- Stock Picker's Corner

- Posts

- From the "People's Car" to the "People's Tank?"

From the "People's Car" to the "People's Tank?"

The $800 billion "ReArm Europe" plan could ignite Euro-defense stocks ...

Germany’s Volkswagen AG is looking into the defense business,. (SPC © 2025).

German defense giant Rheinmetall AG (RNMBY) says it’s looking to acquire a soon-to-be idled factory from Volkswagen AG (VWAGY).

And VW itself says it may seek defense opportunities of its own. (You have to love the irony at play in these two stories: Factories of the company that once produced “The People’s Car” could one day produce “The People’s Tank.”)

A tiny private startup called POLARIS Raumflugzeuge GmbH is developing a low-cost, reusable hypersonic space plane called “Aurora” — ironically, the name of a mythical U.S. black-budget spy plane that’s been rumored since the 1980s. The Aurora would perform commercial, scientific and military missions.

A joint-venture team of British, Italian and Japanese firms recently stepped up with plans to develop a “6th-generation fighter” as part of the" Global Combat Air Programme (GCAP) — whose goal is to replace frontline aircraft in those three countries by 2035.

These, and other storylines, could benefit from an $840 billion push to boost Europe’s industrial base. The so-called “ReArm Europe Plan” was triggered by U.S President Donald Trump’s second term — and the perceived need to plug defense-system gaps historically filled by U.S. defense firms and American money, Newsweek reported.

Key areas of focus: Tanks, armored vehicles and other artillery systems; missiles; drones and anti-drone technology; cybersecurity and cyberweapons; and air-and-missile defenses.

On that last point: NATO states have less than 5% of the air-defense systems needed to keep Central Europe and Eastern Europe safe from massed aerial assaults, The Financial Times and CNBC each reported.

“Europe is ready to massively boost its defense spending. Both, to respond to the short-term urgency to act and to support Ukraine but also to address the long-term need to take on much more responsibility for our own European security,” European Commission Chief Ursula von der Leyen said earlier this month. Europe is in its “era of rearmament.”

None of this is a surprise.

Not to Stock Picker’s Corner (SPC) family members.

Not to you.

Remember, a mantra here is “find the best storylines and you’ll find the best stocks.”

Since the day we launched this service, two of our key storylines consisted of the New Cold War and Deglobalization.

The each fit together. And they each feed into this newest development.

Let me show you how …

And then let’s talk “best stocks” — European style.

WHEN “COLD” MEANS “HOT”

Let’s start with the New Cold War.

I grew up during it, lived through it and wrote about that “original” Cold War, which lasted from 1947 to 1991. And it earned that “cold” sobriquet because the two chief rivals — the United States and the Soviet Union — never tangled directly. And military spending exploded.

Only the Cold War wasn’t actually “cold.” Indeed, it was downright flinty — and the sparks flared into hot spots across the globe.

There were “proxy wars” in places like Korea and Vietnam. There were several “close calls” (including the Cuban Missile Crisis) that we know about. And (you can bet) many that we don’t.

The propaganda (from both sides) had the grinding constancy of a migraine. Or a band of out-of-step drummers.

We’re back here again.

New enemies — including stateless threats — have emerged. And military spending is climbing.

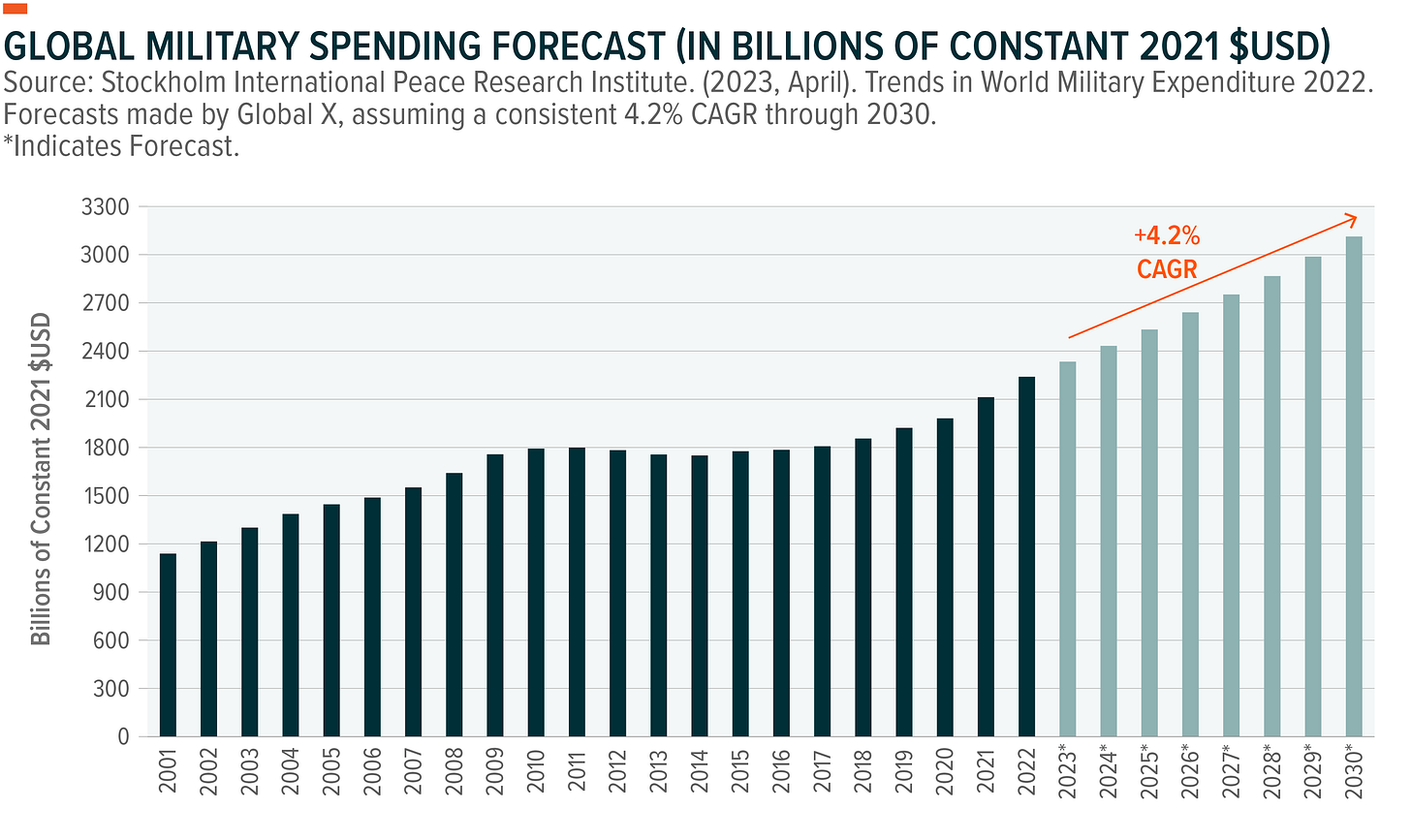

Global defense spending hit $2.46 trillion last year — up 9.8% from the $2.24 trillion in 2023. And growth is accelerating: In “real” terms, those outlays grew 7.4% last year after surges of 6.5% in 2023 and 3.5% in 2022 — huge surges, given that military spending grew at a compound-annual growth rate (CAGR) of only 1% from 2010 to 2020.

Global military spending is now expected to exceed $3.3 trillion by 2030 — an outlay even greater than what’s depicted above — thanks to growing costs of ships, armored vehicles and aircraft, investments in artificial-intelligence technology and new “battlegrounds” in cyberspace and outer space.

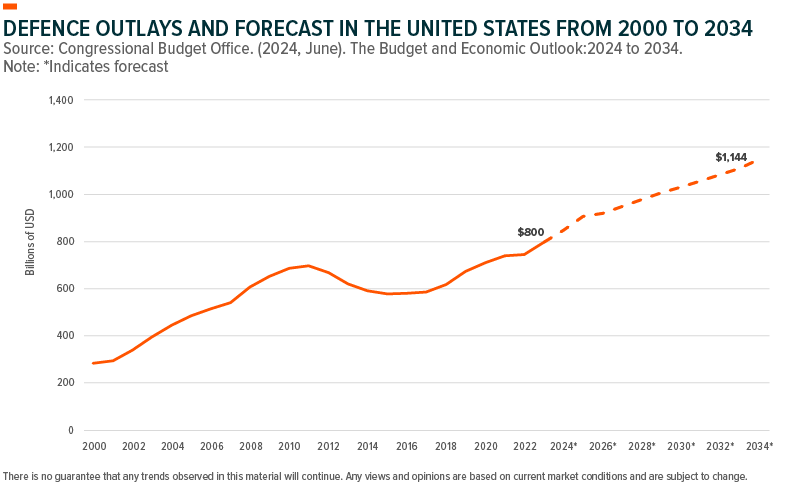

Here in the United States, defense spending will hit $1.14 trillion by 2034 — or about 2.6% of GDP, says the U.S. Congressional Budget Office. That’s up from a projected $849.8 billion for fiscal 2025.

But that’s U.S. spending. Which, increasingly, is domestically (inwardly) focused.

Which is why President Trump is basically saying: “Hey Europe, you’re on your own.”

And that goes hand-in-hand with “deglobalization” — a breakdown in free trade and cross-border relationships that’s fueling a new isolationism and a return to “trading blocs.”

As I said last March:

That opportunity for “prolonged crisis” is front and center … if you just take a moment to look.

Military spending is marching higher across the globe. New enemies are emerging – as old ones return. Breakthroughs in sensors, drones, artificial intelligence (AI), potential space weapons and hypersonic missiles have spawned new weapons systems – neutralizing the defenses that have “protected” us for decades.

A “new isolationism” is unfolding. Academics want to call it “regionalization.”

But deglobalization is a more-accurate term.

Isolationism is more than a historian’s term — or a phrase in some political-science textbook …

It’s another way of saying “powder keg” — with the fuse already lit.

Think about it: What did World War I and World War II have in common?

The entire world was in the throes of an isolationist era.

And that isolationism has returned today.

The Trump Administration has essentially told Europe: “Pony up … or take care of yourselves.”

And that’s what “ReArm Europe” aims to do …

Which brings us back to those companies.

Subscribe to our premium content to read the rest.

Investing is simple – you're either a Wealth Builder or a Wealth Killer. As Wealth Builders, we find the best storylines – AI Era, Biotech Blockbusters, Private Equity Tidal Wave, Commodity Supply Shortfall, and more – leading us to the best stocks and assets. We “accumulate” wealth – foundational stakes, recurring purchases, and opportunistic buys on pullbacks. We hold stocks for 3 to 10 years. We think for ourselves, stick to our strategy, and play our own game. SPC isn’t for everyone, and that’s okay. Like-minded Wealth Builders understand our value, which is why folks from everyday investors to CFAs to venture capitalists have joined SPC Premium. Per Beehiiv's policies, all sales are final and fully earned upon receipt. No refunds for any purchase under any circumstance.

Already a paying subscriber? Sign In.