- Stock Picker's Corner

- Posts

- Four Fed Takeaways You Won't See Anywhere Else

Four Fed Takeaways You Won't See Anywhere Else

And four stocks that are set up to win from Jerome Powell's latest move ...

By now you’ve heard over and over that the U.S. Federal Reserve cut short-term interest rates by a quarter point yesterday.

So I won’t rehash headlines.

In fact, as you’ve often heard me say: These days, there’s an overload of data – but not enough meaning.

So in today’s issue, I’m going to share four takeaways that you won’t see anywhere else.

And I’ll also give you four stocks that will see you through to the other side …

I’m keeping it simple. So you can win.

Takeaway 1: Uncertainty (And Volatility) Will Surge

In the “scrum” with reporters, Chairman Powell underscored that — with growth at about 1.5% and joblessness at 4.3% — “it’s not a bad economy right now.”

But, “from a policy standpoint … it’s challenging to know what to do,” Powell said. “There are no risk-free paths, now.”

That “no risk-free-paths” line sounded nonthreatening at the time he said it.

With the benefit of time, distance and reflection, however, there’s another way to say it: The Fed is between a rock and a hard place.

For real …

Among the 19 attendees of yesterday’s FOMC meeting (including the 12 voting members), there was a good consensus for the quarter-point cut. But there’s an array of views on what to do next.

The politicization of the policymaking process is a worry (more on that in a moment). So is the specter of America’s $37 trillion debt load — which includes the $29.6 trillion that’s more sensitive to inflation and interest rates.

For every 1% change in rates (up or down), America’s yearly interest payments shift by $296 billion.

Interest payments cost us $3 billion a day. Over time, this debt could “crowd out” private borrowing, blunt investment and competitiveness and force major spending and program cuts. That’s certainly behind the politicization of Fed moves.

U.S. gross domestic product (GDP) rose about 1.5% in the year’s first half — down from 2.5% last year. There’s been a slowdown in consumer spending. But business investing — driven a lot by spending on the “backbone” of artificial intelligence (AI).

Powell said U.S. consumers are in “good shape.” I dispute that. They’re truly starting to feel the strain. The cracks are starting to appear.

If anything, the reporting and analysis we’ve done for you leading up to yesterday’s Fed meeting supports the true takeaway — that the American economy is “between a rock and a hard place.”

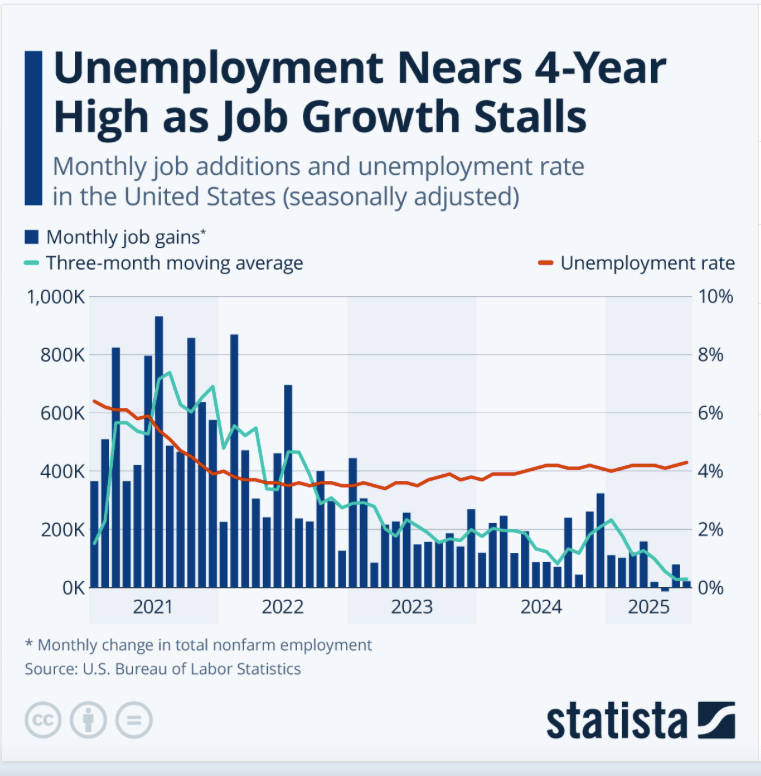

Just look at how job gains are slowing and the unemployment rate is climbing.

Also …

Joblessness exceeds job openings for the first time since April 2021.

Demand for workers is soft, but thanks to immigration, the supply of available workers has plunged, too.

Surprisingly, Powell minimized the impact AI is having on available jobs — something that’s contradicted by the surging level of business investment, which is being driven by AI.

A wheezing economy — paired with rising inflation — would be “stagflation,” something not seen since the 1970s.

Cutting rates aggressively could spur growth, and make it easier to tackle debt, but it would trigger price inflation and asset inflation (particularly in stocks).

And once inflation takes root, it’s super tough to quash.

What’s the bottom line?

Uncertainty. And volatility.

It may not happen tomorrow … or next week … or before the year-end — but it’ll be back. And it’ll hit us when we least expect it.

VIX — the so-called “Fear Gauge” — is at a moderate 15.72 right now. That’s just a smidge above its 52-week low of 12.70 but well below its one-year high of 60.13.

We’ve seen big — and sudden — spikes in the VIX this year. We’ll see more.

And one beneficiary I like is CBOE Global Markets Inc. $CBOE ( ▲ 0.27% ) (Stock No. 1). It’s part of our storyline about investors’ growing love of speculation, known as the “DraftKings Mindset.” CBOE runs the VIX, so there’s a direct link. It’s also a major options exchange. As investors gamble, you can own The House.

Takeaway 2: Welcome Back Inflation?

Inflation has ticked up a bit of late, but remains well below its June 2022 peak of 9.1% — the highest in 40 years.

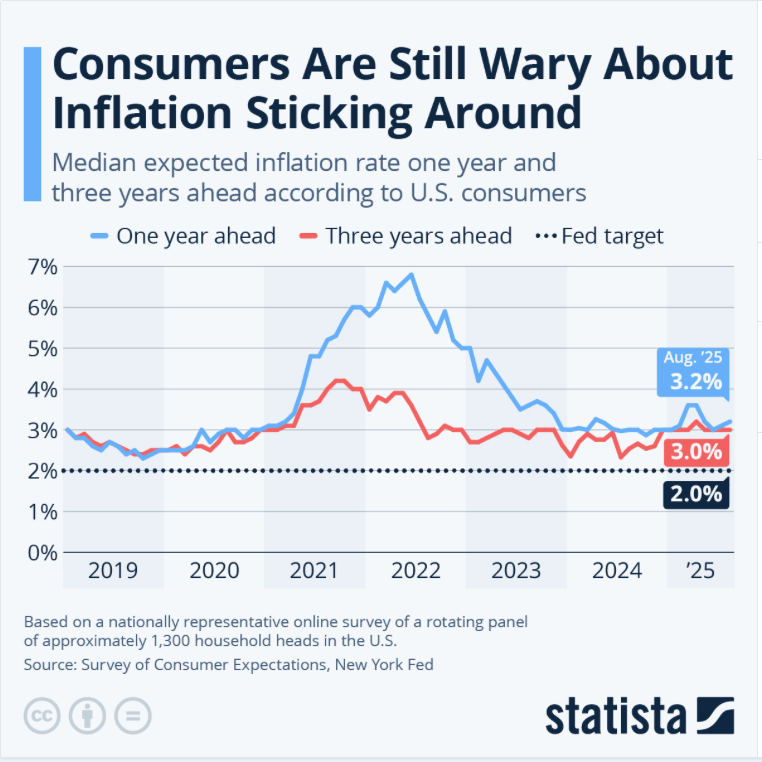

But consumers fear it greatly. And that’s a problem, says this report by Statista.

“When expectations of future inflation are high, prices and wages are likely to be set accordingly, creating a self-fulfilling prophecy,’ the researcher said.

One “inflation wild card” is the White House tariffs program, whose effects “remain to be seen,” Powell told reporters yesterday.

The overall belief (the “base case”) is that any impact will be “relatively short-lived — a onetime shift in prices,” he said.

But pricing pressures could be more persistent — leading to an “ongoing inflation problem,” Powell said.

The tariffs are mostly being paid by the companies that “sit between” the exporter and the consumer — meaning the costs aren’t being passed along to consumers, Powell said. And while those companies can’t pass them along now, they fully intend to.

Powell never said — and, stunningly, no one asked — if those retained costs would squeeze corporate earnings … and crimp stock prices. (My reporter instincts were fired up).

That’s an “inflation wildcard.”

And it makes you wonder: How many other inflation wildcards could be hiding out there?

The Fed has shifted its focus from inflation to the employment (i.e. “the economy”). But nagging inflation could keep central bankers from cutting aggressively.

Powell said policymakers are still aiming for the 2% inflation target they’ve talked about for years. But he also told reporters that they’re looking to get there — by the end of 2028.

We’ll keep following our “find the best storylines/find the best stocks” strategy. One storyline that’ll benefit: The long-term supply shortfall in commodities. And one beneficiary: IperionX Ltd. $IPX ( ▼ 0.33% ) (Stock No. 2), the American company that could win us the Titanium Challenge.

Takeaway 3: It Won’t Unlock the Housing Market

The American housing market is a mess right now. Home sales haven’t been this pokey since 1995. New construction is slowing. And permits and housing starts are both down sharply. In many markets, there just aren’t enough houses to buy — a “supply shortfall” that’s persisted for years.

While housing “inventory” is finally rising in some regions, it’s still 13% to 14% below pre-pandemic levels nationally.

That leads to the Econ 101 Effect: When there’s not enough of something, and demand holds steady or rises (as it has over the past few years), the price of that “something” rises. The median U.S. home price is about $443,000 — up 60% since 2019. That’s created a major “affordability crisis” in U.S. housing. You want to buy a mid-priced house in most markets? You need a yearly salary of $126,000 to make that happen. And if you want a bigger house, you need to make more.

In the South and West, homes are staying on the market longer — and prices are starting to cool.

But in the Northeast and Midwest, inventories are still tight. And prices are holding — or continuing their march higher.

So what’s this got to do with yesterday’s Fed meeting?

Simple: Interest rates – more specifically, mortgage rates — are the key catalyst for housing-market health. Yesterday’s rate cut won’t directly impact mortgage rates — it’ll be a more-indirect process.

And mortgage rates are an issue. Though down slightly, you’re still looking at rates in a range of 5.875% to 6.375% (30-year fixed) or 5.25% to 5.375% (15-year fixed).

And that’s a big problem.

Thanks to the massive refinancing wave of 2020-2021 – when mortgage rates dipped below 3% — an estimated 85% to 90% of Americans holding mortgages have rates below 5%. That’s created something called the “Mortgage-Rate Lock-In Effect” — where folks with those low fixed rates sorta find themselves “stuck” in their current house and “disincentivized” to sell: To sell and move, they’d be buying a more-expensive house, at a higher mortgage rate — a “double-whammy” that sticks them with a significantly higher monthly payment.

This leads to fewer houses on the market and fewer (or no) options for folks who’d like to move.

Fed officials acknowledge the housing slump. And the housing sector could be a drag on jobs and the economy.

To undo this “lock-in effect,” mortgage rates would have to fall to 5.5% or lower — which means we need a Fed Funds rate in the 3% range. That’s the “psychological tipping point” that will get buyers and sellers back into the market.

But it’s an indirect process: Mortgage rates are influenced by the 10-year U.S. Treasury Bond, which (in turn) is shaped by Fed policy.

Two investments I continue to like: Latin American bank Nu Holdings Ltd. $NU ( ▲ 0.87% ) (Stock No. 3), which has zoomed 51.5% since we brought it to you at $10.59 a share in this report back on April 2. If you’re looking for income, check out mortgage REIT AGNC Investment Corp. $AGNC ( ▲ 0.09% ) (Stock No. 4), which we’ve told you about here many times. It’s got a 14.2% yield. The price has held up well. And it should benefit from falling rates and an (eventual) rebound in housing.

Both adhere to our “storylines” strategy. Nu will benefit from “Deglobalization,” and the move back to regional trading blocs — one of our major storylines. It also rides several subplots.

AGNC adheres to our “real income” storyline, where we tell folks to think of “income” more like “cash flow” — and to understand how much “real money” goes into your pocket after taxes, inflation and comparative market rates.

For now, housing remains a mess. Not a crash. But market gridlock:

Buyers can’t afford housing.

Sellers won’t move.

Builders are cautious.

The Fed is watching.

But there’s no quick fix.

Takeaway 4: Politics Could Screw This Up

I know there’s a small, vocal (and growing) group of “experts” who say we don’t need an independent Fed — or don’t need a Fed at all.

As my Dad would probably say: Malarkey.

The American political system — as well as its economy — is structured around “checks and balances.” The central bank is true to that structure.

The Fed has a congressionally defined “dual mandate” — to conduct monetary policy designed to achieve two goals:

Maximum Employment (keep the American jobs engine chugging).

And Price Stability (manage inflation).

Criticize the Fed if you want — no institution is perfect — but it’s done a yeoman’s job through the decades.

The White House is stumping for a “third mandate” — moderate long-term interest rates. My Dad, a career-long engineer, always told me that the more “variables” you have in an equation, the tougher it is to tell which “input” is having the biggest effect. Slash rates and you’ll create lots of cheap money that could overheat the stock market and the economy — revving up inflation … eventually crashing that which it was supposed to benefit (jobs, stocks, the economy).

If you doubt the Fed’s impact, think back to the early 1980s, and Fed Chair Paul Volcker’s maestro-like killing of inflation, which had dogged Americans for years. Or read “Too Big To Fail: Inside the Battle to Save Wall Street” (or watch the superb HBO docudrama of the same name).

The central bank was able to act on the fly, fine-tuning during normal times and acting creatively and decisively during crises — like the Great Financial Crisis of 2008-09.

Was it perfect? No. But this isn’t a science, and new situations arise all the time. (For instance, I well remember the “stagflation” of the 1970s; I lived through it and watched how it affected families, including mine. Before that time, economists believed stagflation was a hypothetical affliction that could never manifest itself in reality).

The Big Money players take comfort in the mere existence of an independent Fed. And in an Economist/YouGov Poll released earlier this month, 45% of surveyed adults said they trusted the Fed to "handle the U.S. economy," while only 26% chose President Donald Trump (with 29% uncertain).

There is an alternative, of course. It’s called “The Marketplace” — or, more specifically, “The Free Market.” It can make similar adjustments. But they’ll be instantaneous. Violent. Displacing. Painful.

A politically managed Fed will be just as bad — and perhaps even worse.

But we’ll need to watch this. And we will.

As a recap, the four stocks mentioned today were:

1️⃣CBOE Global Markets Inc. $CBOE ( ▲ 0.27% )

2️⃣IperionX Ltd. $IPX ( ▼ 0.33% )

3️⃣Nu Holdings Ltd. $NU ( ▲ 0.87% )

4️⃣AGNC Investment Corp. $AGNC ( ▲ 0.09% )

Drop me a line; let me know what you think.

If there’s something you want me to dig into, write to me.

Want to Thrive in This Market Minefield?

Today’s Fed decision is just the latest reminder:

We’re in a market shaped by uncertainty, volatility, and unseen traps.

If you’re tired of reacting to headlines and want a battle-tested blueprint for building real, lasting wealth … it’s time to go deeper.

That’s why we released Wealth Builder / Wealth Killer on Amazon, a guide to navigating markets like this one.

Inside, you’ll learn:

Why most investors fail — and how to avoid the mindset that kills wealth.

How to spot the storylines that lead to the best stocks.

How to turn fear, volatility, and downturns into opportunity.

And how to protect your gains when the next shock hits.

Whether you’re just starting out or have been investing for years, this book gives you the tools to build wealth with confidence.

Grab your copy on Amazon.