- Stock Picker's Corner

- Posts

- Beyond the Headlines: America’s Critical Mineral Push

Beyond the Headlines: America’s Critical Mineral Push

We're tracking "what's next" for an intriguing company whose shares trade below $30 each ...

In this week’s installment of Beyond the Headlines, we’re cutting through the noise to give you real real story and a real opportunity on the critical minerals boom.

Source: Financial Times

What’s Happening

The Pentagon wants to drop as much as $1 billion on critical minerals, a move Washington hopes will offset China’s recent export restrictions on rare earths and related materials. The Defense Logistics Agency (DLA) initiative would stockpile such essentials as cobalt, antimony (remember this word), tantalum and scandium — all of them vital to such defense technologies as radar systems and fighter jets.

Why It Matters

Because they are critical to today’s advanced technologies — they’re the key ingredients for everything from missile-detection systems to modern jet fighters — these minerals have earned their “critical” prefix. In an era of deglobalization where the United States and China each want to dominate, China’s stranglehold on mineral reserves and refusal to export poses a true national security risk to America. The Pentagon, the U.S. military and American defense companies can’t maintain current weapons systems or develop new ones without critical materials. A shortfall could tip the scales on who calls the shots on the world stage.

Investment Takeaway

This entire development is consistent with the storyline-based approach that Stock Picker’s Corner uses: Critical-minerals demand is being catalyzed by such narratives as Deglobalization and the New Cold War — and is being exacerbated by another narrative it’s actually part of: The Long-Term Supply Shortfall in Commodities. Earlier this month, President Donald Trump unveiled an additional 100% tariff on all Chinese imports starting Nov. 1. Those levies get stacked atop existing duties of around 30%. And the White House was responding to China’s increasingly militant stance on trade and its bulked-up export restrictions.

President Trump justified the retaliatory measures by blasting Beijing’s “extraordinarily aggressive position on trade” — tough words that are like a frontal assault in the usually subdued dialogue of global diplomacy.

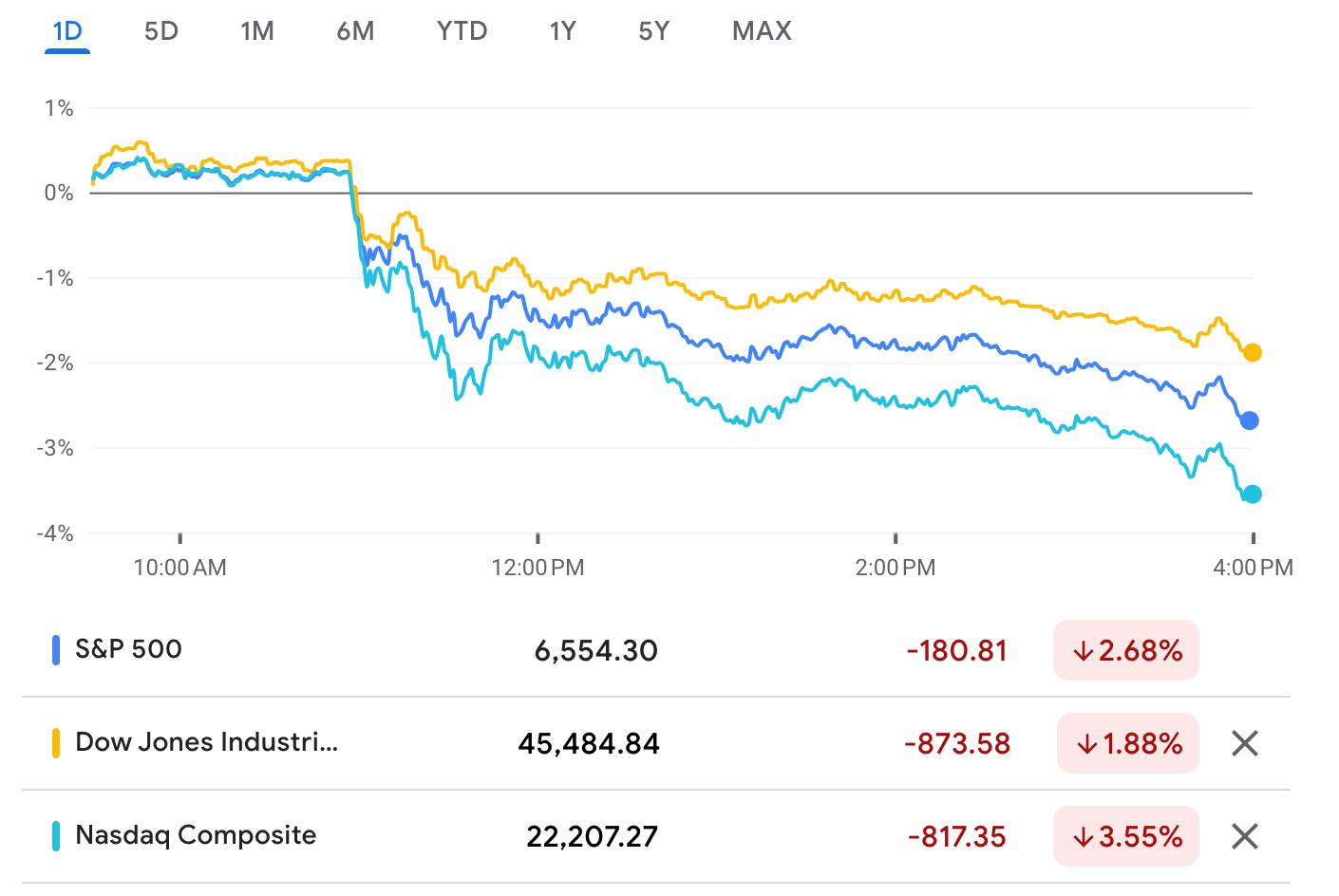

Investors were clearly rattled by at the tariffs and the tough talk, with every major stock index taking a hit.

Source: Google Finance

In the face of this sell-off, one critical mineral company saw its shares surge nearly 8% on the day. And it was a company we told you about Oct. 1.

Shares are now up 25% (as of this morning) since we first launched our coverage less than two weeks ago.

The company we’re talking about is a miner that hasn’t started production …

It’s not profitable …

And it’s not the kind of company we typically spotlight.

But it’s sitting on an estimated $18 billion in gold reserves, plus a mineral that’s even more important.

Remember a moment ago the term we told you to tuck away and to remember?

Antimony (sounds like: AN-tih-moh-nee)?

This company we’re talking about has the potential to become the only domestic source of mined antimony, a critical mineral used in defense tech, semiconductors, and energy storage.

This could create a legal monopoly in a sector where China has cut off exports and continues to try and weaken access to critical minerals.

SPC Premium members can learn what the ticker is and get the report below immediately.

Subscribe to our premium content to unlock the ticker symbol.

Become a paying subscriber today gives you access to this report and other subscriber-only content

Already a paying subscriber? Sign In.

A subscription today gets you full access to our:

- • Model Portfolio

- • Special-Situation Portfolio

- • Quarterly Roundtable

- • Premium Dossiers

- • Farm Team

- • Monday Morning Kickoffs

- • Early Release Access

- • And Much More