- Stock Picker's Corner

- Posts

- As Moscow and Beijing Target Our Networks, This Tech Market Could Grow 31 Times Over the Next Decade

As Moscow and Beijing Target Our Networks, This Tech Market Could Grow 31 Times Over the Next Decade

This free report details big opportunities in the Space Economy ...

Underseas communication cables are like the nerves that tie the world together.

We’re talking about an 800,000-mile global network that carries more than 97% of the world’s communications — including the critical financial transactions that make the world economy go.

Want proof?

Just look at these “Magnificent 7” companies, and how many miles of subsea cables they owned (either outright or as part of a group) as of 2022, says GrandView Research:

Amazon’s cables run from the Mainland United States to the Asia-Pacific Region, connecting the e-commerce heavyweight with markets in Japan, Singapore, and elsewhere on the other side of the world.

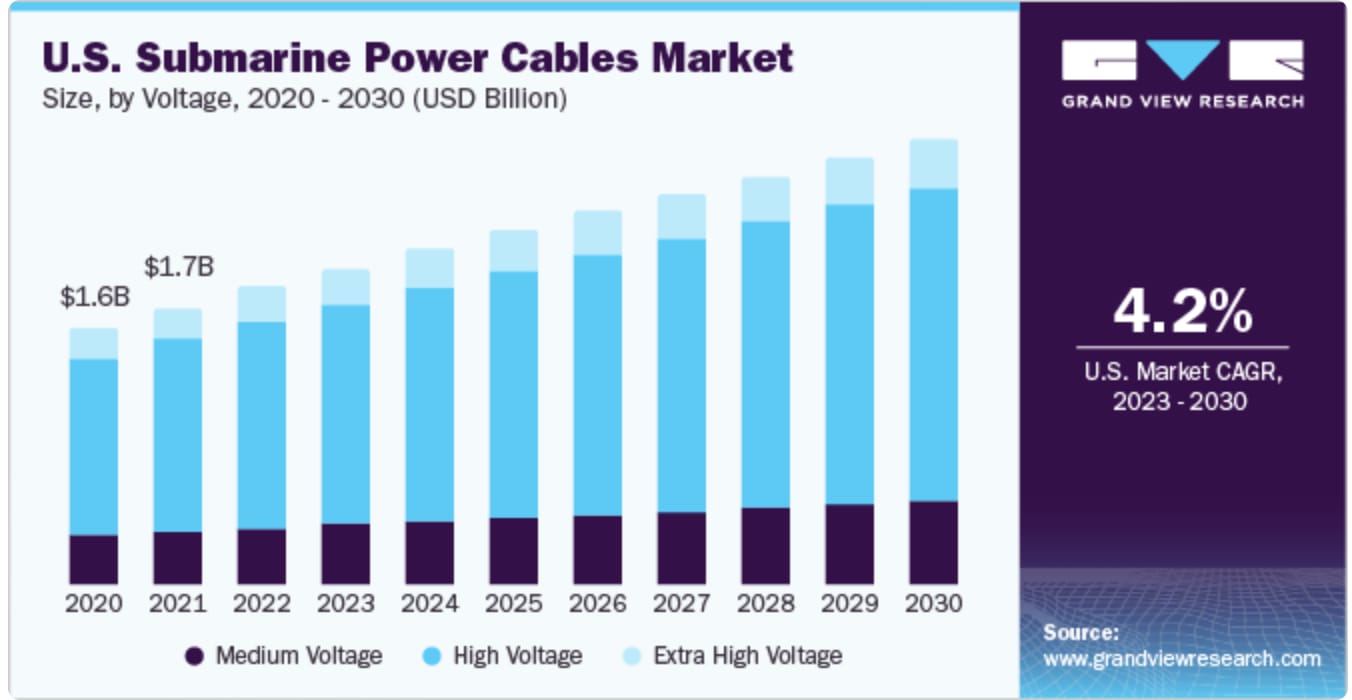

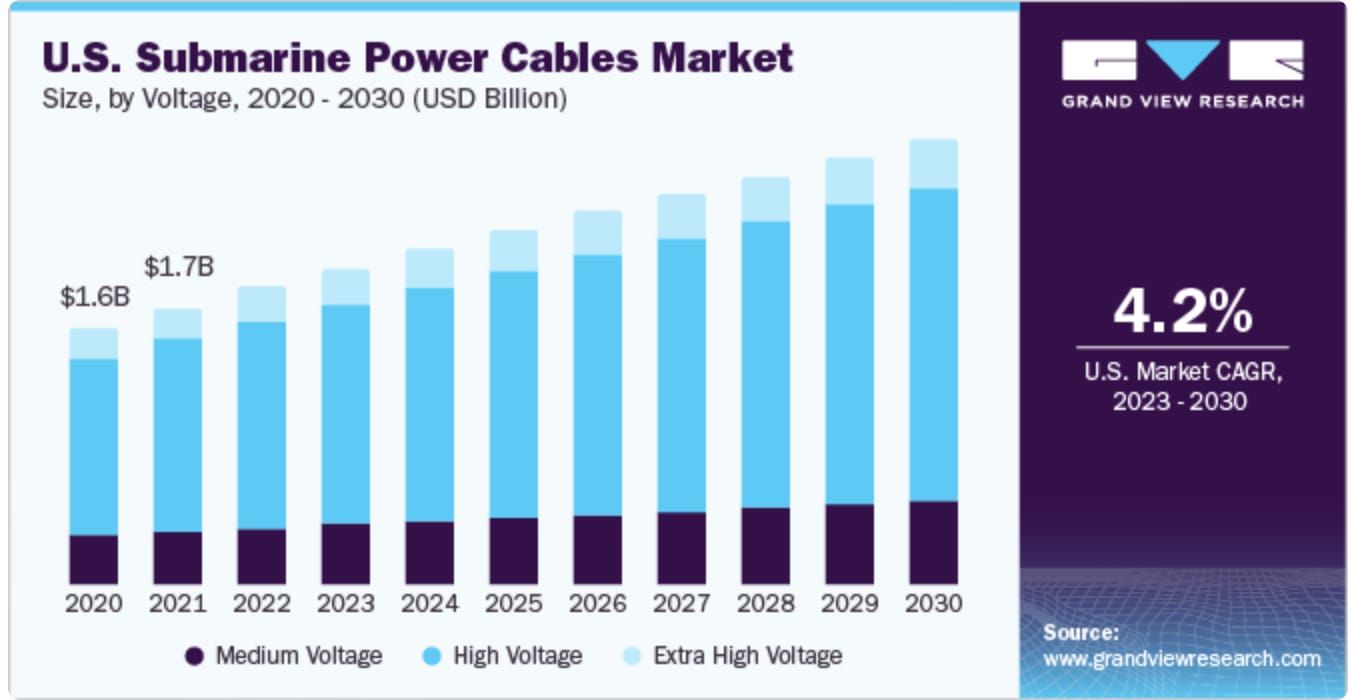

Expect those subsea-cable investments to continue. The $27.6 billion global market will grow at a 5.9% compound annual growth rate (CAGR) from 2022 to 2030.

The communication slice of that will grow even faster at a CAGR of 6.8% through the end of the decade.

That’s the good news.

And here’s the bad news: That economic value and linchpin role means there’s a gigantic “bullseye” on those networks.

Worldwide, about 200 undersea cables are disrupted or are cut outright each and every year. Some of those incidents are accidental, as the damage is unintentionally inflicted by fishing fleets or ship anchors.

But plenty of it is intentional, like the “critical infrastructure” threats you and I hear about all the time. It’s part of the “hybrid warfare” playbook that Moscow and Beijing are using against the West.

Welcome to the New Cold War.

It’s one of the top storylines we’re following at Stock Picker’s Corner (SPC) where we believe: “If you find the best storylines, you’ll find the best stocks.”

At SPC, we use those storylines to turn everyday investors into true Wealth Builders and help them avoid the miscues of Wealth Killers that rob the average retail investors of as much as $300,000 over their lifetimes.

But our goal isn’t just to help investors avoid those “opportunity losses.” We look to educate, to share research, and to spotlight the wealth windows that lead to “beat the market” investing.

The “storyline” approach may sound simple. But that makes it easy to understand, which, in turn, makes it super powerful.

Also super powerful: When multiple storylines that we’re following “intersect,” that magnifies the Wealth opportunity at hand.

And that’s exactly what we have with the New Cold War, Deglobalization, Artificial Intelligence (AI), and the Space Economy.

All of these are converging into one of the biggest opportunities we see: The Satellite Revolution.

Anchors Aweigh

The first successful subsea cable was laid in 1850, connecting England and France via the English Channel. Entrepreneurs could see the potential and took a shot at a transatlantic telegraph cable seven years later. The technology was new, brittle, and unreliable.

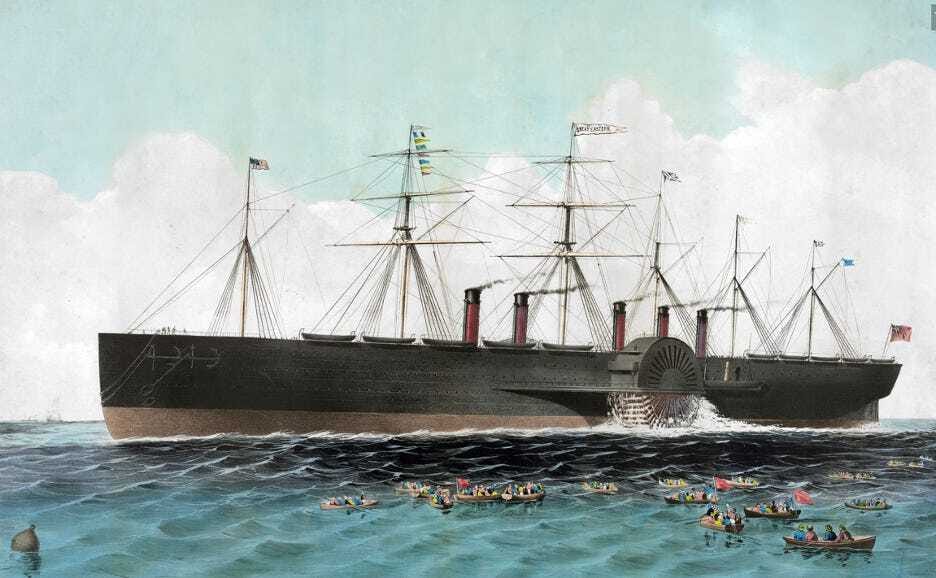

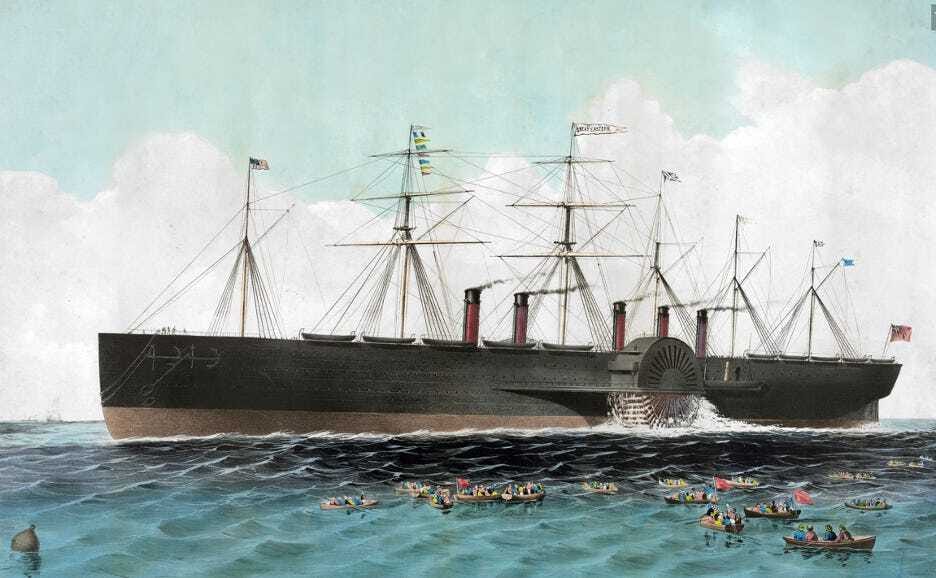

The first truly reliable transatlantic cable was put in place in 1858 thanks to an amazing ship called the SS Great Eastern.

The steamship — iron-hulled, with massive paddle-wheels on each side and conventional screw propellers at its stern — was 692 feet long. At the time of its launch, it was the biggest ship ever built. It cost a reported $6 million back then, which is equal to $232 million today. And the Great Eastern was originally conceived as a transatlantic passenger ship; one capable of carrying 4,000 people on each voyage.

But the ship made its mark in history when it was converted into a cable-laying ship in 1865. And its career lasted until 1874.

In the 150 years since, undersea-cable networks have proliferated in number, reach and importance. Just 10 years ago, the $300 million Hibernia Express transatlantic cable network was built to give high-frequency traders (HFT) a millisecond’s advantage over their rivals.

And we saw earlier the investments tech heavyweights like Microsoft and Amazon have made.

Threat Assessment

But that increased importance is accompanied by increased vulnerability.

So it’s no surprise that Western undersea cable networks have emerged as prime “critical-infrastructure” targets for geopolitical rivals. It’s also no surprise that Russia and China each operate specialized military units that are dedicated to cyberwarfare and the disruption of communications.

Russia:

The GRU: The Glavnoje Razvedyvatel'noje Upravlenije, which translates to Main Intelligence Directorate, is the foreign military intelligence agency of the General Staff of the Armed Forces of the Russian Federation. (Think of it as the Russian counterpart to the U.S. Defense Intelligence Agency, which aids the U.S. Department of Defense by monitoring and analyzing foreign military capabilities and intentions.) The GRU has several groups – including Unit 29155, Unit 26165 and Unit 74455 — which are known for political intrigue, cyber operations, and targeting global critical infrastructure, including communications networks. That reportedly includes cyberattacks, espionage, sabotage, and communications disruptions.

China:

The PLA: The People's Liberation Army of China has dedicated cyber units, such as the Strategic Support Force. It specializes in cyber espionage and cyber warfare. These units are responsible for conducting cyber operations against commercial, governmental, and military networks of their rivals.

We’re seeing this hazy bit of warfare unfold in real time in something I’m calling “The Battle of the Baltic Sea,” since that’s a region that is strategically vital for communications and energy transmission between countries like Germany, Finland, Sweden and Estonia. In that area, between October 2023 and January 2025, at least 11 cables were damaged and believed to be deliberate acts of sabotage involving Russia and its “Shadow Fleet.” In that fleet are ships of opaque ownership that are used to circumvent sanctions and sabotage undersea communications networks, energy cables, and pipelines.

These attacks can have significant impacts on global communications and security, highlighting the vulnerability of undersea infrastructure.

This included the November 2024 C-Lion1 Cable Incident, near the Swedish island of Oland, when the undersea communications cable between Finland and Germany was damaged. At just about the same time, BCS East-West Interlink Cable — which connects Lithuania and Sweden — was also sabotaged. Investigations focused on the Chinese cargo ship Yi Peng 3, which allegedly used the heavy-handed (but effective) “anchor-dragging” approach – reportedly with the help of Russian intelligence.

This isn’t new.

Undersea telecommunication cables have served as juicy sabotage targets since the Spanish-American War.

And we saw it again during the Cold War.

Indeed, way back in February 1959, during the so-called “Transatlantic Cables Incident,” U.S. Navy personnel from the destroyer USS Roy O. Hale boarded a Russian ship after cables owned by AT&T and Western Union suffered a dozen breaks in less than a week. Some were accidental, but a number were man-made. And Russia was known to equip its fishing and merchant ships with marine sabotage gear.

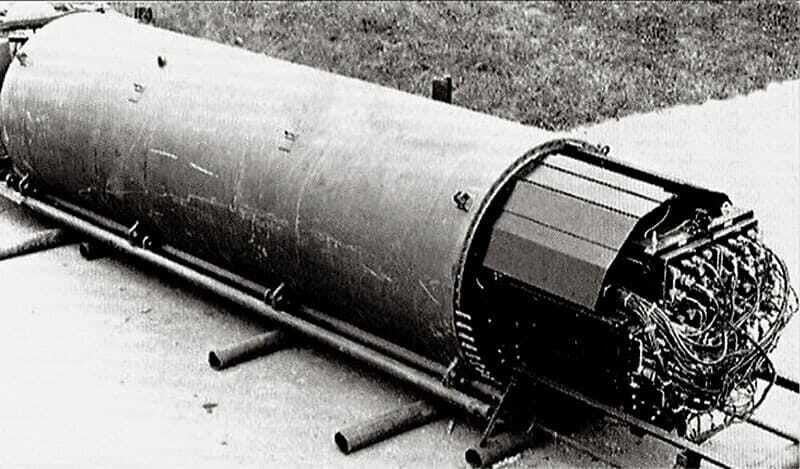

U.S. intelligence operatives took a different approach to subsea communications cables: They had specially equipped U.S. Navy spy subs sneak inside territorial limits and “tap” them. Known as “Operation Ivy Bells,” it was one of the most-successful intelligence-gathering missions of the Cold War until the Soviets learned about part of it via American spy Ronald Pelton.

Welcome to the Dataverse

Here in the “New Cold War” where military budgets are accelerating globally, digital data has taken its place alongside bullets, bombs, rockets, and missiles as both a weapon … and a competitive advantage.

In the general economy, digital data is both a “raw material” — the “stuff” that makes the economy go — and that same competitive advantage.

And the amount of data we must handle, store, organize, and manage has exploded.

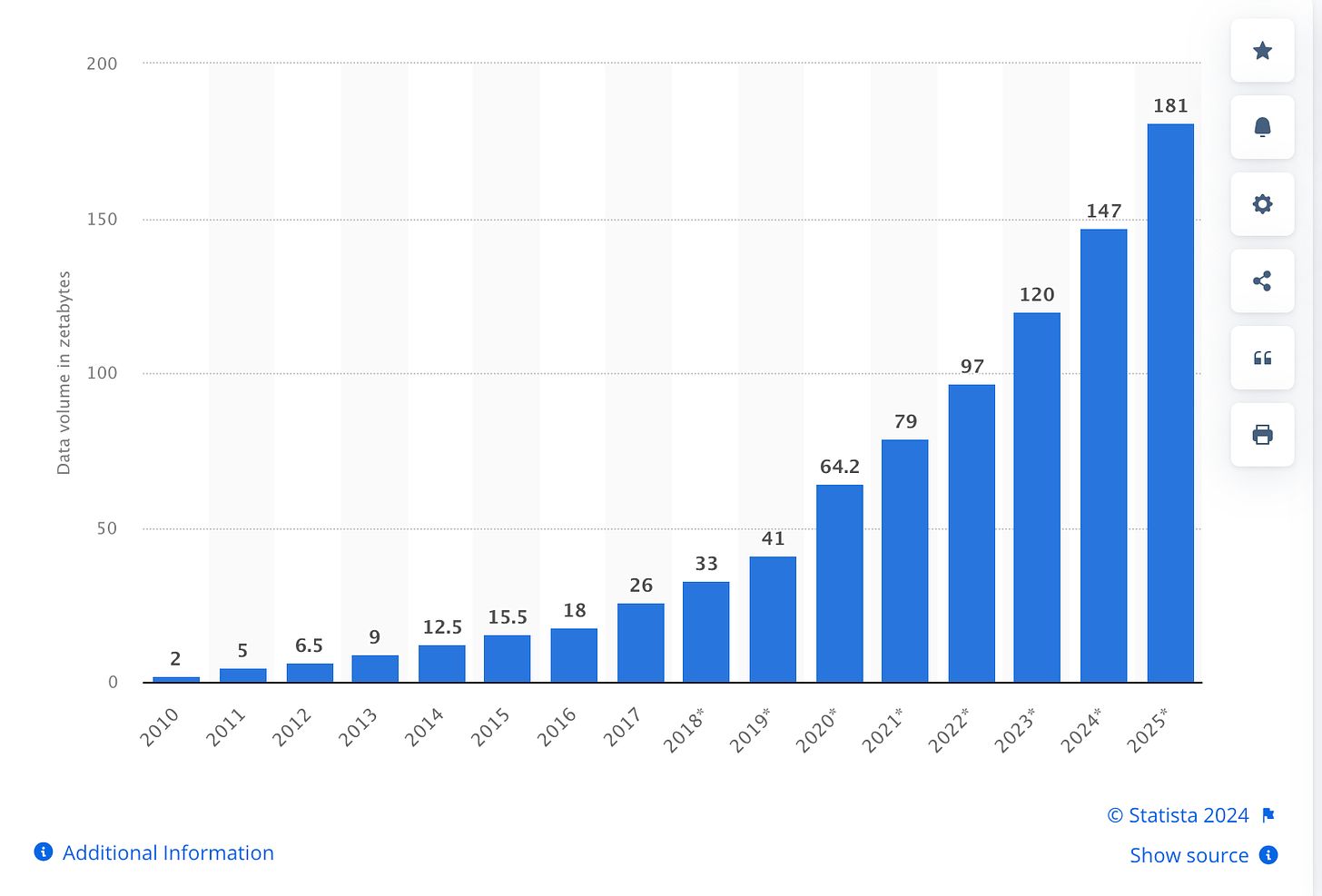

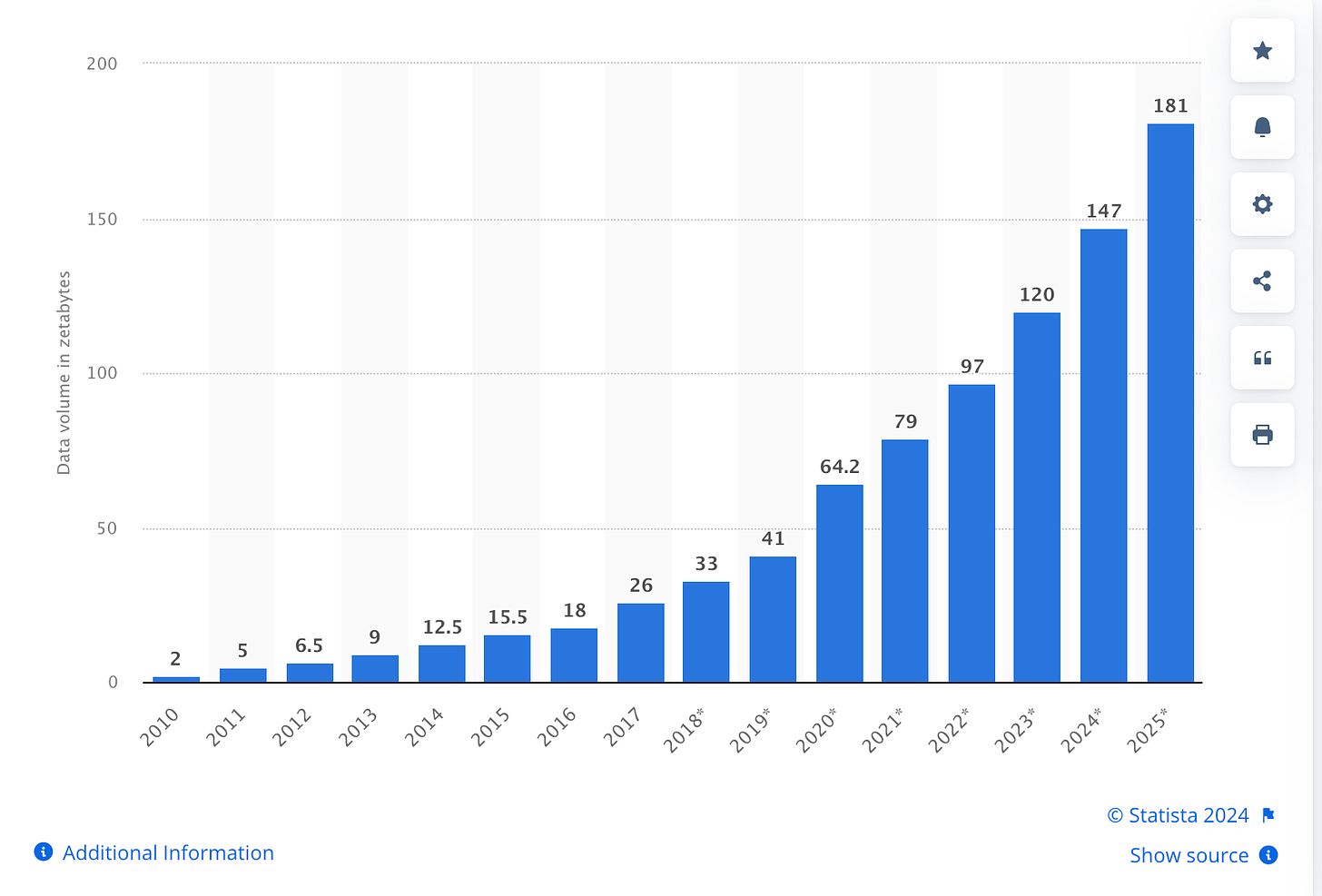

The “data universe” will grow more than tenfold from 2020 to 2030, when it’ll reach 660 zettabytes, says UBS Wealth Management.

That’s the equivalent of every person in the world having 610 iPhones; each with 128 gigabytes of storage.

It creates one of the biggest profit opportunities for companies to grab.

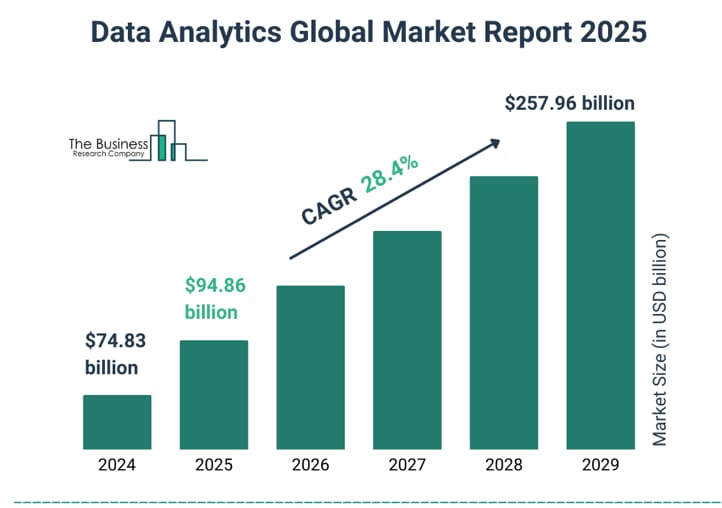

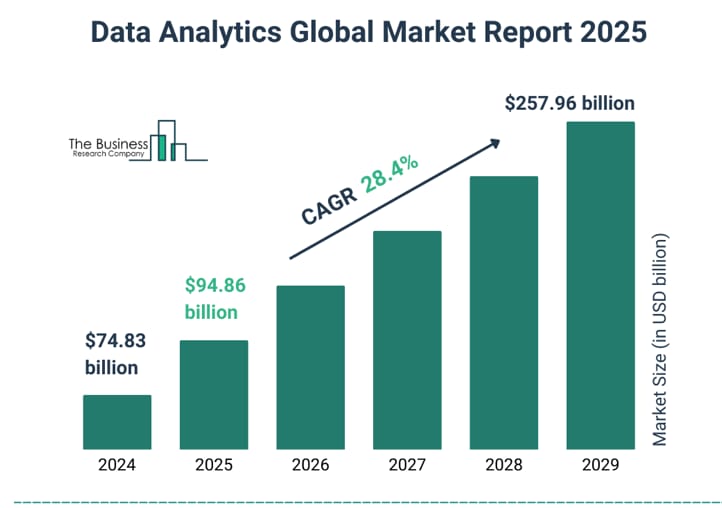

The “data-analytics” market surged from $74.8 billion last year to an estimated $94.9 billion this year, which is a growth rate of nearly 27%, says The Business Research Co.

And it’s projected to zoom to nearly $258 billion by 2029; a CAGR of 28.4%, the research firm says.

Accelerating this data explosion are such key acceleration “triggers” as:

The New Cold War, which is leading to deglobalization and even isolationism – a reality that will lead us back to carefully-defined “trading blocs.”

The AI Revolution, which demands more data even as it creates more data.

And the Automation Economy, which includes drones, driverless vehicles, robotics, and more – where actionable, real-time data takes the place of a human being.

That translates into three data-pipeline “musts.”

Those “data pipelines:”

1. Must be enlarged.

2. Must be increased in number.

3. And must be protected.

And there’s one innovation that achieves all three things.

Sophisticated satellites.

The New High Ground

The “Space Economy” is another of those storylines that we’re following.

And Low-Earth Orbit (LEO) Satellites are a major “ignitor” of the growth we’re about to see.

A LEO satellite orbits the Earth at an altitude of 112 miles to 1,243 miles. That’s closer than Medium-Earth Orbit (MEO) or Geostationary Orbit (GEO) satellites.

LEO satellites achieve some of the key goals I highlighted:

They’re Fast: The low altitude means they complete their orbits in 90 minutes to two hours. That offers lower latency for communication (data transfer to and from and higher resolution for imaging).

They’re Plentiful: That lower orbit translates into lower costs for construction and launch, meaning you can afford more of them. That means they can be replaced much more easily than an undersea cable. And if one is taken out, three more can be launched to replace it.

And They’re Adaptable: They can be used for an array of purposes, including satellite internet services, GPS, monitoring, and surveillance. They could add to cellphone, broadband, and data transfer services or provide those needed new “pipelines.”

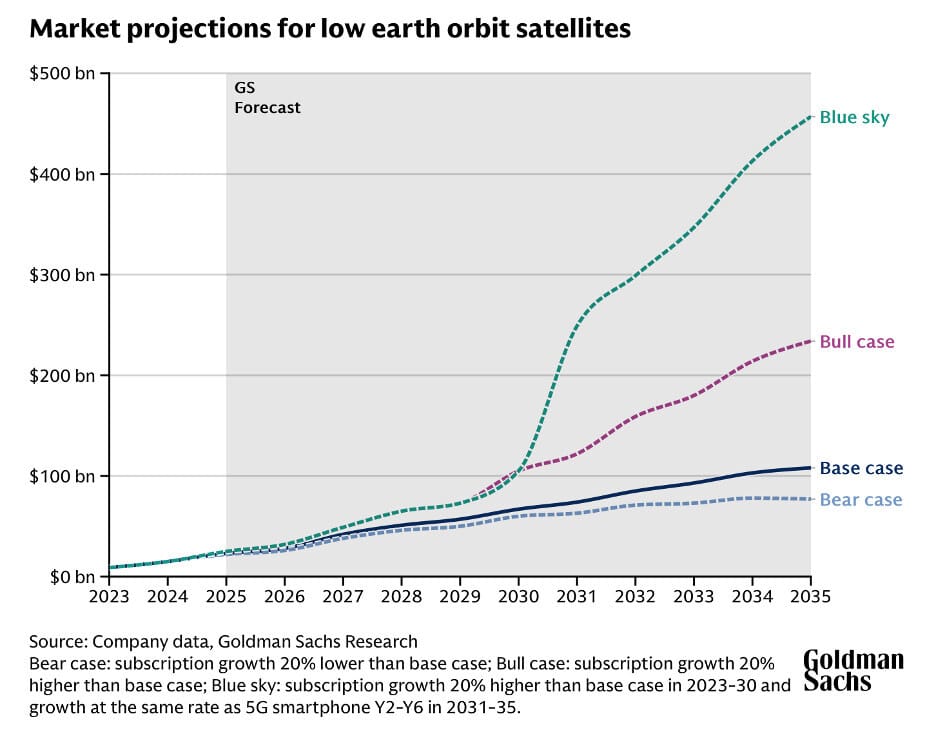

The LEO market is projected to grow at least seven times over the next decade. But it could grow as much as 31 times, says a new report by investment bank Goldman Sachs Group Inc. GS -0.11%↓.

As many as 70,000 LEO satellites will be launched in the next five years, Goldman Sachs says.

“Our analysts’ base-case forecast is for the satellite market to grow to $108 billion by 2035, up from the current $15 billion,” analysts for the investment bank wrote. “In the most optimistic scenario, the market could grow to be worth as much as $457 billion in that same period.”

Roughly 53,000 of the estimated 70,000 launches in the next five years will come from China; a data point that underscores our New Cold War and Deglobalization storylines.

Here’s a small sampling:

The United States: Thanks to government and private-sector initiatives, the U.S. satellite economy is strong. Companies like SpaceX and Amazon are launching large constellations of LEO satellites to provide global internet coverage. And the Pentagon and private companies are working on “quick-launch” programs to make sure damaged or targeted satellites can be replaced.

The European Union: The EU has been investing in satellite technology through programs like Galileo for navigation and Copernicus for Earth observation. As part of the shift back to “trading blocs,” EU members are looking at ways satellites can boost “connectivity” across the continent.

China: With initiatives like the BeiDou Navigation Satellite System and communication-satellite programs to support its Belt and Road Initiative, Beijing has been rapidly expanding its satellite capabilities.

Russia: Moscow continues to pump money into satellite technology for its commercial economy and military. One example: Its GLONASS navigation system.

India: The Indian Space Research Organisation (ISRO) has launched an array of communication satellites to bolster its data programs and improve connectivity across the country.

If you follow the news or look around your “personal world,” you can see this for yourself.

With AI, you need satellites so John Deere DE -0.09%↓ tractors can autonomously navigate corn fields … so self-driving cars “see” what’s in front of them on roadways … so drone aircraft can fly a planned route … and more.

For the New Cold War, government and military agencies need satellites for real-time intel, secure communications, navigation, and missile detection.

There are smaller pieces, call them “subsets,” of what I’m describing. And they vary in both size and rates of growth.

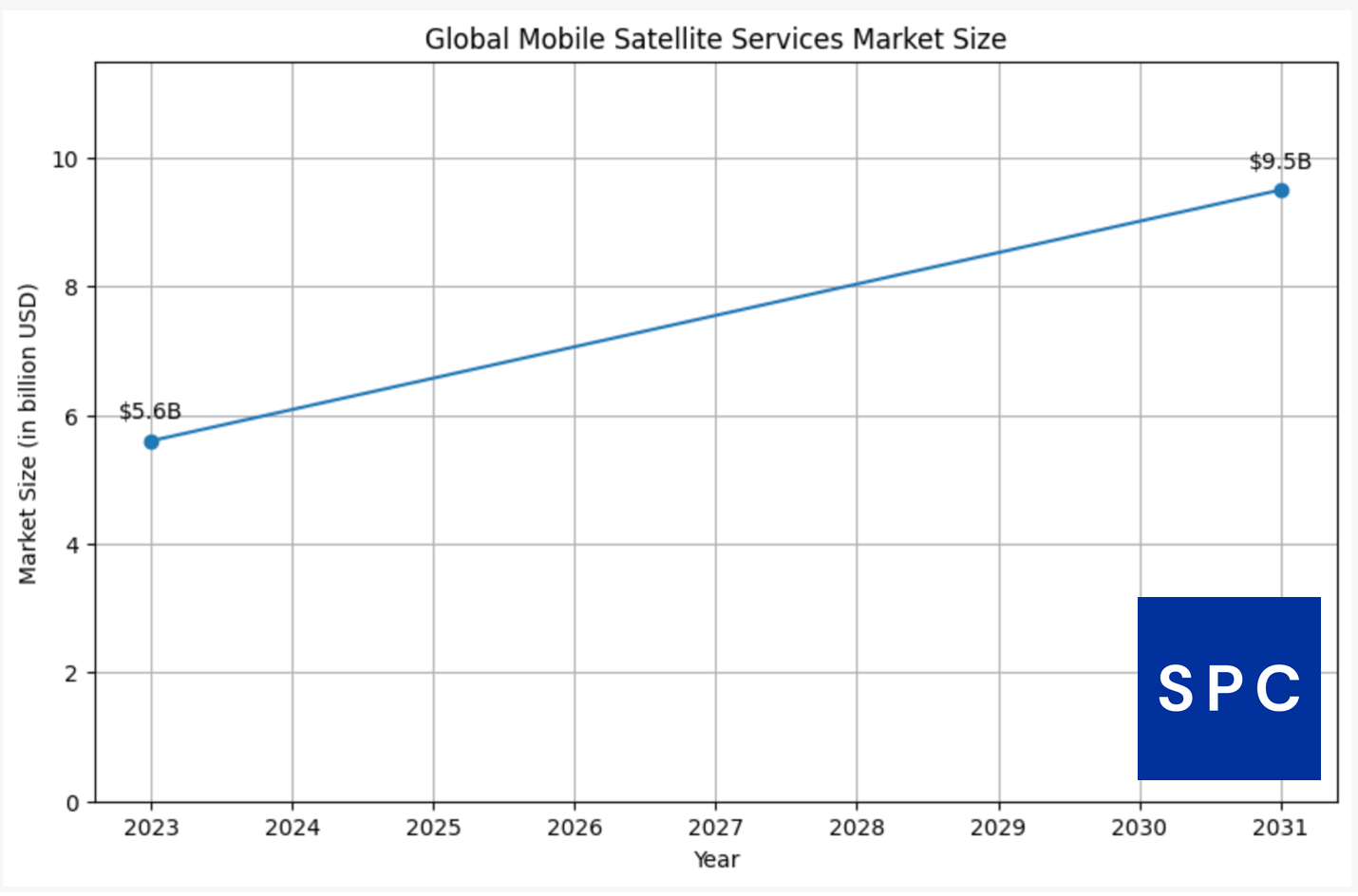

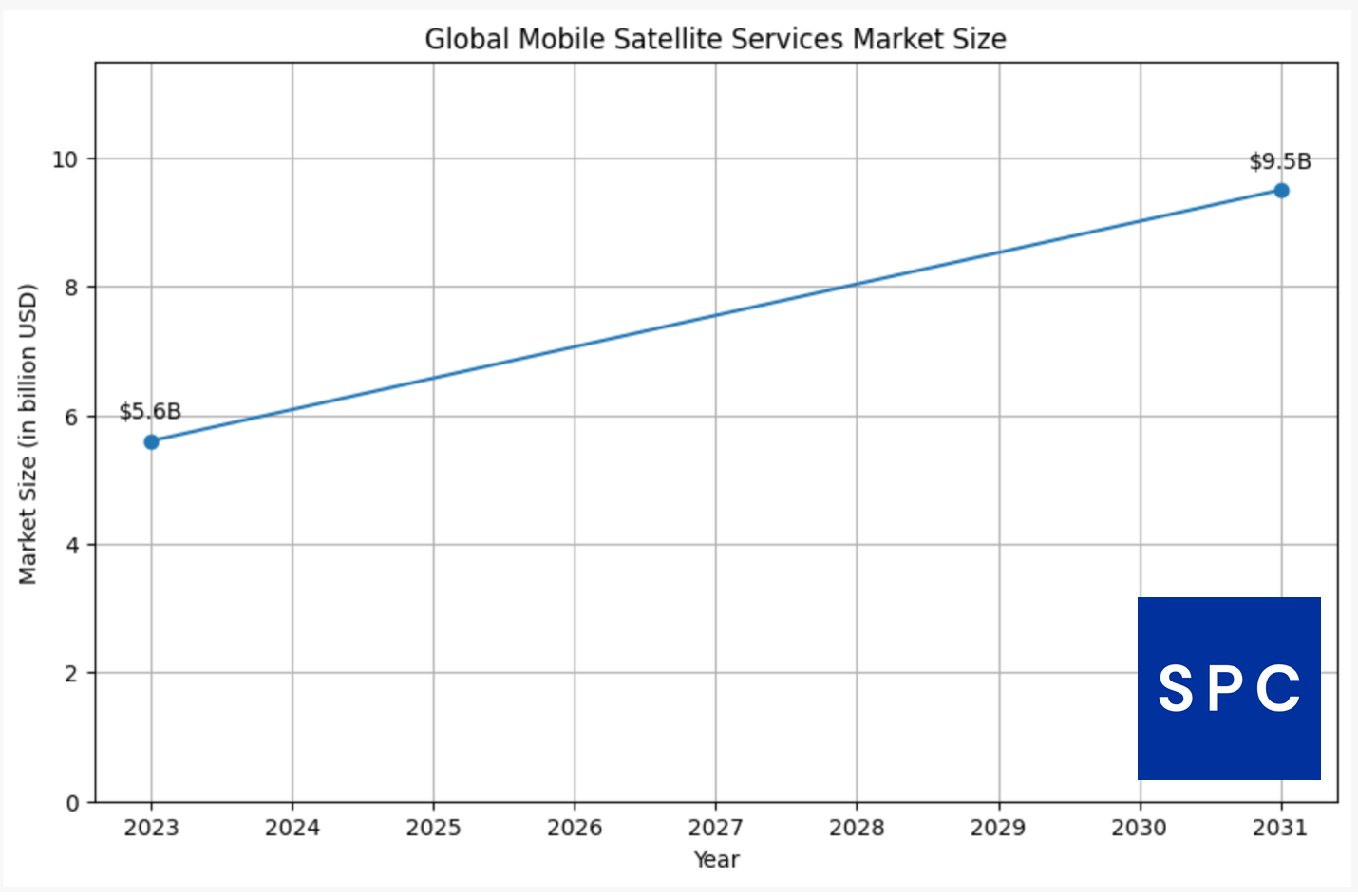

The global mobile satellite services market size is still relatively small. It was valued at $5.6 billion in 2023 and is expected to reach $9.5 billion by 2031 for a modest compound annual growth rate (CAGR) of 6.9%.

Underseas communication cables are like the nerves that tie the world together.

We’re talking about an 800,000-mile global network that carries more than 97% of the world’s communications — including the critical financial transactions that make the world economy go.

Want proof?

Just look at these “Magnificent 7” companies, and how many miles of subsea cables they owned (either outright or as part of a group) as of 2022, says GrandView Research:

Amazon’s cables run from the Mainland United States to the Asia-Pacific Region, connecting the e-commerce heavyweight with markets in Japan, Singapore, and elsewhere on the other side of the world.

Expect those subsea-cable investments to continue. The $27.6 billion global market will grow at a 5.9% compound annual growth rate (CAGR) from 2022 to 2030.

The communication slice of that will grow even faster at a CAGR of 6.8% through the end of the decade.

That’s the good news.

And here’s the bad news: That economic value and linchpin role means there’s a gigantic “bullseye” on those networks.

Worldwide, about 200 undersea cables are disrupted or are cut outright each and every year. Some of those incidents are accidental, as the damage is unintentionally inflicted by fishing fleets or ship anchors.

But plenty of it is intentional, like the “critical infrastructure” threats you and I hear about all the time. It’s part of the “hybrid warfare” playbook that Moscow and Beijing are using against the West.

Welcome to the New Cold War.

It’s one of the top storylines we’re following at Stock Picker’s Corner (SPC[JD1] ), where we believe: “If you find the best storylines, you’ll find the best stocks.”

At SPC, we use those storylines to turn everyday investors into true Wealth Builders and help them avoid the miscues of Wealth Killers that rob the average retail investors of as much as $300,000 over their lifetimes.

But our goal isn’t just to help investors avoid those “opportunity losses.” We look to educate, to share research, and to spotlight the wealth windows that lead to “beat the market” investing.

The “storyline” approach may sound simple. But that makes it easy to understand, which, in turn, makes it super powerful.

Also super powerful: When multiple storylines that we’re following “intersect,” that magnifies the Wealth opportunity at hand.

And that’s exactly what we have with the New Cold War, Deglobalization, Artificial Intelligence (AI), and the Emerging Space Economy.

All of these are converging into one of the biggest opportunities we see: The Satellite Revolution.

ANCHORS AWEIGH

The first successful subsea cable was laid in 1850, connecting England and France via the English Channel. Entrepreneurs could see the potential and took a shot at a transatlantic telegraph cable seven years later. The technology was new, brittle, and unreliable.

The first truly reliable transatlantic cable was put in place in 1858 thanks to an amazing ship called the SS Great Eastern.

The steamship — iron-hulled, with massive paddle-wheels on each side and conventional screw propellers at its stern — was 692 feet long. At the time of its launch, it was the biggest ship ever built. It cost a reported $6 million back then, which is equal to $232 million today. And the Great Eastern was originally conceived as a transatlantic passenger ship; one capable of carrying 4,000 people on each voyage.

But the ship made its mark in history when it was converted into a cable-laying ship in 1865. And its career lasted until 1874.

In the 150 years since, undersea-cable networks have proliferated in number, reach and importance. Just 10 years ago, the $300 million Hibernia Express transatlantic cable network was built to give high-frequency traders (HFT) a millisecond’s advantage over their rivals.

And we saw earlier the investments tech heavyweights like Microsoft and Amazon have made.

THREAT ASSESSMENT

But that increased importance is accompanied by increased vulnerability.

So it’s no surprise that Western undersea cable networks have emerged as prime “critical-infrastructure” targets for geopolitical rivals. It’s also no surprise that Russia and China each operate specialized military units that are dedicated to cyberwarfare and the disruption of communications.

Russia:

The GRU: The Glavnoje Razvedyvatel'noje Upravlenije, which translates to Main Intelligence Directorate, is the foreign military intelligence agency of the General Staff of the Armed Forces of the Russian Federation. (Think of it as the Russian counterpart to the U.S. Defense Intelligence Agency, which aids the U.S. Department of Defense by monitoring and analyzing foreign military capabilities and intentions.) The GRU has several groups – including Unit 29155, Unit 26165 and Unit 74455 — which are known for political intrigue, cyber operations, and targeting global critical infrastructure, including communications networks. That reportedly includes cyberattacks, espionage, sabotage, and communications disruptions.

China:

The PLA: The People's Liberation Army of China has dedicated cyber units, such as the Strategic Support Force. It specializes in cyber espionage and cyber warfare. These units are responsible for conducting cyber operations against commercial, governmental, and military networks of their rivals.

We’re seeing this hazy bit of warfare unfold in real time in something I’m calling “The Battle of the Baltic Sea,” since that’s a region that is strategically vital for communications and energy transmission between countries like Germany, Finland, Sweden and Estonia. In that area, between October 2023 and January 2025, at least 11 cables were damaged and believed to be deliberate acts of sabotage involving Russia and its “Shadow Fleet.” In that fleet are ships of opaque ownership that are used to circumvent sanctions and sabotage undersea communications networks, energy cables, and pipelines.

These attacks can have significant impacts on global communications and security, highlighting the vulnerability of undersea infrastructure.

This included the November 2024 C-Lion1 Cable Incident, near the Swedish island of Oland, when the undersea communications cable between Finland and Germany was damaged. At just about the same time, BCS East-West Interlink Cable — which connects Lithuania and Sweden — was also sabotaged. Investigations focused on the Chinese cargo ship Yi Peng 3, which allegedly used the heavy-handed (but effective) “anchor-dragging” approach – reportedly with the help of Russian intelligence.

This isn’t new.

Undersea telecommunication cables have served as juicy sabotage targets since the Spanish-American War.

And we saw it again during the Cold War.

Indeed, way back in February 1959, during the so-called “Transatlantic Cables Incident,” U.S. Navy personnel from the destroyer USS Roy O. Hale boarded a Russian ship after cables owned by AT&T and Western Union suffered a dozen breaks in less than a week. Some were accidental, but a number were man-made. And Russia was known to equip its fishing and merchant ships with marine sabotage gear.

U.S. intelligence operatives took a different approach to subsea communications cables: They had specially equipped U.S. Navy spy subs sneak inside territorial limits and “tap” them. Known as “Operation Ivy Bells,” it was one of the most-successful intelligence-gathering missions of the Cold War until the Soviets learned about part of it via American spy Ronald Pelton.

Okhotsk Wiretap removal, 1981 (SIGINT CHATTER)

WELCOME TO THE “DATAVERSE”

Here in the “New Cold War” where military budgets are accelerating globally, digital data has taken its place alongside bullets, bombs, rockets, and missiles as both a weapon … and a competitive advantage.

In the general economy, digital data is both a “raw material” — the “stuff” that makes the economy go — and that same competitive advantage.

And the amount of data we must handle, store, organize, and manage has exploded.

The “data universe” will grow more than tenfold from 2020 to 2030, when it’ll reach 660 zettabytes, says UBS Wealth Management.

That’s the equivalent of every person in the world having 610 iPhones; each with 128 gigabytes of storage.

It creates one of the biggest profit opportunities for companies to grab.

The “data-analytics” market surged from $74.8 billion last year to an estimated $94.9 billion this year, which is a growth rate of nearly 27%, says The Business Research Co.

And it’s projected to zoom to nearly $258 billion by 2029; a CAGR of 28.4%, the research firm says.

Accelerating this data explosion are such key acceleration “triggers” as:

The New Cold War, which is leading to deglobalization and even isolationism – a reality that will lead us back to carefully-defined “trading blocs.”

The AI Revolution, which demands more data even as it creates more data.

And the Automation Economy, which includes drones, driverless vehicles, robotics, and more – where actionable, real-time data takes the place of a human being.

That translates into three data-pipeline “musts.”

Those “data pipelines:”

1. Must be enlarged.

2. Must be increased in number.

3. And must be protected.

And there’s one innovation that achieves all three things.

Sophisticated satellites.

THE NEW “HIGH GROUND”

The “Space Economy” is another of those storylines that we’re following at Stock Picker’s Corner.

And Low-Earth Orbit (LEO) Satellites are a major “ignitor” of the growth we’re about to see.

A LEO satellite orbits the Earth at an altitude of 112 miles to 1,243 miles. That’s closer than Medium-Earth Orbit (MEO) or Geostationary Orbit (GEO) satellites.

LEO satellites achieve some of the key goals I highlighted:

They’re Fast: The low altitude means they complete their orbits in 90 minutes to two hours. That offers lower latency for communication (data transfer to and from and higher resolution for imaging).

They’re Plentiful: That lower orbit translates into lower costs for construction and launch, meaning you can afford more of them. That means they can be replaced much more easily than an undersea cable. And if one is taken out, three more can be launched to replace it.

And They’re Adaptable: They can be used for an array of purposes, including satellite internet services, GPS, monitoring, and surveillance. They could add to cellphone, broadband, and data transfer services or provide those needed new “pipelines.”

The LEO market is projected to grow at least seven times over the next decade. But it could grow as much as 31 times, says a new report by investment bank Goldman Sachs Group Inc. GS -0.11%↓.

As many as 70,000 LEO satellites will be launched in the next five years, Goldman Sachs says.

“Our analysts’ base-case forecast is for the satellite market to grow to $108 billion by 2035, up from the current $15 billion,” analysts for the investment bank wrote. “In the most optimistic scenario, the market could grow to be worth as much as $457 billion in that same period.”

Roughly 53,000 of the estimated 70,000 launches in the next five years will come from China; a data point that underscores our New Cold War and Deglobalization storylines.

Here’s a small sampling:

The United States: Thanks to government and private-sector initiatives, the U.S. satellite economy is strong. Companies like SpaceX and Amazon are launching large constellations of LEO satellites to provide global internet coverage. And the Pentagon and private companies are working on “quick-launch” programs to make sure damaged or targeted satellites can be replaced.

The European Union: The EU has been investing in satellite technology through programs like Galileo for navigation and Copernicus for Earth observation. As part of the shift back to “trading blocs,” EU members are looking at ways satellites can boost “connectivity” across the continent.

China: With initiatives like the BeiDou Navigation Satellite System and communication-satellite programs to support its Belt and Road Initiative, Beijing has been rapidly expanding its satellite capabilities.

Russia: Moscow continues to pump money into satellite technology for its commercial economy and military. One example: Its GLONASS navigation system.

India: The Indian Space Research Organisation (ISRO) has launched an array of communication satellites to bolster its data programs and improve connectivity across the country.

If you follow the news or look around your “personal world,” you can see this for yourself.

With AI, you need satellites so John Deere DE -0.09%↓ tractors can autonomously navigate corn fields … so self-driving cars “see” what’s in front of them on roadways … so drone aircraft can fly a planned route … and more.

For the New Cold War, government and military agencies need satellites for real-time intel, secure communications, navigation, and missile detection.

There are smaller pieces, call them “subsets,” of what I’m describing. And they vary in both size and rates of growth.

The global mobile satellite services market size is still relatively small. It was valued at $5.6 billion in 2023 and is expected to reach $9.5 billion by 2031 for a modest compound annual growth rate (CAGR) of 6.9%.

Data Sources: Skyquest

In 2023, CCS Insight had a more bullish forecast that the satellite smartphone services market would reach $18 billion by 2027. Still relatively small, but this all may turn out to be conservative, as the AI Era can supercharge the need to get more satellites into space, which will help to easily exceed market forecasts.

The military satellite market is larger and expected to climb in value from $31.97 billion in 2024 to $53.85 billion in 2029; a 10.99% CAGR.

Data Source: Mordor Intelligence

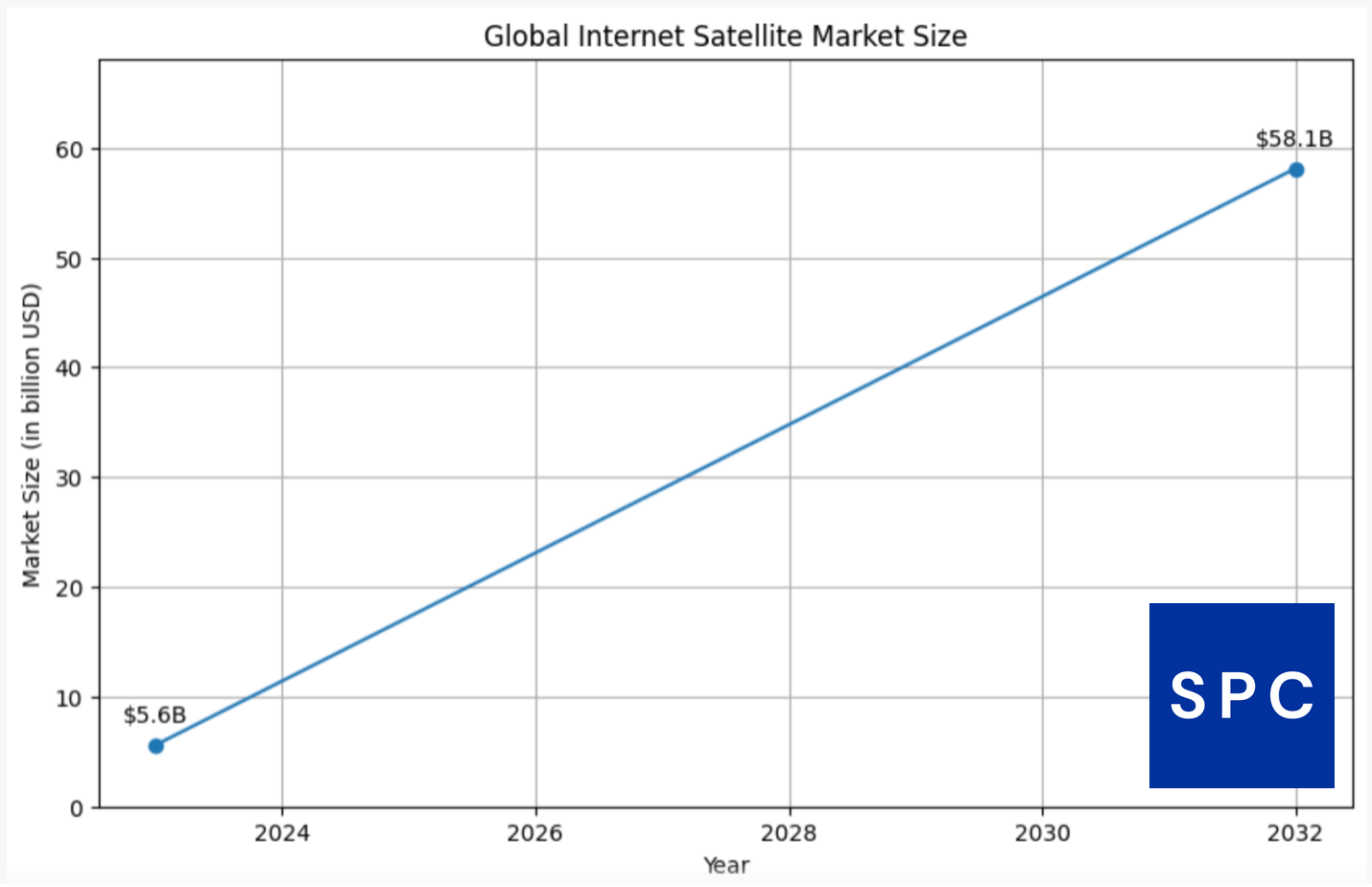

And the global internet satellite market is even bigger. In addition to smartphone satellites, internet satellites are also important in the AI Era. This was a market valued at $5.6 billion in 2023 — just like the mobile satellite services market — but is forecasted to reach $58.1 billion by 2032, for a whopping CAGR of 33.90%.

Data Source: Fortune Business Insights

And just as there are different pieces, there are different ways to invest.

There are big companies that are well established but where the satellite unit is a small piece, tucked deep inside. And there are smaller “pure-play” firms that are more speculative in nature.

But we don't just follow trends: We anticipate them … like the growing need for satellites. By analyzing and understanding the evolving landscape around us, we position you to seize opportunities and profits and to become Wealth Builders.

That’s why we we’re putting these four companies on your investing watch list today.

Company No. 1: Iridium Communications Inc. (IRDM)

Earnings growth projections and price targets are consensus targets from Yahoo! Finance.

Dividend Yield: 2.03%

2025 Earnings Growth Projection: 63.13%

One-Year Price Target: $39.71

Iridium Briefing

Iridium offers satellite phones, Internet of Things (IoT) terminals (reliable two-way satellite communication), and mobile connectivity services that are used in sectors like emergency response, aviation, government, and maritime.

One area of interest for us is Iridium’s IoT capability: Having autonomous machines communicate with the world around it is only possible with reliable satellite communications and data transmissions.

According to Precedence Research, the global AI in IoT market will be worth $93.12 billion in 2025 and will jump 73.89% to $161.93 billion by 2034.

In December, Iridium launched its newest IoT model and development kit, which the company described as “the smallest and most powerful created by Iridium, ideal for supporting satellite IoT applications that require real-time data analysis, analytics, and automated decision-making.”

As an example of IoT in action, Iridium partnered with Kobelco Construction Machinery to utilize Iridium’s two-way satellite communications for Kobelco’s heavy machinery, including its hydraulic excavators and something it refers to as its “remote asset management platform.”

Translated into plain English, that last thing is pretty cool.

It:

Tracks Kobelco’s Equipment — showing where each bit of machinery is located and how they are being used.

Monitors Equipment Health — crucial, since this equipment is super expensive, meaning tracking engine hours, fuel performance, wear and tear, and maintenance schedules can extend the useful life even as maintenance costs are kept as low as possible.

Provides Geofencing — which makes sure the machinery is used in its designated work area.

And it does all this on a global basis even when the machinery is being used in the world’s most-remote locations.

Source:: Iridium

On the “special-situation” front, the Virginia-based Iridium approved a shareholder-friendly $500 million buyback boost last year; a move that brings Iridium’s authorized buyback program to $1.5 billion since 2021.

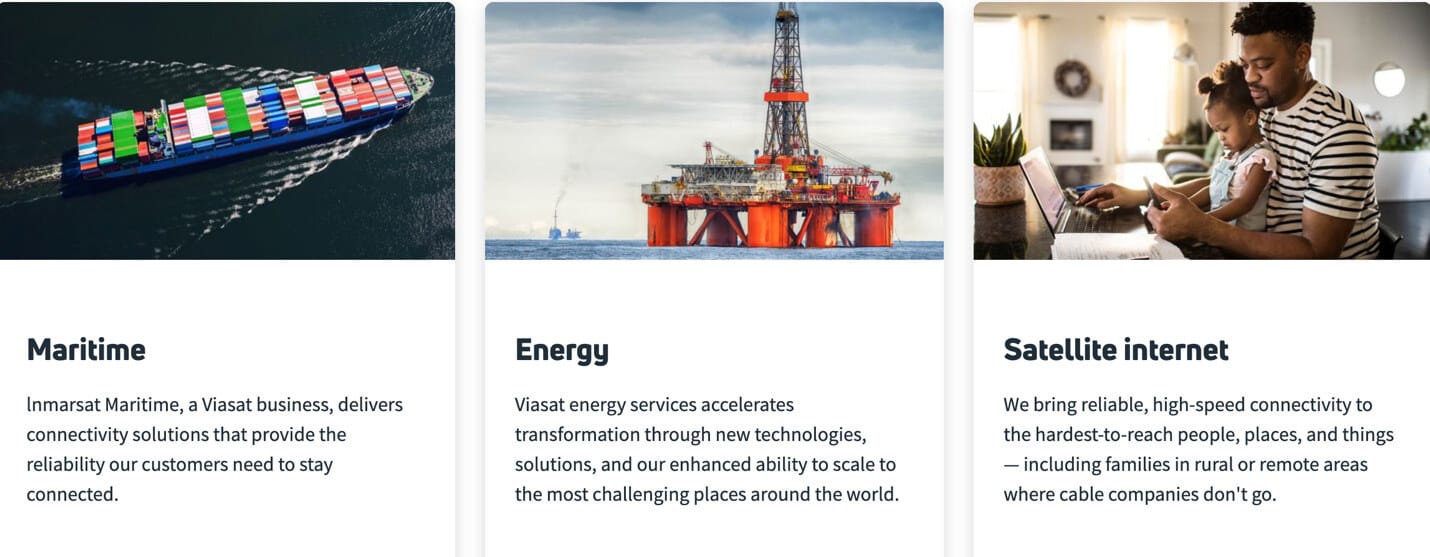

Company No. 2: Viasat Inc. (VSAT)

Dividend Yield: NA

2025 Earnings Growth Projection: -71.20%

One-Year Price Target: $18.86

Viasat Briefing

Through its network of satellites, Viasat provides connectivity services and high-speed internet to the business, residential, military, and government markets. Some of its more well-known customers include: JetBlue Airways Corp. JBLU -2.02%↓, Delta Airlines Inc. DAL 1.06%↑ nd the Department of Defense.

In January, Viasat was one of four companies selected for a $4.8 billion NASA contract to provide the U.S. space agency ground-to-space communications services.

ViaSat is not profitable. But this is a potential “special-situation” play here: The company’s business model is not well understood. And there’s a possible corporate turnaround in the works, says the Los Angeles-based Cove Street Cap.

Check out what Cove Street said in a 2024 “Small Cap Value Fund” investor letter:

“Viasat Inc. has no friends. We are in the limbo of waiting for the launch of two satellites, with essentially $1 billion of cost sitting around in warehouses. We expect those satellites to be in service mid-25 and late-25. There is no growth until then, as the company has slowly abandoned the rural broadband market to allocate limited capacity to their commercial markets. There is tremendous ‘not being monetized’ value in the Viasat/Inmarsat combination given commercial and defense opportunities in space in the decades ahead, but a pair of satellite failures has clearly given Starlink and eventually Kuiper a complete four-year ‘gimme’ to develop as formidable competitors. Irrelevant at current stock price. The defense business is arguably worth 2x the current market cap.”

So the company should have $1 billion worth of currently idled satellites in service by the end of 2025 and Cove Street sees the defense business alone being worth double Viasat’s market cap.

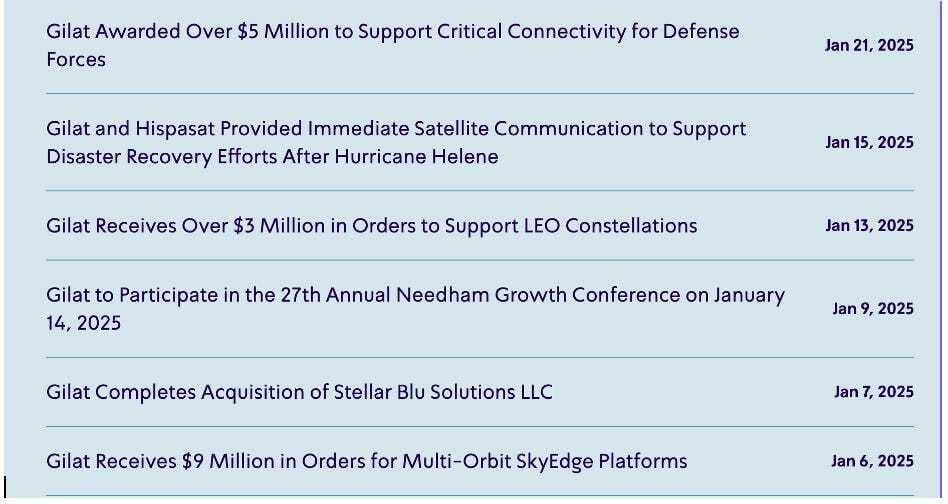

Company No. 3: Gilat Satellite Networks Ltd. (GILT)

Dividend Yield: NA

2025 Earnings Growth Projection: 10.88%

Consensus One-Year Price Target: $8.40

Gilat Briefing

Like the other companies we’ve spotlighted here, Gilat provides satellite services for companies, government agencies, and the defense market.

It also offers broadband to rural areas and to air travelers.

Since the start of the year, the company has announced a slew of contracts:

Source: Gilat

It also created a new Defense Division to address increased demand for secure military and government satellite communication systems.

And, most recently (in March, in fact), Gilat landed a $6 million deal with an Asia-Pacific military customer for its SkyEdge II-c satellite communication system.

Company No. 4: Globalstar Inc. (GSAT)

Dividend Yield: NA

Five-Year Earnings Growth Projection Per Year: -42.86%

Consensus One-Year Price Target: $43.33

Globalstar Briefing

Apple Inc. AAPL -2.36%↓ works with Globalstar, which had 31 orbiting satellites at the close of 2024. And it’s planning to 17 more this year as part of its coverage-boosting strategy.

And it didn’t just land Apple as a customer. The iDevice King is also an investor: In November 2024, Apple ponied up $1.5 billion. That included $400 million for a 20% equity stake, and the remaining $1.1 billion will be for launching a next-generation “satellite constellation” with accompanying infrastructure. Part of that cash (about $232 million) will be used to refinance Globalstar debt.

While Apple accounts for 85% of Globalstar’s network capacity, the Louisiana-based company also offers services in several industries.

Source: Globalstar

Just like with Iridium, one thing we’re really intrigued by is Globalstar’s IoT technology, which could let customers track “assets” in remote locations.

And by “assets,” we’re talking about things like:

Machinery

Equipment

Livestock

Oil

And gas.

Globalstar says its agriculture systems can “monitor irrigation levels, livestock herds or track assets to minimize loss, manage farm machinery with solar-powered asset trackers, and ensure safety of workers using GPS satellite messengers.”

Pretty cool … all of it.

And the technologies these companies have developed are more powerful than any underseas cable network.

Final Thoughts

The companies we covered today are:

The satellite market is still in its early stages, evident from share prices whipsawing all over the place.

But that doesn’t diminish the growing need for satellites to boost cellular connections around the world and to make sure self-driving cars are always connected to navigate the roads.

Satellites will also play a crucial role in national defense in the New Cold War.

Your Strategy Blueprint

At first glance, the sub-$10 dollar share prices of Viasat and Gilat may seem the most compelling because they look “cheap.”

Viasat is also one of the most interesting with its special-situation nature.

But the least flashy on this list – Iridium Communications – may be one of the better starting points for your own investing research.

The reasons:

✅Iridium has a massive earnings growth rate projection of 63.13% in 2025.

✅Iridium has stability through its major customers that include Caterpillar Inc. CAT -1.96%↓, Honeywell International Inc. HON 0.59%↑ and Garmin Ltd. GRMN -0.53%↓ .

✅Albeit on the smaller side, it pays a dividend of 56 cents (yield of 2.03%) for income.

✅And it has that additional $500 million buyback we covered earlier.

If you consider investing in Iridium, follow our “Accumulate Strategy,” where you’ll buy shares on pullbacks or have a regular investment schedule where you’re buying more shares.

That way, you can lower your total share cost and won’t have to worry about having bought in at just the highs of the market.

Today, we gave you four satellite plays in this report. But there’s actually a fifth stock that I really like a lot. It’s a smaller, under-the-radar company that’s not yet a household name.

But this company’s technology could prove critical to the satellite boom … it’s landed a key military contract … and we have a full free report available for you.