- Stock Picker's Corner

- Posts

- As Silver Passes $100, I'm Bargain-Hunting Right Here

As Silver Passes $100, I'm Bargain-Hunting Right Here

One stock everyone should own — and the silver coin that'll heat up next ...

You’ve heard me say this over and over.

And you’ll continue to hear it as we continue our work here at Stock Picker’s Corner.

There are only two kinds of investors.

Wealth Killers succumb to emotion. They act on tips. They have no belief system. They can’t control their emotions — so their emotions control them. They don’t invest — they trade. They want it all now — which means they “swing for the fences” … and usually just “whiff.”

Wealth Builders invest — they don’t trade. They’re self-reliant — which means they’re often Contrarian Investors. They hunt for bargains. They look for powerful storylines — and seek the companies, markets or assets most likely to benefit.

In short, we look for powerful, long-term value plays wherever they are …

Usually that’s in stocks — which is why I always joke about being a “stock jockey.”

And it’s why the team chose to call this service Stock Picker’s Corner.

But we’ve also used the “Commodities Supply Shortfall” storyline to identify wealth plays in commodities. We just handed you a market-beating profit in coal. And the SPC team detailed this out-of-the-mainstream critical minerals play in gold that’s up 68% since it was first mentioned.

But I’m also a self-professed “silver bug.” My Dad got me started collecting coins when I was little.

At the start, it was Lincoln pennies — finding a “wheat back” or a World War II “steelie” was like finding treasure for my 10-year-old self.

As I moved into my late teens, I branched out. Silver Canadian coins were a favorite. And the older, 90% silver U.S. coins became a passion: I loved the history they represented; and I understood the value they represented once Washington shifted away from the precious metal.

Most folks referred to this as “junk silver.” But I knew differently.

And having lived and worked through recessions and financial crises — and having experienced the inflation-ridden 1970s — I knew the day would come when “The Market” would see the real value these coins held.

In 2018, ’19 and ’20 — when silver averaged $15, $17.50 and $20.50 an ounce, respectively — I started buying U.S. Mint Silver Eagles, Canadian Maple Leafs, South African Kruggerrands and their silver counterparts from countries like China, Mexico, Austria and Australia. And I tried to buy more when prices were near their lows ($16 in 2018 and 14.40 in ’19, for instance).

When we launched SPC in early 2024, we said that silver was cheap — and would probably surge (a lot) in the years to come. With this SPC Dossier, we made it an inaugural part of our Model Portfolio.

When we first started telling you about the “other precious metal,” it was trading down around $23. And it’s in that Model Portfolio at about $27.

As I worked on this last night, silver futures had actually traded as high as $99.20 and have now crossed $100.

Source: Google

We knew silver was undervalued. And we knew a big rally was inevitable. But I need to show a bit of humility here, too: Even we’ve been surprised by how much silver has skyrocketed in such a short time.

In being surprised, we weren’t alone, of course. As we told you yesterday, the U.S. Mint was also caught off guard. Pummeled by the surge in silver, that important U.S. agency — which mints coins for commerce, as well as collectible/investment plays like Silver Eagles — was forced into a “standing-eight count:” It warned of a price review, froze sales of popular coins — then came back a few days later with price increases approaching 90%.

(If you missed that report, check it out here.)

Having “set the table” by explaining what’s happened and why, it’s time to give you insights on two crucial questions:

What’s next?

And what should you do?

Let’s talk about both …

Silver Boom

I was confident silver would surge — a lot. But I admit, again, that I’m surprised it happened this quickly.

When an asset price “goes vertical” — as this one did — there’s a good chance it’ll stall for a bit … or maybe even backtrack.

The pros refer to this as “consolidation.” It’s not always a bad thing. In fact, it’s often healthy. It thins out the speculators, shaking out what old-time financial writers referred to as the “weak hands” (or what current-day writers refer to as the “FOMO” crowd, for “fear of missing out”).

That, in turn, creates a strong foundation for the next move higher.

Will that happen here? Perhaps. But it doesn’t have to. And it may not.

If it does, it’s an opportunity to add to your “silver stack.” Or to “Accumulate” additional shares of Wheaton Precious Metals $WPM ( ▲ 3.47% ) , a royalty company that’s in the SPC Silver Dossier and a stock that just about every Wealth Builder should own a bit of.

I’m saying that with some confidence because, long-term, we still believe silver is headed higher. (My good friend and longtime colleague Peter Krauth, author of The Great Silver Bull, has set a long-term target of $300 an ounce — though even he recently conceded surprise at the rally the metal’s experienced.)

Some heavy-hitters are starting to see it our way, too.

Using historical metrics, Michael Widmer, Bank of America’s head of Metals Research, says silver could hit peak prices between $135 and $309 per ounce — perhaps this year.

And then there’s that U.S. Mint price increase: New one-ounce Silver Eagles (uncirculated) were boosted from $91 to $169 — an 85.7% increase. Since Silver Eagles are an ounce of silver and a good proxy for the silver market: They usually trade at about a 20% premium to the “spot” price of silver. At $99 an ounce, that would put the coins at about $119 each.

That’s well above the $91 market price before the U.S. Mint price hike — but well below the “new” price of $169.

The takeaway: The U.S. Mint, an official agency of the U.S. government, expects silver prices to increase — a lot.

Given what I’ve said, what should you do?

First, keep accumulating Wheaton Precious Metals — either on pullbacks, via “dollar-cost-averaging,” or both.

Second, if you’re a Silver Eagle fan, look at places like the Pinehurst Coin Exchange, which is still selling those coins (including MS-70 graded versions) at lower prices. I’ve been buying from these folks (and a few others) for years. And I’ve been happy with the service.

Third, look at the “next” opportunities. Like old Morgan Silver Dollars.

In yesterday’s issue, I promised to circle back with some “cheat sheet” notes on Morgans. And that’s exactly what I’m doing here today.

Something very interesting could be playing out with Morgans — iconic 90% silver U.S. coins minted from 1878 to 1904, and again in 1921.

So let’s talk …

From Trash (Junk) to Treasure

With silver prices high, we’re seeing zooming interest in “junk silver” (old coins, including pre-1965 U.S. quarters, dimes and half dollars — which are 90% silver). I like those coins myself: My paternal grandparents — definite “products” of the Great Depression – loaded up on 1964 Washington quarters, which I inherited after their passing.

I’m also intrigued by some old Canadian coins – which trade at discounts to their U.S. counterparts (on a price/ounce basis). We’ll talk about that another time.

For now, let’s get into the Morgans.

As silver stampedes toward $100 an ounce, we’re watching as investors act — with some long-term implications.

Lots of folks — especially vaunted “silver stackers” — are cashing out. They’re selling their hoards for cash.

And why not? Those 1964 Washington quarters I mentioned: At $99 an ounce, their melt value would be $17.64 — each.

Now, coin shops, pawn shops and other metals buyers pay less than spot. So they’re culling their collections — sometimes en masse.

Morgans are suffering the same fate, says Jeff Garrett, a well-known expert who founded Mid-American Rare Coin Galleries.

Writing in CoinWeek, Garrett recounted how “one large shop owner recently told me he sent 10,000 Morgan and Peace dollars in for melting. For most collectors, that kind of story is painful to hear. Unfortunately, it is becoming more common.”

As I like to say, it’s a case of Economics 101: When the price of an asset rises, many long-term holders sell out and take their profit. Likewise, when the supply of something plummets — at a steady level of demand — the price of that asset climbs.

If the supply of that asset plummets, and demand also surges because more folks realize its value, its market price skyrockets.

With silver’s surge, and prices marching higher for “usual suspect” coins like Silver Eagles, investors are looking for other coins to invest in.

Morgan Silver Dollars have benefited from all these factors:

Rising silver prices.

Rising prices of “other” silver coins.

The melting of circulated — so-called “junk” — Morgans, which is paring supply.

One upshot: “Collectors are feeling the impact as base values rise,” Garrett, the expert, wrote. “Common Mint State Morgan dollars have nearly doubled in a short time.”

One lesson: Since we believe silver prices will keep rising long-term — and as more old coins end up with the smelter — those “junk” coins you’ve been saving in a shoebox may become “collectible.” They could even end up as “classics.”

So here’s my short “cheat sheet” list for Morgan Silver Dollars. If you’re a bargain-hunter, you can use it as a kind of “watch list” — or as a starting point for your own research.

One way to approach a particular coin you want to collect is to specialize:

Specific Years – for instance, collecting all the issues from those years, error coins or mint marks.

Key Dates – a coin-collector term for coins that are scarce because low numbers were minted, or because they were collected and melted down, are valuable for other reasons, or tended to wear, meaning those that remain are in poor condition.

Or Are Historically Significant.

With Lincoln pennies, one example is the 1909-S VDB — sought for its unique mint mark, low mintage and inaugural year of the wheat back design.

With Buffalo nickels — which you’d find in change when I was a kid — it’s the 1913-S Type II, thanks to its short run and toughness to find in a high grade.

With Morgans, I’m partial to the coins struck at the Carson City Mint. That’s no surprise, given my love of history. The Carson City Morgans are known for their “CC” mark on the back, and their historical significance (some years were tied to the American Westward Movement, and the silver-and-gold booms in California, Nevada and surrounding areas.

Public Domain

The Carson City Mint (pictured above) operated from 1870 to 1893. It was created because of Nevada’s Comstock Lode Silver Boom. That short production run adds an allure to the coins minted there.

Here the “key dates” are 1879-CC and 1893-CC — thanks to low survival rates and that Old West mystique.

As key dates, though, they are expensive.

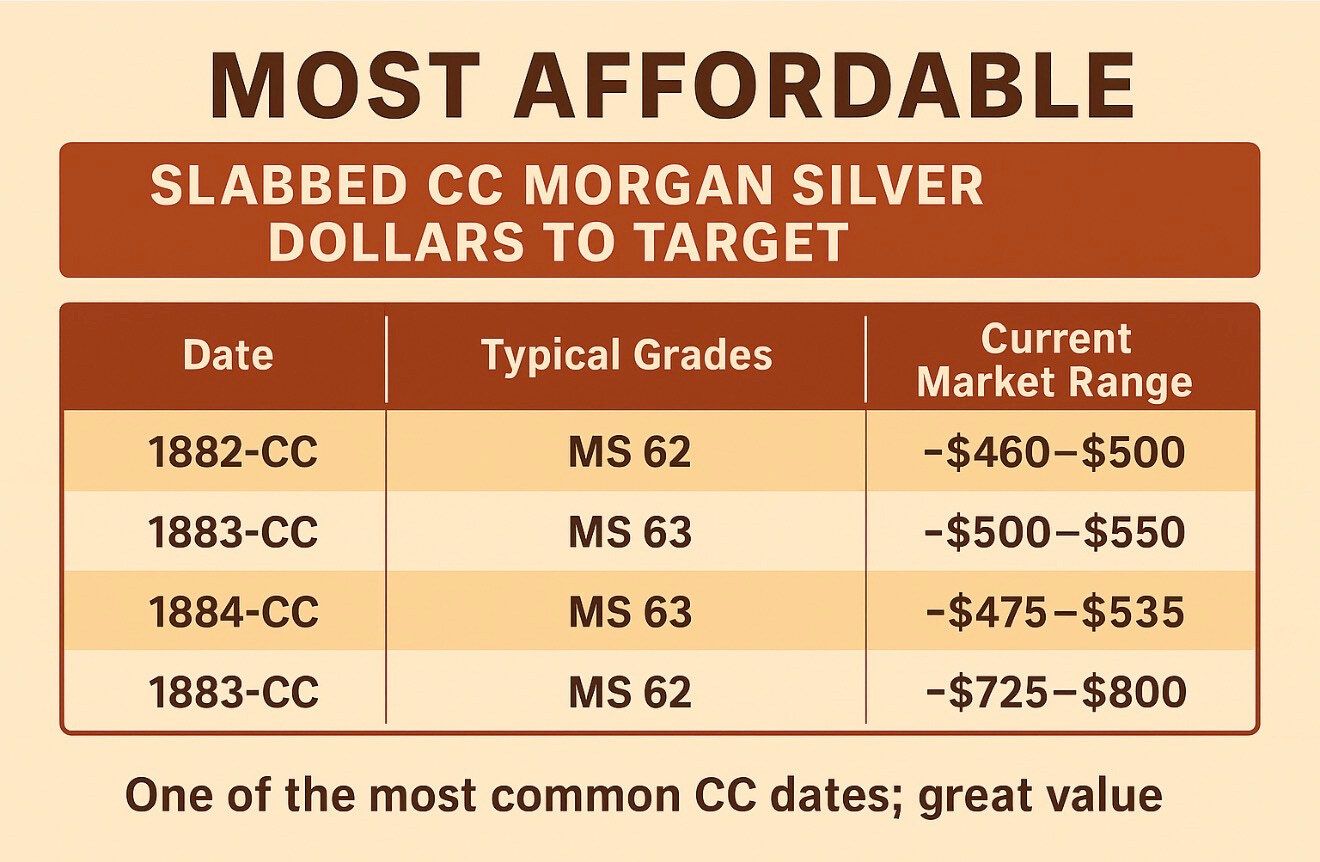

So I created a list of “most-affordable” CC Morgans to consider (see chart).

Source: SPC Team Research

Here are the best “value picks” — and some factors to look for:

1. 1882‑CC Morgan

• Usually the cheapest CC Morgan on the market.

• Plenty of supply, so prices stay reasonable.

• Great for building a CC set without breaking the bank.

2. 1883‑CC Morgan

• Nearly identical value proposition to the 1882‑CC.

• Often found in decent, circulated grades at prices that won’t blow your mind.

3. 1884‑CC Morgan

• A touch more expensive, but still widely available.

• Longer-term, expect strong demand to build.

4. 1878‑CC Morgan

• As the first CC Morgan, it’s historically significant.

• Low-grade examples can be surprisingly affordable on eBay.

• Higher grades jump quickly, so stick to G–VF for value.

Here’s a “buying strategy” to keep it affordable.

1. Target Circulated Grades (G–VF)

These offer the best price/history ratio. You get the CC mystique without paying MS premiums.

2. Avoid GSA Slabs (if Budget Is a Priority)

GSA holders add a premium — great for investment, but not necessary if you want to keep your purchase price down.

3. Stick to the “Big Three” Affordable Dates

As outlined in our chart, you’re talking here about:

— 1882‑CC.

— 1883‑CC.

— 1884‑CC.

4. Watch for Clean Surfaces

So-called “eye appeal” matters: Even in lower grades, cleaned coins take a value hit, meaning you should look to avoid:

• Heavy scratches.

• Rim bumps.

• Deep gouges.

🏆 If You Want the Single Best Buy Right Now: It’s the 1882‑CC in Good-to-V/F condition.

It consistently shows up in the $225 to $275 range and is the most budget-friendly CC Morgan available today. The price has climbed $25 — at both ends of that range — since I first started researching this report for you folks over the holidays.

Now, if it’s graded (slabbed) coins you want — not a bad strategy, given what I’ll talk about next – here’s a “cheat sheet” for those same coins — graded and “slabbed,” with some current price ranges to guide you.

Source: SPC Team Research

As with everything, there’s a tradeoff: With graded coins, you’ll pay more — often a lot more. But you get certainty – which is good when you’re buying … and when you’re selling.

Grading and slabbing means a professional has reviewed your coin, assigned a grade — and told you that your coin is real.

That’s not a small thing.

China likes to fake stuff — and coins are a favorite.

Take a tour of eBay and you’ll see Silver Eagles selling at “too-good-to-be-true” prices. Many of those coins are steel or copper blanks, stamped and clad in a thin veneer of silver.

With Morgans, the “artisans” are even more slippery.

Source: SPC Team Research

Here’s a rundown on some of their tactics — the coins they target, why they target them and how they pull it off.

Forewarned is forearmed, after all.

There you have it

It’s a departure from our usual talk of stocks, storylines, strategies and news analysis.

But we look for value and opportunity wherever we find it. And wherever we can bring it to you.

Let me know if you liked it.

And tell a friend about Stock Picker’s Corner.

See you next time;

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.