- Stock Picker's Corner

- Posts

- Copper Wars: If You Think Tariffs Ignited Prices, You Need to See This

Copper Wars: If You Think Tariffs Ignited Prices, You Need to See This

Copper demand is surging. Supply’s tight. Here are 3 stocks to watch ...

On July 8, President Donald Trump announced a sweeping 50% tariff on all copper imports which he said will “once again, build a dominant copper industry.”

The immediate reaction?

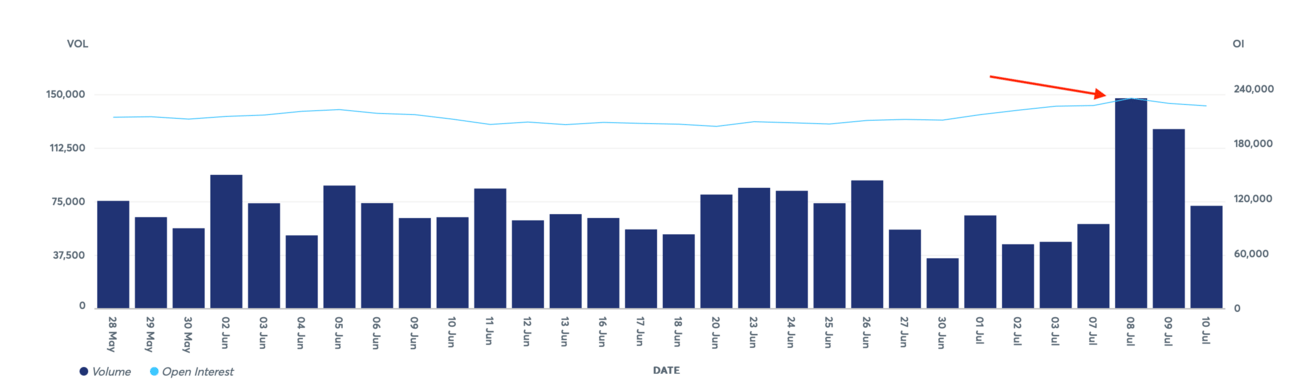

Explosive interest in copper, as the COMEX (a marketplace for trading options and futures contracts on commodities) saw trading volumes nearly triple that day from the day before:

Source: CME Group

That briefly sent copper futures up 17% to a record $5.89 a pound, which was the largest intraday increase for the commodity since 1989, according to Forbes.

Some of the short-term winners from the week were U.S. companies Freeport-McMoRan $FCX ( ▲ 1.74% ) and Southern Copper $SCCO ( ▲ 3.24% ), both poised to benefit from blocked-off foreign competition and higher domestic prices.

Many of the perceived short-term losers are outside of the commodities market: Low-cost copper adds muscle to industries like construction, real estate, electronics, power, infrastructure, and more. So higher copper prices would hurt those sectors.

While the tariffs are set to take effect on Aug. 1, a guest on Bloomberg Radio recently described the broader trend as a “Tariff Cycle” — suggesting that these announcements and implementations may come in waves for the foreseeable future.

I like that as a framework for understanding and navigating investing.

If you accept that uncertainty is the only thing that’s certain, you’re less likely to react emotionally (overreact) to any single piece of news.

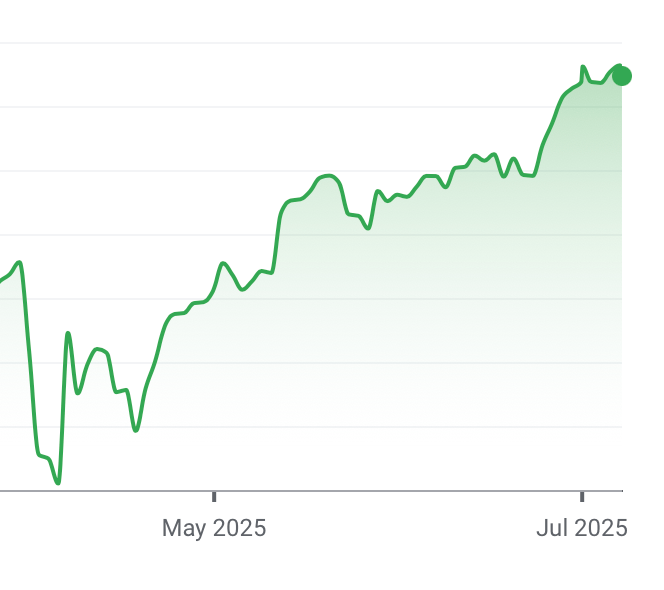

Consider the S&P 500’s low point on April 8, a little less than a week after “Liberation Day” tariffs were announced. That sell-off was triggered by emotion.

Then, look at that 25% rebound by July 11.

Source: Google Finance

There will always be curveballs out there, but we can set up plans for long-term wealth building and protection …

Like we have been in the commodities market.

While this tariff news brought more attention to copper, we’ve been following the commodity for the last year for a simple reason — a growing supply and demand imbalance.

Copper “powers the world,” and we’re going to need more of it than ever before, meaning demand will surge.

And when the demand for something surges, prices usually increase.

But when the demand for that same product or material surges — at the same time there’s a supply shortfall — prices can skyrocket.

Identify the right companies before that happens, and you will thrive.

But here’s the paradox: The more important commodities become, the harder they are to understand.

Analysts and industry insiders often obscure insights under layers of jargon like:

“Polymetallic resource expansion”

“Capex intensity”

“Grade reconciliation”

And more.

What we do is offer clear, relatable insights.

We make commodities investable — not intimidating.

We’ll use that approach today to share the key things you need to know about copper, the reason demand will surge, and offer some insight on the approaching supply shortfall most investors don’t seem to fully understand yet. And we’ll share three stocks to kick-start your investing research.

Wired for Demand: How Copper Powers the World

Copper is one of the behind-the-scenes workhorses that make the Artificial Intelligence Era possible.

Copper is used in semiconductors, so they can process signals faster, consume less power and get smaller and smaller with each design iteration.

Copper is used in data centers for power cables, power distribution strips and cooling systems.

And the new hyperscale AI data centers (designed to handle the training and deployment of large AI models) can use up to 50,000 tons of copper, compared to the 5,000 to 15,000 tons used by traditional data centers, according to the Copper Development Association Inc.

Outside of AI, it’s also used in electric vehicles for batteries and motors, as well as in solar panels and wind turbines.

Below is a quick overview of how copper “powers the world.”

🔌1:Electrical & Electronics

Usage: Wiring, circuit boards, transformers, motors, and power cables.

Growth Drivers: Data centers, smart devices, and electrification of infrastructure.

🏗️ 2.Building & Construction

Usage: Plumbing, roofing, HVAC systems, and electrical wiring in houses, apartments, stores, offices, and other commercial buildings.

Growth Drivers: Urbanization, infrastructure upgrades, and smart city projects.

🚗 3.Automotive & Electric Vehicles (EVs)

Usage: EV batteries, motors, inverters, and wiring harnesses.

Growth Drivers: Global EV adoption and government mandates for zero-emission vehicles.

🌞 4.Renewable Energy

Usage: Solar panels, wind turbines, inverters and grid connections.

Growth Drivers: Net-zero targets and global clean energy investments.

The Supply and Demand Shortfall

Getting back to our “uncertainty is the only certainty” framing, here’s the long-term reality to keep in mind: Although tariffs are dominating the news right now, the reality is we’re facing a long-term “gap” where supply will increasingly fall short of growing demand.

Copper is mined. Existing ones will eventually play out. And opening new mines isn’t as simple as flipping on a switch; between discovering a new copper deposit and getting permits to start digging, you could be looking at stretches as long as 20 years, according to Mining.com.

The International Energy Agency expects we will only meet 80% of the world’s copper demand by 2030. And other research shows that “supply gap” could be deeper into the 2030s.

This growing supply/demand imbalance spells opportunity for copper mines with existing production capacity and exploration companies that are sitting on untapped reserves.

Last April, our friend Danny Brody of The Net Worth Club offered a few copper stocks for you to start your own investing research.

We’re sharing some of that research here again today.

Hudbay Minerals Inc. $HBM ( ▲ 4.8% )

Founded in 1927, Hudbay is a critical minerals company with operations in copper, gold, silver, and zinc mining. It has three long-life operations (expected to produce critical minerals for many years or even decades), with growth projects in tier-one mining jurisdictions (areas highly attractive for mining activities that are also considered low-risk) in the United States, Canada, and Peru. Its Copper World project is fully permitted in Arizona. And once in production, Hudbay expects Copper World to boost its total output across all of its operations by 50%.

Lundin Mining Corp. (LUNMF)

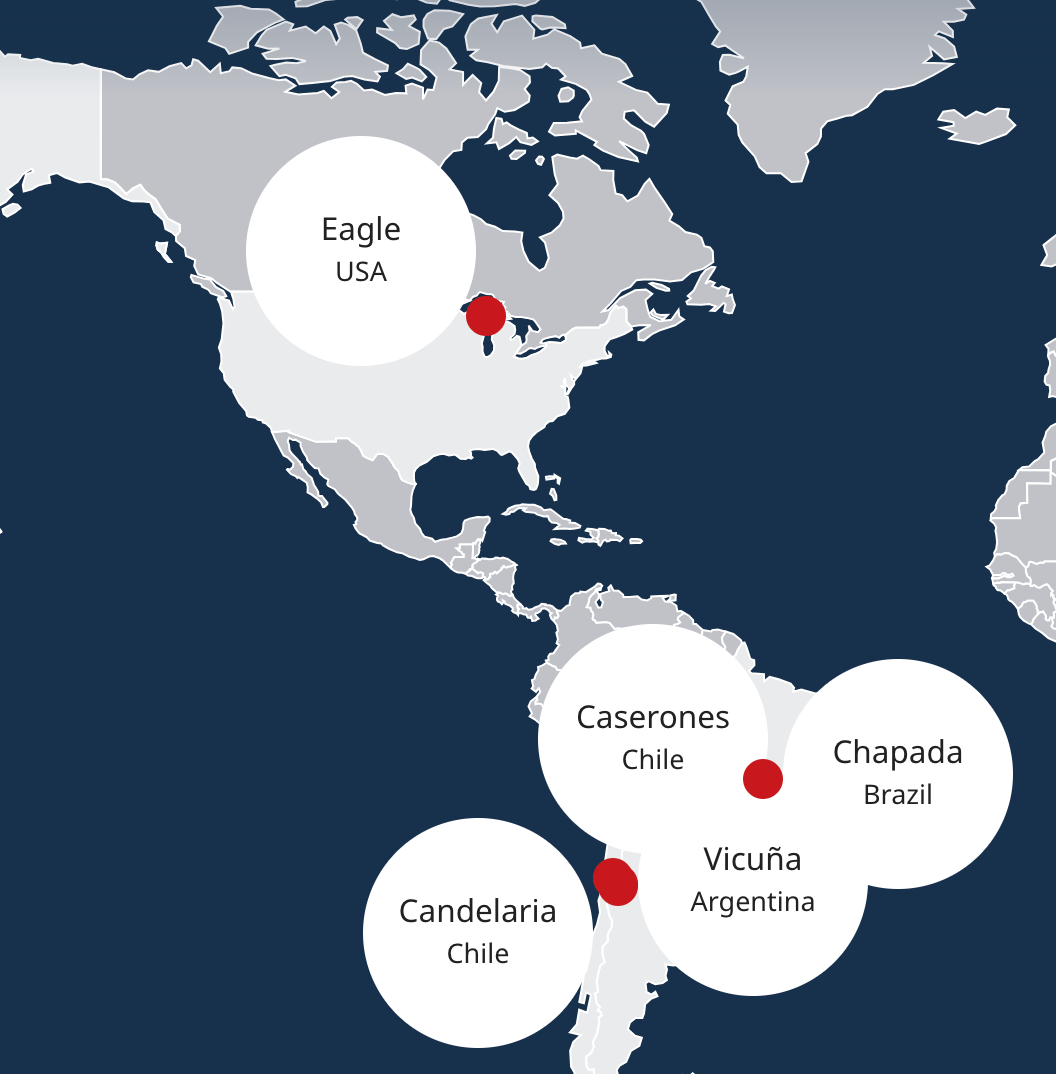

Lundin is a miner primarily focused on copper, gold and nickel, with operations in Argentina, Brazil, Chile, and the United States. The company is allocating $40 million to exploration this year. Back in March, Lundin signed a “earn-in” deal with Talon Metals Corp. that could end with it owning 70% of a mineral-rich project adjacent to its Eagle mine in Michigan’s Upper Peninsula. Earn-in agreements let a company like Lundin incrementally acquire an ownership stake by meeting specified investment or performance milestones.

Source Lundin Mining

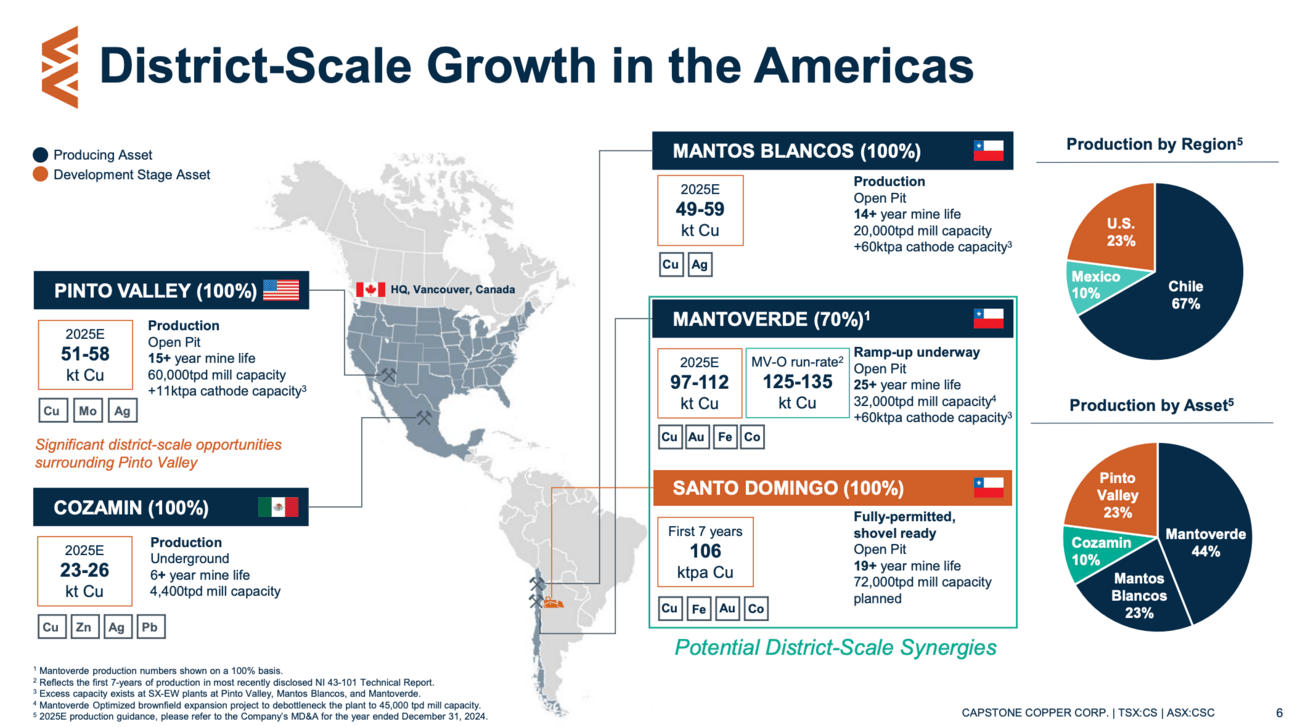

Capstone Copper Co. (CSCCF)

Capstone has operations in Arizona, Chile, and Mexico. Cashel Meagher took over as CEO in May of this year; he previously served as the COO of Capstone and the senior vice president and COO of the afore-mentioned Hudbay Minerals. In 2024, 96% of the company’s revenue came from copper.

Source: Capstone

Key Takeaways

Copper tariffs: A 50% tariff on copper imports is set to kick in Aug. 1, sparking a surge in trading and a spike in prices.

Market reaction: Copper futures briefly rose 17% to a record $5.89 per pound — the metal’s largest intraday increase since 1989 — before ending the day up 13% (at $5.68).

Winners: U.S.-based copper producers like Freeport-McMoRan and Southern Copper stand to benefit from reduced foreign competition.

Losers: Industries reliant on cheap copper may face rising input costs.

Tariff cycle: Analysts suggest this may be the start of a broader pattern of trade policy shifts, not a one-off event.

Investor mindset: Despite short-term volatility, long-term demand will continue to grow.

Supply constraints: We’re headed into a tight supply window by the end of the decade and into the 2030s; new copper mines can take up to 20 years to develop, creating a structural supply shortfall.

Opportunity: Companies with existing production or advanced exploration projects are well-positioned to benefit from the imbalance.

Take care,

Missed a few issues? No worries — our archive is always open.

👉 Free Issues

You’re just getting started with this free issue. Access deep-dive research, curated newsletters, and our latest high-conviction calls in SPC Premium.

🧠 Join Premium to follow along.

SPC Premium equips CPAs and financial advisors with the insights they need to lead conversations — not follow them.

💡We help you connect the dots before your clients even ask.