- Stock Picker's Corner

- Posts

- Beware of the "Day-Trader Bubble" — And What It Means For Stocks

Beware of the "Day-Trader Bubble" — And What It Means For Stocks

We've seen this before ... and it's alarming ... but there's one move you can make — today ...

I was looking around the Amazon Kindle store a week ago — getting an update on our brand-new book Wealth Builder/Wealth Killer, but also checking out some of the other titles — when I made this interesting discovery.

The No. 1 title is a longstanding book aimed at stock market beginners.

The No. 2 title is a day-trading guide.

Talk about a study in contrasts.

Buyers of the first book want to learn how to invest.

Buyers of the second book want to learn how to trade.

Buyers of the first book are willing to delay gratification — to work patiently today to live the American Dream “tomorrow.”

Buyers of the second book want the dream, too. But they want it immediately … now … today.

They want independence — no boss, no office, no job. But they believe they can “speculate” their way to freedom — making a living as a “day trader.”

I’m the last guy to begrudge anyone’s dream — even the day-trader crowd. But wanting it now and believing they can get there through high-speed speculation?

Wanting the dream is one thing. Achieving it is another.

And being honest with yourself — asking “will this work?” and “do I have emotional fortitude to stick with it?” — is crucial.

If you’re a retail investor, day trading (heck, any kind of options speculation) is a rough path to travel and kind of like a westward-ho Conestoga Wagon journey back during Death Valley days.

Here’s another Reddit post in the day trading subreddit that pretty much tells that tale:

Honestly, as the next post shows, “blowing your account … again” isn’t the only cost of reckless speculation.

It can cost you … everything.

Here’s what followed …

“I started with passion,” the trader wrote. “Charts day and night. Killzones in London, then New York. Alerts buzzing. Indicators stacked. I convinced myself it was “grind.” In reality, it was obsession. I did a course for 8K … [but] had build a good puffer since I was lucky with crypto since 2017 … the account went red. My energy went red. And the relationship followed.”

As a Dad, husband and stock picker, I often tell folks that “I’m all about family … and free markets.” And my “family” includes all of you — the readers of Stock Picker’s Corner (SPC).

So the words of that failed day trader was like a harpoon to the heart.

Zero Days, Zero Future, Zero Profits

I know what you’re thinking here: “Okay, Bill … I see what you’re saying … I see where you’re going … but are you kinda ‘cherry picking’ your examples here?”

I cherry picked the examples that would have maximum emotional impact.

But I can prove what I’m saying.

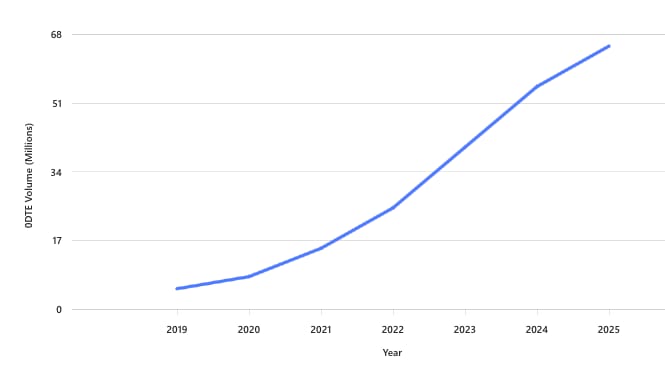

For real investors, speculative trading is death. Especially so-called “zero-day options” (zero-days-to-expiration, or 0DTE) — whose use among retail investors is soaring.

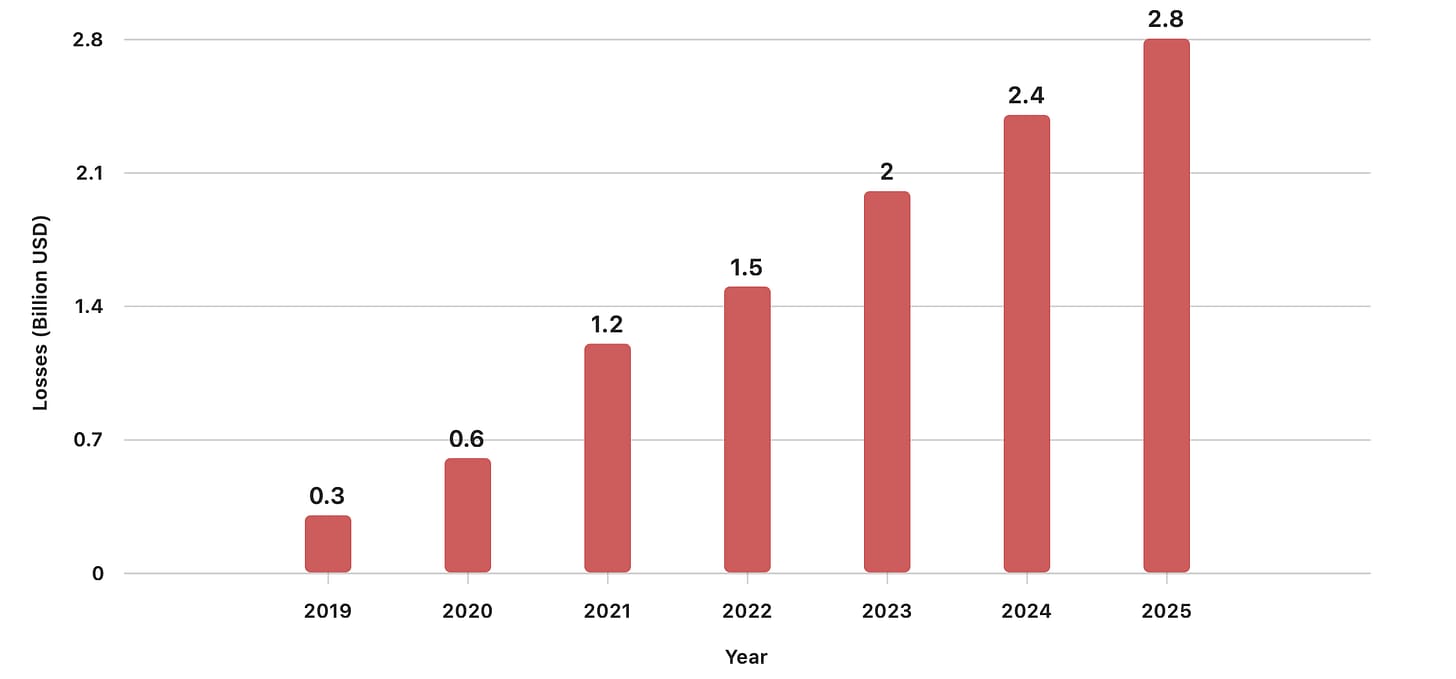

As are the losses those options bring.

And there’s an outrageous twist here.

As U.S. stocks have galloped to record high after record high over the last few years, so has speculative options trading by retail investors.

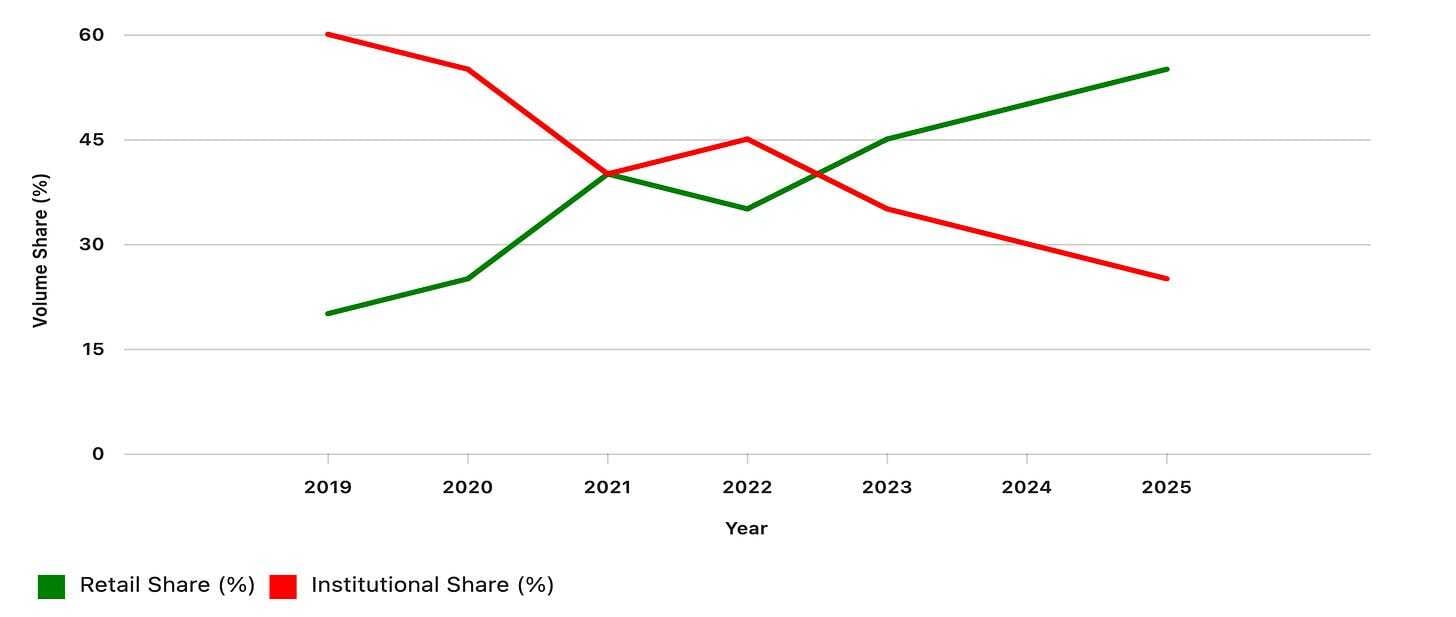

But here in recent months, as stocks keep climbing and retail investors keep trading, something has changed: Institutional investors — the Big Money pros that are often referred to as the “Smart Money” — have aggressively reduced their risky options trading.

You heard me …

As retail investors are taking on more and more risk, the “smart money” is cutting back.

That means Wall Street is setting retail investors up to take the fall. It means retail investors are being set up to be the “Greater Fools” – to take the losing side of increasingly bad, super-speculative trades.

That’s outrageous. But true.

Here at SPC, I want to keep you out of Death Valley.

So I’m going to prove what I’m saying. Then I’ll show you one way to benefit.

Recipe for Disaster

I’m a straight shooter, so let me start with a key concession: Some day traders do make money. But it’s less than 20%. And some studies say the winner’s club is super exclusive — like in the low single digits.

And with the different day-trading “bubbles,” we’ve seen enough to know.

Day trading hit for the first time in modern times in the late 1990s, with the rise of online brokerages and the whole Dot-Com bubble. We saw it again starting in 2006 — when the housing bubble, leveraged speculation and cheap money jump-started it anew. We saw it again in the early 2010s – thanks to the invention of mobile apps and the trading “democratization” brought on by Robinhood Inc. HOOD 0.00%↑. The COVID-19 Pandemic Era — with lockdowns, zero commissions, Meme Stock Mania, social media and the cheap-money stimulus checks — got folks back into day trading mood anew.

The Artificial Intelligence (AI) Era — with booming markets, easier access to options and fast-moving tech plays — is just the latest installment.

So take these to the bank (so to speak):

Attrition’s a Killer: 40% of day traders quit within a month, and only 13% remain after three years.

Profits Are Elusive (And Illusory): Only 13% of day traders are consistently profitability over six months; and a mere 1% succeed over five years. (A study of Brazilian day traders found only 3% were profitable — with just 1.1% earning above the minimum wage.

You’ll Actually Lose Money: 72% of day traders ended the year with financial losses, according to the Financial Industry Regulatory Authority (FINRA).

“Make a Living?” — Make Me Laugh: Among proprietary traders, only 16% were profitable, with just 3% earning more than $50,000 (and median earnings coming in at $13,000).

A Bull Market Doesn’t Mean “Success:” Profitability is highly correlated with the Nasdaq Composite Index — meaning those profits come from momentum, not skill or a “system.”

Overconfidence is a Catalyst — And a Killer: Investor overconfidence is a major “trigger” for the excessive activity that’s a day trader hallmark — but it also exposes the trader to a heck of a lot of risk if (when) the market rolls over and the momentum tailwind disappears.

Are You a Sadist? Use Leverage: Traders using “margin” (borrowed money) to leverage their speculative wagers racked up an average return of (minus) 4.53% — putting them on a path to blow themselves up.

Bottom Line: That book that dangles the potential for “making a living” as a day trader? Don’t you believe it. You won’t make a living. You’ll probably lose money. Indeed, you’re being set up as a human sacrifice — as an unwilling contributor to Wall Street’s next bonus cycle.

It’s about to get worse.

The DraftKings Mindset

A London Business School study found that — between 2019 and 2021 — retail traders lost more than $2 billion in options premiums, mostly on short-dated options. And a 2022 Massachusetts Institute of Technology Sloan School of Business study found that trades made around earnings announcements generated losses of 5% to 9% — a range that ballooned to a range of 10% to 14% when they traded high-volatility stocks.

This mess will only get worse for everyday investors who keep staying on the day-trading path — for a bunch of reasons, including these four:

New platforms, lower barriers and new “products” will make it easier for regular folks to speculate.

The explosion of online gambling is making it easier for folks to see sports betting and securities speculation as kinda the same thing — a dangerous view I’ve labeled as the “DraftKings Mindset.”

A record bull market in stocks and an uninterrupted economic expansion — both of which will eventually end.

And a clearly increasing attitude of circumspection by institutions, which are throttling back on their speculative excesses in a way that may signal a market reversal and that puts more risk in the hands of retail investors.

Let’s start with those lowering barriers. Check out this recent headline from NerdWallet:

Source: NerdWallet

So back in 2001 — in the aftermath of the Dot-Bomb implosion, where swaths of retail traders were eviscerated by a free-fall in tech stocks — rules were put in place to protect smaller, beginning retail investors from the risks that came with that kind of trading.

The rule requires folks who are classified as “pattern day traders” to keep a $25,000 balance.

FINRA and the Securities and Exchange Commission want to alter those protections — so, as the NerdWallet story says, small retail investors can “get in the game.”

When folks start talking about high-risk speculation as a “game” that they want you to “get in,” your personal air-raid siren should be shrieking.

And let’s understand who is making the “get in the game” invitation: It’s Wall Street. Because it’s to their advantage.

Check out what an industry pro told Traders Magazine recently.

“This rule change reflects the view that active trading plays an important role in today’s markets,” David Russell, TradeStation’s global-market-strategy head, told Traders. “The $25,000 threshold, while originally designed to protect investors, may no longer align with current trading practices. Responsible day trading can improve market efficiency and widen participation. One man’s speculation is another man’s liquidity.”

Hey, I’m all for market liquidity and efficiency. I just hate to see it being achieved by having a bunch of inexperienced retail investors borrow against their 401(k)s or tap into their home equity credit line — to blow it on 0DTE options trades.

And without protections, that’ll happen.

It already is.

Tick, Tick, Tick

Zero-day options trading has exploded. 0DTE options — contracts that expire the same day — have become the speculative instrument of choice. They now account for as much as 65% of all S&P 500 options volume — a record. Retail traders account for 50% to 60% of 0DTE volume, according to CBOE Global Markets Inc. CBOE 0.00%↑, one of the top options exchanges.

Robinhood now earns four times more revenue from options than from stock commissions —something that shows a “retail tilt,” says RIA Advisors.

Folks who want to “make a living as a day trader” are really looking to bet tiny bits of money and get windfall gains. That’s a lottery-ticket formula. But with “lotto,” the odds of a win are tiny. With 0DTE options, retail day traders “believe” they’re going to win … and win big.

In July, 70% of options contracts were “calls” — bets that stocks would go up. That was the highest since the 2022 Meme stock frenzy – and a sign of frothy prices.

“This is more than a quirky market statistic,” RIA Advisors Chief Investment Strategist Lance Roberts wrote in July. “It’s a glaring warning sign of rising risk-taking behavior among retail investors. History consistently shows that markets peak when the average investor starts chasing lottery-like returns. Options, by design, are speculative instruments used to hedge risk or make directional bets. However, the explosion in 0DTE options points to a significant behavioral shift from investing to outright gambling.”

Yeah, boy … couldn’t agree more.

And retail traders are losing — in a big way.

But while retail investors are growing more frisky — and the institutions are sending out gilt-edged invitations for more to join — those professionals are throttling back the risk.

0DTE options volume by institutions rose 70% year-over-year. But hedge funds, investment banks and other institutions are using them for risk management — not speculation. They’re throttling back on duration risk and are using them to generate income. And while retail investors are heavily playing call options, institutions are deploying them for hedging and smoothing out volatility. They’re also shifting toward alternative investments, commodities and specific slices of stocks — especially AI and healthcare.

And if you compare options volumes, you can see how retail trading surges during speculative stretches, while institutional players are more careful — and capitalize on more-tangible macroeconomic trends.

Summed up, this tells me four things:

Retail speculation is peaking, especially in ultra-short-term options.

Institutional investors are active, but with more discipline.

The imbalance in risk-taking is worrisome from an overall market point of view — a possible sign of a trading mania that often peaks before a correction or crash.

And the potential for big losses — and the end of this latest day-trading “window,” as I’ve seen before.

There’s one move you can make.

While Others Lose, Win Here

Circling back to that “DraftKings Mindset,” we know that one long-term beneficiary will be CBOE Global Markets $CBOE ( ▼ 0.81% ) inventor of the “Fear Gauge,” known to investment pros as the VIX.

Here’s the “kicker:” If we get the big volatility spike I just talked about, CBOE will be a short-term beneficiary, too. So why not own CBOE now?

You see, emotions and markets share one strong tendency — they both run in cycles: (fear →panic → calm → complacency). The CBOE “Fear Gauge” — the VIX — spiked to 45 before the historic two-day stock market wipeout of early April. It’s been as high as 60 in the last 52 weeks.

Now it’s back down to 16, near its 52-week low of 12.70, reached in early December.

While trouble continues to bubble on the peripheries, retail investors are complacently speculating. And if volatility spikes, so will options trading — and so will the VIX. Own CBOE now and profit when this happens — because it (eventually) will.

For certain.

Get the full lowdown on CBOE in the report below.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.