- Stock Picker's Corner

- Posts

- Forecast 2026: Hot Spots to Watch — And Stocks to Help You Win

Forecast 2026: Hot Spots to Watch — And Stocks to Help You Win

I spent months researching this report for you ...

A car dealer told me that a twenty-something entrepreneur just dropped $125,000 on a fully loaded pickup — even as other customers are putting off essential repairs they are afraid to spend on.

A high-tech machining operation playing catch-up after the government shutdown has all the work it can handle — but can’t find the workers it needs to do more.

A specialty retailer who’s operated for decades says his market has changed and sales have stalled — and that he’s “giving it two more months” before pulling the plug.

So-called “Silver Stackers” — an ardent group whose members are equal parts investor, survivalist, trader, hoarder, treasure hunter and storage-locker buyer — argue over where the “other precious metal” goes next … but most keep buying (and refuse to sell) even as silver zoomed 145% during 2025.

Experienced wheeler-dealers in muscle cars, collectibles, vintage instruments, boats and machining gear say nothing is moving — not even with price cuts — and tell me they hear one emotion over and over and over again: Worry.

And consumers kvetched — ardently and repeatedly — about how much prices have soared … for electricity … for groceries … for insurance … for car repairs.

Those were the emotional undercurrents of 2025. They continue to hold here. And they tell us a lot about what this New Year will look like.

This 2026 outlook report is the culmination of a year’s worth of detailed research and careful observation by the Stock Picker’s Corner (SPC) team. We’ve seen the headlines as you have. And the same reports and statistics.

As always, we’ve refused to accept any of that at face value.

Over the last six months, I have traveled extensively: I have been up and down the Eastern seaboard, to Boston, New York, Washington and Connecticut. I’ve questioned folks who live and work on the U.S. West Coast — and others who’ve been working in Europe, Asia and the Caribbean.

These talks included corporate execs (including CEOs), merchants, financiers, research analysts, technology workers, entrepreneurs, white-collar professionals, consultants, hourly service workers, skilled blue-collar specialists, part-timers making the minimum wage, retirees and even “wheeler-dealers” who make their plays on eBay or Facebook Marketplace — and more.

I talked. I asked questions. I took notes. I analyzed what I saw and heard.

And I did all this to answer one question: “What happens next?”

By that I mean: What happens next with stocks? With gold and silver and other commodities? With the U.S. economy? With the growing flintiness that accompanies Deglobalization and the New Cold War? With the regular workers and investors who make up the disappearing American Middle Class?

A core belief — one that separates the Wealth Builders from the Wealth Killers — is: If you find the best storylines, you’ll find the best stocks.

We kick off SPC’s coverage for the New Year by sharing what was found, by sharing storylines to watch and by sharing a few ideas to get your year started.

Ready, folks?

Here we go.

Uncertainty, Volatility and Risk

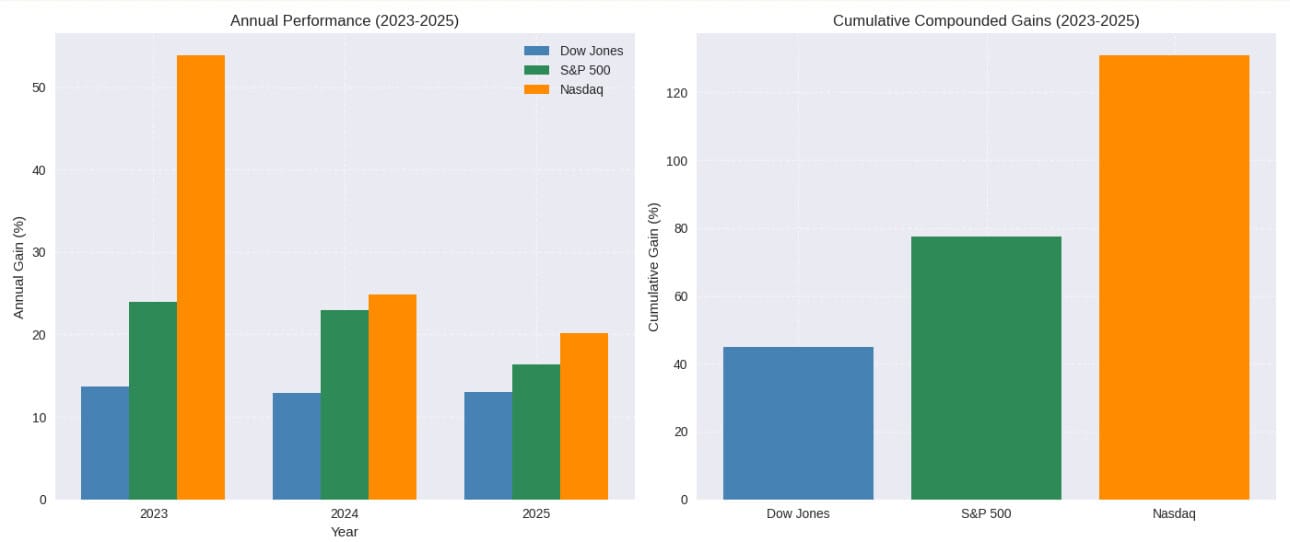

U.S. stocks are on a three-year winning streak. And it’s been a scorcher.

Trouble is, that’s a tough act to keep following.

While most retail investors view the Dow Jones Industrial Average as “The Stock Market,” let’s look at the S&P 500— the index the pros tend to use the S&P 500 as the bellwether.

And it’s rare for the S&P to turn in a triple play: In fact, it’s only happened three times since World War II. And the last time was during the 1990s tech boom — when it reeled off five years of double-digit returns.

Then there’s the tech-laden Nasdaq Composite — up a cumulative 130% over the last three years. It, too, rang up five years of double-digit gains from 1995 to 1999, a 435% cumulative gain that led to a 78% peak-to-trough collapse. And it took the Nasdaq 15 years to regain its early-2000 high of 5,048.62.

I don’t see that kind of collapse here. And neither does Wall Street, where S&P performance forecasts generally range from 3% to 11% for 2026.

I’m not a forecaster by nature — I’m an opportunist. I like to find good companies poised to benefit from those great storylines. And I like to Accumulate my way to a solid block of shares by grabbing more on pullbacks.

I think a correction would actually be healthy from a long-term point of view. It would shake out the “weak hands” — the speculators and the late-to-the-party FOMO crowd.

Selloffs are often triggered by the unexpected (so-called “wildcards”) or by worrisome factors that suddenly get ugly. And those worry points are starting to swirl like the black thunderheads we see in the skies over our Maryland headquarters – just before a summer thunderstorm.

Wildcards like:

The potential loss of independence for the U.S. Federal Reserve — something that would be very bad for the financial markets.

Rounds of “rate-cut roulette” motivated by politics (and the need to lower the cost of financing America’s debt) — instead of the traditional (and wiser) use of monetary policy to keep the economy in good form.

The billions being dumped into data centers (the “infrastructure” of artificial intelligence) — with no massive payoff in the offing (as of yet).

A greenback that just endured its worst year since 2017.

The acceleration of Deglobalization, which makes America a bigger security target for its enemies — but which isn’t being offset by shrewd regionalism or realistic “reshoring” efforts.

The co-mingling of gambling and investing, explained by this simple equation (Gambling Mindset + Financial-Markets Arena + Easier Access to Trading Capabilities + The Need to Play “Financial Catch-Up” = Losses (Some Massive) for 95% of the Players.

Super-high valuations on many growth stocks.

An economic expansion that’s getting long in the tooth.

An increasingly gassed Middle-Class Consumer/Investor (more on that soon).

There’s more, but you get the point. There’s more uncertainty than we’ve seen for several years. And that uncertainty is morphing into worry — but not yet fear.

2026 Takeaway: We could see a pullback/correction/sell-off (you choose the term) — probably in the year’s first half … maybe because a number of worry points collide, or because of a wildcard no one anticipates. Even without that, I see a volatility spike. Here are two moves to make. First, get a Watch List of stocks you’d like to own, or stocks you already own but want more of, set aside some cash, and be ready to Accumulate if it happens. Second, if volatility increases — and if we know that increases trading volumes — own one of the companies that benefits, like CBOE Markets Inc. CBOE 0.00%↑. Here’s our full report.

The Wood-Chippered Middle Class

If there’s one key lesson I learned in my travels, talks and research over the last six months, it’s this: The American Middle Class family is weary and overworked, wheezing financially — and worried about it all.

Productivity is up 80.9% since 1979; but pay is up only 29.4% — a long‑term squeeze. But it’s accelerated since the COVID-19 Pandemic.

Folks I talked to grouse about how much more things cost today than just a few years back. They told me they’ve cut spending they don’t see as essential.

Just one example: Car dealers and repair shops I visited told me that customers are putting off repairs as long as possible — or aren’t doing them at all.

That anecdotal evidence checks out against national studies. A 2025 FinanceBuzz survey found that 58% of drivers wouldn’t be able to finance an emergency repair of $1,000 or more. Nearly a third of American vehicle owners used debt to pay for a car repair in the previous two years. And 64% of drivers say they’re delaying repairs or regular maintenance like tires, brakes or oil changes.

As of August, car repairs were up 8.5% year-over-year — nearly three times the 2.9% general inflation rate.

That brings us to a key point: The Middle Class feels squeezed (heck, some folks feel crushed) because prices for essentials (housing, groceries, electricity/cable/utilities) have soared as much as 25% to 45% and overall consumer prices are up about 24%.

Prices “reset” — at a higher level.

Nominal wages (the dollar of your paycheck) have surged 20% or better since 2020. But real wages are up only 2% to 5%.

So while Middle Class paychecks look bigger, they can’t buy as much. And that stings.

From the standpoint of the overall economy, that actually increases risk. You’re probably starting to hear about the “K-Shaped Economy.” Some have called it the “Jenga Tower Economy.”

And we’re looking at a new reality where America’s rich are supporting the entire economy — thanks to the “Wealth Effect.”

American net worth is up $46 trillion (about 42%) since 2020 — to about $156 trillion.

The Top 10% is driving half the U.S. economy right now and controls 70% of that — or more than $109 trillion.

If inflation spools up (for the reasons we discussed), uncertainty spirals or a selloff hits, those rich folks could pull back — and torpedo stocks and the economy, supercharging worry which then feeds on itself.

2026 Takeaway: You need to build your own safety net. And you need to be prepared. Prices have “reset” at higher levels; inflation is likely to accelerate. Own silver and gold (we’ll be getting to that) – and metals-related investments. But you also need to own “Real Income” investments – stocks or securities that put money in your pocket, even after you back out inflation, taxes and general market rates. I just presented the latest lowdown on two “Real Income” stocks in our year-end portfolio review – which paid SPC Premium members can access right here.

The Many Spinoffs of the New Cold War

Our “Find the Best Storylines” strategy as an amped-up corollary: When multiple storylines intersect, go hunting.

And that’s what we’ve got with the New Cold War, which has America squaring off against China and Russia, which has fueled the Deglobalization storyline and that’s also ignited “reshoring” efforts.

The New Cold War has also created new “battlegrounds.” In cyberspace. In outer space (we’ll be back to that one, too). Heck, it’s even transformed the once-humdrum commodities sector into a de facto battleground. That spools up our “Long-Term Commodities Supply Shortfall” story into a strategic tale known as “Critical Minerals.” China is hoarding rare earth elements — which is spurring new U.S. exploration, mining and collaboration strategies. It even has Washington making direct investments in promising companies.

2026 Takeaway: In my 40 years as a journalist, analyst and stock picker, I’ve never seen retail investors this interested in commodities. That’s okay: This is opening a Wealth Window for new types of companies. One free recommendation I’ll share: IperionX Ltd. $IPX ( ▲ 1.96% ) — a company that can help America win the global “Titanium Challenge.” Check out my report here.

Lasso the Silver Bull

Okay, I admit it: I’m a bit of a “Silver Bug” myself — and have been for years. My Dad got me into coin collecting when I was in elementary school. It was Lincoln pennies back then. But I moved on to Washington quarters, the pre-1948 Walking Liberty half dollars and (most recently) U.S. Silver Eagles, Canadian Maple Leafs (gold and silver),Mexican Libertads, South African silver Krugerands and U.S. Morgan silver dollars. You’ve benefitted from that “buggery.” Silver was down around the $23 level when we launched SPC and made it part of our Model Portfolio. It’s now at about $72 (a gain of 213%) and popped over the $80 level over the holidays. Like everything else, we believe the near-term outlook is volatile.

But a selloff is an opportunity. Long-term, silver goes higher.

2026 Takeaway: Silver is a must-own asset.

A New Storyline: The Space Economy

We were already talking about the commercialization and militarization of space when Elon Musk’s announcement of an IPO for pet project SpaceX set the stock market’s hair on fire. It was like the California Gold Rush. Suddenly, folks were suddenly aware of the Space Economy — a market with a $5 trillion upside.

But we had you there first. Long before everyone got so excited. You quadrupled your money on a space-launch play and grabbed a huge short-term gain on a space-imaging company.

2026 Takeaway: Just as “Bo Knows,” Elon knows, too. Musk understands the potential here. And we do, too. I just gave SPC Premium members my favorite “space stock.” Paid-up members can access that report here.

A New Storyline: Stop Back Tomorrow

Throughout my investing career — both personally and in my work as the head of research services working for folks like you — I work off a core list of long-term Wealth Builder storylines.

But I like to add several new ones each year — as trends converge and new wealth windows open up.

And we’re adding a new one tomorrow.

Don’t miss it.

This year could be a wild one for investors — one where traders get chewed up and where folks without a strategy or with a flawed belief system get left behind.

There are threats.

And there are opportunities.

We’ll be with you the whole way.

Happy New Year. May health, wealth and happiness find you.

We’re here to help ….