- Stock Picker's Corner

- Posts

- Canada’s Playbook for a Post-Global World

Canada’s Playbook for a Post-Global World

Plus a jam-packed week of investing outlooks, ideas, and the top moves for Wealth Builders ...

Hi folks,

With markets closed Friday for the July 4 holiday, we’re using this issue to catch you up on our content schedule for the rest of the week.

Yesterday, we released our Quarterly Roundtable to our SPC Premium members, featuring Mark Rossano, founder and CEO of the private equity firm C6 Capital Holdings LLC.

With investments in hydroelectric power and fertilizer, Mark brings deep insight into the energy market and cross-border investing, making him the ideal guest for Chief Stock Picker Bill Patalon’s latest chat.

While everyone else has focused on the recent back and forth between President Donald Trump and Prime Minister Mark Carney over a digital services tax, we’re following a much bigger story at play …

Canada is reinventing itself as the world steps back from decades of “Globalization.”

From fintech to AI infrastructure to energy, America’s northern neighbor is positioning itself for a more sovereign, self-reliant future.

For today, we’re sharing a piece of that interview with all of our members, as Mark offers his insights on one company we believe will be a benefactor of more investors looking north of the border for investment opportunities: Enbridge Inc. $ENB ( ▲ 0.67% ).

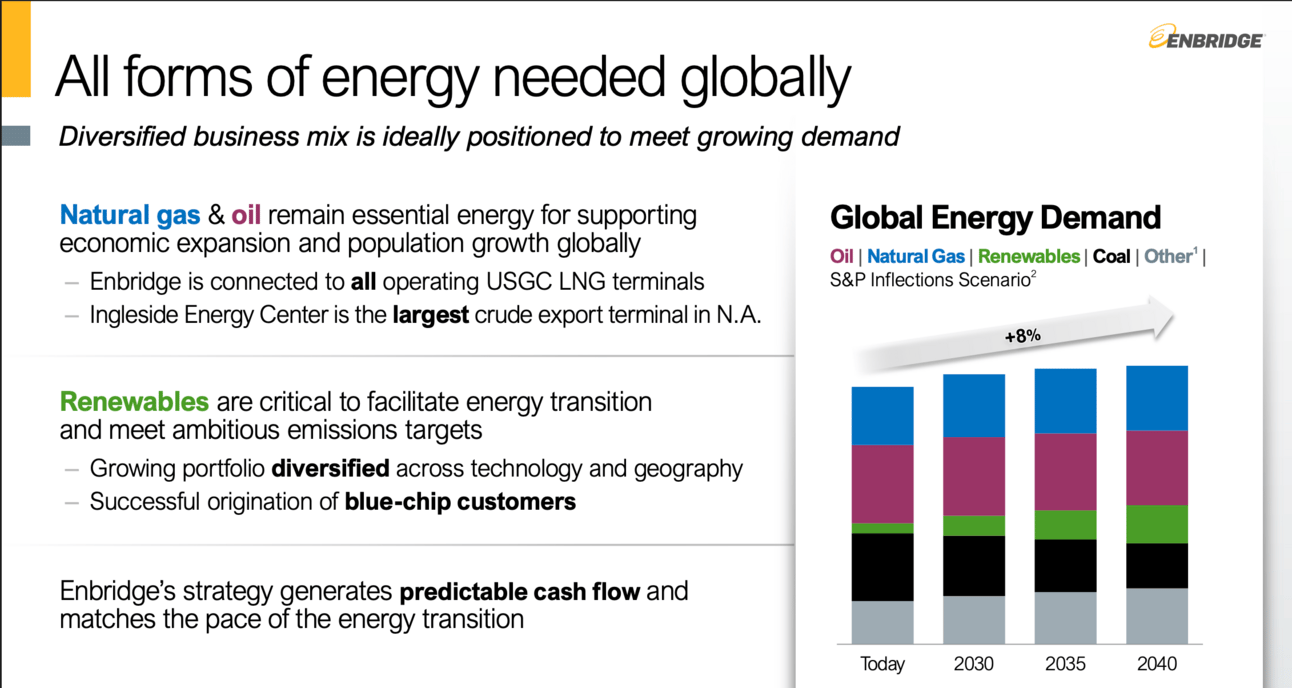

It’s an "all-of-the-above” energy provider headquartered in Alberta.

Source: Enbridge

Thanks to its strong cash flows, it is a “Dividend Aristocrat,” increasing its dividend payout annually for more than 25 consecutive years.

Even better? Its five-year average dividend yield sits at a hefty 6.87%.

I won’t go into too much detail about Enbridge here, as you can hear more from Mark below.

We will also have more about Enbridge in a special report we’ll send to you on Wednesday.

On Thursday, Bill will share his 2025 Mid-Year Review, breaking down the dizzying downturns, rallies, and geopolitical curveballs heaved at all of us over the past six months.

He’ll share his outlook for that all-important question: “What comes next?”

And he’ll also show you the moves to make for Wealth Builders.

So keep a lookout on your inbox, as we’re excited for what we have to share.

Take care,