.90 | 52 million |

The third is “uncertainty.” Many of these newly public companies aren’t profitable and the reason they are going public is because they need the money. With all the uncertainty swirling around us, it’s not a great environment to be unprofitable — especially if we hit an economic downturn.

When you add all of those issues up, it’s worth it just to wait.

If you think you can make real wealth from that company that just went public, you’ll be needing to hold it for years and decades anyways, so waiting a few months or even a year before buying shares won’t set you back.

Bottom Line

IPOs can be exciting, but excitement alone doesn’t build wealth.

And just because something is new doesn’t mean it’s the best opportunity.

To understand how to find investments with real staying power, we have you covered.

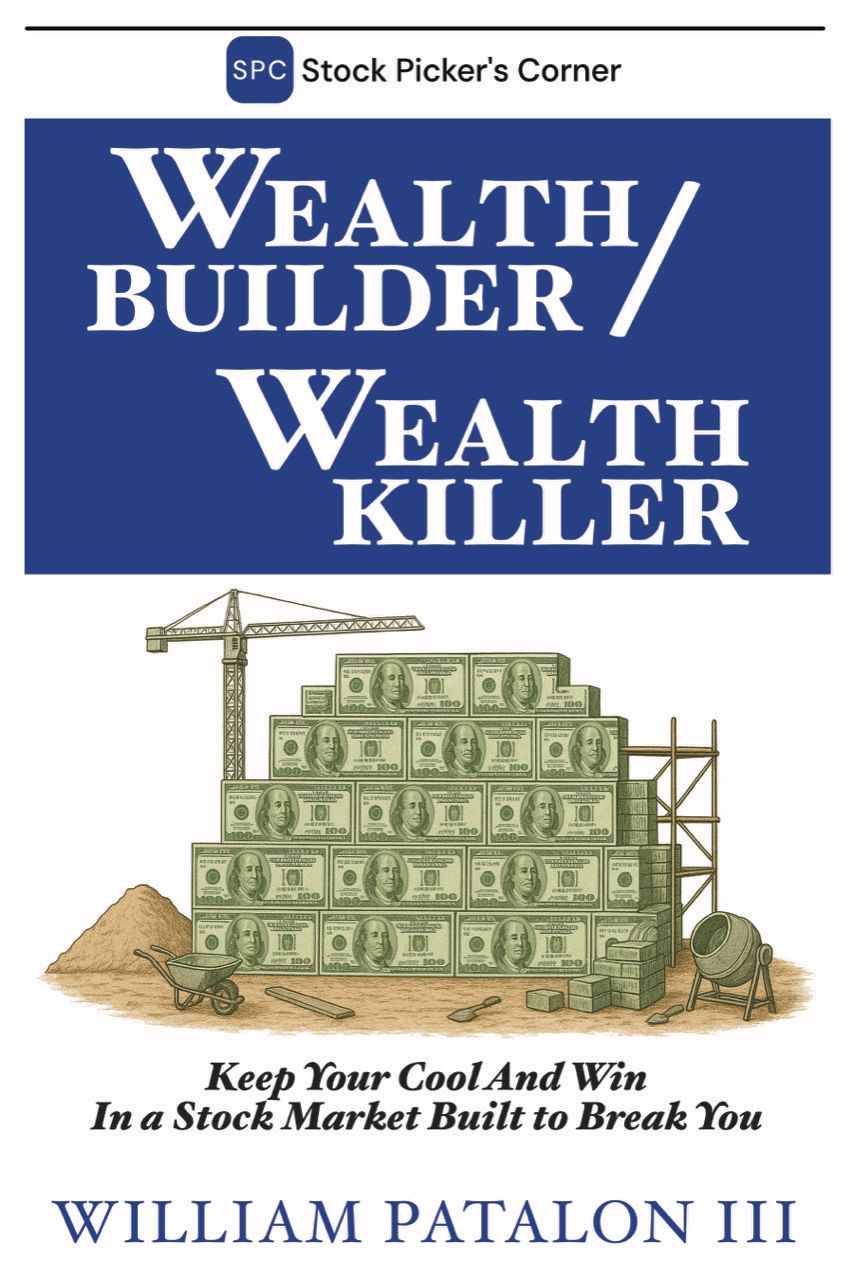

We’re excited to announce that, next week, we’re releasing on Amazon:

In it, you’ll learn that there are only two types of investors. One builds wealth with discipline, strategy, and long-term vision. The other chases hype, trades on emotion, and watches opportunity slip away.

And you’ll also learn how to spot the right storylines, avoid costly mistakes, and build a portfolio designed to last – with real-world examples, insider insights, and Wealth Builder Pro Tips you won’t find anywhere else.

We can’t wait for you to check it out.

Enjoy the long Labor Day weekend,

P.S. For SPC Premium members, with the markets closed on September 1, instead of your Monday Morning Kickoff, we’ll be back Tuesday with an update.